The Department Store Dilemma: Nordstrom Invests in New Store Concept

Investing in the integration of retail and online channels.

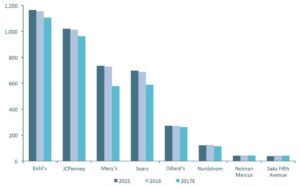

Will the department store as we know it cease to exist? Industry headwinds have led to significant department store closures (see below).[i] However, Nordstrom is meeting the challenge by leveraging digitalization to invest in its supply chain.

Number of Department Stores in the US, 2015-2017E

Several factors have caused the shift towards supply chain digitalization, which is transforming the industry. Historically, department stores represented the only place where consumers could shop for a wide variety of product. Now, shoppers can make purchases via desktop and mobile devices.

Consumer preferences have also changed. Relative to older generations, millennial shoppers demand more authentic, experiential, and artisanal products.[ii] Given technological advancements, shoppers now expect the latest fashions to be conveniently available. The growth of fast fashion competitors such as H&M poses another threat to department stores like Nordstrom.

Nordstrom has substantial infrastructure. It must adapt in order to survive in today’s highly competitive retail landscape. Management is prioritizing the integration of its online and store channels, while continuing to offer customers great service.

Nordstrom is piloting several supply chain initiatives to determine which concepts cater well to millennial shoppers. Its latest store format, Nordstrom Local, opened in Los Angeles in October 2017 and houses eight fitting rooms. [iii] As shown below, the store is relatively small (~3K sq. ft. vs. average ~140K sq. ft. store).[iv]

Nordstrom Local is a showroom concept with no inventory; rather, shoppers leverage Personal Stylists to try on product samples and order in-store. Employees pull inventory from Nordstrom’s neighboring stores and online.[v] Orders can be delivered to shoppers’ homes or picked up in-store that same day for $15.[vi]

Nordstrom Local demonstrates the integration of several short-term pilot concepts that aim to connect the digital and store experience (see below).[vii]

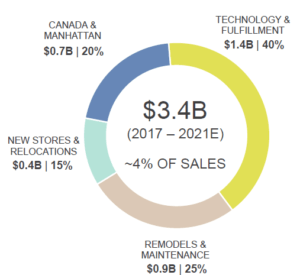

Over the medium term, management plans to optimize and roll out proven supply chain initiatives across its store base. This involves growing online sales (23% of total) by incorporating emerging technology into customer-friendly formats.[viii] By accelerating spending around technology and supply chain capabilities, management hopes to “re-imagine the customer experience.”[ix] Below is management’s estimate for capital expenditures from 2017 to 2021E.[x]

2017-2021E Nordstrom Capital Expenditure

Increasing supply chain productivity through digitalization both improves consumers’ shopping experience and allows Nordstrom to save on product and overhead costs. Shipping merchandise to homes and retail locations from warehouses, Nordstrom can avoid building up seasonal inventory. This will reduce product markdowns and trucking costs from warehouses to large stores.[xi]

Management must weigh investment costs against expected returns of these initiatives. Furthermore, management should consider reducing its larger format retail footprint (122 doors), rather than remodeling. In particular, management should exit unprofitable locations as leases expire, especially within low-grade malls. Simultaneously, Nordstrom should consider expanding its showroom format stores in profitable locations with favorable consumer demographics.

Discussing digitalization with a former Nordstrom Personal Stylist, I learned that Stylists collect a wealth of customer purchase and return information in “personal books.”[xii] Data could be leveraged to provide targeted, automatic updates regarding new inventory. Information could also be utilized to create personalized, dynamic online interfaces accessed when consumers log into their Nordstrom web account. These initiatives would drive sales by increasing purchasing frequency by targeting inventory towards more likely potential buyers.

Despite the challenges that Nordstrom and its peers face, department stores thus have the potential to weather digitalization by offering differentiated customer service, expansive product variety, and the unique opportunity to experience and test merchandise.

Questions

- Do you think department stores such as Nordstrom will continue to have a role in the retail industry going forward? If so, how should Nordstrom innovate in the context of increasing digitalization and the demands of millennial consumers?

- Similar to Nordstrom Local, primarily online players such as Bonobos and Warby Parker have built inventory free stores. How can Nordstrom differentiate itself?

(797 words)

[i] 17 Retail Trends for 2017. Fung Global Retail & Technology, 2017, 17 Retail Trends for 2017, www.fungglobalretailtech.com/research/17-retail-trends-2017/.

[ii] Kestenbaum, Richard. “Why So Many Stores Are Closing Now.” Forbes, Forbes Magazine, 7 Apr. 2017, www.forbes.com/sites/richardkestenbaum/2017/04/07/why-so-many-stores-are-closing-now/.

[iii] Nordstrom Inc. “Nordstrom Announces Latest Retail Concept: Nordstrom Local.” PR Newswire: News Distribution, Targeting and Monitoring, 11 Sept. 2017, www.prnewswire.com/news-releases/nordstrom-announces-latest-retail-concept-nordstrom-local-300516824.html.

[iv] Ruff, Corinne. Los Angeles, 2017.

[v] Weissman, Rich. “Digital Sourcing Will Revolutionize the Apparel Industry. In Fact, It Already Has.” Supply Chain Dive, 26 Sept. 2017, www.supplychaindive.com/news/apparel-digitization-mckinsey-survey-CPO/505826/.

[vi] Nordstrom Inc. “Nordstrom.com Shipping Information.” Nordstrom, shop.nordstrom.com/c/shipping-methods-charges.

[vii] Nordstrom Inc. “UBS Global Consumer & Retail Conference.” Nordstrom Inc. Investor Relations, 8 Mar. 2017, investor.nordstrom.com/phoenix.zhtml?c=93295&p=irol-audioarchives.

[viii] Nordstrom Inc. Nordstrom Reports Third Quarter 2017 Earnings, 9 Nov. 2017, investor.nordstrom.com/phoenix.zhtml?c=93295&p=irol-newsArticle&ID=2316007.

[ix] Nordstrom, Blake. “Q4 2016 Nordstrom Inc Earnings Call Transcript.” Nordstrom Inc. Investor Relations, 23 Feb. 2017, investor.nordstrom.com/phoenix.zhtml?c=93295&p=irol-Quarterly. Accessed 12 Nov. 2017.

[x] Nordstrom Inc. “UBS Global Consumer & Retail Conference.” Nordstrom Inc. Investor Relations, 8 Mar. 2017, investor.nordstrom.com/phoenix.zhtml?c=93295&p=irol-audioarchives.

[xi] Bhasin, Kim. “The Future of Shopping at Nordstrom and Wal-Mart Is Home Delivery.” Bloomberg.com, Bloomberg, 20 Sept. 2017, www.bloomberg.com/news/articles/2017-09-20/the-future-of-shopping-at-nordstrom-and-wal-mart-is-home-delivery.

[xii] Simmons, C, and J Kim. 9 Nov. 2017.

Just yesterday, I was in Nordstrom and was shocked by the large number of silver boxes and bags behind a customer service kiosk for in-store pick-up of online orders. Nordstrom is right to understand that digital and live interactions are deeply intertwined for today’s consumer. Buying online and picking up in store is just one example of this trend; the opposite model – try in store and essentially purchase online – is what Nordstrom local is espousing. I’m impressed that Nordstrom is facing digitization head-on, and agree with their approach to trial a number of ideas through the “local” concept.

However, I am not convinced that the traditional retail store will lose its role for consumers entirely for a number of reasons. Nordstrom sells tactile, fashion goods, which consumers need to try or feel. Stores enable customers to compare goods in a way that is not possible online by employing all their senses. More importantly, customers can walk out with their goods right then and there enabling immediate gratification. Amazon’s investment in services like Prime Now and next day delivery illustrates that the need to not only choose what you want but also get it immediately remains important even in the age of online shopping. I think that Nordstrom should continue to invest in models that allow consumers to do some of the buying process online, but I think the traditional retail model in which extensive options and inventory are available in store will continue to be important for the foreseeable future.

Just yesterday, I was in Nordstrom and was shocked by the large number of silver boxes and bags behind a customer service kiosk for in-store pick-up of online orders. Nordstrom is right to understand that digital and live interactions are deeply intertwined for today’s consumer. Buying online and picking up in the store is just one example of this trend; the opposite model – try in store and essentially purchase online – is what Nordstrom local is espousing. I’m impressed that Nordstrom is facing digitization head-on, and agree with their approach to trial a number of ideas through the “local” concept.

However, I am not convinced that the traditional retail store will lose its role for consumers entirely for a number of reasons. Nordstrom sells tactile, fashion goods and health products, which consumers need to try, smell, or feel. Stores enable customers to compare goods in a way that is not possible online by employing all their senses. More importantly, customers can walk out with their goods right then and there enabling immediate gratification. Amazon’s investment in services like Prime Now and next day delivery illustrates that the need to not only choose exactly what you want but also get it immediately remains important even in the age of online shopping. I think that Nordstrom should continue to invest in models that allow consumers to do some of the buying process online, but I think the traditional retail model in which extensive options and inventory are available in store will continue to be important for the foreseeable future.

This is a really interesting concept given the current landscape of retailers – especially given the recent success of companies that you mentioned above (Warby Parker and Bonobos). However, given the restricted size of the Nordstrom Local locations – how does the company think about cross-selling products across various departments? For example, currently when a Nordstrom customer walks into the department store, does the company have data around what % of customers buy products from more than one department (e.g. women’s apparel, children’s shoes, cosmetics)? Is Nordstrom losing out on sales from other departments? Is this a trade-off that the company is willing to take a hit on given shifting consumer trends?