Smooth Sailing or Rocky Waters? The Effect of Climate Change on the Shipping Industry

How will shipping companies adapt to new GHG regulations in a previously unregulated industry?

When you think of a container ship, you probably envision a wide, bulky boat. You probably think of metal boxes bound for Walmart, transported by over-sized trucks. You probably don’t immediately think of carbon emissions. But when asked about what will imminently affect his business in the next 5 years, Mr. Skou, the CEO of A.P. Møller-Mærsk A/S (“Maersk”), would probably not mention trucking contracts or Walmart orders; instead, he might mention the implications of new industry greenhouse gas (“GHG”) regulations.

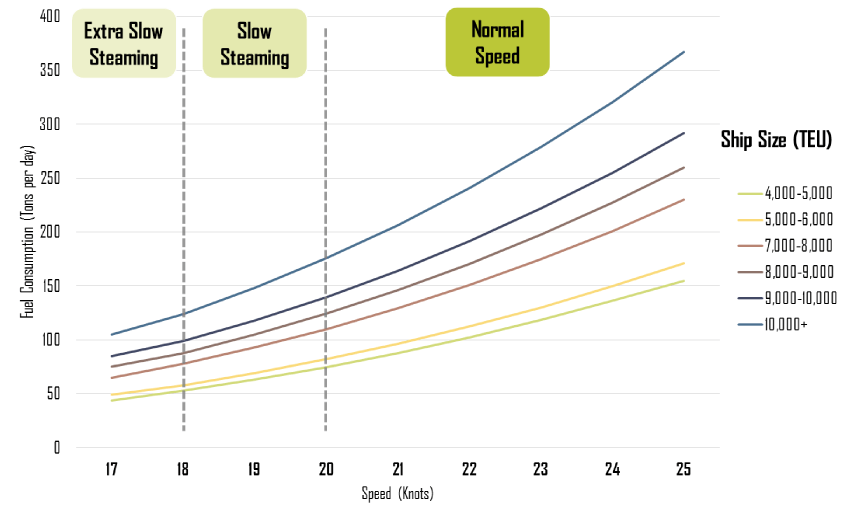

As a factor of their size and the enormous loads they transport, container ships can use between 150-350 tons of maritime fuel per day. [1] Fuel consumption accounts for approximately 50% of a container ship’s operating cost, representing a huge expenditure for shipping lines. [2] For a company like Maersk, the largest shipping line in the world which operates over 600 vessels globally, managing this expense is critical to turning a profit. Burning maritime fuel (also known as “bunker fuel”) is an inherently dirty business, emitting roughly 8% of global sulphur oxide (SOx) and 15% of global nitrogen oxide (NOx) annually while also releasing dust, soot and small particles into the air. [3] Although bunker fuel is estimated to contribute only 3% of overall GHG emissions annually, by 2050 this percentage is expected to grow to 6% as world container traffic continues to increase. [4] It’s clear that the shipping industry will have a consequential impact on climate change, as any growth in international trade results in an increase in worldwide shipping, which in turn causes higher industry GHG emissions.

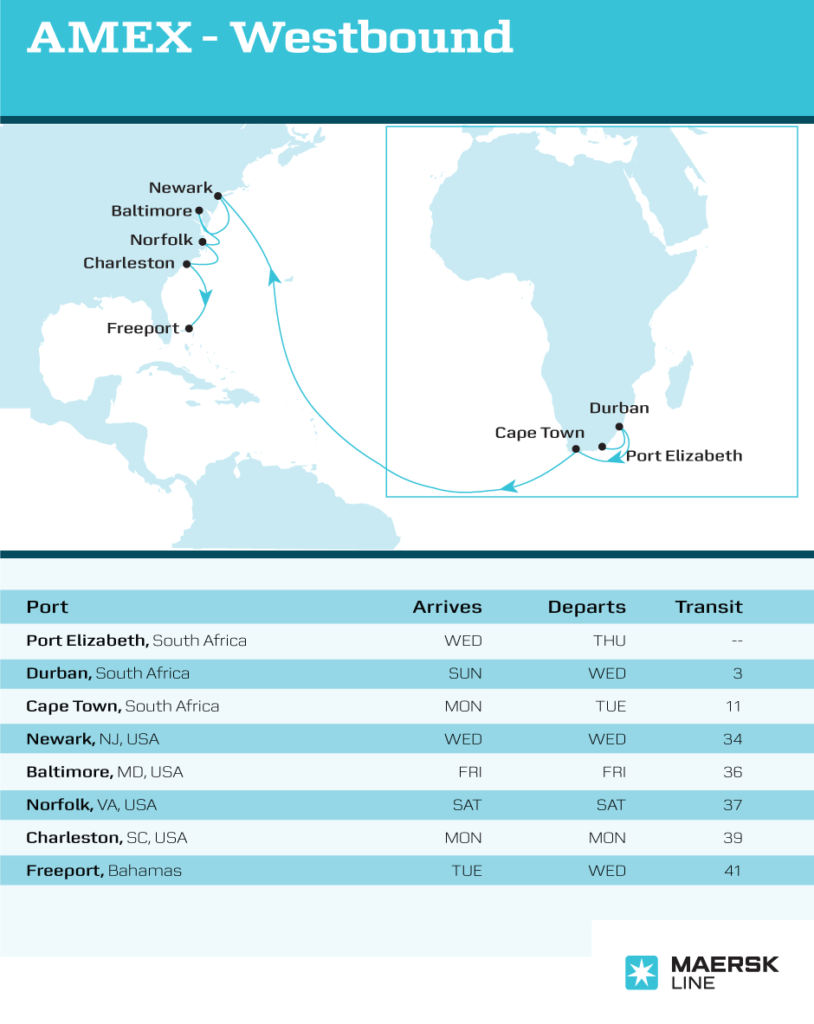

Maersk has benefited from operating in a relatively unregulated industry when it comes to GHG emissions. By the nature of international shipping, goods are often transported between two or more countries (for example, from South Africa to the United States) by a ship flagged in a different country (such as Panama) that is owned by company headquartered in a fourth country (for Maersk, Denmark).

As a result, it is extremely difficult to assign GHG emissions to a specific region and regulator, which has allowed Maersk and its competitors to take full advantage of lax fuel protocols. Only recently, as global warming and climate change have come to the forefront of several discussions such as the Kyoto Protocol and the Paris climate treaty, have regional and international organizations, including the International Maritime Organization (a UN agency that develops protocols and regulations for the maritime industry) and the European Union, begun creating stringent regulations regarding shipping emissions. As a result, over the next 5 years, Maersk and other shipping companies will need to comply with strict SOx, NOx, and CO2 protocols, requiring them to reevaluate integral parts of their operations and business plans.

Recognizing that it faces an enormous uphill battle in the face of GHG regulations, Maersk has begun to take steps to reduce its carbon emissions through leveraging economies of scale, new technologies, and network optimization of trade routes to reduce sailing time. [5] The company is targeting a 60% reduction in CO2 emitted per container moved by 2020 compared to a 2007 baseline, with an overall target of reducing carbon emissions by 30% at the company level. As of the end of 2015, Maersk had made great strides towards attaining these goals, reducing emissions by 42% per container and 23% at the company level. [5] As a leader in the industry, Maersk has set an example for others to follow, encouraging compliance among other shipping lines.

Maersk will have to continue to think outside of the box in order to stay competitive in an industry that now values energy efficiency.

Options such as retrofitting or rebuilding parts of ships by adding items like scrubbers or exhaust filters to reduce their carbon footprint will be a cost efficient alternative to replacing entire fleets, since a typical container ship costs an average of $100 million and lasts for approximately 30 years. In the short term, vessels can also sail at slower speeds, which can reduce CO2 emissions by more than 50%. [2]

Maersk can also look ahead by including more energy-efficient vessels in their order books or undertaking design changes to allow ships to sail more efficiently on less fuel. Another alternative includes switching to low-sulphur fuels or liquefied natural gas, which both release less toxic emissions than bunker fuel. However, all of these changes will involve huge capital expenditures, ranging from $3-$11 billion in spending—a significant budget item for a company with $925 million in net profit.

As Maersk sails into the future, it will no longer only need to think about shipping routes and customer orders; finding innovative ways to reduce GHG emissions will be an important part of staying competitive within a rapidly changing maritime industry.

(Word Count: 790)

Text Citations:

[1] https://people.hofstra.edu/geotrans/eng/ch8en/conc8en/fuel_consumption_containerships.html

[2] http://www.nytimes.com/2015/12/08/science/carbon-emissions-shipping-container-ships.html

[3] http://www.schroders.com/en/SysGlobalAssets/digital/insights/pdfs/the-costly-future-of-green-shipping-schroders.pdf

[4] http://environment.tufts.edu/wp-content/uploads/AaronStrongThesis.pdf

[5] Maersk Annual Report 2015 (http://files.shareholder.com/downloads/ABEA-3GG91Y/3150339647x0x874219/9643DB80-2142-4D2F-8FCE-F5DB67E26B70/Maersk_Group_Annual_Report_2015.pdf)

Image Citations (in order of appearance):

http://www.wardshoes.co.uk/index.php?page=shipping-details (cover and first image)

http://www.maerskline.com/bg-bg/shipping-services/routenet/maersk-line-network/africa/amex-westbound

https://people.hofstra.edu/geotrans/eng/ch8en/conc8en/fuel_consumption_containerships.html

Great post! I enjoyed a lot learning about Maersk; the container ship industry is very distant from my previous work experiences. I found very interesting that you mention how until recently Maersk and other similar players had taken advantage of flexible fuel protocols. The fact that the Kyoto Protocol and the Paris climate treaty had actually triggered mitigation climate change responses speaks to the power of policy and cross-country partnerships. Moreover, I agree with all the alternatives you propose to increase Maersk’s fuel efficiency. I will add that given the significant capital expenditures ($3-$11 billion USD) to move the needle, I think that Maersk should partner with its competitors to see how they can catalyze the entire system. Hopefully, players in the industry will realize that if they not join forces, they will not be able to survive in a less lax fuel protocols.

Ariana, you’re right I don’t often think of the shipping industry when I think of greenhouse gas emissions, but I definitely will now! As I was reading about the topic, I noticed that just the other week meetings ended between the United Nations and the shipping industry with regards to the industry’s impact on climate change. The meetings didn’t appear to conclude with any formal plan for how shippers should go about reducing their climate impact. This is disappointing news. In the future, I hope to see shipping companies take more responsibility for climate-protection as global corporate citizens (although, this seems unlikely considering how they took advantage of lax laws in the past). I understand that these companies have profit obligations to their shareholders but as some of the world’s worst contributors to climate change, it is imperative that they adjust their operations for the sake of the global community. Very interesting and timely post!

Very interesting post and very topical in today’s economic environment due the world economy’s increasing reliance on international trade in an ever more globalised world. Supply chains that extend across borders and continents are becoming the norm and consumers today expect the unlimited availability of imported consumer goods, such as toys from China, parma ham from Italy or tulips from the Netherlands. These trends will lead to an increased reliance on transportation and logistics giants like Maersk. I think an important step, as you mention, will be to make their vessels more fuel efficient by working with shipbuilders on integrating more light weight materials to decrease the consumption of maritime fuel for each voyage. Another aspect could be to aim to avoid vessels travelling at below full capacity, i.e. with empty space, as this drives up distance travelled unnecessarily. Whilst I have a feeling the this is may be less of a concern for bulk or container ships, I think it could be a larger concern in smaller vessel classes, like barges that may travel empty more often.

Maersk has been ahead of its cohort for many years with respect to addressing climate change.

The Triple E series is one result of this. The ships were designed and commissioned by Maersk in 2011, and won Maersk the “Sustainable Ship Operator of the Year”. Between 2013 and 2015, 20 ships were delivered each able to carry 18,000 containers. The Triple E’s are designed to be “slow-steamers” meaning that they are built to sail slower than a typical container ship. Greenhouse gas emission is exponentially related to speed, and so CO2 emissions can be halved per container when transported aboard a Triple E vessel. In building slow-steamers, however, Maersk has had to emphasize to customers the benefit of “on-time delivery” vs. “speed of delivery”. Customers have been willing to accept that trade-off only because they know that Maersk is the best in the industry to adhere to their promised times. And, as we know from TOM, variability is a pain. 🙂

If you want to read more about the Triple E’s: http://www.maersk.com/en/hardware/triple-e

Further, Maersk has a number of sustainability and CSR awards.