Shell’s Evolution from Oil and Gas to Energy

A perspective on how climate change is pressuring oil and gas firms to transform their business models.

Climate change is a concern for many business and governments around the world; however, oil and gas firms in particular have begun to assess what the implications of climate change are for their businesses. A few progressive oil and gas firms have publicly stated their belief in climate change and how they will address this issue in their business models.

Over the last few years scientists, non-profits, and governments have raised a call to action against climate change – calls which mostly fell on deaf ears. The Paris Agreement in 2015 has solidified these calls and governments and businesses have sprung to action to combat climate change. Oil and gas companies have taken note and realized that public and economic pressures will continue to exert downward pressure on demand for hydrocarbons.

Royal Dutch Shell, an oil supermajor based in The Hague, believes in climate change and has taken steps to shift the focus away from oil and towards gas and renewables [1]. This shift will require modifications to the existing supply chain of their business. The concern is no longer a supply concern, as it was less than 10 years ago, but a peak-demand concern due to the advent of renewables, electric vehicles (EV), and increasingly energy efficient technologies. Both private and public investment in energy has been focused on renewables. Venture capital firms are getting back into the cleantech industry after years of reticence due to the cleantech bubble 10 years ago. Technologist billionaire Bill Gates has taken up the call to battle climate change and launched a cleantech fund, Breakthrough Energy Ventures, [2]. Sovereign wealth and endowment funds are facing increasing pressure from investors to diversify assets away from carbon-emitting energy sources – Harvard included [3]. The increased competition in the energy space and the demand from the public to transition to renewable sources will persist into the foreseeable future and O&G firms will need to find a way to adapt.

Changes in the Industry

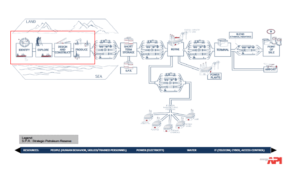

Market and public pressures on the supply chain of oil and gas firms have resulted in leaner companies, grappling with how to change their operating models and optimize for the future. Figure 1, illustrates the supply chain for most oil and gas companies [4]. Many of the changes on the supply chain for Shell are currently happening on the Upstream (red box) portion of the supply chain. A few examples of the changes on the supply chain include, no longer drilling in the artic, decreased focus on offshore production, increased focus on onshore production and shale oil. The focus on costs and efficiency have predominately been due to market pressures, which have in turn positioned them to take these learnings to other sectors of the energy industry. The focus on keeping a competitive cost advantage and global supply chain will position Shell to be successful on its energy journey.

Currently, Shell is investing in optimized oil production technologies, which would enhance the productivity of a well. They are also investing in carbon capture and sequestration technologies in order offset their upstream and downstream carbon emissions.

The focus on costs and efficiency are great short-term solutions, however; they do not address the longer-term impacts of climate change.

The Future

In the short term, Shell should focus on exploring for low-cost oils and incorporating carbon capture and sequestration technologies to their current operations. They should explore more efficient and autonomous focused transportation methods for their products and their demand is global. Shell should also begin exploring carbon pricing scenarios and its effects on their current operations as some governments are currently moving towards carbon taxation as a potential means to reduce carbon emissions.

In the medium term, Shell should focus on identifying and developing new renewable energy sources which they can add to their business model. There are many capabilities that an oil and gas firm can directly translate into the renewable sector such as engineering, project evaluation, and operations. Shell should begin to develop these internal capabilities for themselves and offer renewable sources such as wind, solar, hydrogen, and biofuels.

Given the changes Shell has undertaken to pivot towards gas and renewables, it begs the question of whether Shell can and more importantly should become an energy firm.

(707 Words)

- Steven Mufson, “Shell CEO Says Climate Change is Real but Energy Demand is Unstoppable” , Washington Post, May 22, 2017, https://www.washingtonpost.com/news/energy-environment/wp/2017/05/22/shell-ceo-says-climate-change-is-real-but-energy-demand-growth-is-unstoppable/?utm_term=.95e22ccba411 , Accessed November 2017

- Kerry Dolan, “Bill Gates Launches $1 Billion Breakthrough Energy Investment Fund”, Forbes, December 16, 2017, https://www.forbes.com/sites/kerryadolan/2016/12/12/bill-gates-launches-1-billion-breakthrough-energy-investment-fund/ , Accessed November 2017

- Oliver Milman, “Harvard Pausing Investments in Some Fossil Fuels”, The Guardian, April 27, 2017, https://www.theguardian.com/environment/2017/apr/27/harvard-university-pausing-investments-in-some-fossil-fuels , Accessed November 2017

- Susan Lumieux, “Energy Understanding Our Oil Supply Chain”, American Petroleum Institute, http://www.api.org/~/media/Files/Policy/Safety/API-Oil-Supply-Chain.pdf, Accessed November 2017

Super interesting post, Danny! I have no doubt that as population and GDP per capita continues to grow, the world will use more energy and not less, and thus regardless of society’s efforts to conserve energy, ultimately alternative energy sources are absolutely necessary to remediate climate change. Thus, I strongly agree with many of your conclusions.

At first I was surprised as to why shifting from oil to natural gas was a good thing, as it feels like both are hydrocarbons and burning either should should result in CO2 emissions. I dug up this link [1] from the EIA which I thought was interesting, as it shows that burning natural gas actually produces 26% less CO2 than burning gasoline per BTU.

My question for you – do you think that shifting from one fossil fuel to another, albeit one with a better CO2 profile, is enough to solve climate change, or do you think this is only a half step? Also, I’m curious as to why you don’t recommend that Shell explore nuclear as an energy source, as it is CO2-free?

[1] https://www.eia.gov/tools/faqs/faq.php?id=73&t=11

Danny, really interesting post! You bring to light the rapid technology shift in the energy industry and disruption from dirty oil / HFO to cleaner energy sources. A few questions around the entrenched interest of the oil majors and potential delays in the implementation of this transition to renewables:

1. Do you think Shell is intentionally holding back on the move to cleaner energy sources in order to solidify it’s dominance in the oil & gas industry? Given Shell is a market mover, it can continue to enjoy the cash flow streams from it’s oil & gas business by delaying the industry’s rate of change to renewables.

2. Do you believe the cost of energy can be lower on renewables than current fossil fuels, especially taking into consideration that firms have already invested in power plants that have long operating lives (up to 50 years)? For renewables to truly be scaleable, it should be commercially viable without subsidies. Do you think governments or private investors such as Bill Gates (as Adam mentioned) will need to subsidize the short term switch, especially as these projects are very capital intensive and have long payback periods?

Danny, this is an amazing topic! When I first read that you were writing about Shell, I immediately thought that climate change most likely was not affecting their production directly but creating an enormous pressure to shift their operations to more cleaner energies. Thank you for bringing this lens!

I really like the challenge that you propose to shift Shell business model towards clean energy sources (like solar or wind). However, this seems a disruptive change and it is not so clear how Shell should do. Should Shell gradually end the oil production and start building competencies in clean energy? Does Shell have time, or is it urgent to start serious change today?

My proposal for Shell would be to gradually shut down their oil operations and to quickly change gears to the clean energies. There are two main reasons for this urgency, in my opinion. First, as oil prices are going down, Shell is focusing their efforts in being more efficient. However, the economy is expected to no longer be fueled by oil in a very near future, given mega trends as electric transportation – 2/3 of US oil consumption is for transportation. [1] I feel that Shell is jeopardizing valuable resources in a dead end. The second reason is because of the quick increase in competition for clean energies. Companies like Tesla are now building all the relevant competences for clean energy – Elon Musk only took 100 days to build the most powerful battery in the world, used to store renewable energy.[2]

As you mentioned, Shell possesses valuable expertise. However, given the fast pace of technological development in clean energy, I would bet not for long.

—

[1] The Economist (2017, August 12) “The death of the internal combustion engine”. Retrieved from: https://www.economist.com/news/leaders/21726071-it-had-good-run-end-sight-machine-changed-world-death, accessed on November 2017.

[2] The New York Times (2017, Nov 30) “Australia Powers Up the World’s Biggest Battery — Courtesy of Elon Musk”. Retrieved from: https://www.nytimes.com/2017/11/30/world/australia/elon-musk-south-australia-battery.html, accessed on November 2017.

Great article, Danny! I’m very glad to hear that a major oil and gas producer like Shell is taking climate change seriously. I also agree with you that the current actions leave much to be desired. Shell has a real opportunity to not only become the standard bearer for climate consciousness amongst the majors, but more importantly, to disrupt themselves before they are disrupted by someone else.

I took a quick look at Shell’s operating metrics. Shell operates in more than 70 countries, employs 92,000 people, sold more than 57 million tonnes of liquid natural gas (LNG) in the last year, and produces more than 3.7 million barrels of oil equivalent per day [1]. The impact that they could have by shifting to more sustainable production practices is staggering. Furthermore, the energy economy is inevitably shifting towards renewable, clean energy sources. To avoid being disrupted, Shell can partner with venture capital funds such as the Gates’ Breakthough Energy Fund to provide capital to fund riskier projects that may be outside of their realm of expertise. This is not merely an efficiency change but a strategic one necessary to avoid obsolescence. Shell can also acquire more renewable assets that have become less valuable in the current US political environment. NRG and Elliott Management, for instance, may look to divest its renewable assets in order to improve value for the activist and other investors [2]. Shell is optimally positioned to acquire these assets if they come on the market.

[1] http://www.shell.com/about-us/who-we-are.html

[2] https://www.bloomberg.com/news/articles/2017-05-08/nrg-board-members-said-to-consider-sale-of-entire-renewable-unit