Ripple: Leveraging Distributed Ledger Technology to create a single International Remittance Network

Opening up International Remittances

Open Innovation: Internet 3.0?

The internet is the first example of Open Innovation in which peers can interact within the network through a common protocol (TCP/IP), allowing information to be shared within seconds. While the present layer of internet has significantly improved how parties interact with one another, the time has come for an additional layer on the internet that allows value to be shared at equal speed and efficiency.

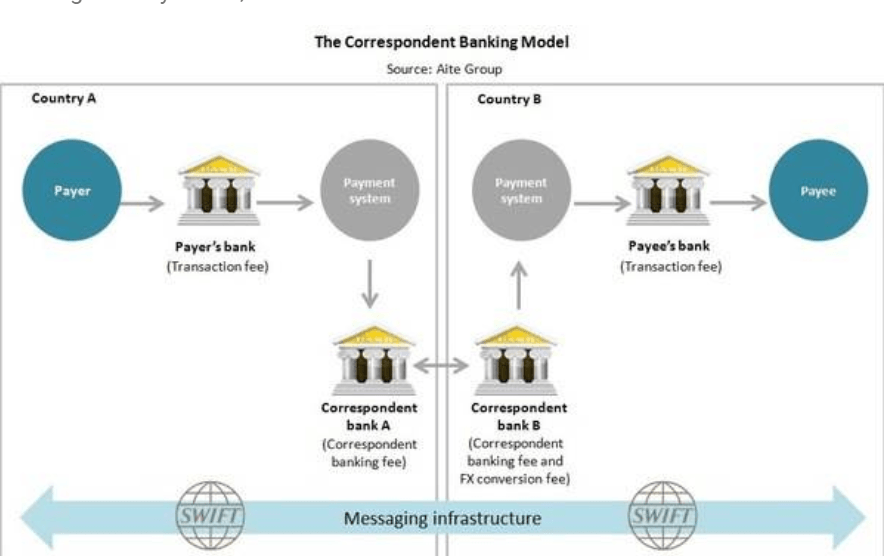

The most obvious example use case of sharing value through the internet is in the international remittances and money transfer market. Presently cross-border remittances are transacted through the archaic correspondent banking system. There are usually 6 participants to a transaction: payer, receiver, payer’s bank, payer’s correspondent bank, beneficiary bank’s correspondent bank, beneficiary bank and finally the beneficiary[1]. The transaction flows exactly in this sequence through the SWIFT messaging network. Even today, international transfers still take 1- 5 days and can cost the customer between $25-$30 [2]over and above the foreign exchange spread.

What is Ripple doing?

The importance of improving this legacy framework is obvious both from a customer and Bank perspective. The company that is making progress in this space is Ripple that uses the Integrated Ledger Protocol[3], an open source distributed ledger that connects across different Bank’s proprietary ledgers through connectors for seamless peer to peer transactions. The Interledger [4]can be considered as the second layer on the internet that allows any financial institution to connect its core system to transact within the network.

Ripple’s ultimate goal

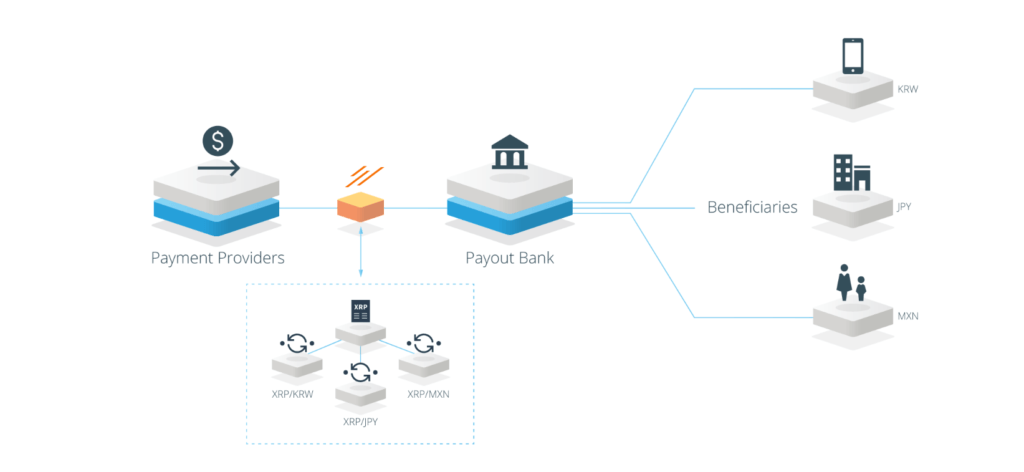

At full potential of the ILP use case, transaction costs will be go down, forex fluctuations will be limited, and operational efficiency will increase. The true cost saving for Banks will be not having to pre-fund correspondent banks or creating multiple trust lines with different banks, making the network more scalable. Ripple has introduced its own product known as the Xrapid[5] that uses its own digital asset called the XRP[6] to act as a liquidity provider within the network. If this is achieved, financial institutions will transact with each other using the XRP and exchange it to fiat currency when crediting/debiting to customer accounts. This is the example of Internet of Value, in which through use of digital assets, money transfers are getting executed in a matter of seconds.

Source: Ripple

Barrier’s ahead and Ripple’s response

However, Banks are still hesitant to use a digital currency/asset such as the XRP which has volatility much like other cryptocurrencies. To counter this problem, the company is offering its solution known as the xCurrent[7] for FIAT currencies through using the Interledger protocol to share information on a real time basis and automatically update the banks’ systems, eliminating settlement risk. However, the argument is made that while the present solutions provide all the advantages of improved operational efficiency, it is still not sharing of value and parties to the transaction still need to maintain correspondent relationships to maintain trust. For now, the strategy of the company is to build the network through the xCurrent and slowly integrate the digitized asset solution (xRapid) in future years.

Alternative strategy?

I believe that Ripple should look at adopting a stable price digitized asset rather than the current XRP. The digitized asset is essentially an IOU that is universally accepted between partners to the network and can be moved around in the system in a faster way. This could be the proposed XRP, Bitcoin or even just a stable token as long as its utility has a consensus within the network. I believe; however, a stable token solution may get more acceptance from mainstream companies rather than a volatile cryptocurrency. From Ripple’s perspective, it should not matter if the price of the asset is stable for them to deliver the true potential of their product. Although few countries (Abu Dhabi being the latest [8]) are making strides in adopting digital assets, most user acceptance is still for Ripple’s Fiat currency product.

The uncertainty ahead…

I see great potential in Ripple and its impact on the international remittance market. However, I am still uncertain about their willingness to adopt a fixed token model as the company will lose out if there is capital appreciation of the XRP since they also hold significant quantity of the token. If they continue to operate with the XRP, it may well prove to be difficult to get institutional buy-in, without which the true value of the XRP and its ability to appreciate is circumspect.

Word Count: 800

[1] Blair, David. “Ripple vs SWIFT: payment (r)evolution” Treasury Today, Jul 2017, http://treasurytoday.com/2017/07/ripple-vs-swift-payment-r-evolution-ttpv

[2] Rethinking correspondent banking, McKinsey & Co.,

[3] Leonard, Shanna. “The Internet of Value: What It Means and How It Benefits Everyone” Ripple, Jun 21, 2017 https://ripple.com/insights/the-internet-of-value-what-it-means-and-how-it-benefits-everyone/

[4] “Interledger Architecture” Interledger, https://interledger.org/rfcs/0001-interledger-architecture/

[5] “Source Liquidity, xRapid”, https://ripple.com/ripplenet/source-liquidity/

[6] “XRP, The Digital Asset of Payments” https://ripple.com/xrp/

[7] Technical Overview of xCurrent, Ripple, October 2017; https://ripple.com/files/ripple_product_overview.pdf

[8] “Guidance – Regulation of Crypto Asset Activities in ADGM”, https://www.iosco.org/library/ico-statements/Abu%20Dhabi%20-%20FSRA%20-%20Guidance%20-%20Regulation%20of%20Crypto%20Asset%20Activities%20in%20ADGM.pdf

Extremely insightful article, it clearly articulates the use case of Ripple in cross-border transfer. My fundamental concern with Ripple or other similar crypto-currencies/ block-chain technologies is that the fundamental feature of money is store of value. Since these tokens are consolidated in a large quantities among several buyers, it could result in large swings based on sentiments rather than functional value. I share your concern that transfer of money could be instantaneous which is a clear benefit, but if those 100$, 3 minutes later are worth $95 that would prevent banks from widespread adoption – and an alternative solution needs to be explored. An additional pain-point I see that could hurt widespread adoption is similar technologies such as XLM (Stellar Lumen) – my belief is that for an XRP/XRapid adoption you would want majority of the banks leveraging one blockchain technology.

Thanks very much for the contribution, Jayant. One (of the many) potential challenges I see to the adoption of cryptocurrencies and alternative financial technologies is the chicken and egg problem they face in climbing the adoption curve. As you note, when asset valuations are extremely volatile, such as they have been for cryptocurrencies, potential users will be reticent to come onboard, but without new users it’s hard for a platform to achieve the critical mass necessary to reduce that volatility. It is simple enough for traditional fiat currencies to cross that chasm–they have the coercive power of the state mandating their adoption–but alternative payment mechanisms will have to cross that chasm all on their own. Whether they can do it and how quickly will be a fascinating process to watch.

Really nice article, thanks for sharing! This seems to be a legitimate use case for blockchain, which I’m happy to read! I’m curious about the regulatory risk associated with cross-border settlements, especially regarding anti-money laundering rules. AML rules are a primary reason for the length/ scope of validation between foreign banks. If I am able to send money instantaneously across borders, how can I be assured that banks will still meet these requirements, especially given that users of crypto exchanges are often de-identified?

Very interesting article Jayant! I agree Ripple has the potential to transform the way we transact online on an international level. As you raised, I am also concerned about Ripple’s holdings of XRP. Because Ripple owns both the majority of XRP tokens and protocol development, their approach is more centralized than other cryptocurrencies like Bitcoin, which in some ways may make adoption easier given the trust and credibility imbued in a consolidated system. However, there are issues with classification (token vs. security) which could fundamentally alter the value received from distributed technology, limiting movement and ultimately forcing a reversal to the current complex remittance system.

Reference: https://www.nytimes.com/2018/07/01/technology/cryptocurrency-ripple.html

Thank you very much for the insightful article! I also wrote about open innovation for a big company,but is interesting to know that there is still an open innovation space for a startup like Ripple and also for an industry like cross-border remittances where I believe security could be a key issue for its operation. I agree with you that block chain technology could be the next generation of international remittance considering its technology durability and trait. I generally think mega players in banking industry would surely move in the same direction, so wonder what kind of differentiation could be provided by doing this open innovation.

Thanks for sharing Jayant – this was an interesting read. I agree that the potential in this space is huge given the sheer volume of remittances especially with the increasing number of people in the developing world seeking jobs in the west. I do think adoption will take a while in this sector, especially due to the fact that a lot of people who are receiving remittances are not necessarily financially sophisticated. Moreover, there is an innate distrust in what is perceived as more abstract concepts such as Blockchain as opposed to your local high street bank. It will be interesting to see how Ripple overcomes these difficulties going forward, and also if other companies based on Blockchain will exploit this opportunity too.