Rent the Runway Digitizes High-Fashion

Rent the Runway uses data and proprietary technology to revolutionize the operational model behind how millennial women shop.

Haute Rentals

In 2009, Jennifer Hyman and Jennifer Fleiss created Rent the Runway (RTR) as a way to solve the quintessential fashion problem for cost-minded, millennial women: not being pictured twice in the same high-end dress.

“On-demand economies” a la Netflix and Uber were new to the luxury fashion market. As a result, RTR was uniquely positioned to revolutionize the way women shopped. But managing inventory for an e-store, ensuring an efficient supply chain management system, and minimizing cleaning costs posed incredible operational challenges for the business.

Today, RTR is valued at $500 million because it has used data and a “technology-first” mindset to build a two-sided platform that serves both high-end designers and millennials. The result? A scaleable model that delivers reliable rentals and accessibility to an enormous breadth of high-fashion options.

Super Models

BUSINESS MODEL

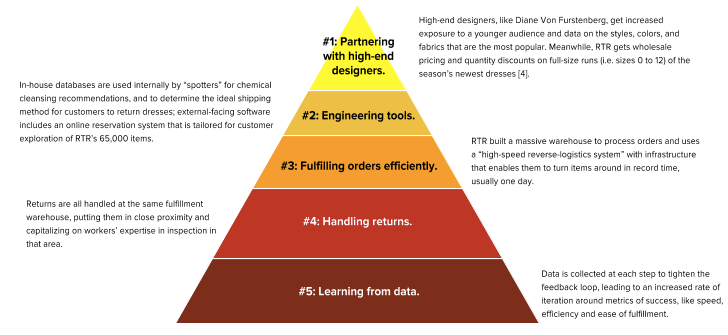

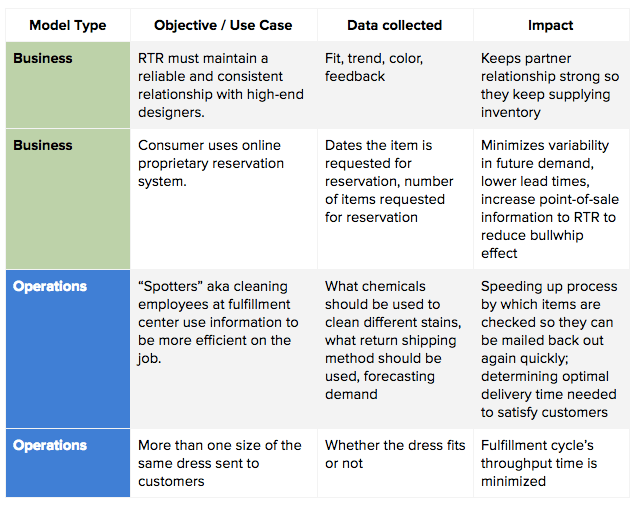

RTR’s value proposition is to “give people access to luxury experiences, and to change the meaning of ownership [1].” Its business model achieves this via five tenants: partnerships, engineering, fulfillment, returns, and learning from data.

OPERATIONS MODEL

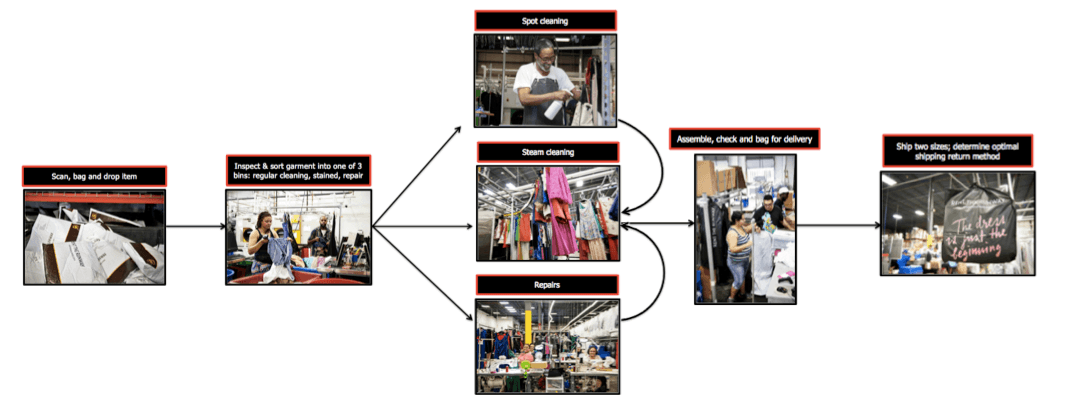

RTR’s “high-speed reverse-logistics” operations model facilitates efficient returns [10]. To obtain throughput times of less than one week, RTR collects data on “physical” (when a garment is moved, whether it is damaged, in rotation, or put out for sample sale) and “theoretical” inventory (expressing what state the garment is in when put up for rental, what seasonal demand will look like). RTR has built a 150,000 square foot warehouse – the largest dry cleaner in the U.S. Finally, RTR is focused on “spotter utilization:” the rate at which employees identify and correct stains. Because the job requires specialized knowledge and lots of experience, hiring is difficult, and they become the bottleneck in the fulfillment process.

Digital Design

RTR’s primary advantage is the data they collect and the technologies they have built to store and learn from such data. For example, a “chemical database” is used by spotters at the fulfillment center to identify and record which chemicals to use on different fabrics when removing stains.

As with Toyota’s operation, RTR has built software to facilitate open and bidirectional channels of communication – between customers and RTR through the reservation system, but also between fulfillment employees, and between designers and RTR. Furthermore, fulfillment employees are encouraged to use rolling bins and portable tools like mallets. This allows movement between steps to occur more easily, and a reallocation of resources to flow effectively.

Couture Challenges

When RTR was founded in 2009, its challenges were centered on partnerships and variability of demand. Specifically, why would high-end designers choose to partner with a rental service? Moreover, swift changes in fashion trends could lead to huge variability in demand – how would RTR handle the bullwhip effect? Most importantly, how would RTR deliver consistent high-quality items in a timely manner in order to not lose customers for life?

The answers to those questions were solved by building software to increase information transparency to all parts of the organization. However, it remains to be seen whether RTR can survive financially. It remains unprofitable [7] (despite raising $126 million in VC), with Fortune estimating only $28 million in revenues in 2013 (25% lower than RTR’s internal projections), and losses of $14.5 million. RTR has had to rethink its entrance into other markets, like unlimited accessories – a program that has been in beta for over a year and a half, despite having 10,000 people on the product’s wailtist. Additionally, by branching into in-house-made “private” labels, as they did in December 2015 [2], RTR is toeing the line between horizontal and vertical integration, as well as customer trust.

Above all, as RTR grows from start-up to a full-fledged corporation, it must reconcile its mission with its apparent culture problems [7]: in 2015 alone, four C-level executives left, including the COO and CTO. Ex-RTR employees describe a Mean Girls culture, where assignments are based on founders’ whims rather than business acumen. This toxic environment merits introspection, largely because it can be a problem to operational efficiency, as exemplified by the case on Shinkansen in Japan.

A Fresh New Look

RTR has proven that rental services for high-end clothing can be operationalized with digital innovation. As it moves forward, I recommend RTR remain focused on what it’s clearly good at – clothing items for millennial women – and move to permeate additional geographies in the U.S., outside of the urban centers that it has been most focused on. To do this, RTR should invest in more brick-and-mortar stores beyond New York and Los Angeles, increasing “try-ability,” and earned media. This will require consideration of the type of inventory and pricing strategies used in the physical versus online stores. Most importantly, however, leadership must improve the company’s culture if they plan on being a sustainable enterprise.

Word count: 798

References:

[1] Rent the Runway “About” page (2016). <https://www.renttherunway.com/pages/about>” [Online]. Retrieved 14 Nov 2016.

[2] Maheshwari, Sapna (16 Dec 2015). “Rent The Runway quietly puts its in-house labels alongside designer names” [Online].

<https://www.buzzfeed.com/sapna/rent-the-runway-sells-own-brand-alongside-designer-dresses>. Retrieved 14 Nov 2016.

[3] AOL.com editors (21 Oct 2016). “Rent the Runway launches first West Coast store — opens in Los Angeles” [Online]. <http://www.aol.com/article/lifestyle/2016/10/21/rent-the-runway-launches-first-west-coast-store-opens-in-los/21589019/>. Retrieved 14 Nov 2016.

[4] Galbraith, Sarah (3 Dec 2013). “The secret behind Rent the Runway’s success” [Online]. <http://www.forbes.com/sites/sashagalbraith/2013/12/03/the-secret-behind-rent-the-runways-success>. Retrieved 15 Nov 2016.

[5] Bertoni, Steven (26 Apr 2014). “The secret mojo behind Rent the Runway’s rental machine” [Online]. <http://www.forbes.com/sites/stevenbertoni/2014/08/26/the-secret-mojo-behind-rent-the-runways-rental-machine>. Retrieved 15 Nov 2016.

[6] Wortham, Jenna (8 Nov 2009). “A Netflix model for haute-couture” [Online]. <http://www.nytimes.com/2009/11/09/technology/09runway.html?_r=0>. Retrieved 15 Nov 2016.

[7] Roberts, Daniel (17 Nov 2015). “Exclusive: What’s behind the exodus from Rent the Runway?” [Online]. <http://fortune.com/2015/11/17/rent-the-runway-exodus/>. Retrieved 15 Nov 2016.

[8] New Relic and Rent the Runway pitch deck [Online]. <https://try.newrelic.com/rs/newrelic/images/FINAL_RentTheRunway_CaseStudy.pdf>. Retrieved 15 Nov 2016.

[9] Greenfield, Rebecca (28 Oct 2014). “Inside Rent the Runway’s secret dry cleaning empire” [Online]. <https://www.fastcompany.com/3036876/most-creative-people/inside-rent-the-runways-secret-dry-cleaning-empire>. Retrieved 15 Nov 2016.

[10] Primary source, Rent the Runway Senior Data Engineer [Phone interview]. 16 Nov 2016.

This post is spot on. Speaking of spots, I just learned a ton about stain removal! Thanks. I would never have imagined it was the bottleneck in the fulfillment process.

I thought it might be worth touching upon RTR’s just-in-time logistics. When renting for a specific event, let’s say a Saturday wedding, the standard 4-day rental arrives on Thursday afternoon so it can be tried on to make sure it fits. If it doesn’t, send it back and RTR rush-delivers a new dress to you either Friday evening or Saturday morning in extreme cases. Wear the dress to the event on Saturday before putting it in a dropbox on Sunday. $50 late fee if you keep it an extra day. From my perspective, RTR has minimized the time a dress is in the hands of the costumer and by that same token, they have maximized dress utilization (excluding the aforementioned cleaning and processing times).

In terms of what they can do going forward, I agree that more brick-and-mortar stores could be beneficial. Specifically, trying on the dresses beforehand would guarantee that the it fits as expected, eliminating the need for costly rush replacements. However, if they went in this direction, what would that imply about the digital aspect of the business model? Can the app-based, on-demand business model work without physical stores?

I’m a huge fan of RTR, with both a PRO and Unlimited membership. Up until now, I hadn’t really put much thought into the logistics behind the business, but just relied on them to have clothes to me when I needed them, looking like new. I liked how you applied not only theory we’ve learned in TOM, but also in FRC. The goal around spotting is really well aligned to what they’re trying to accomplish.

I’m really curious how all of this will translate to their Unlimited model, which the company launched in March 2016 [1]. Under this service, members get three items (accessories, clothing, cocktail dresses, etc.) at any time. Members can keep these as long as they wish, which could represent a logistical nightmare, especially as others wait for a specific clothing item. Also, branching out of dresses means that RTR will need to carry more inventory and become even better at trend spotting across a wider variety of clothing items. So far, it has worked out for me, but in order to justify the expense, RTR will need to ensure even fast turnaround times (on the consumer end) than mentioned above. For example, I would be incredibly unhappy if RTR took a week to change out clothes and send me new ones, leaving me paying for a service on a monthly basis, but only getting two or three weeks of use from it. This could be a barrier to expansion in the future, unless they decentralize their warehouses, which has other implications.

Either way, I’m excited for the future of RTR and so thankful it exists.

[1] http://fortune.com/2016/03/23/rent-the-runway-unlimited/

Neets, love this post, and serves as a nice shoutout to some young HBS alumni! Like @kdegs, I’ve used RTR as a customer but never considered the sophisticated backend logistics used to make the operation so successful. Your recommendation for RTR to expand to brick and mortar is spot on — I just read on Fortune a few days ago that Neiman Marcus is partnering with the company to build an in-department RTR kiosk [1], which may be beneficial to both parties. RTR won’t have to absorb the full independent cost of opening up a standalone, and Neiman benefits from RTR’s young customer base (versus Neiman’s 51-year-old shopper average).

I also love the way RTR leverages technology as part of the customer experience. It’s review platform in particular encourages past renters to post photos for future customers. I love this because not only does it add a human-touch element to an activity that occurs behind a screen, but also it heavily influences a renter’s likelihood of a product purchase. Because the customer is more informed, she’s likely to make a favorable selection at the outset, which reduces returns and increases overall satisfaction. Would love if more retailers instituted this type of photo sharing feature.

—

[1] http://fortune.com/2016/11/16/neiman-marcus-rent-the-runway/

Anita, love this post on RTR! As an avid user of RTR, I have always been curious to understand how the company is able to manage their complex supply-chain process given that inventory management is their greatest asset and biggest risk. The value proposition of RTR is deeply correlated with their ability to get the right products in the hands of the consumer at exactly the right time. Without the assurance that consumers will receive quality items of clothing at the time they plan to wear them, they will immediately lose credibility and trust. Quality control is crucial in this business model so I loved hearing about their intricate process of spotting and cleaning stains. This process, although extremely human capital intensive, is critical in maintaining RTR’s customer base. However, given that the company still isn’t profitable, RTR will need to carefully consider how they grow their business model without sacrificing their customer promise.