The $10,000,000,000,000 Oil Company You’ve Never Heard Of

Oil usage is the single largest contributor to greenhouse gases (GHG) in the entire planet. According to the EPA, CO2 represents 81% of all GHG’s and oil combustion is the number one source of CO2 emissions [1]. Because of this, governments around the world are pursuing policies and regulations aimed at decreasing dependence on oil.

So who could possibly be worse to tackle the global threat of Global Warming than the largest oil company in the world?

But… then again, who else would have a larger financial incentive to invest in technologies that reduce carbon dioxide levels and replace non-oil related sources of greenhouse gases to solve climate change once and for all?

Company Profile

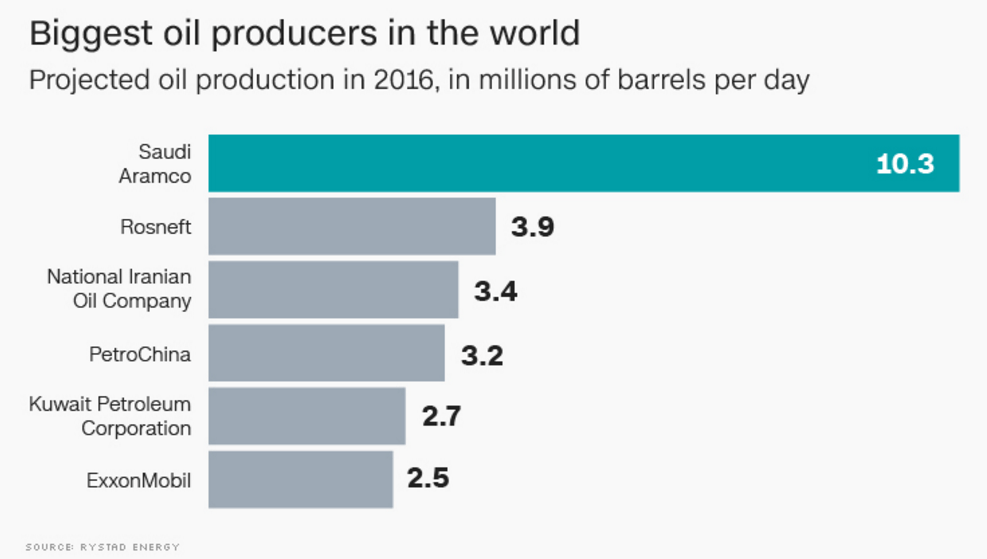

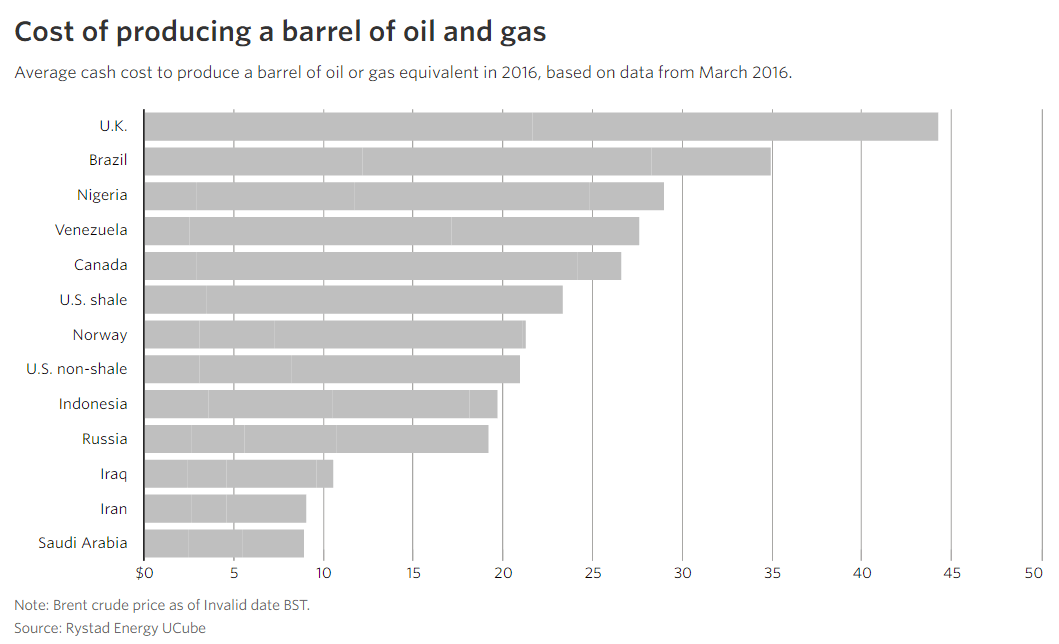

Saudi Arabia’s Aramco is the largest oil and gas company in world. Aramco produces 10 million barrels of crude oil per day – more than 10% of the world’s oil production [2]. Its production is more than 2.6x than that of Russia’s Rosneft, the next largest producer of crude oil (Exhibit 1). Additionally, Aramco has 261 billion barrels of proven crude-oil reserves – the largest of any oil company in the world [3]. Importantly, Aramco has a cost of production of $9.90 per barrel, which is the lowest cost of any oil producer besides Kuwait (Exhibit 2).

In January 2016, Mohammad bin Salman Al Saud, the Deputy Crown Prince of Saudi Arabia announced his intentions to IPO Aramco, which will make it the largest publicly traded company in the world. [4]

Exhibit 1

Exhibit 2

How is Aramco likely to be affected by Climate Change?

As our global annual production of GHG’s continues to accelerate, governments, companies and NGO’s are increasingly focused on finding ways to curtail our dependence on oil through regulation, tariffs, taxes, and funding renewable energy sources.

Additionally, consumers are looking for ways to reduce their carbon footprint through making lifestyle changes such as purchasing hybrid and electric cars.

Because of this, Aramco’s business model is facing an existential threat from climate change as the entire planet is looking for ways to reduce our global dependence on Aramco’s core product: oil.

The steps Aramco is taking to address Climate Change’s expected effects

Aramco is pursuing a 3-pronged strategy to address the expected impacts of climate change.

First, Aramco is focused on funding research and development of technologies that eliminate or repurpose CO2 for beneficial products, create energy efficiency in end markets, and replace non-oil based sources of GHG’s [4]:

Secondly, Saudi Aramco is taking a leadership role in creating partnerships to fund and support carbon management initiatives. In Jan 2014, the Oil and Gas Climate Initiative (OGCI) was created along with 9 other of the largest oil producers to share best practices and collaborate on ways to mitigate the causes of climate change.

Lastly, Aramco is seeking to diversify its financial ownership to increase its focus on improving operations. By IPO-ing, Aramco is forcing itself to increase its transparency and as a result will be subject to strong investor pressures to increase the efficiency of its operations, which will better prepare the business for declines in oil demand.

On the negative side, Aramco is incentivized to do everything it can to derail global climate change initiatives that would decrease oil consumption and not surprisingly, Aramco has been recorded as attempting to do so by adding roadblocks to slow negotiations, watering down policies, and using its influence with America and its allies in the Middle East [8].

Additional steps Aramco should consider implementing

Aramco should consider implementing the follow 3 strategies for further protecting itself from the expected effects on climate change:

- Aramco should do everything it can to discourage others from investing in technologies competing with oil. A great way to do this is to erratically increasing and restricting oil supply with the goal of increasing the volatility of oil prices. This would increase the risk of investing in substitute technologies affected by the price of oil and thus would increase the cost of capital for such projects.

- Focus on significantly improving operations, so that you can invest additional profits in defeating climate change by funding win-win disruptive technologies that limit the effects of climate change. Additionally, these cost savings would allow Aramco to further lower the price of oil, which would reduce the attractiveness of investing in and purchasing technologies that reduce our oil usage such as hybrid and electric cars.

- Lastly, Aramco should significantly increase investment in CO2 reduction technologies. The sooner we discover a cost-effective solution for eliminating CO-2 in the atmosphere the sooner climate change will no longer be a global issue and governments will no longer need to prioritize finding ways to curb global oil usage. (799 words)

Footnotes

[1] Overview of Greenhouse Gases | Greenhouse Gas (GHG) Emissions | US EPA. 2016. Overview of Greenhouse Gases | Greenhouse Gas (GHG) Emissions | US EPA. [ONLINE] Available at: https://www.epa.gov/ghgemissions/overviewgreenhousegases. [Accessed 03 November 2016]

[2] Saudi Aramco. 2016. Key facts and figures. [ONLINE] Available at: http://www.saudiaramco.com/en/home/about/key-facts-and-figures.html. [Accessed 03 November 2016].

[3] SaudiAramco. 2016. Aramco 2015 Annual Report. [ONLINE] Available at: http://www.saudiaramco.com/content/dam/Publications/annual-review/2015/English/AR-2015-SaudiAramco-English-full.pdf. [Accessed 02 November 2016].

[4] The Economist. 2016. Saudi Arabia is considering an IPO of Aramco, probably the world’s most valuable company | The Economist. [ONLINE] Available at: http://www.economist.com/news/middle-east-and-africa/21685529-biggest-oil-all-saudi-arabia-considering-ipo-aramco-probably. [Accessed 03 November 2016].

[5] WSJ.com News Graphics. 2016. Barrel Breakdown – WSJ.com. [ONLINE] Available at: http://graphics.wsj.com/oil-barrel-breakdown/. [Accessed 02 November 2016].

[6] About the Oil and Gas Climate Initiative | OGCI . 2016. About the Oil and Gas Climate Initiative | OGCI . [ONLINE] Available at: http://www.oilandgasclimateinitiative.com/about. [Accessed 03 November 2016].

[7] Climate Summit 2014: Oil & Gas Climate Initiative Action Summit | OGCI . 2016. Climate Summit 2014: Oil & Gas Climate Initiative Action Summit | OGCI . [ONLINE] Available at: http://www.oilandgasclimateinitiative.com/news/climate-summit-2014. [Accessed 03 November 2016].

[8] Democracy Now!. 2016. Why Is Saudi Arabia Undermining COP21 When Climate Change Could Make the Gulf Uninhabitable? | Democracy Now!. [ONLINE] Available at: http://www.democracynow.org/2015/12/10/why_is_saudi_arabia_undermining_cop21. [Accessed 03 November 2016].

[9] Saudi Aramco. 2016. Saudi Aramco makes joint collaborative declaration on climate change with oil and gas industry CEOs. [ONLINE] Available at: http://www.saudiaramco.com/en/home/news-media/news/COP21.html. [Accessed 03 November 2016].

Regarding the first step, wouldn’t restricting the oil supply, which could increase the global price of oil, benefit substitute technologies by making them more attractive alternatives to oil? Similarly, wouldn’t this also effectively reduce demand for Aramco’s oil supply in other countries that have oil reserves which can only be economically exploited once oil surpasses a certain price?

Aramco should invest money in funding candidates in US elections who are opposed to climate change regulation, as really world climate change is just a question of American politics.

It’s interesting to see how not investing in alternative technologies could actually help the environment – something which might seem counter-intuitive initially. But then, the caveat is that we’d be betting big on oil companies figuring out how to clean up their emissions. Unfortunately, big oil doesn’t really inspire an environmentalist’s confidence 😛 So, I still feel it would be a major risk to stop exploring alternative technologies.

Focusing on technologies that could reduce CO-2 seems like a very intresting approach — though sometimes far away of the core of O&G companies such as Aramco. I would challenge if the “urgency” to provide these kind of solutions is such, and whether it makes strategic sense for Aramco to try to achieve that objective. It is estimated that by 2040 renewable energies will occupy nearly 15% of the world’s energy matrix. However energy from fossil fuels will continue to occupy a high percentage of more than 80% [1]. That “oil demand decline” seems to be quite long term…

Source: [1] http://www.ypf.com/Vacamuertachallenge/Paginas/index.html

As someone coming from the O&G Industry, I found the article a very interesting read. Great job collating facts on Aramco, which is clearly a powerhouse in the sector. I also agree that given Aramco is sitting on the largest pool of resources with low extraction costs, and as such they possibly have the least incentive to make a change.

I would just like to complement your article, by adding some insights from my experience in the industry. Unfortunately, the O&G industry has virtually no internationally accepted regulations around GHG emissions, and as a result companies across the globe follow whatever loose standards their countries hold them to. Regulations (if any) are basically self-imposed. The biggest change I would make is for Aramco to lobby for stronger international regulations that force O&G operators to keep their GHG emissions below a certain threshold – forcing them towards operational improvements. For instance, the O&G exploration startup I worked with prior to HBS had adopted IFC Performance Standards, thereby self imposing fairly stringent internal checks on how we chose equipment, service providers etc to do our projects. Additionally, monitoring and reporting GHG emissions to IFC on an annual basis helped force our decision making to incorporate sustainable choices. I would personally hope that an international O&G body follows through and implements such regulations on operators across the globe. Given Aramco’s low cost of production, they are in a position of strength and can certainly incur additional costs to meet any such regulations (unlike many operators with higher cost of deepwater production).

Lastly, I just wanted to stress that I don’t believe O&G firms need to actively stop alternative sources of energy from developing. Given that the rate of energy demand is miles ahead of the rate at which alternate technologies are developing – I personally believe that O&G is here to stay for many decades. If anything, development of these alternative source will reduce the burden on O&G companies to meet the ever increasing global energy demand and allow them to focus on extracting O&G from reservoirs/basins with a lower cost of production.

I agree that improving the efficiency and profitability of current oil production operations is a great way to increase cash to invest in changes to help climate change; however, I think at some point policies will end up limiting emissions so much that it will force oil companies to cap their production. At that point it seems like it would be more in Aramco’s best interest to have invested in alternative energy to be diversified as opposed to investing in ways to increase oil prices.

While Aramco is making an effort to remain competitive in a market impacted by climate change by investing in Research & Development, how are they going to differentiate themselves from other competitors who are doing the same? The massive size of Aramco’s core business threatens to constrain it in a post-climate change market. While other competitors in the Oil & Gas space might have the opportunity to leverage research & development in order to pivot its core business out of Oil & Gas and into new markets, MIM’s suggestion for Aramco is to do the same will be exceedingly difficult because of its size.

Interesting article…

However I don’t think the first option (increasing volatility) will help, but instead fuel the incentives to go green

The third option (increasing CO2 efficiencies) is the best alternative for Aramco right now. If we didn’t take into account the negative externalities of oil production, Aramco is the most profitable company in the world right now and theystill have room for growth. So, finding a way to have cero CO2 footprint could lead them to ultimately increasing their market share. Going public will give Aramco further incentives to go after this strategy.

Very interesting lay out of the scope of Aramco and its impact on global warming. One thought that I have is that the IPO likely doesn’t have much to do with the Co. looking to slowly increase transparency (especially with regards to global warming), but is rather the Saudi government desperately trying to raise cash to subsidize its spending during the current oil downturn. In that same vein, I don’t think Aramco is able to lower its marginal cost of production on reserves through any climate change technologies and therefore is unable to keep prices too low in the long run without existential risk to the stability of Saudi. Therefore I agree that your #3 proposal is the only real way to affect positive change, but in all likelihood their best option is misinformation and using global influence to affect foreign policies towards oil and GHGs.

I really enjoyed reading your post. I’d like to add some value by giving my perspective on the first proposed strategy. I believe that volatility in oil supply, which will indeed lead to volatility in oil prices may end up being a good thing for substitutes. Let’s look at LNG for example. Natural gas prices have always been indexed to oil prices, which means that if the prices of oil are low then natural gas prices will also be low. As a result, this closes the arbitrage window from West to East, significantly reducing the spread between US, European, and Asian natural gas prices. Hence liquefaction facilities in the US, such as Sabine Pass, may struggle to make a profit when selling LNG because when they take into account the cost of production and the cost of shipping LNG to Asia, their profit margin is minimized. This is what happened in 2014 in the LNG industry causing many liquefaction projects to get delayed. However, this was due to a prolonged period of low oil prices. If you add volatility though, then I would expect the dynamics to start changing. Liquefaction facilities have the ability to secure long-term contracts with LNG buyers when oil and hence NG prices are high, hence they are more likely to go ahead with the project. Furthermore, volatility always attracts commodity traders in the game who could be willing to enter into contracts with LNG liquefaction facilities at prices that make sense for these facilities in the hope to benefit from price volatility.

Interesting post. I agree with the points suggested for Aramco to fight climate change, except for the idea that “Aramco should do everything it can to discourage others from investing in technologies competing with oil.” While such an activity might be beneficial for Aramco on the short run, I would argue that it hurts them on the long run. It is in the benefit of Aramco to encourage investment in alternative energy resources, as Aramco should view itself as an Energy company not just an oil and gas company. Hence, Aramco should invest in and create an ecosystem that supports innovation in alternative energy to enable them to generate high quality energy at competitive prices (the same way they are today with oil) and to focus on being the leader of the world’s energy companies.