SwissRe: Banking on Climate Change

How should reinsurers price catastrophic loss related to natural disasters? SwissRe has been sharing its findings but also shifting costs to insured entities; perhaps there is room to take a more active stance against climate change.

Swiss Reinsurance Company Ltd (SwissRe) is a “leader in wholesale reinsurance, insurance, and risk transfer solutions.”[i] SwissRe is the 2nd largest reinsurer – to put it simply, reinsurance is the insurance of insurance firms. SwissRe insurers USD $2.6B of property & casualty reinsurance claims for natural catastrophe covers – the risk of which is significantly heightened due to climate change. Worldwide, $37B of natural catastrophe is insured, giving SwissRe 7% market share in the category. Why does this matter? Reinsurance works to reduce risk in the system by shoring up insurers: “Reinsurance provides direct or primary insurers, multinational corporations, reinsurance intermediaries, nations, and captive insurers with reduced volatility, improved financing, and access to additional expertise.”[ii]

How SwissRe is Affected by Climate Change

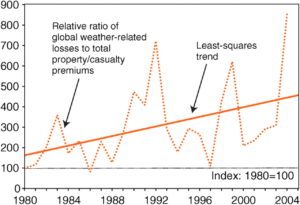

SwissRe takes on global warming risk by reinsuring damage caused by natural catastrophes e.g. floods, storms, earthquakes, and other natural disasters. When typically pricing risk for any category, SwissRe’s actuaries have looked to historical loss ratios. However, pricing risk has been quite challenging as climate change has been incredibly difficult to forecast; for example, the IPCC’s 2007 model predicting ice-free Arctic summers was revised in 2012 as the pace has “exceeded [even] the worst case scenarios predicted.”[iii] In particular, climate change has increased the frequency of loss events; shifted the geographic distributions of events; and impacted the correlation between weather events.[iv] The following chart shows both the increasing frequency and unpredictability of global-weather related losses:

To quote an industry expert speaking to the Smithsonian about modeling catastrophic events: “‘In the past, when making these assessments, we looked to history. But in fact, we’ve now realized that that’s no longer a safe assumption—we can see, with certain phenomena in certain parts of the world, that the activity today is not simply the average of history.'”[v]

Steps SwissRe is Taking

In addition to providing reinsurance covers, SwissRe is offering clients strategic expertise and integral risk assessment of natural disasters and climate adaptation. For example, SwissRe committed to the United Nations to “having advised 50 sovereigns and sub-sovereigns on climate risk resilience and to have offered them USD 10 billion against this risk. The company also helped create “the Caribbean risk pooling scheme as well as similar schemes in Africa and among Pacific Island nations” – nations where insurance penetration is quite low, thereby increasing systemic risk.[vi]

However, not all of SwissRe’s reactions to climate change have been as magnanimous. As the insurability of the market declines, SwissRe has used many traditional methods to reduce its exposure, including increasing premiums and deductibles, lowered limits, non renewals, and new exclusions. Moreover, SwissRe has been switching to one year (or even shorter) contracts with insured entities to mitigate risk of long-term assumptions in its climate change models. The market has also avoided reinsuring in certain unpredictable regions e.g. specific areas of Southeast Asia, thereby increasing volatility and financing costs for local insurers.[vii]

Additional Steps SwissRe Should Implement

Insurers have a long history of not just risk sharing but also addressing root causes of issues. Following the Great Fire of 1666, during which London had no organized fire protection system, insurance companies began creating some of first organized fire departments to combat the risk of fires at buildings the company insured.[viii] Instead of simply creating short-term insurance, SwissRe should offer long-term insurance – perhaps even up to 25 years – to companies and countries against major climate events. To help mitigate their risk, SwissRe should also actively help these countries and companies reduce their carbon footprint through private-public partnerships, while also preparing the organizations for disaster recovery scenarios. Taking on long-term contracts will help SwissRe move from an organization simply providing information about climate change and pricing its risk to an organization impacting the future of climate and putting its capital behind this effort.

Word Count: 629

[i] Swiss Re, 2015 Annual Report (Zurich: SwissRe, 2016), p. 4.

[ii] Anis Bajrektarevic and Carla Baumer, “Climate Change and Reinsurance: The Human Secruity Issue,” Economics, Management, and Financial Market Volume 7(4) (2012), pp. 42–86: EBSCO HOST, accessed November 2016.

[iii] Rebecca M Henderson, Sophus Reinert, Polina Dekhtyar, and Amram Migdal, “Climate Change: Implications for Business,” HBS No. N2-317-032 (Boston: Harvard Business School Publishing, 2016), p. 3.

[iv] Evan Mills, “Insurance in a Climate of Change,” Science, Vol. 309, Issue 5737, pp. 1040-1044 (2005), Google Scholar, accessed November 2016.

[v] Joseph Stromberg, “How the Insurance Industry Is Dealing With Climate Change,” Smithsonian, September 14, 2013, [http://www.smithsonianmag.com/science-nature/how-the-insurance-industry-is-dealing-with-climate-change-52218/?no-ist], accessed November 2016.

[vi] Eduardo Lull, “Insurers’ Pledge to Help Developing Countries on Climate Change,” Financial Times, June 28, 2016, [https://www.ft.com/content/ec2e7e30-ccc9-11e4-b5a5-00144feab7de], accessed November 2016.

[vii] Anis Bajrektarevic and Carla Baumer, “Climate Change and Reinsurance: The Human Secruity Issue,” Economics, Management, and Financial Market Volume 7(4) (2012), pp. 42–86: EBSCO HOST, accessed November 2016.

[viii] London Fire Brigade, “The Great Fire of London,” http://www.london-fire.gov.uk/great-fire-of-london.asp, accessed November 2016.

Having never heard of re-insurance before your blog post, I’m glad that you chose this topic because it clearly connects both the physical and financial impacts of climate change. Insurance companies at their core are intended to reduce risk, but when the impacts of climate change become too big and unpredictable, it’s scary that companies like SwissRe are choosing to limit their exposure to certain areas.

Historical trends aren’t predictive of a changing future and models’ projections contain unproven assumptions; this is a real problem for the future of insurance. It is neat how SwissRe is changing from a re-insurance company to a climate change advising company.

My favorite part of your post is your analogy to the Great Fire of 1666. Everyone (from insurance companies to governments to any business) needs to band together to create “fire departments” to combat climate change. As you wrote, “fire departments” will serve financial goals for all the contributors by reducing risk and it will directly improve our environment.

Very informative article! Climate change has definitely been difficult for insurance and re-insurance companies. I agree that taking on long-term contracts is a good solution, but I wonder how difficult it would be for the company to assess the underlying risk of these contracts (especially as climate change has made many historical data irrelevant in catastrophe prediction models). I also think it’s a good idea for SwissRe to work with companies and countries in building resiliency against severe weather conditions. Perhaps the company could even create an incentive for its clients, such as setting specific standards and building codes so that they can be better prepared for catastrophic events. As a reward for following these standards, SwissRe could potentially offer a rebate or reduction in its insurance premiums.