The Axis of Change: Navigating the Digitalization of India’s Banking Industry Value Chain

The digitalization of India’s banking industry supply chain, powered by multiple technological breakthroughs and government-backed initiatives, has spawned disruptive new business models and forced incumbents to reimagine their end-to-end business processes and value propositions. How is Axis Bank (“Axis”) – India’s 3rd largest private-sector bank, with a large physical footprint (~3,300 branches), legacy systems and a traditional organizational setup – repositioning itself to face this digital onslaught?

Technological advancements like cloud computing and artificial intelligence (AI), a rapidly and consistently growing mobile internet user base (150m in 2014 to 350m in 2016) [1], and the corresponding proliferation of user data or “digital footprints” have driven two major developments in India’s banking system:

- The threat of “unbundling”, wherein both products and processes in a bank’s value chain are attacked by tech-enabled entrants ranging from mobile wallet companies like PayTM that have broader banking ambitions, to niche credit-scoring engines like CreditVidya that sell their new-age, big data driven risk analytics models to banks

- Competition from large technology and telecommunication firms that have captured a vast share of user-generated data that can be leveraged for financial services offerings [2]

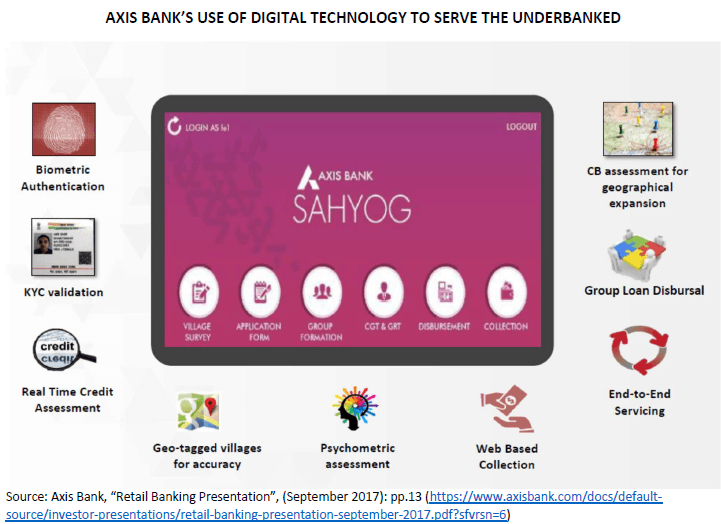

A third, uniquely Indian dimension has been the development of publicly accessible, unified digital infrastructure such as Aadhaar (a biometrically-verifiable unique identity for every Indian) and IndiaStack (APIs underlying an interoperable digital payment network, a digital signature system, and digital lockers) [3]. This has widened the competitive playing field substantially for Axis – not only new non-bank entrants but also digital laggards among existing banks can adopt these open architecture platforms to accelerate their own digital capability-building. Additionally, by driving down the cost of customer acquisition and servicing relative to physical acquisition, verification and disbursement, this infrastructure has made expansion into less-accessible rural areas and traditionally “unbanked” customer segments more viable for Axis.

Axis’ Digital Journey Thus Far

Having identified the need to realign around digital, Axis began upgrading core processes to better serve its digitally-enabled customers. Despite 66% of its transactions being digital, it focused on re-engineering both the back-end software and front-end customer experience at its branches, deploying a faster, more user-friendly, modular software platform, and installing digital self-service kiosks and biometric readers to facilitate automated account sign-ups [4][5]. The now leaner branch teams can spend more time cross-selling versus processing, further boosting profitability and engagement.

Axis has also used robotic process automation to reduce the time and human error involved in data entry and verification [5]. In a rare case of an Indian incumbent acquiring a prominent, albeit struggling disruptor, Axis acquired Freecharge, one of India’s leading mobile payment startups, in 2017.

To sustain its technological progress and build internal capabilities over the medium term, Axis created a Centre of Excellence comprising members from its technology and transformation teams and from partners like Infosys and WorkFusion. It has also hired a team of engineers for its “Thought Factory” innovation lab to focus on cutting-edge AI (beginning with chatbots), cloud and mobility solutions [6].

Can More Be Done?

To drive the system-wide strategic shift necessary to be a digital banking pioneer, Axis may need to consider altering its stance on branch expansion. While an omnichannel presence is important given varying customer preferences especially in smaller towns, growing its total branch footprint by 400 per year [4] seems misaligned with a desirable long-term goal of being “digital-first”. Prioritizing its ongoing engagement with “business correspondents” – intermediaries that help banks navigate the last-mile problem to serve remote customers in a more asset-light manner – could be explored.

Organizationally, while “Centres of Excellence” add tremendous value as independent labs, an even more agile, cross-functional organizational structure within the core business would be required to bring products to market much faster and to build first-mover advantage in the latest technology-based solutions. Finally, using AI not just to identify credit and fraud risk but also to preempt cyber security threats will be critical.

Over the medium term, Axis could consider disrupting itself by incubating a “digital-only” bank. A few newly-licensed Indian banks are already taking this radical, digital-only route; Axis could learn from their missteps while concurrently building a futuristic model inside its four walls. It could look to reimagine itself as not merely a bank but a one-stop information and transaction hub for multiple non-financial services as well, akin to the WeChat payment-enabled ecosystem model in China.

There appears to be plenty of positive momentum surrounding digitalization both at Axis and within the broader financial services industry today. The question I wrestle with is: Can Axis turn its “incumbent” status into a competitive advantage rather than a potential liability? Can it leverage existing strengths like its trove of customer data to consistently develop the most innovative B2C and B2B digital financial products? Will it challenge convention by aspiring to a bold long-term vision, say “to be 90%+ digital in 5 years”?

(Word count: 800)

Sources:

[1] Tripathi, S., et al, “Encashing on Digital: Financial Services in 2020”, The Boston Consulting Group

[2] Diwanji, A., et al, “Banking in the Age of Disruption”, EY (February 2017)

[3] Sengupta, J., et al, “Mastering new realities: A blueprint to transform Indian banking”, McKinsey & Company (May 2017)

[4] Anand, N., “It’s too early to write an obituary for bank branches and ATMs in India: Axis Bank”, Quartz India (Aug 23, 2017)

[5] Gupta, S., “How Axis Bank is shaping its digital journey”, Mint (Nov 10, 2017)

[6] Adhikari, A., “Axis Bank to strengthen digital system for safer online transactions”, Business Today (Jan 29, 2017)

This essay raises an interesting point around the “unbundling” of banking products and processes. Typically, products are bundled to maximize a company’s ROE on the client and allow less profitable products to be offered to clients that are subsidized by others. How will these tech-enabled entrants affect profitability at more established institutions and what are the potential responses to this competitive threat? For a company like Axis, how does it build up trust in its customer base in a digital world? The model seems to contrasts with what we observed in the Handelsbanken FRC case of a high-touch and personalized relationship. Can a banking model survive in the long-term in a fully digital way? This is a tension that seems to be at the fore of the expansion model as described above (e.g. growing its total branch footprint by 400 per year). It will be interesting to see how this story unfolds and the operating environment has dynamics that will be lessons for other banking groups in developing countries.

Large incumbents such as Axis should seriously consider opportunities to grow digital capabilities through acquisition. Axis needs to move quickly or they will be left behind. While many large incumbents see acquisition as expensive, I believe many often underestimate the complexity and time required to build a competing technology. With the pace of technological change in today’s world, the value of plug in technologies cannot be overstated. In addition to specific capabilities, these add-on acquisitions bring in the innovators power of these start ups to help fuel future development and innovation within Axis. Incumbents that overestimate their abilities to innovate in the digital space risk letting ego drag them down to disaster.

The essay poses an interesting question of whether an incumbent Indian bank trying to be a digital banking pioneer should continue with its branch expansion along with its aggressive digital expansion. I think the answer is yes. The context is important – digital banking is relatively new product in India and largely ushered in by government’s push for digitalization of paper currencies a year or so ago. The technical ecosystem and and internet/digital penetration, while growing, aren’t necessarily mature. The change in consumer behavior to easily accept digital-only banking might take time given the novelty of the technology and issues such as security for service as sensitive as banking.

The other consideration is that digital and physical expansions are not mutually exclusive – in fact they should be quite synergistic. Branches raise brand awareness and serve as customer acquisition vehicles. Those customers can then be easily transferred onto the digital platform. Many customers may also view the physical branch as the troubleshooting center for the digital banking and thus be more likely to sign up for the service online. I also wonder question whether the third largest bank can remain third largest if it stops physical expansion at 3,300 branches for 1.3bn people to focus just on digital expansion.

Interesting Article!

One of the biggest challenges that has plagued the Indian banking system in recent times is the rise of Non-performing Assets (or NPAs) [1]. NPAs rise due to the process called evergreening where banks provide propping up ailing companies with fresh loans, even as firms struggled to repay old debts.

One area that will be particularly crucial is how Axis banks, and others, use digitization and increased data availability to reduce the risk of NPAs. One potential solution could be increased transparency and increased data sharing between the bank and the firm it is lending to. Banks need to keep a tab on an enterprise’s key financial transactions, resources and commitments. Having a digital system in place could be used to identify potential defaulters way in advance and on the flip side, actually provide lower interest rate loans more financially healthy enterprises. [2]

[1] http://www.firstpost.com/business/bad-loans-of-indian-banks-cross-rs-800000-cr-banking-mess-explained-in-7-charts-3939999.html

[2] https://www.linkedin.com/pulse/how-technology-can-solve-indias-npa-banking-crisis-digital-ahmar/

This is a very interesting essay in that many of the implications for Axis are relevant for incumbent banks not only in India but other countries as well. While expanding branches may be a necessary strategy for the near term, given the awareness and infrastructure barriers to implementing a digital-only bank, I believe that incubating or acquiring (like in the case of Freecharge) a digital-only brand is a prudent next step for Axis in understanding the changing consumer behaviors of India. By adopting a digital-only brand within its portfolio, Axis will be able to further develop capabilities in marketing (e.g. creating a personalized experience, raising brand awareness and acquiring new customers without the benefit of branches serving as outdoor advertisement, media channel effectiveness, customer targeting), and product development (e.g. developing and testing innovative financial products that could be served well through the digital channel, such as loans for e-commerce marketplaces), without necessarily associating the risks with the existing Axis brand. One interesting related article:

https://www.mckinsey.com/industries/financial-services/our-insights/building-a-digital-banking-business

Great article. To respond to your question on implications of Axis’ incumbent status, from my perspective Axis faces increasing competitive pressure as certain barriers to entry in India’s banking system erode due to digitalization; at the same time, the company maintains other competitive advantages that are outside of the scope of digital platforms.

Whereas physical branch networks once served as a substantial moat that deterred potentially competitive entrants, this impediment has significantly diminished. Consumers are increasingly relying on online banking and increasing touchpoints with financial institutions through mobile devices. That said, customer acquisition is still costly for technology-enabled entrants, and the brand recognition afforded by a branch network has considerable value [1].

As financial services increasingly leverage technology, physical branch networks and online-only banks share in the benefits of unprecedented access to customer data. This enables greater cross-selling of financial products, increased ability to create loyalty with customers, and more effective underwriting.

—–

1. International Finance Corporation. Mobile Financial Services: Its Role in Banks and the Market. Washington, DC; 2014. https://www.ifc.org/wps/wcm/connect/5e24430042b925809415bc0dc33b630b/M-Banking_Workshop_Presentation_Jan28-2014_ENG.pdf?MOD=AJPERES.