Can Ocado Weather the Disruption of the Grocery Industry?

Ocado has invested in a supply chain that is years ahead of its competitors’, but will these investments pay off in time to help the company weather the disruption of the grocery industry?

Anticipating the Future of Grocery

Amazon’s acquisition of Whole Foods reiterated the threat that e-commerce poses to brick-and-mortar grocery retailers, but one company has been trying to anticipate this threat for almost twenty years.

Founded in 2000, UK-based Ocado is “the world’s largest dedicated online grocery retailer,” and their mission is to deliver “the best shopping experience in terms of service, range, and price.”[1] Ocado’s ability to do so hinges on the digitalization of their supply chain, which leverages automation, proprietary technology, and the aggregation of scale using large warehouses called Customer Fulfillment Centres (CFCs)s.[2] Every activity carried out in these CFCs runs on data:

Receiving and stocking inventory: When inventory arrives, Ocado’s computers use data to predict what stock will be needed and when, so that they can direct a human-operated crane to organize these pallets in the most efficient manner possible.[3]

Picking: When picking items for customer orders, the picker does not have to worry about deciding the best way to place items in each bag – the computers have learned how to avoid suboptimal outcomes like putting bleach next to meat and guide the picker accordingly.[4]

Delivery: To create the most efficient delivery schedule, Ocado relies on data from past deliveries. Ocada tracks each van’s GPS, fuel usage, acceleration, braking, and even “dwell time” in front of a customer’s house.[5]

Rising Concerns

Given their first mover advantage, why should Ocado be concerned about this megatrend? The answer, in short, is competition. Already dominated by established competitors like Tesco, Sainsbury’s, Marks & Spencer, and ASDA, the UK grocery industry is becoming increasingly crowded with the introduction of discount retailers like Aldi and Lidl, and e-commerce giants like Amazon. In an industry with notoriously low margins, success depends on one’s ability to maximize efficiency. Thus Ocado is facing a situation wherein a number of hungry and aggressive competitors are looking to invest in their supply chains and eliminate Ocado’s competitive edge.

Staying Competitive

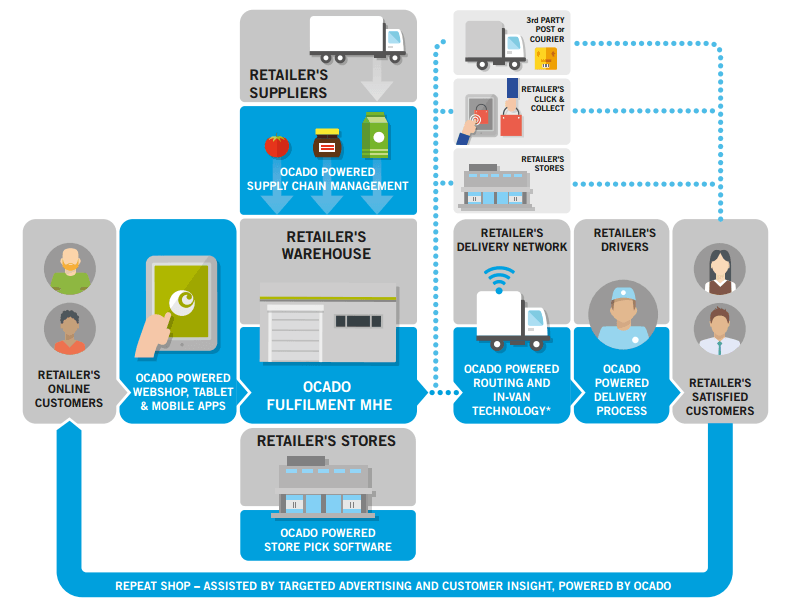

One of Ocado’s ongoing strategies is to monetize their IP. Companies who lack the resources to digitalize their supply chains can purchase Ocado’s proprietary end-to-end solution, the Ocado Smart Platform. This strategy is having limited success. As of this time, only two companies – grocery retailer Morrison’s[6] and garden center business Dobbies[7] – have partnered with Ocado.

Ocado’s long-term strategy is to double down on their technology and automate as many of their processes as possible. This strategy reflects their confidence that these investments will reap long-term efficiency and cost-cutting benefits that outweigh the initial costs. Some of the projects in development include the following:

- A robotic hand that that can sense and handle a wide variety of products (e.g. everything from a six-pack of Evian to a single orange).[8]

- A fleet of driverless delivery vehicles.[9]

- Humanoid robots that help engineers carry out repairs and access dangerous areas.[10]

- A warehouse “staffed” almost entirely by robots.[11]

Recommendations

Ocado’s decision to double down on their innovation is having a negative impact on their bottom line. Their financial results for the first-half of 2017 reveal an almost 20% decline in profits accompanied by a substantial increase in debt.[12]

It is hard to predict when Ocado’s investments will pay off. For Ocado to reap the benefits, they need to stay in business. My recommendation for Ocado is to shift their focus to activities that bring in revenue. They need to grow their top line by increasing the customer base and their basket size. They also need to be very selective about their investments and take on only those projects that will lead to customer growth and satisfaction. Otherwise, they may fall prey to investing in technology just for the sake of investing in technology.

Questions

What do you think of Ocado’s strategy to help others digitalize their supply chains? How will they stay competitive if they are giving other companies access to their proprietary technology?

(799 Words)

Footnotes

[1] Ocado, “At a Glance,” http://www.ocadogroup.com/who-we-are/ocado-at-a-glance.aspx, accessed November 2017.

[2] Ocado, “Strategic Objectives,” http://www.ocadogroup.com/who-we-are/strategic-objectives.aspx, accessed November 2017.

[3] James O’Malley, “Inside Ocado: Discover the Hidden Robotic Intelligence Behind Your Online Shopping,” Gizmodo, February 7, 2017, [http://www.gizmodo.co.uk/2017/02/inside-ocado-discover-the-hidden-robotic-intelligence-behind-your-online-shopping/], accessed November 2017.

[4] Ibid.

[5] Ibid.

[6] Jack Torrance, “What does the future hold for Ocado?”, Management Today, July 5, 2017, [http://www.managementtoday.co.uk/does-future-hold-ocado/future-business/article/1438659], accessed November 2017.

[7] Emma Weinbren, “Dobbies strikes five-year deal with Ocado,” The Grocer, May 2, 2017, via LexisNexis Academic, accessed November 2017.

[8] Ben Rossi, “How Ocado plans to lead the Fourth Industrial Revolution,” Information Age, March 24, 2017, [http://www.information-age.com/ocado-plans-lead-fourth-industrial-revolution-123465260/], accessed November 2017.

[9] Jon Excell, “Roboshop: grocery 4.0.,” Engineer (00137758), March 2017, 297, 7885, pp. 27-28, Business Source Complete, EBSCO, accessed November 2017.

[10] Ibid.

[11] Dan Worth, “Ocado’s Robot Army,” Computing, March 2016, pp. 36-37, Advanced Technologies & Aerospace Database, accessed November 2017.

[12] Emma Weinbren, “Ocado: Amazon-Whole Foods deal ‘boosts us,’” The Grocer, July 8, 2017, via LexisNexis Academic, accessed November 2017.

[1] http://www.ocadogroup.com/~/media/Images/O/Ocado-Group/image-gallery/PR%20images/Large%20Image/ocado-grocery-image.jpg

[2] https://s3-eu-central-1.amazonaws.com/centaur-wp/theengineer/prod/wp-content/uploads/2017/03/10120251/IMG_3019-e1489147452855.jpg

[3] http://www.ocadogroup.com/~/media/Files/O/Ocado-Group/OSP.PNG?h=614&w=792

[4] https://secondhands.eu/wp-content/uploads/sites/4/2015/06/secondhands-feature-960×300.jpg

I’m in favor of Ocado’s strategy to help others digitalize their supply chains – specifically for traditional brick-and-mortar grocery chains. I think they could create mutual value in serving as an additional step in the value chain to traditional grocers as a last-mile-provider. This would allow Ocado to gain competitive data and potentially expand their own offerings in the future. Additionally, with their business currently struggling to make a profit, the revenue stream created through partnerships and/or consulting services could stabilize their finances and fuel growth.

Ocado’s delivery system seems incredibly impressive, but I worry about their long-term strategy. While increased efficiency and cost-savings are always a good thing, I’m concerned that this will become a race to the bottom with shrinking margins squeezing them out of business, mostly because this fails to account for the enormous of risk of Amazon (or similar). It seems as if a giant, well-funded, growth-focused player (like Amazon) could enter the UK both without any need to turn profit and with the ample time and resources available to steal market share and push out competitors. Thus, playing the cost-cutting game seems dangerous. Instead, I would think that they should better differentiate themselves and double down on that competitive advantage.

I see monetizing their operational strategy as a really interesting play. I wonder if they should not only be selling their end-to-end solution, but also if they should be utilizing their existing warehouse to handle the outsourced distribution of other companies, similarly to how Amazon distributes the products of third-party players. This would not only give them the opportunity to monetize their system, but also to perhaps better serve their existing customers with a more diverse product mix.

I also wonder if perhaps they should be focused solely on the distribution of perishable goods, which is a space not only less saturated but also dependent on an incredibly efficient supply chain. It appears that they already do this quite well. Ocado was clearly ahead of the curve when it came to online grocery! It will be incredibly interesting to see if they’re able to stay ahead – or at least not fall behind.

Very interesting piece on a company I had not previously heard of! It’s amazing how ahead-of-the-curve they have been, but I find myself wondering why they haven’t been able to grow faster (revenues of 1.3bn GBP in 2016). I think monetizing their IP will be a difficult revenue stream to count on moving forward since competitors are catching up rather quickly. I’m also not a fan of giving up the proprietary technology that the business was founded on. Autonomous delivery vehicles will be a step in the right direction, but competitors such as Amazon will benefit from this too. One thing to ponder is whether Ocado would be an interesting target for Amazon to acquire. Do they still have differentiating technology that would help a giant like Amazon, or have others caught up via investments in technology over the past few years?

Elan, this is a fascinating article and topic! I do agree that although Ocado has very impressive automation the question does need to be asked whether some of their solutions are beautiful engineered solutions rather than having a compelling business cases. I think they need to be careful of this trap as it can be argued that a their capex investments are yet to be paying off as suggested by their bottom line performance.

For example, I think investing in the robotic hand will not make commercial sense. Robotic picking has proven extremely hard to implement in an environment with a high number of SKU’s and has led to companies like Amazon still doing their final picking manually. Although auto-picking 5 axis robots supplied by companies such as Kuka or Swisslog are widely available especially for items that are rigid, have the same defined shape (such as the Evian cases) it is hard to make a business case when you have too many SKU’s. This is because each SKU will at minimum need a different gripper tool for the robot. As if this is not challenging enough Ocado’s hand is solving for items that are can be categorized as “hard to automate” through auto pickers. This includes delicate items that have slightly different shapes (such as the orange in your article). An orange is harder to pick automatically as it requires adding vision systems which can help detect the item to the robot. Products for this are still widely available in the market but are more of coure more expensive (suppliers include Schubert or ABB). The orange has the additional complexity of being fragile which the Ocado hand is trying to solve for. As suggested this solution in my opinion is very far from being able to commercialize as even the “easy to automate” items aren’t making commercial sense for companies such as Amazon which struggle with a high number of SKUs.

I think helping others digitalize their supply chain could be a good revenue stream for the company. Given the successful implementation in their own warehouse Ocado has a lot of credibility in their knowledge of automation within the grocery market. I think sharing the knowledge is not a major risk as the technologies they are using are widely known but just hard to automate / commercialize successfully. A lot of the complexity is in the successful implementation rather than the R&D which is generally available off the shelf from various vendors.