Stem: Energy Storage-as-a-Service, Delivering Value to Customers and Utilities

Stem offers energy storage to reduce electricity bills for commercial and industrial customers.

Stem offers energy storage to reduce electricity bills for commercial and industrial customers, solving a fundamental problem in the electricity markets and laying the foundation for a renewable energy economy.

In the absence of storage, electricity must be consumed the moment it is produced, making electricity a very unique product and the task of supplying it a challenging one. If electricity were consumed at a very smooth or flat level at all time, utilities would know exactly what constant level of electricity they needed to buy on the electricity markets from power generators (see Figure 1 below for a simplified structure of the electricity market).

![Electricity Markets depend upon the ability to predict electrical power needs to avoid the system losses caused by overproduction. Source for image: [1].](https://i4tsk12in2b2y7uts14c528g-wpengine.netdna-ssl.com/wp-content/uploads/sites/4/2015/12/Simplified-Electricity-Market-1024x476.png)

Stem has a strong and effective link between its business model and operating model; furthermore, the business helps its customers achieve better alignment between their business and operating models with regard to energy usage.

Business Model

Stem’s customers need high power consumption over short periods in order to provide consistent service to their customers, so Stem helps these businesses improve their energy operating model so they are charged a more consistent (and lower) rate for their energy use.

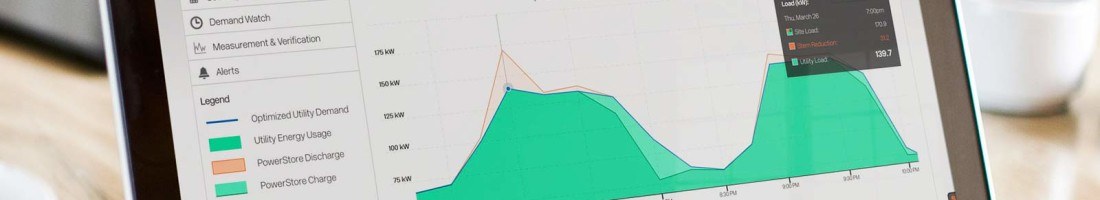

The company offers customers (1) on-site installation of batteries integrated with (2) cloud-based predictive software that constantly monitors energy use and costs, making real-time cost-based decisions for the customer on when to draw power from the grid versus batteries [3].

Stem offers financing for business customers that do not want to pay upfront for the battery and software system but prefer to pay for the benefits over a three-year financing term. Effectively, the monthly cost to finance the system installation is less than half of the energy cost savings created by the Stem system.

Operating Model

Stem remains agnostic to the battery technology used for its system [4], which positions the company’s operating model around the company’s cloud-based software, the data it collects from its customers, and the financing of energy storage for its customers.

Financing Storage-as-a-Service

Stem closed on a $100 million fund to finance the energy storage portion of its business in September 2014, raising the largest amount of capital among all players in the distributed storage space [5]. Stem is able to raise this amount of capital because it is a recognized leader in the energy storage space, although this advantage remains contingent upon the development of its software architecture [6] and salesforce.

Software Development to Automate and Optimize Customers’ Energy Decisions

Stem’s software development team focused on real-time analytics capable of taking day-to-day energy decisions out of the hands of its customers. Before installing Stem’s system, one customer noted that they would constantly try to monitor and make operational changes based upon their energy usage [7]. After installing the system, however, the customer knows that their energy usage is being monitored and managed optimally and only checks the system once per week [7].

Data-Based Operating Model for the Future

Stem’s software has the ability to change whether its customers draw power from the grid or from the Stem battery systems, and this software can be controlled from a central location (by Stem). As Stem adds customers, it is amassing the capability to offer a massive amount of data on energy usage from its commercial and industrial customers to utilities that would pay for this information, combined with the ability to change the energy usage of those customers from one central location. Eventually, utilities that need a short-term shift in energy usage might avoid the very expensive spot market for immediate delivery of electricity; instead, utilities could pay Stem to have its customers’ systems temporarily draw from battery storage to create a more consistent demand for the utilities.

Ultimately, Stem’s success is derived from helping its customers (currently commercial and industrial customers and eventually utilities) create a better fit between their business and operating models.

Joe, this is a very interesting blogpost, great job!

I have to admit that this is the first time that I heard of stem and I am intrigued by its business model and operating model. I did not realize that battery storage technology is now adequate to help business customers reduce demand charges, I wonder how much capacity Stem is able to provide to its customer and also how often the batteries need to be replaced? I really appreciate the fact that Stem can provide financing for its customers to better relate the costs to the benefits derived from the energy storage system. I hope many large scale renewable energy projects can learn from this model in the future. I see great potential for Stem to increase its storage capacity and apply its software to help better match energy supply and energy demand for the whole word through its own integrated business and operating models, as well as helping customers better integrate their business and operating models.

Thanks for your post, Lee. As you pointed out, Lithium Ion degrades with time – although these types of batteries would not degrade as quickly as a standard iPhone battery, for example. The use case here for the Stem batteries might not even require the batteries have full capacity. Monitoring the batteries for their capacity is something that the Stem software constantly does, and the periods that we’re talking about for replacement are over 10 years.

Great post Joe! I really liked the way you laid out the business model and explained the three elements of the operating model which enable the business model. I am fascinated by the technology STEM brings to the fore – both the hardware for the energy storage and the cloud software for the energy monitoring. Storage-as-a-service is a unique way to capture the value created. I have two specific questions –

1. In the financing model, does the customer pay as a percentage of actual energy savings? So, if the actual energy savings is zero or low, will the customer have to pay close to nothing to STEM? Aren’t the energy savings contingent on how the customer has implemented your system and hence how does STEM hedge against it?

2. Are STEM’s storage system and software solution bundled together? Can customers opt for just one of these components and pay for only one of these solutions?

Thanks, Aravind! On your questions, (1) given in part the agency problem that you brought up, no, the customer doesn’t pay an actual percentage of their energy savings. The agency problem is mitigated by the Stem software control system — the customer doesn’t need to take any action to realize savings. It’s more a “plug and play” technology. The nature of these commercial & industrial customers is that their energy use patterns involve many “spikes” of peak power consumption during the day, so the storage system simply evens these out. The financing contract with the customer would include provisions that would be relevant if the customer were to go out of business (i.e. security in the underlying storage assets).

(2) They are bundled together, but Stem is agnostic in the storage system actually used. In other words, when Tesla’s gigafactory is in full production, as long as their batteries are more efficient, Stem would have no problem substituting those into the Stem package.

Insightful article, Joe! The mismatch in demand and supply of electricity is a major challenge that the world faces. This challenge will become especially acute with more of the world’s electricity generation moving to low load factor sources such as solar and wind. Stem is an interesting play on that thesis. A few thoughts:

1) Do utilities get penalized by the grid operator for “overdrawing” and hindering grid frequency? If yes, then there is a potential for Stem to sell directly to utilities as well

2) Can (large) commercial customers buy electricity from generators directly bypassing the utility? In India, that is possible through “open access” i.e. a commercial customer pays the transmission company and the utility only for using their infrastructure. If that is possible in the US, then there is potentially a new business model that can be spun off based on that capability – selling only the analytics as a service and excluding the batteries

3) I think the ability to finance the batteries is an extremely important operating model tenet. So many innovations fail because the customers do not have the cash for an upfront purchase; financing overcomes that barrier.

Thanks, Prerit! I responded to your questions one-by-one below.

1) In the U.S. grid system, utilities need to purchase all the power that they need for their regulated territory. In the event that they’re coming close to the capacity of the power plants that they have supplying them, those utilities need to purchase energy from the spot market, which consists of higher cost plants that are turned on when everyone has their air conditioners on during the summer (etc.). The penalty for “overdrawing” as it exists in India doesn’t exist in the U.S. since the utilities have to buy everything that their customers are using and there is at least some plant, albeit more expensive, that can supply that need. That said, during moments of peaking power use (everyone has their A/C on, etc.), utilities do frequently have issues due to failure to maintain grid infrastructure (power lines that have more current running in them get hotter, and therefore start dropping and can be short circuited if they hit trees, putting additional stress on other portions of the grid).

2) Yes, large commercial customers frequently sign power purchase agreements directly with power generation companies. This is specifically legally sanctioned in 25 states, Washington D.C. and Puerto Rico. In those cases, commercial customers manage their electricity needs — and, if they need to, will purchase in the spot market to supply electricity during times of peak power. Managing that is a huge part of what Google’s energy procurement team does (given all of their data centers). I agree the analytics could be valuable as a separate business line, independent of the batteries, so that commercial customers can gauge their energy needs.

Very nice job. I had not heard of Stem before this blog post but it looks like an impressive business. The operating strategy questions I have for Stem are:

1) In terms of scope, is there a way to partner with utility companies to speed up adoption? Perhaps offering a special discounted energy rate from the utility. Since they know the customer’s demand will be less variable, maybe they would be willing to do this.

2) How do customers measure the energy savings generated by Stem? Unfortunately, as you pointed out, energy consumption is highly variable month to month which I believe leads to energy costs being fairly opaque. If a customer cannot immediately see the savings (besides the software telling the customer a number), Stem needs to have an appropriate communications strategy to explain the benefits of the product.

Thanks, Akash.

On the first question, utilities generally charge a fixed percentage over the cost they incur to supply electricity to a grid, helping those utilities fund consistent dividends for their shareholders (usually over 75% institutional mutual fund type of investors). Therefore, the utilities use demand charges to compensate them for the variability of the customers’ consumption. That said, adding predictive power for utilities is definitely valuable, which is what I think Stem will eventually monetize as it sells data to utilities. It’s a good question whether utilities will pay for the reduced variability to an even larger extent than forfeiting the demand charges.

On the second question, Stem’s software measures the energy usage each month, making the usage transparent and recorded in real-time and viewable online. At the customer’s peak power, Stem would be drawing power from the batteries but it also has current data on the demand charges the customer would have paid. I agree that this system can’t simply share a number and the customer needs to trust its analytics and the process behind it.