The Digitization of Ice Cream

Nestle is leveraging digitization to modernize its cold chain. Melting ice cream and stockouts are only some of the issues that it hopes to tackle through this initiative.

Background

There’s nothing better to cool off on a hot summer day than eat a scoop of ice cream. However, this simple pleasure of life is under threat.

Nestle, one of the world’s largest ice cream manufacturers, faces a serious challenge in Italy. Given the fragmented nature of the retail sector in Italy [1], Nestle must manage a network of several warehouses, over 150 trucks, and 100,000 Nestle owned freezers at its retailers. Among several other things, Nestle must ensure that the temperature of its ice cream is maintained at various stages of its supply chain: during production, transportation, and at the retailer. Even small increases in temperature can result in the crystallization of the product, transforming the creamy texture that everyone loves to one that is grainy [2]. When this happens, Nestle must identify that a temperature fluctuation occurred and replace the ice cream immediately. Failure to do this, could result in a consumer purchasing damaged ice cream. Frequent short-circuiting and consumers leaving freezer doors open contribute to temperature shocks occurring regularly.

Enter, digitization…

Nestle plans to install RFID temperature sensors across its cold chain, starting from their production facilities to the freezers at their retailers [3]. These sensors will alert technicians if the temperature were to fall below a threshold, enabling them to resolve the problem before any damage occurs to the ice cream. The move is favorable for both consumers, who are provided with a quality product, and retailers, who don’t have to have to pay expensive premiums for product insurance. Nestle estimates that retailers can also save 5-10% on its electricity consumption by optimizing freezer temperatures [3].

What now?

Managing over 100,000 retailers is a daunting task for Nestle. Complex route plans have to be created to ensure that each freezer has ample supply. Emergency deliveries have to be made to accommodate an unexpected spike in demand.

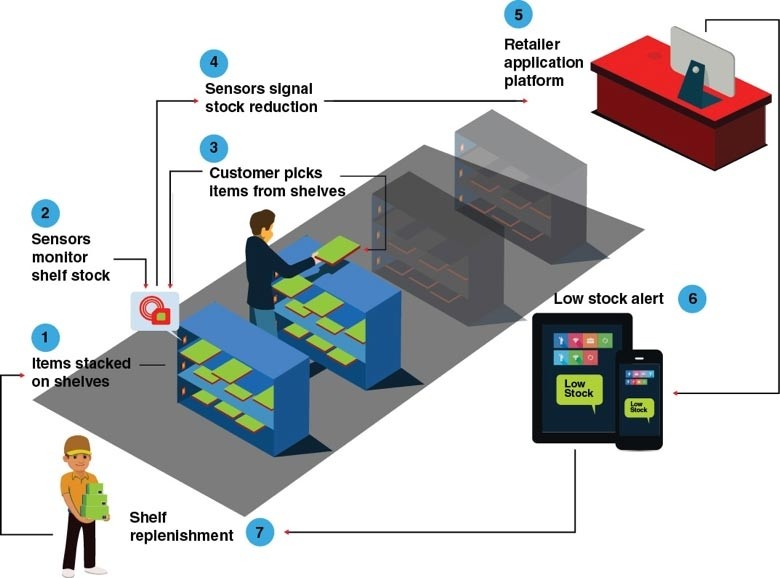

Globally, Nestle has made a push for investing more in digitization of its supply chain. One such area is the installation of devices on the shelf that monitor stock levels by detecting pressure, weight, depth, and various imaging technology [4]. The data that’s collected from these devices will be sent to a central server, alerting the Nestle salesperson that a particular store has low stock. This approach has significant benefits and is particularly important for the ice cream segment for the following reasons:

- Ad-hoc ordering process: Many large retailers have still not developed a systematic process for reordering products. McKinsey reports that, “the department manager [often] basically orders products based on last week’s sales, without ever checking the current stock levels in the store.” [5]

- High shelf-space cost: The cost of frozen shelf space is the highest among retail departments due to the limited refrigerated space available. Further, Nestle provides retailers with a freezer free of cost.

- Expensive stockouts: Stockouts are extremely expensive for both the retailer and the manufacturer, results in customer frustration, and may eventually cause a loss of customer patronage [6]. Research suggests that 8.3% [7] of products are out of stock (OOS) at the average retailer.

Recommendations

The smart shelf has the potential to eliminate the requirement for retailers needing to place orders, a process which already required improvement. Instead of salespeople reminding retailers to place orders due to OOS, Nestle should develop predictive models which forecast when replenishment is required based on stock levels and lead times. Salespeople will receive computer-generated orders without any intervention required from the retailer. Eventually, Nestle can create a model where production schedules are created in real-time based on both warehouse and retailer stock levels. This Just In Time model would optimize SKU availability and reduce the requirement to hold inventory for Nestle and its retailers. This will have a domino effect on Nestle’s entire supply chain, which includes Nestle’s own procurement of raw materials.

Through this initiative, Nestle will also gather significant data that can be used to understand consumer behavior. Translating this data into actionable insights through the use of advanced analytics will help Nestle improve its operations significantly. For example, movement of inventory can help Nestle derive insight into whether a new product will be successful, how the physical positioning of various SKUs in their freezer will impact its sales, or whether a new consumer promotion is delivering the required ROI.

Open questions?

The success of this project depends on several factors. Given the fragmented nature of the Italian ice cream market (with over 100,000 outlets), it’s not clear whether installing devices is feasible from a cost perspective. Further, in order to truly take advantage of this opportunity, Nestle will have to leverage the large amount of data coming in from its connected freezers and derive insight, a challenge that the retail industry is already facing [8].

Word Count: 796

[1] Sloop, Christine, “Italian Food Retail and Distribution Sector Report”, GAIN Report, USDA Foreign Agriculture Service, https://gain.fas.usda.gov/Recent%20GAIN%20Publications/Italian%20Food%20Retail%20and%20Distribution%20Sector%20Report_Rome_Italy_12-28-2012.pdf.

[2] Cook, K.L.K. and Hartel, R.W., “Mechanisms of Ice Crystallization in Ice Cream Production”, Comprehensive Reviews in Food Science and Food Safety, 9: 213–222, http://onlinelibrary.wiley.com/doi/10.1111/j.1541-4337.2009.00101.x/full.

[3] Wessel, Rhea, “Nestlé Italy Finds RFID Brings ROI for Ice Cream”, RFID Journal, http://www.rfidjournal.com/articles/view?4017/.

[4] “How IoT is helping retailers eliminate product stock outs”, https://www.mu-sigma.com/our-musings/blog/how-iot-is-helping-retailers-eliminate-product%20stock%20outs.

[5] Buck, Raphael and Minvielle, Arnaud, “A fresh take on food retailing”, McKinsey & Company, https://www.mckinsey.com/~/media/mckinsey/dotcom/client_service/retail/articles/perspectives%20-%20winter%202013/3_fresh_take_on_food_retailing_vf.pdf.

[6] Zinn, W., & Liu, P. C., “Consumer response to retail stockouts. Journal of Business Logistics”, 22(1), 49-72. http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/212643262?accountid=11311.

[7] Gruen, Thomas W., “A comprehensive guide to retail out-of-stock reduction”, University of Colorado at Colorado Springs, http://itsoutofstock.com/wp-content/uploads/2013/04/OOS-Guide-2008-Revision.pdf.

[8]Goldman, Sharon, “How the internet of things is revolutionizing retail,” CIO, February 30, 2016, https://www.cio.com/article/3090123/internet-of-things/how-the-internet-of-things-is-revolutionizing-retail.html.

The possibility of digitizing a portion of the ice cream supply chain to better understand and communicate customer preferences, forecasting demand and order fulfillment is an interesting one. You mention that the level of investment required for this project may not be feasible, and I agree that the magnitude of the investment could be significant. But if Nestle decides to use “smart shelves,” who should pay for it? If the proposed technology is located inside the retailers, and benefits both the inventory levels and costs of the retailer and the distribution flow and costs of the manufacturer, who should bear the cost of this investment? Nestle, or the retailers? When various costs can be improved across a supply chain, which group(s) in the chain is(are) responsible to generate the improvement ideas and bear the costs?

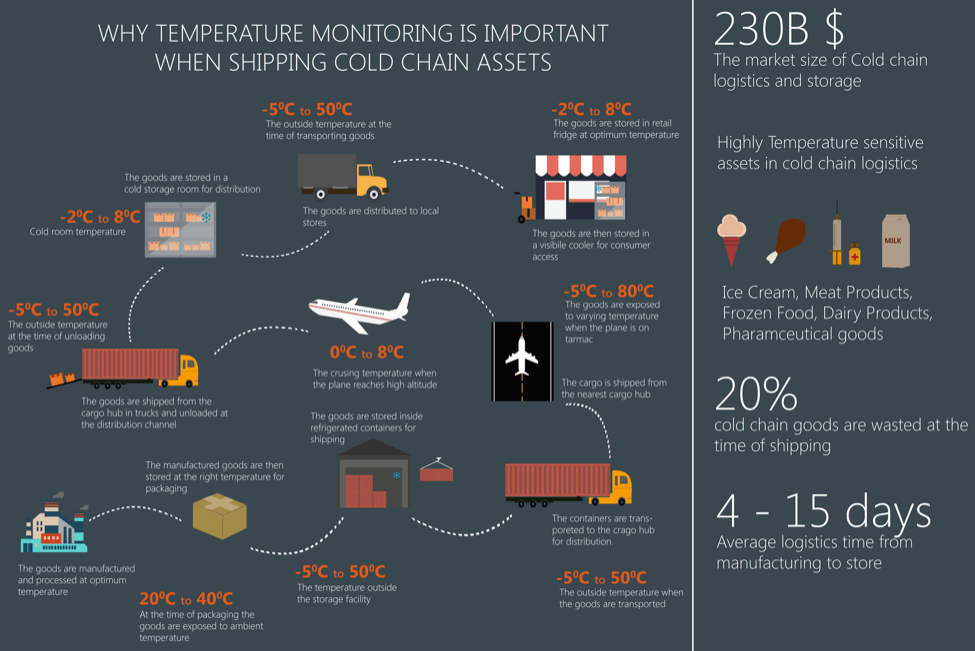

I’m also left wondering, is this the most relevant supply chain improvement that Nestle should focus on? The sample cold chain diagram above states that 20% of cold chain goods are wasted at the time of shipping; this quantity is huge and presumably, a significant cost to companies. If this statistic is true for Nestle, the smart shelves don’t seem to address this problem at all! Will smart shelves propelling Nestle into the future of better forecasting and order fulfillment matter if 20% of its ice cream melts / is wasted during transport? Why is such a high percentage of goods wasted during transport, and what could Nestle do to improve this costly element of its supply chain?

Within the resource constraints Nestle presumably has to support supply chain improvements, are smart shelves the best investment?

I think andrea.nichols brings up a salient point about the product loss during transportation. After further review of figure outlining the cold supply chain, it appears that the product experiences the most drastic temperature swings while in trucks or plane, ranging from -5 oC upwards of 50 oC on a truck or 80 oC on a plane. No wonder the ice cream is being damaged! Unless Nestle has been spending money in R&D working to create ice cream with a much higher melting point, I suggest they focus their efforts on ensuring temperature controlled transportation methods.

You mentioned that they were working on RFID cold sensors to be used throughout their supply chain. I’m curious what actions this information is driving while the product is in transportation? I can appreciate that in the fragmented ice cream market, Nestle does not own all of the trucks at every point in the delivery process. Perhaps, Nestle could create temperature controlled boxes that store the product while maintaining an acceptable temperature range. While I don’t imagine this to be a simple solution, I do believe an investment of this nature would generate material cost savings for Nestle.

This is a really interesting article on the potential of digitization to address issues in ice-cream supply chain. My initial thoughts on the questions raised about the cost burden of the smart shelves is that Nestle could consider a cost-sharing strategy with the retailers. Given that the smart shelves would prevent stock-outs or excess inventory as well as decreasing operational costs (e.g. electricity costs by 5-10%), the retailer would also experience significant cost-savings from adopting the smart shelves. I would suggest that Nestle educate retailers on the potential for operational efficiencies from smart shelves and create partnerships where both Nestle and retailers contribute to the cost of the smart shelves.

In terms of the 20% of cold chain goods are wasted at the time of shipping, Nestle could consider partnering with producers requiring a cold supply chain, such as meat and other dairy producers, to create a joint venture that focuses on co-developing trucks and planes with the appropriate cold chain facilities to prevent wastage. Given that this is an pervasive challenge, Nestle would benefit from pooling resources across other key players to find an industry-wide solution.

Interesting article about how the digitization of the ice cream supply chain can lead to a more just-in-time inventory model and prevent stores from having to anticipate demand. My first thought reading this, however was similar to Andrea’s in the fact that in order to implement this model it is important to note who will pay for the smart shelves. The retailer would benefit because they would no longer have to order inventory as Nestle would automatically know based on inventory levels what to send the retailer. Nestle would also benefit because they would have much more predictability and the bullwhip effect would be much less profound (as we learned in the beer game exercise). The problem with this model, however would be when Nestle wants to introduce new ice cream flavors or new products. Who would determine when the new orders would be shipped and how? Would the retailer have any say if a new product would replace an old product or would Nestle make that determination? Would Nestle’s product innovation suffer if they were making all of their inventory decisions on historical buying behavior?

As others above have mentioned the most striking data point is the 20% loss of cold goods due to temperature variances causing either spoilage or quality degradation. My interpretation is that Nestle is vertically integrated and thus bearing these losses directly. To mitigate these losses and instead focus on production, Nestle could offload its supply chain assets and responsibilities, moving the responsibility to a dedicated partner who will bear the losses and thus will be incentivized to dramatically shift to technology incorporation for monitoring. This could be more attractive by partnering with other companies (milk, meat, etc.) who share the benefit of a supply chain that is solely focused on key improvements in that area.

I am struck by the relevance of these “smart shelves” to a wide variety of companies both within and outside the ice cream industry. While working on a strategy project for a foundation’s Vaccine Delivery team, we spent considerable time researching the capabilities being developed within cold chain, and it came to our attention that there are a number of smart shelves under development, but no product has captured significant market share. It seems anyone who can develop this capability and sell it at a reasonable price will likely have significant market advantage. While it would likely be a considerable R&D expense, if Nestle was able to produce this capability in-house, it could license it to other organizations across industries. I would love to learn whether Nestle is considering producing this, or whether it plans to harness technology developed by another firm.

Ice Cream, I thoroughly enjoyed reading your blog post and am now craving some ice cream! While I am convinced that the smart shelf concept would provide meaningful benefits to manufacturers like Nestle – assuming that the shelves are viable from a cost perspective – I am not convinced that retailers are going to welcome this idea with open arms. As a retailer, I would be hesitant to allow Nestle to have so much access and control over the shelf space in my store. While many retailers could likely be convinced, this is something that Nestle will have to consider when evaluating this idea.