Say “Helio” to the future of private investing

CircleUp’s Helio software has created an edge for its freshly raised consumer-focused investment fund. But can its edge last?

CircleUp is leading the charge in using quantitative methods, such as machine learning and artificial intelligence, to find attractive investments in consumer brands.

Founded in 2011, CircleUp began as a marketplace to connect “non-tech” start-up entrepreneurs and investors.[1] The start-ups funded on its platform have been largely successful. Since 2012, the company has helped over 200 companies raise over $300 million, with few failures and a return of over 40% (largely unrealized as of 2017)[2]. To further capitalize on this success CircleUp has begun to do its own investing, raising a $125 million fund.[3]

CircleUp’s investment edge lies in the data it collects, including those of the start-ups featured on its marketplace to publicly available data from large retailers and research firms, such as IRI Research[4]. Leveraging this data, its software platform Helio aims to predict emerging consumer brands in a Moneyball-fashion.

If its first fund proves successful, CircleUp would have a repeatable, scalable model that requires a fraction of the man-hours necessary to find attractive investments. Furthermore, its efficient process would pass its savings to investors through reduced management fees.

But as artificial intelligence continues to pervade the investing world, will CircleUp be able to maintain its data-driven edge? What does the future of Helio look like?

How it works & why consumer brands

Currently, Helio tracks 1.4 million companies in North America, sorting out and classifying consumer companies into 100+ detailed sub-categories. Its categories are highly specified, for example separating brands between the “Kombucha” and “loose-leaf” tea market. Additionally, Helio applies brand attributes to each identified company, such as “Woman-led”, or “Seattle-based”, which allows the company to be benchmarked across other, non-ingredient-based indicators[5].

In an interview[6], CircleUp co-founder Ryan Caldbeck outlined what makes consumer the ideal sector to apply its Helio software:

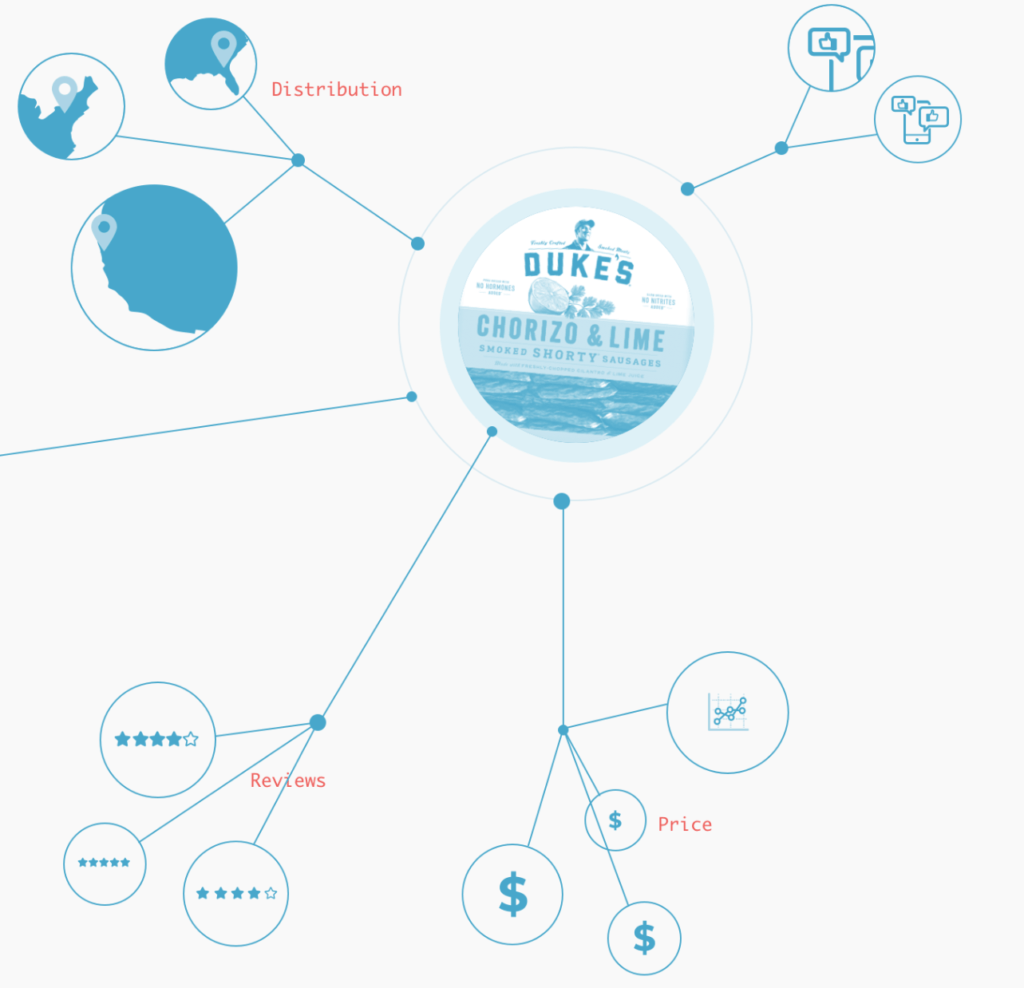

- Key Product data widely available online (see Exhibit A). Pricing, consumer reviews, SKU[7] proliferation, and door/location expansion is publicly available online.

- Consumer impressions are widely available through social media. Brand strength and consumer interaction can be monitored real-time through analytics of social media.

- Consumer business models and success stories are straight-forward. In technology, successful start-ups tend to have various business models (e.g. SaaS[8], license sales, ‘freemium’[9], etc.) and different success outcomes (platforms acquired not for the tech but for the team, etc.). This make comparisons of success stories difficult among companies, even within the same end market. Conversely, consumer packaged goods start-ups tend to have a similar success story (Product is created > brand story is told > goods are sold in as many channels as possible > brand is acquired because people love the product). This allows Helio to create indicators, with high confidence, for successful emerging consumer brands.

- CircleUp still has opportunity to be the “go to” investor for consumer goods. When tech founders gain traction on a new venture, their main aspiration is to raise funds from “Sand Hill Road” darlings such as Sequoia or Benchmark. That is currently not the case with consumer-based start-ups. With fewer blue-chip players in the early-stage consumer packaged goods market, an investor like CircleUp has an opportunity to carve an attractive niche.

| Exhibit A: visualization of a consumer brand’s publicly-available key data |

|

| Source: CircleUp |

CircleUp has been able to identify successful consumer brands. Using Helio, CircleUp was able to identify RX BAR and Halo Top as high-value brands well before they became the established brands they are today. Eden Creamery (the creators of Halo Top) was recently rumored to be valued at $2 billion[10], and RX BAR was acquired by Kellogg for $600 million last year[11].

What’s Next?

CircleUp has identified a few adjacent sectors that can benefit from the Helio-approach, including real estate and entertainment rights (think non-blockbuster film and music rights). Yet, there are many challenges ahead as CircleUp expands it investment focus beyond consumer goods. For example, CircleUp would have to invest in building (or acquiring) a two-sided marketplace for those industries.

Furthermore, CircleUp’s success and the increasing trend of data-driven insights in investing have attracted well-resourced competitors to begin similar efforts. Blackstone, a $434 billion alternative asset manager and private equity behemoth, has recently invested millions into building an Internal Data Group to harvest its wealth of data from investments across various asset classes around the world[12].

What should CircleUp do?

Analyzing consumer goods is a strong first start and use-case to raise funds for further development of its marketplace business. In order for CircleUp to remain competitive with its data-driven approach, it will need to augment its software platform for other industries and expand internationally.

What do you think CircleUp should do to remain competitive? Are there other industries that CircleUp’s Helio software can benefit in the short-term?

(793 words, excluding exhibit titles)

[1]. https://www.institutionalinvestor.com/article/b14z9r14lr2l21/circleup-rethinks-venture-capital-for-consumer-goods.

[2] http://fortune.com/2017/02/27/circleup-moneyball/

[3] https://www.axios.com/circleup-raises-125-million-fund-to-invest-in-consumer-goods-1513306563-5f1a9835-5a6a-420d-a5d0-efbdaedec23a.html

[4] https://www.iriworldwide.com/en-us/

[5] https://circleup.com/helio/

[6] https://investlikethebest.libsyn.com/ryan-caldbeck-quant-in-private-markets-invest-like-the-best-ep110

[7] Stock Keeping Units. https://en.wikipedia.org/wiki/Stock_keeping_unit

[8] SaaS: Software-as-a-Service. https://en.wikipedia.org/wiki/Software_as_a_service

[9] https://en.wikipedia.org/wiki/Freemium

[10] https://www.fooddive.com/news/halo-top-owner-explores-potential-2b-sale-of-ice-cream-brand/448798/

[11] https://newsroom.kelloggcompany.com/2017-10-06-Kellogg-adds-RXBAR-fastest-growing-U-S-nutrition-bar-brand-to-wholesome-snacks-portfolio

[12] Blackstone’s AUM: https://www.sec.gov/Archives/edgar/data/1393818/000119312518067079/d522506d10k.htm. Blackstone’s Use of AI: https://www.privateequityinternational.com/blackstone-pushes-use-data-ai/.

This is a really interesting business model. Due diligence processes in private investing world are highly manual and out-dated, relying on investment committee members’ previous experience and memory ahead of data-driven analysis. CircleUp needs to prove its business model further by realising a set of successful exits. I would be curious to hear what fees they charge on their funds – there is downward pressure on fees in the wider investing world, and the use of AI and big data could be an effective way for players like CircleUp to undercut existing players on fees through lower due diligence costs, and potentially squeeze lower-quartile investment funds out of the market. An alternative strategy could be to consider developing a SAAS platform providing such data to other asset managers. Whilst Blackstone is creating its own internal data hub, the vast majority of firms do not have the internal resources or deal track record to undertake such a challenge – there may be an opportunity to leverage the needs of those firms that get left out of the data revolution.

I wonder if CircleUp have thought about applying AI to other parts of the VC model. For example, one of the ways that VCs add value as investors is helping startups recruit top talent. Recruiting seems another area that is data rich yet done in an “old school” way today. If CircleUp could add extend their AI capabilities to recruiting, it can help them stay in front of competition.

Coming from a background with both VC (including some work with a CPG entrepreneur!) and machine learning experience, I am fascinated by this topic. I follow CircleUp’s CEO, Ryan Caldbeck, on Twitter, and have seen him fleshing out this idea over the past few years.

Previous commenter Emma is right — CircleUp will have the ability to undercut existing players through lower costs. Caldbeck has gone so far as to suggest “VC as a Service”, where the company could generate term sheets based on data. That could “disrupt” the VC’s. However, as you point out, this data-driven technique probably only works for CPG investors. Their investments have such similarity (especially in business models) that data is probably relevant from one firm to another.

I’d love to see what they have identified as the factors that correlate most significantly with success.

Although I definitely see the potential of applying AI to VC to attempt to predict success, it is important to understand that it is an ambitious task to automate the whole investment process whose success factors might be difficult to attribute. Additional idiosyncrasies (geography, product, timing, team dynamics) relating to each startup only amplify this and therefore it might be hard for AI to capture these factors.

I guess the true test relies in the final performance of the fund after certain investments have been exited – so we shall wait and see! (unrealized gains which are mentioned in the article can potentially be highly inflated especially in today’s startup market)

CircleUp’s usage of AI technology on VC investment itself is really interesting, but the most impressive part for me is about how the company collects data about consumer’s reactions and analyze those data into figuring out the success of consumer products. There are a lot of research and articles about using AI technology on investment, but I’ve never thought about focusing on CPG market. I think CircleUp became successful because of its approach to use AI on very narrow and specific topics in the market. To remain competitive, CircleUp should keep focus on building detailed criteria for gathering data about their target companies and consumers and investing on similar sectors to what it has invested so far.