Royal Roadblocks: Toyota’s Fight for Auto Primacy In the Age of Isolationism

The specter of Brexit has upended the U.K. automotive manufacturing industry. How will Toyota UK fare?

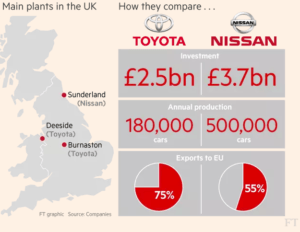

For decades, the United Kingdom has served as an important hub in Europe for global automotive manufacturers, with the country’s production volume reaching a historic high of 1.7 million cars and $226 billion in 2016 (approximately 10% of British GDP) [1]. Toyota, in particular, has established a sprawling manufacturing presence in the UK since December 1989, with its national operating capacity spanning two plants and representing a total investment value of £2.5 billion and about 3,000 employees [2].

Toyota’s Footprint in the U.K.

Impact of Isolationism on Automotive Manufacturers in the U.K.

The increasing wave of hardline conservative ideologies sweeping across the globe ushered candidates and legislatures to power with a mandate to enact protectionist trade policies. Consequently, on June 23, 2016, the British electorate voted by a majority to leave the European Union by March 2019 [3].

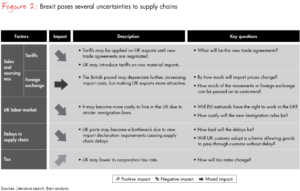

Implications: The exit of the U.K. from the EU (“Brexit”) will present unique challenges to automakers such as Toyota with manufacturing bases in Britain but deeply entrenched supply chain networks across the entire EU bloc. The success of the English automotive industry has relied on several factors, but its unfettered access to the EU Single Market remains the primary success factor [4]. Furthermore, the extent to which Brexit disrupts Toyota’s supply chain will be determined by how much the following factors are affected: tariffs, foreign exchange rates, the U.K.’s labor market regulations, immigration laws and tax policy [5]. As the British government opts for a “Hard Brexit” (stipulating both a departure from the EU single market as well as a restriction on the free movement of people into its borders), it is estimated that there would be a shift to standard WTO tariffs on all exports and imports (2% to 13%), a 10% increase in the cost of U.K. labor and a 20% depreciation in the British pound [5]. This equates to approximately £2 billion in losses for the U.K. automotive industry [6].

Toyota’s Reaction

Short-term: In response to Brexit, Toyota has reaffirmed its commitment to the U.K. as its strategic manufacturing hub in the near term and has sought further clarity on the Brexit deal from the British government. On March 16, 2017, the automaker announced plans to invest £240m into modernizing its car plant in Derbyshire despite the impending EU departure [7]. Toyota will also look to source more components from the UK, which could offset the impact of currency fluctuations and soften the blow of WTO tariffs.

Long-term: However, continuous competitiveness of Toyota and other automakers in the long-term hinges on a comprehensive and bespoke trade agreement – one that provides for the U.K. to stay in the Single Market and customs union until a new relationship has been consummated [8]. Johan van Zyl, president and CEO of Toyota Motor Europe maintained: “Continued tariff- and barrier-free market access between the UK and Europe that is predictable and uncomplicated will be vital for future success.” [7].

In a strong vote of confidence in its future U.K. prospects, Toyota has publicized its intention to build its future Auris model (commences production in 2021) at its Burnaston plant if the government secures a transitional Brexit deal. This would help reassure Toyota of an avoidance of a “cliff-edge” reliance on WTO trade rules in the interim period [9]. Under the transitional deal, there would be a two-year moratorium used to negotiate a comprehensive trade deal between the U.K. and the EU, granting U.K. businesses continued free access to the EU’s market when the U.K. formally exits the EU, with little change from current arrangements.

What else should Toyota do?

Toyota will need to tackle the supply chain overhang head-on to remain competitive in the U.K. and broader European market.

Buy Local: First, it would need to consolidate as much of its supply chain as possible, domestically within the U.K. to minimize production costs after Brexit. Only about 40% of components within a U.K. assembled car are sourced locally [4]. That number will need to increase.

Seek concessions: Second, as a low-margin manufacturer that caters to the mass market and relies heavily on exports, Toyota should seek to get concrete guarantees on a transitional deal from the government as soon as possible. Nissan was able to secure concessions as a requirement to keep production of its Qashqai and XTrail models at its Sunderland plant. Toyota can use its own leverage to extract a similar deal.

Other Considerations

There are a couple of questions Toyota will need to address going forward:

- A major source of labor for Toyota’s plants has been the skilled labor market outside of the U.K. Under a redesigned labor market post-Brexit, what will be the implication to Toyota’s production cost structure going forward and how does the company prepare itself for that change?

- How best does Toyota consolidate its geographically disparate supplier base to minimize production costs?

Word Count: 798

Citations

[1] Rick Li, (Sept. 1, 2017). [online] Available at: https://www.linkedin.com/pulse/global-supply-chain-automotive-manufacturing-disrupted-rick-li/ [Accessed Nov. 2017].

[2] Toyota Motor Manufacturing UK. Available at: http://www.toyotauk.com/ [Accessed Nov. 2017]

[3] Hunt, A. and Wheeler, B. (Nov. 13, 2017). Brexit: All you need to know. [online] BBC News. Available at: http://www.bbc.com/news/uk-politics-32810887 [Accessed Nov. 2017].

[4] Bailey, D. and De Propis, L. (January 2017). What does Brexit mean for UK Automotive and Industrial Policy? [online]. Available at http://brexit.regionalstudies.org/custom/uploads/2017/01/Bailey-De-Propris-What-does-Brexit-mean-for-UK-automotive-and-industrial-policy.pdf [Accessed Nov. 2017].

[5] Allen, J. (April 17, 2017). How Companies Should Prepare for Brexit. [online] WSJ. Available at: https://blogs.wsj.com/experts/2017/04/17/how-companies-should-prepare-for-brexit/ [Accessed Nov. 2017].

[6] Kwasniok, T., Guarraia, P. and Garstka, M. (Feb. 6, 2017). Is Your Supply Chain Ready for Brexit?. [online] Bain.com. Available at: http://www.bain.com/publications/articles/is-your-supply-chain-ready-for-brexit.aspx [Accessed Nov. 2017].

[7] Ruddick, G. (March 16, 2017). Toyota invests £240m in Derbyshire plant – but warns over Brexit tariffs. [online] the Guardian. Available at: https://www.theguardian.com/business/2017/mar/16/toyota-brexit-derbyshire-plant-burnaston-uk [Accessed Nov. 2017].

[8] Smith, R. (June 20, 2017). Car makers call for interim Brexit deal or risk falling off a “cliff edge”. [online] Cityam.com. Available at: http://www.cityam.com/266981/car-industry-calls-transitional-brexit-deal-risk-falling [Accessed Nov. 2017].

[9] Leggett, D. (Oct. 9, 2017). Toyota planning to build next Auris in UK – report. [online] Just-auto.com. Available at: https://www.just-auto.com/news/toyota-planning-to-build-next-auris-in-uk-report_id179049.aspx [Accessed Nov. 2017].

Really interesting article! I had no idea the UK was such a hub for auto manufacturing and the implications of Brexit on that.

Toyota’s approach to Brexit is interesting and in some ways seems counterproductive to their goals. For example, you reference a Toyota announcement that the UK would remain a priority of theirs and that they’re investing hundreds of millions of pounds in existing operations. If I were Toyota, I’d take the opposite approach: I’d express open concern about the implications of Brexit and the future of Toyota manufacturing in the UK, and get major public concessions from the government to ensure any increase in tariffs or costs would be made up for by Parliament. Toyota’s willingness to so quickly double down on their loyalty to the UK makes me think that they’re very confident that Brexit may in fact not cause the types of problems industry analysts are predicting. Indeed, it would make sense that the government would do everything in its power to have the post-Brexit system reflect as much of the pre-Brexit system as possible (except in name).

This is a broader point but relevant: one of the most interesting components of the isolationist movement both in the US and the UK is that there is some evidence that it is in fact working as intended. For example, in the article above, Jide writes that “Toyota will also look to source more components from the UK, which could offset the impact of currency fluctuations and soften the blow of WTO tariffs.” This is EXACTLY the type of incentives voters wanted when they chose Brexit. In the US we also see slight upticks in some of the industries white color liberals thought were dead, as well as some amount of on-shoring. While many scorn the promises of politicians like Trump or Boris Johnson as infeasible, they might actually be delivering in some ways (even if it is to the detriment of society at large and the future of their countries).

I agree this is really interesting! I think the most concerning part of Brexit for a global company like Toyota is the uncertainty it creates. Many scenarios are being discussed in which the UK leaves but remains very close to Europe with relatively few trade barriers. In this case, Brexit wouldn’t be too bad for Toyota in and of itself. What’s particularly difficult for a global company like Toyota is the high level of uncertainty today that makes investment decisions difficult. In that context, it’s interesting that Toyota has announced plans to invest into the Derbyshire plant. I wonder if this investment is politically motivated – by investing more in the UK today, Toyota is more likely to have a seat at the table as the UK is negotiating Brexit to advocate for lower trade barriers on automakers. As you point out, if trade barriers are severe, then Toyota will likely need to increase production in the UK, which this factory might also help it accomplish, so the investment may provide benefits in a variety of scenarios.

A very compelling piece, indeed! I was surprised to learn how significant the automotive sector is for the UK (10% of GDP is very large). My biggest concern however with these turn of events, is that the populists who propagated the thought of Brexit being good for the country might get exactly what they wanted, i.e. a return of certain types of manufacturing back to the UK. While this is undoubtedly good for the average UK auto worker, it generates the impression within the general public that these types of policies will deliver on their promise and be good for the country in the long term.

On the other side of the coin is the issue of talent and migration to/from the EU. Any product that is heavily engineered and relies somewhat on progressive R&D to improve and compete will require a fresh stream of technical talent which I understand the UK is not able to provide on its own [1]. I could see a situation where Toyota might have to outsource some level of R&D to the EU if it cannot fill its engineering vacancies. Additionally, the automobiles produced in the UK for the EU market (~75% according to your essay), need to be designed with the EU consumer in mind. If it becomes more difficult for Toyota (or any other auto manufacturer) to import design talent they will most likely have to send that work to the continent. Both of these cases see high paying jobs leave the UK.

On your question about supply chain consolidation, I fear this is much easier said than done. Automotive supply chains are complex for a reason. Forcing Toyota to source new parts from local suppliers could: increase costs, require engineering level re-designs, complicate the spare parts business and obsolescence planning, reduce quality, and place additional risk on manufacturing. I think the cumulative effect of these risks will be to increase the cost of Toyota vehicles to the consumer and potentially reduce quality. It will be a huge challenge for them to transition their supply base.

At the end of the day though, Toyota has a massive amount of investment tied up in the UK, and as you said will not pick up and leave for the Rhineland. Besides, where else can you enjoy mediocre football and warm beer at your local pub?

[1]https://www.highfliers.co.uk/download/2017/graduate_market/GMReport17.pdf

Really interesting piece! I was particularly surprised to read that Toyota has announced further investment into its Derbyshire plant, even as Brexit talks remain fraught, uncertain and (from here) with no resolution in sight. Given this backdrop, this seems a short-sighted move. Rather I agree with you that Toyota, like all other UK-based auto manufacturers, needs to focus on streamlining its supply chain. If Toyota is going to increase investment in its UK plants, it needs to protect its supply chain from the risk of high tariffs on imported component parts.

So to that point, I theoretically agree with your suggestion that Toyota should Buy Local. But I am concerned that in reality, at least for the moment, this just isn’t possible. As I noted in my post (on one of Toyota’s fellow UK-based auto producers, Jaguar Land Rover), the UK does not currently have either the technologies or production capabilities for auto manufacturers to be able to source 100% of car component parts domestically. I highlighted ‘reshoring’ as one solution to this. Given the high capital investment required to do so, another avenue could be if Toyota together with other auto firms to lobby the government for funding to put towards reshoring and/or production efforts on home ground.

Really great article, and also enjoyed reading the comments here. I completely agree with the comments that Toyota’s increased investment right now is confusing – I would probably just call it a bad decision, given that clarity should be emerging so soon on how this actual affects them. I also agree with the idea that this may be a way to curry favor with the government during this period of policy re-definition. For better or worse, Toyota already has made significant investments here, and now needs to do its best to squeeze profits out of it.

The broader question I am grappling with is how Toyota should respond to this as it plans its future investments. For example, I know the US still has a large auto manufacturing industry, but we too are getting hit with the impact of isolationist / nativist political movements. Much of the decision for new plants then, might depend on where Toyota sees favorable free market winds blowing. Despite Toyota’s further investment in the UK recently, I still would believe that their future manufacturing facility decisions are going to steer away from countries like the UK that show these isolationist tendencies.

I’m so curious about the long-term impacts of protectionist immigration policy are to labor markets, and long-term, to country-level degrees of economic growth. It’s easier to in-source supply chains than it is to source and development new talent in-country.

Very interesting article. I agree with you that Toyota should have quite a bit of leverage in negotiations given its large amount of investments in the UK over the years and its contribution to the UK economy and employment.

With regard to your question on how Toyota should consolidate its geographically disparate supplier base, I’m not sure it should start that process just yet (or potentially at all). Firstly, these policies have the potential of being fickle and not long-term, so entering new contracts too soon could put them in a position where they wish they could reverse their actions. Secondly, without more detailed information on what exactly the regulations and tariffs will entail, Toyota should not begin to jeopardize its relationships with existing suppliers. In fact, even after tariffs, it’s possible that its existing contracts could still be cheaper than switching to domestic suppliers. That said, the reality is that it might need to pass on some of these additional costs to its consumers. In this regard, it should acquire data on (a) how price sensitive its customers are and (b) which of its competitors might also be affected by similar tariffs and how Toyota will stack up against them. Lastly, the potential of increased prices to UK consumers could be another negotiation chip with government and regulators.

With regard to employees, it can also discuss this with regulators, as there is the potential for having to lower wages in order to accommodate additional tariffs. Regulators might want to avoid this and grant certain exemptions.

One other lever could be to make the process more efficient in order to compensate for the additional tariffs it might have to pay. For example, it might decide that it can internally create something that it used to import. This might require some factory or process redesign, but could be a profitable investment over time.

I am really surprised by Toyota’s increased investment, given the uncertainty during this period. Because of Toyota’s long-term presence in the market and number of people they employ, I suspect they believe that the government will look at the investment positively and work with them to find a suitable solution. That said, I am not sure I would have made the same bet and would look at future investments in the UK cautiously.