The impact of 3D printing on innovation and supply chain logistics at Medtronic

3D printing or “additive manufacturing” is positioned to revolutionize the face of medical device manufacturing and could be a great opportunity or a significant disruptive threat, depending on how they respond.

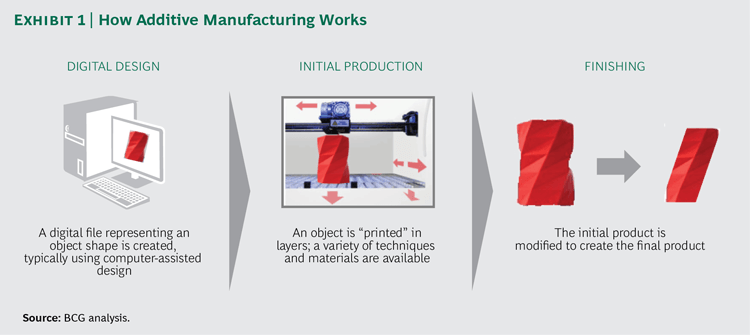

3D printing, or “additive manufacturing”, is rapidly advancing manufacturing and could potentially transform innovation and supply chain logistics for the medical device industry. 3D printers leverage digital profiles to print materials in successive patterns creating finished products. The tech allows for fast and efficient production of customized products significantly reducing production costs. Additionally, placing 3D printers close to customers could remove the need for complex distribution networks reducing overall logistics costs. Within healthcare, additive manufacturing is already leveraged in the production of prosthetic implants, artificial limbs1 and pharmaceuticals2. This technology should concern a company like Medtronic. As the world’s largest medical device supplier, its portfolio leverages complex production processes and a vast distribution network. 3D printing offers an opportunity to streamline these processes and increase future profits but also opens up Medtronic to disruption.

3D printing, or “additive manufacturing”, is rapidly advancing manufacturing and could potentially transform innovation and supply chain logistics for the medical device industry. 3D printers leverage digital profiles to print materials in successive patterns creating finished products. The tech allows for fast and efficient production of customized products significantly reducing production costs. Additionally, placing 3D printers close to customers could remove the need for complex distribution networks reducing overall logistics costs. Within healthcare, additive manufacturing is already leveraged in the production of prosthetic implants, artificial limbs1 and pharmaceuticals2. This technology should concern a company like Medtronic. As the world’s largest medical device supplier, its portfolio leverages complex production processes and a vast distribution network. 3D printing offers an opportunity to streamline these processes and increase future profits but also opens up Medtronic to disruption.

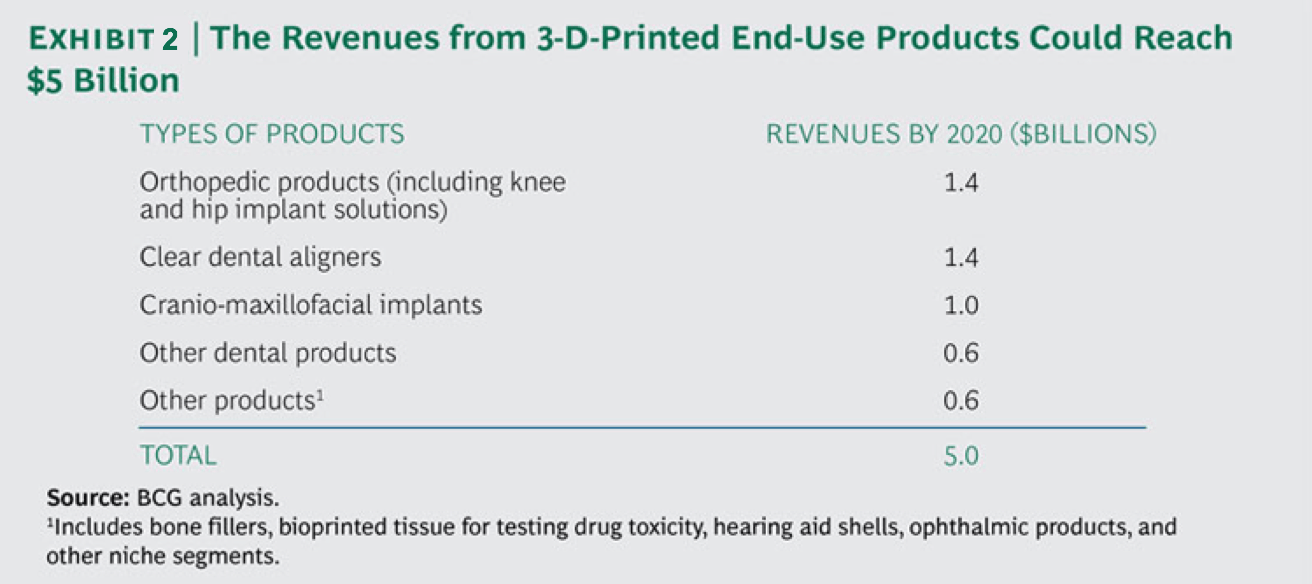

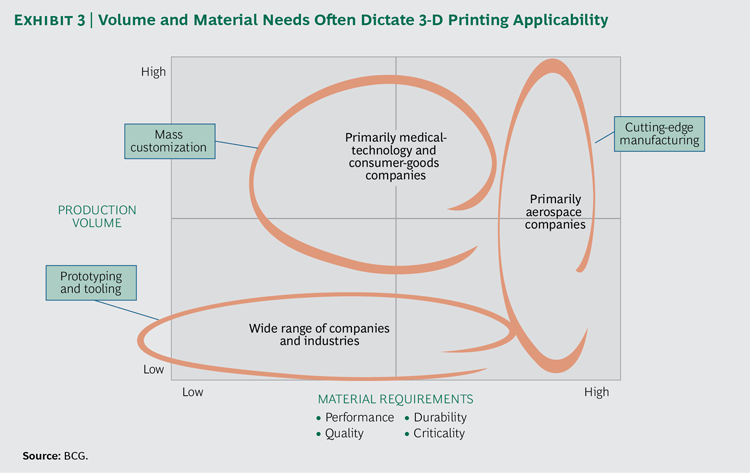

With personalized care increasingly becoming a priority for Medtronic, there is an opportunity to drive innovation through rapid prototyping and production of complex products that could not be produced through traditional manufacturing. It is estimated that by 2019, 3D printing will be leveraged in 35% of all surgeries that require prosthetic and implant devices and 10% of people in the developed world will live with a 3D printed implant3. Additionally, some experts believe that revenues from 3-D-printed biomedical products could reach $5 billion by 2020. 3D printing could allow Medtronic to produce custom built implants based on unique digital patient profiles. Additionally, while mostly leveraged as a rapid-prototyping tool, 3D printing’s greatest opportunity lies in the mass customization space4. Personalized implants can be priced higher and production equipment does not require retooling to produce additional products. For incremental units, suppliers simply need to upload new specs to the printer. Currently, the 3D printing market is dominated by Stratasys and 3D Systems who control ~75% of the market with the remainder split across 35+ smaller players5. Several of Medtronic’s competitors have already invested in this technology and Medtronic should position themselves to have a dominant position in a commercially viable additive manufacturing platform to gain a competitive advantage6.

Currently, Medtronic is investing heavily in additive manufacturing to allow their scientists and engineers to continue the work on customized devices. In the long term, Medtronic is also positioning themselves to capitalize on technology that might allow for damaged human organs to be repaired with living tissue or replaced with new organs produced through 3D printing7.

“We are thinking that far ahead, but it’s going to take time and determination. It’s one thing to do a prototype, it’s another thing to say we’re actually going to do it for the long haul.”

Michael Hill, VP Corporate Science, Technology and Clinical Affairs at Medtronic

Medtronic has not publicized any significant investments or partnerships but they continue to leverage this technology within prototyping and innovation. However, unlike many competitors, they have not invested in long term partnerships that could lead to the development of a strong platform. While this is concerning, it is possible that a more strategic investment could be made if Medtronic waits for further technology advancements.

While is it unlikely that additive manufacturing will completely replace traditional manufacturing in the future8, Medtronic should take action to prepare for a future where additive manufacturing is a core technology driving competitive advantage:

- Identify a strategy: develop a strong 3D printing platform can take years so companies must invest now to be competitive; this is both an opportunity and a potential threat

- Generate short and long-term plans: develop long-term plans to evaluate potential impacts to products and business models and be prepared in the short term to respond to unexpected events such as rapid disruptions.

- Identify value creation levers: assess the portfolio to identify potential cost reductions from increased efficiency (e.g. reduced waste, labor, retooling) and opportunities to increase revenue through higher priced personalized products.

- Investigate potential investment or partnerships: map the 3D printing industry and identify partnerships or investments that would position Medtronic with a competitive platform in the future. As competitors invest in this space, the number of attractive partners is diminishing9.

This technology could fundamentally change the face of medical device manufacturing. However, there are adoption barriers that will protect Medtronic in the short-term. These include the limited range of materials currently used, higher costs relative to traditional manufacturing, quality concerns and the adoption by healthcare stakeholders. Therefore, while Medtronic should be investing in this technology, industry adoption of 3D printing as a mainstream manufacturing process is unlikely to occur in the near future.

There are two key questions requiring further investigation to assess Medtronic’s position:

- Should Medtronic invest in their own platform or contact an established provider of additive manufacturing such as Stratasys?

- What product areas are likely to be impacted by 3D printing? How can Medtronic be ready to respond to rapid disruption?

(Word count: 796)

References

1) Beckershospitalreview.com. (2017). How 3-D printing could disrupt the healthcare supply chain. [online] Available at: https://www.beckershospitalreview.com/supply-chain/how-3d-printing-could-disrupt-the-healthcare-supply-chain.html [Accessed 15 Nov. 2017].

2) Pharmabiz.com. (2017). 3D printing of medicine may disrupt traditional pharmaceutical value chain: Rajesh Pednekar. [online] Available at: http://www.pharmabiz.com/NewsDetails.aspx?aid=98452&sid=1 [Accessed 15 Nov. 2017].

3) Pete Basiliere. (2015). Gartner Predictions 2016: 3D Printing Disrupts Healthcare and Manufacturing. [online] Available at: https://blogs.gartner.com/pete-basiliere/2015/12/02/gartner-predicts-2016-3d-printing-disrupts-healthcare-and-manufacturing/ [Accessed 15 Nov. 2017].

4) Sirkin, H., Zinser, M. and Rose, J. (2015). Why Advanced Manufacturing Will Boost Productivity. [online] www.bcgperspectives.com. Available at: https://www.bcgperspectives.com/content/articles/lean_and_manufacturing_production_why_advanced_manufacturing_boost_productivity/ [Accessed 15 Nov. 2017].

5) Bray, J., Howe, K., Zinser, M. and Lukic, V. (2015). Is It Time to Take the 3-D Plunge? Hope Versus Hype in Additive Manufacturing. [online] www.bcgperspectives.com. Available at: https://www.bcgperspectives.com/content/articles/engineered-products-project-business-time-to-take-3-d-plunge/ [Accessed 15 Nov. 2017].

6) Fiercebiotech.com. (2016). Stryker buys into 3-D printing, to build new printing facility in 2016 | FierceBiotech. [online] Available at: https://www.fiercebiotech.com/medical-devices/stryker-buys-into-3-d-printing-to-build-new-printing-facility-2016 [Accessed 15 Nov. 2017].

7) Medtronic News | 3D PRINTING: A NEW FRONTIER IN HEALTHCARE (2017) Medtronic.com http://www.medtronic.com/us-en/about/news/3D-printing-at-Medtronic.html.

8) DHL. (2016). 3D PRINTING AND THE FUTURE OF SUPPLY CHAINS: A DHL perspective on the state of 3D printing and implications for logistics. [online] Available at: http://www.dhl.com/content/dam/downloads/g0/about_us/logistics_insights/dhl_trendreport_3dprinting.pdf [Accessed 15 Nov. 2017].

9) Möller, C. and Durand, C. (2016). Biomedical 3-D Printing: A Niche Technology or the Next Big Thing?. [online] www.bcgperspectives.com. Available at: https://www.bcgperspectives.com/content/articles/medical-devices-technology-innovation-biomedical-3-d-printing/ [Accessed 15 Nov. 2017].

This is a fascinating look at the impact of 3D printing on an industry that, at least in my mind, has always tried to achieve standardization over personalization. Medtronic’s goal of using 3D printing to speed up their prototyping process strikes me as an unambiguously positive move for the company — staving off, rather than welcoming, disruption. I’m curious about what a partnership strategy would look like for Medtronic. Would they hold the product’s IP and just use a 3D printing partner to fulfill production needs (similar to the idea of Chrysler producing Waymo’s cars)? You allude to this in your recommendations, but it seems that one of the risks is that Medtronic commit to a 3D printing strategy solely to keep up with competitors, without it being a core part of their competitive advantage.