Rural Renewal: Will Amazon help or hurt Whole Food’s progress in promoting local food systems?

Local food producers have played a key role in economic development across rural areas in the US. Whole Foods built a model that scaled this ecosystem and provided access to eager consumers. How will Amazon’s acquisition affect the local-first philosophy that Whole Foods has championed?

The “locavore” food movement has gained steam thanks to increased access to farmer’s markets, community supported agriculture, and support by the industry’s largest proponent of whole, natural, and local food producers: Whole Foods. With the Amazon merger and profit pressures, that business model is now at risk.

Why should localization be of concern to the management of Amazon and Whole Foods?

Whole Foods has demonstrated a strong commitment to small producers in the locavore movement:

Starting in 1980, Whole Foods created the market for local and organic food. By sourcing goods from local producers, the retailer created many success stories of companies who entered a local Whole Foods, gained wider distribution, and then quickly grew [1]. Whole Foods has long been considered the “Holy Grail in Distribution” by many in the food industry [2], a title the company has historically been very proud to demonstrate with its support of small producers. Furthermore, Whole Foods has been able to sustain many small-to-medium-sized producers with its stringent supplier accreditations, local sourcing initiatives, and price points that reflect the true cost of growing and producing food [3].

The locavore movement helps to sustain rural economies:

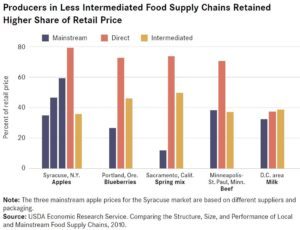

As more consumers demand locally produced goods, small economies are thriving. Food produced and purchased locally keeps a greater share of money recirculating in the local economy and allows farmers to retain a greater share of consumer spending. Study after study shows local supply chains generate more revenue for growers and producers than mainstream supply chains (Figure 1, [4]). Whole Foods’ national involvement in promoting local practices has helped to sustain some of these benefits at a larger scale.

How are Amazon and Whole Food’s business models transitioning amidst this commitment?

Whole Foods actions demonstrate how difficult it is to scale the locavore movement:

In recent years, pricing pressures, efficiency-optimization, and corporatization have been threats to Whole Food’s business model. Wall Street pressure for revenue and profit growth continuously ran contradictory to the company’s original method, and for much time, John Mackey as CEO resisted many pressures from the street. However, some recent actions demonstrate that profit growth is still difficult when paying suppliers as fairly as Whole Foods does. The company has lengthened the supply chain by centralizing some key buying decisions in Austin (as opposed to local stores), which happened even before the Amazon news was announced [5]. To some, with the Amazon acquisition, Whole Foods is relinquishing its pursuit of combining higher profits while incorporating small scale producers [6].

Amazon’s influence is the largest outstanding question as the two companies begin their integration:

Industry followers question Amazon’s record in other fields and wonder if the retailer will continue to use its power to further centralize and streamline Whole Food’s operations. Historically, small producers have been protected by Whole Foods on the distribution and financial side. Many wonder if Amazon will be so generous, or if some of the positive developments in the locavore movement will be undone with the merger [2].

Since the merger has closed, some local producers have already been pushed out. Meanwhile, senior execs at Whole Foods have commented on their commitment to remaining “locally relevant” and being “an incubator of local and innovative trends and brands” [1].

How should the combined Whole Foods and Amazon continue to demonstrate their commitment to local food producers?

These comments are meaningful, but one can’t help wondering how senior execs will marry the two business models. As one company strives for growth at all costs, and even negative margins in key segments, how does the acquired company maintain its reputation with, and support of, small agriculturalists?

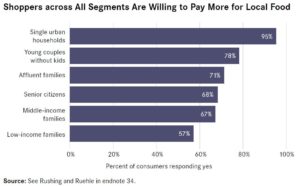

Going forward, Whole Foods should re-emphasize its commitment to local producers and increase the visibility of its supply of local produce and meats. As the company has gotten larger, and profit pressure has increased, some focus has been lost on a local-first mission, especially amidst some nicknames such as “whole paycheck.” However, consumers are willing to pay up for goods they know are local (Figure 2, [4]). Whole Foods and Amazon should take advantage of this pricing differential before assuming the need to cut costs.

Questions for the future:

Is it truly possible to scale “local,” profitably?

Will another type of organization or company step in to be a new, smaller, and refocused Whole Foods-like company?

(Word count: 781)

Figure 1 [4]:

Figure 2 [4]:

Sources:

[1] Peters, Adele. January 2017. “Will Whole Foods’ New Buying Strategy Make It Harder For Food Startups To Launch?” https://www.fastcompany.com/3066780/will-whole-foods-new-buying-strategy-make-it-harder-for-food-startups-to-launch

[2] Dewey, Caitlin. June 2017. “The big consequence of the Amazon-Whole Foods deal no one’s talking about.” https://www.washingtonpost.com/news/wonk/wp/2017/06/30/the-big-consequence-of-the-amazonwhole-foods-deal-no-ones-talking-about/?utm_term=.2a449106ea08

[3] Peters, Adele. June 2017. “Sustainable Food Makers Are Worried About The Future Of Whole Foods Under Amazon” https://www.fastcompany.com/40444919/sustainable-food-makers-are-worried-about-the-future-of-whole-foods-under-amazon

[4] Federal Reserve Bank of St. Louis. 2017. “Harvesting Opportunity: The Power of Regional Food System Investments to Transform Communities.” Abstract: https://www.stlouisfed.org/community-development/publications/harvesting-opportunity

[5] Soderlin, Barbara. May 2017. “Changes at Whole Foods could mean fewer local products on the shelves.” http://www.omaha.com/money/changes-at-whole-foods-could-mean-fewer-local-products-on/article_cfa01ca1-36c2-5a0d-b9a6-070ac86423f1.html

[6] June 2017. “Valuing Farmers in the Whole Foods Acquisition.” https://foodtechconnect.com/2017/06/21/valuing-farmers-amazon-whole-foods-acquisition/

Other sources accessed:

NPR. May 2017. “How I Built This” Podcast with Guy Raz: Whole Foods Market: John Mackey. https://one.npr.org/?sharedMediaId=527979061:528000104

Tuttle, Brad. September 2017. “A Bunch of Local Brands Are About to Disappear From Whole Foods.” http://time.com/money/4951402/whole-foods-amazon-small-local-brands-groceries/

Holt, Steve. September 2017. “From Coal to Kale: Saving Rural Economies with Local Food.” https://civileats.com/2017/09/20/from-coal-to-kale-saving-rural-economies-with-local-food/

I may be a die-hard Whole Foods fan, but I still drag myself down the road to Trader Joes every week. I just can’t stomach the cost. So when I heard the news of the Amazon acquisition, and began to hear the buzz about real, serious price cuts, I was thrilled. Publicity and marketing materials catered to consumers like me; Whole Foods’ CEO John Mackey said, “By working together with Amazon and integrating in several key areas, we can lower prices and double down on that mission and reach more people with Whole Foods Market’s high-quality, natural and organic food.” (Forbes: Amazon Lays Out Its Whole Foods Strategy And Shakes Up Wall Street Anew). The key takeaways seem straightforward: Amazon is doing some fancy Amazon magic to maintain quality high, but slash prices. I didn’t think about the “how,” though. Is it too good to be true?

As you mentioned, Whole Foods was founded on the principles of local and organic. This was a key differentiator from other grocers, and one of the key reasons consumers are willing to pay more for their products, as you highlight in Figure 2. It is unsurprising that as Whole Foods has scaled nationally, they’ve had to consolidate certain elements of their supply chain. I presume dry goods and private label products comprise a hefty majority of their inventory. But I like to think that, at least pre-merger, produce and meat continued to be sourced locally where possible.

You make an excellent point that with Amazon in the picture, it’s hard to know if they will continue to prioritize local over profits. There are many reasons I’d imagine they will NOT do so… to cut raw material costs and increase purchasing power; to reduce labor costs (assuming the sourcing / accreditation process is resource-intensive); to centralize procurement to enable integration with Amazon Fresh and other digital platforms. But the optimist in me hopes that Amazon will recognize and protect Whole Foods’ core values with long-term, sustainable profits in mind. Perhaps with their financial backing and technological systems they can absorb or decrease the costs of local sourcing, making it nearly impossible for smaller players to compete – but ultimately supporting local communities nationwide. Only time will tell… fingers crossed.

Great article Melissa! I agree that the traditionally small local suppliers to Whole Foods have a right to be nervous about this acquisition. However, giving Amazon the benefit of the doubt for the moment and proceeding as if they truly acquired Whole Foods out of admiration of their successful and unusual model, I think the “locavore” community can be reassured. Amazon has shown consumers, first through Amazon Prime and more recently through their methodical build out of their own proprietary shipping system, that they know how to do logistics better than any other player in the marketplace. I think it is quite likely that Amazon grasps that much of Whole Foods’ appeal to millenials is precisely its local, authentic, almost “small-business” culture, and will work to protect that aspect of the business. I expect Amazon to realize the value of their Whole Foods acquisiiton, and hopefully pass savings on to the customer, purely through optimizing and refining the supply chain amongst the current Whole Foods suppliers.

Super interesting article, Melissa and great comments, Lisa and Leigh! I have to say I can definitely see both sides of the argument, but I’m siding with Leigh on this one. Amazon is known for its acceptance to using a ‘loss leader’ strategy to grow its business. For this reason, I think we can be more cautious with assuming that Amazon will look to immediately revamp the core principles of Whole Foods in order to be more profitable. This to me just doesn’t quite feeling like an Amazon type move.

Personally, I believe Amazon has its sight on much larger corporate goals and this is just another piece in the puzzle that allows them to push towards its ultimate larger goals. Amazon wants to continue to bring in new customers and to grow its network of offerings and coverage. Whole Foods supplies them with both. Amazon can make a volume play. It has the potential to push the Whole Food brand and its products far far beyond its current reach and probably even the goals of the previous management team. This volume actually allows Amazon to be less critical on the margins. I’m excited to see how the partnership expands the way we experience grocery delivery. I only hope that Amazon will take me up on my request that students need a discount on Amazon Fresh 🙂

Thank you for writing this post, this is a topic that I have been thinking about since the acquisition of Whole Foods took place. One thing that I wonder about is whether or not Amazon will continue Whole Foods “locavore” ways. Another is whether or not the market (customers of Whole Foods) will react accordingly.

Amazon as a company is incredibly talented at sourcing and logistics. With that, scaling their supply chain has always been a core value at Amazon, the locavore model clearly does not fit this model since they will have to source from many smaller farms instead of national large farms. I wonder if Amazon has any interest in doing so. As Whole Foods, the expectation is that you MUST keep this model. As Amazon, I’m not so sure that they will care to anymore..

For me the next question is how will the customers of legacy Whole Foods react if Amazon moves away from this model. Only time will tell..

Thank you for writing about this! While I agree with Briana’s comments about Amazon potentially viewing this acquisition as a short-term loss leader and a long-term volume play, I’m not sure that it will be motivated to improve the infrastructure for local products. Amazon dropped Amazon Prime to rural areas in Canada and Alaska, as these were so unprofitable [1]. It seems plausible that they’ll invest in local products in less rural, and so less expensive, agricultural areas. But given their issues building a profitable delivery market in rural areas, I don’t think they’ll be optimistic about their ability to build a profitable supply market in these areas.

This article really highlighted how even Whole Foods, which sparked the locavore movement, has done an inadequate job creating an infrastructure that brings local goods to market. These goods are disproportionately expensive to move to market and sell, and Amazon doesn’t seem likely to invest in this segment. However, if Amazon’s takeover leads to reduced investment in the locavore market, it seems to open up room for a new business that can successfully aggregate local suppliers and deliver efficiently to interested consumers, like a large-scale CSA that allowed you to pick from a number of suppliers.

[1] http://www.cbc.ca/news/canada/north/amazon-ca-drops-free-shipping-for-remote-customers-1.3026859

Thank you for the great article, Melissa.

Jeff Bezos is fanatic about customer satisfaction. I think he will do whatever needs to be done to satisfy its customers. There is, however, something that is hard to balance. Customers want low price and small/local products, and this is not possible to co-exist. A local brand simply cannot sell a craft beer at the same price that AB-InBev does because of scale. I can’t see this changing, but these products could perfectly co-exist in the supermarket shelves. Whole Foods could open space to the authentic and local brands, while offering its own 365 brand at low prices in the supermarket. They are already doing this and I bet this is what they will continue to do.

The demand for local and authentic products exists and will continue existing independently of what Amazon chooses to do. A few weeks after the Whole Foods acquisition, Kroger announced that they would support and foster small brands in their supermarket shelves. They are now announcing on their website and stores that “Kroger Loves Local” and “We Are Local”. [1] As an avid consumer of authentic small brands, I am not worried anymore because if Amazon chooses to compete on the low-cost segment and exclude local brands from Whole Food’s shelves, other players such as Kroger will take the lead on that. However, I think Jeff Bezos will do his best to offer both products and satisfy both the cost-conscious through the 365 brand and the millennials who are looking for more expensive local products.

[1] https://www.cnbc.com/2017/09/25/as-amazon-takes-whole-foods-national-kroger-thinks-local.html