The Grape Depression

Why you may have to trade in your California Cab for an Oregon Pinot Noir — or be forced to pay the price

The effects of climate change—particularly the warming of the planet, water scarcity, and extreme weather—are already beginning to impact agriculture. Compared to other agricultural products, wine is especially sensitive to variations in climate. Even by conservative estimates, the area suitable for wine production is projected to decrease by 19-62% in major wine producing regions by 2050 [6]. A key driver of this decline is the water intensity of wine production, requiring nearly 1,000 liters of water per liter of wine produced [6,8]. As the climate shifts, water management will likely become increasingly important to offset its destructive effects: a warmer growing season and more frequent droughts.

With global operations in wine, beer, and spirits, Constellation Brands (CB) is one of the largest alcoholic beverages companies in the world. While shrinking as a percentage of its portfolio (from 42% of net sales in 2015 to 37% in 2017), wine production remains a significant portion of CB’s volume [1]. Estimates indicate that the magnitude of climate-related changes will vary highly by geography, and researchers believe that California vineyards, particularly “regions known for fine wine, like Napa and Sonoma… [may be] too hot to produce premium wines in the future” [6, 3]. CB is particularly exposed to climate risk in that its facilities are highly concentrated in risky geographies [1]. CB owns or operates 13,600 acres of vineyards in California, where all but two of its 18 wineries are located [1].

In terms of climate risk management, CB already operates a somewhat flexible and diversified supply chain—many of the grapes used for production are purchased from approximately 950 independent growers [1]. Additionally, CB has implemented recent changes to become more water efficient. CB has invested in a wide range of projects, including glycol heat exchangers, landscape irrigation projects, and wastewater recovery and reuse lines [9]. CB collaborates with peers in the Beverage Industry Environmental Roundtable (BIER) to better evaluate and manage water risk. Partnering with the EPA and conservation groups, CB has invested in projects to maintain and protect rivers and water sources near production sites [9]. The company has also launched internal water conservation awards to its wineries that achieve or exceed conservation targets [4]. In the medium term, CB’s Water Policy outlines seven strategies: increase water efficiency, ensure water source availability and quality, raise awareness, engaging supply chain, maintain alignment with strategic goals, and ensure transparency and reporting [5]. Furthermore, CB seems to be diversifying its portfolio by growing acquisitions in beer, spirits, and even marijuana [7].

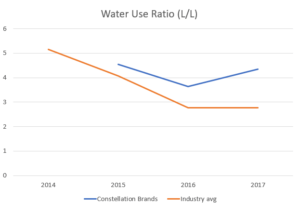

Still, CB’s efforts appear to fall short. According to company reports, CB’s production is significantly more water intensive than the industry average [9,2]. This metric excludes water usage related to irrigation, which may be increasingly necessary to combat extreme weather patterns like droughts. Given that an effective response to water concerns will be highly localized, CB should begin a thorough evaluation of each winery to identify short- and medium-term strategies. In the next two years, CB should look to identify and implement best practices in water management across its vineyards and wineries, particularly in its recent acquisitions. In addition, CB should partner with its many independent grape suppliers to improve water efficiency up the supply chain. Hiring specialized personnel or enhancing training programs may support these efforts. CB may also consider financial incentives at its vineyards and wineries to tie water conservation to performance evaluation or compensation. Establishing new strategic partnerships, like the water source initiative with the EPA, will be essential.

[Source: Company documents, BIER, author’s analysis]

In the medium term, CB may be able to transition some of its production to less water intensive and more resilient varietals by building new supplier relationships or replanting vineyards under CB management. Nevertheless, while varietal and region play a large role in the water intensity of operations, strong consumer preferences may limit the feasibility of pulling these levers. CB should consider investing in cutting edge technologies, such as precision irrigation systems and integrated water management systems. In addition, as CB continues to grow, the company should look for acquisition targets and suppliers in geographic areas that are less at risk, including the Pacific Northwest and Northern Europe [1].

Nevertheless, the path ahead for CB is not fully clear. How should the company think about largescale investment in water initiatives, which may not be NPV positive in the short or medium term? Also, effective investments in water management may not replace the need for contingency plans in the case of climate-induced complications. CB must consider: What are the essential elements and tradeoffs of a comprehensive contingency plan? For example, CB may be able to offset shortfalls in grape supply with new suppliers from less impacted regions, but margins will likely suffer due to 1) higher market rates reflecting decreased supply, and 2) transportation costs to its California-based wineries.

[799 words]

Works cited

- “Annual Report.” Constellation Brands. April 2017. http://www.cbrands.com/sites/default/files/2017-Annual-Report.pdf, Accessed November 2017

- “Beverage Industry Continues to Drive Improvement in Water and Energy Use.” Beverage Industry Environmental Roundtable. December 2016. http://media.wix.com/ugd/49d7a0_fb6ab6f0359c45d89b6e0a72a42988d1.pdf, Accessed November 2017.

- Blaind, Alastair. “An Upside to Climate Change? Better French Wine.” NPR. March 21, 2016. https://www.npr.org/sections/thesalt/2016/03/21/470872883/an-upside-to-climate-change-better-french-wine, Accessed November 2017

- “Constellation Brands Announces Franciscan Estate Winery As Its 2016 Internal Sustainability Award Winner.” Water Online. January 16, 2017. https://www.wateronline.com/doc/constellation-brands-announces-winery-as-its-internal-sustainability-award-winner-0001, Accessed November 2017 [5]

- “Constellation Brands: Water Policy.” July 30, 2013. https://static1.squarespace.com/static/569fcae3e0327ce43da144e0/t/56d9b7534d088e73108ab7dc/1457108819940/CBI+Water+Policy.pdf, Accessed November 2017 [6]

- Hannah, Lee et al. “Climate change, wine, and conservation.” PNAS. February 19, 2013. https://www.conservation.org/publications/Documents/CI_PNAS_Climate-Change-Wine-Production-Conservation_Lee-Hannah_March-2013.pdf, Accessed November 2017 [1]

- Kell, John. “Constellation Brands Inks $900M in New Deals.” October 17, 2016. http://fortune.com/2016/10/17/constellation-brands-deals/, Accessed November 2017 [7]

- Veseth, Mike. “Turning Water into Wine.” The Wine Economist. November 27, 2008. https://wineeconomist.com/2008/11/27/turning-water-into-wine/, Accessed November 2017

- “2017 Corporate Social Responsibility Report.” Constellation Brands. April 2017. https://static1.squarespace.com/static/569fcae3e0327ce43da144e0/t/59347571d1758ee8c2042237/1496610172775/CBI+2017+CSR+Report.pdf, Accessed November 2017.

- Image. Penn State Sites. http://sites.psu.edu/siowfa15/wp-content/uploads/sites/29639/2015/12/28curious-span-articleLarge.jpg, Accessed November 2017.

Climate change and its effect on water scarcity is an interesting topic especially in relation to agriculture. Yet, I worry about some of the largely capital intensive projects you recommend, especially those that are not NPV positive anytime in the foreseeable future. Of course, becoming more efficient in its use of water will be good for the environment and for business and a lot of gains can be made with little investment, such as training and implementing industry best practices. However, before a significant investment I believe it would be important to understand the long-term viability of the California wine landscape. As mentioned above, over time climate change is only expected to get worse and with it the expense and risk of agriculture in California. Therefore, CB should first ensure that California will still be viable for growing before investing a significant investment. Conversely they could make that investment in regions that are projected to be less affected by climate change and water scarcity.

Very interesting essay, Grant. I agree with Berit about the need for a holistic look at California’s longterm viability as a wine producing region. While the bulk of your essay dealt with water management, I appreciated that you touched on increasing temperatures in California wine country. My main takeaway is that it might not matter how efficient CB becomes at water management in California; if it’s too hot to grow grapes, it’s too hot to grow grapes. That’s an existential threat to their current business. The threat is further exacerbated by the fact that climate change may actually improve the prospects of some competing regions [1]. As such, I am skeptical about large scale investments in their California water infrastructure.

CB should look to spin off the part of their grape supply chain that is vertically integrated. While they no doubt enjoy cost savings from operating 13,600 acres on their own, that acreage also exposes them to more climate related risk than might be prudent in the long run. If they believe that California’s climate is changing in a way that will imperil its ability to produce quality grapes, then there is no time like the present to act. That land is likely valued at a premium over what it might be valued at if it were used for other purposes; in other words, it will be quite expensive to transition it “when the time comes.” If CB’s sensitivity to the business ramifications of climate change outpace a good share of possible buyers, which the essay seems to indicate, then the time to sell is now. Even if the longterm ramifications of climate change are already somewhat priced into the value of the land, I would imagine that a degree of uncertainty is also priced in, along with some level of irrational attachment (or vanity driven attachment) to the region. That will change with time.

Moving away from a vertical supply chain makes sense because it makes them nimble; being nimble is only useful if they begin to look at where they might pivot. I think they are wise to diversify their product mix; I also very much agree with your recommendations about looking at acquisitions in geographic areas that may stand to “benefit” from climate change.

1. Bland, Alastair. “An Upside to Climate Change – Better French Wine.” NPR.org, March 21, 2016, https://www.npr.org/sections/thesalt/2016/03/21/470872883/an-upside-to-climate-change-better-french-wine, Accessed November 2017

You had me at “The Grape Depression” (love a good pun!)

You lost me at “more expensive wine” (hate increased alcohol expenses!)

Just kidding.

Great article, Grant. It’s a really interesting look into a not-often-talked-about consequence of rising temperatures and rising sea levels. I really like the action steps you’ve proposed here, but I am concerned, just as Berit and Yohannes seem to be, that they aren’t feasible – that management will not be willing to engage in these capital-intensive and low-NPV projects. I would be less concerned if CB were not a publicly-traded company. But it is. And not just that, it’s a thriving one: “The stock has been a solid winner for long-term investors, up by over 500% in the last five years compared to a 78% rise in the broader market” [1] This, in spite of lackluster performance in CB’s wine business: from 2015 to 2017, revenue in CB’s wine division increase only 8%, compared to those from Beer and Spirits divisions which grew 33%. Similarly profit margin growth also trailed that of other divisions [2].

I wonder if the more feasible, and impactful, approach to combatting climate change and its affects on CB’s supply chain, is through industry-wide (and collaboratively-funded) initiatives and coalitions, aimed at maintaining water supply efficiently, and counteracting carbon emissions. Such organizations could also play a lobbying role, aiming to positively impact regulations at the state and national level. These types of initiatives could be rolled under the company’s corporate sustainability functions, rather than attributed to supply chain overhaul or infrastructure investments, and therefore would likely face a lesser reaction from the investor community. This type of approach might also lead to secondary benefits, in terms of supply chain coordination, a key driver of supply chain effectiveness as discussed in conversation related to bull whip effect.

Thanks again Grant! Great food (and wine) for thought.

Sources:

[1] ICE Data Services, 2017 “Why Constellation Brands Stock Has Soared 25% This Year”

[2] CB Brands, 2017 “CB Brands Annual Report 2017”

While Constellation Brands should invest in innovative, high-tech water management strategies to preserve the short and medium-term health of its California vineyards, I agree with the comments above that smart regional diversification would increase the long-term viability of the company. Given the extreme effects of climate change, implementing your short and medium-term plan to spread best practices in water management across vineyards and wineries may prove ineffective. I believe Constellation Brands’ best option is to seek new partnerships with suppliers in Oregon and Washington, which have more reliable climates, while maintaining operations in California due to the longstanding brand popularity of Napa Valley and Sonoma Valley wine. As climate change impacts yield and price of California wine, drinkers in the US may be forced to acquire a new taste from other regions. One wine blogger is extremely satisfied with her wine from the Pacific Northwest:

“All the climatic factors that make Oregon and Washington wines reliable translate directly to value for all as drinkers. The trifecta of climate, flavor, and price makes these bottles safe bets, regardless of brand name or vintage. Happily, reliability isn’t synonymous with boredom, and there are plenty of varieties and subregions to explore comfortably.” [1]

One point that you made that I want to push back on is that margins would suffer as Constellation Brands moves into new territories. Instead of transporting WIP back to California, could the entire process take place locally in the new region? This may benefit Constellation Brands from a bottom line and supply chain perspective.

[1] https://vinepair.com/articles/why-you-should-be-drinking-wine-from-oregon-and-washington/