REDFIN: USING DIGITIZATION TO FLIP THE HOUSING MARKET

Residential real estate agents are on the brink of extinction. Can Redfin, through digitization, finish the job?

Homeowner: “You’re going to charge me how much to sell my house?!”

Real Estate Agent: “6% of the sales price.”

Homeowner: “That’s $60,000?!”

Real Estate Agent: “Yup 🙂”

The race is on to disintermediate an overly paid job function in America. Historically, real estate agents were valued tremendously by customers who did not have access to the information necessary to buy and sell their homes. In the last 10 years, digitization of the industry has changed everything. With companies like Redfin innovating the way customers buy homes through digitization, realtor duties are diminishing. So, will real estate agents become obsolete?

This is the same question Glenn Kelman asked himself when he founded Redfin in 2005 and additionally stated, “Real estate is the most screwed up industry in the world.”1 Based on the premise that the digitization of data flow through the medium of the internet could provide buyers with everything they needed to find their own home to purchase, Redfin is on its way to disrupting the industry.

A TRADITIONAL INDUSTRY BUILT FROM THE GROUND UP

Image: Kelly Englar discussing how she felt when she sold homes as a traditional agent

Historically, real estate brokerages have operated in a de-centralized model, working with clients 1-on-1. Redfin has centralized the model and digitized the information process flow. The firm uses the internet to sell homes to its customers and only uses human capital when absolutely necessary- mostly to negotiate terms with other human realtors4. Thus, partially dis-intermediating the real estate agent and moving towards making the profession obsolete. The result, less realtors and more deal flow.

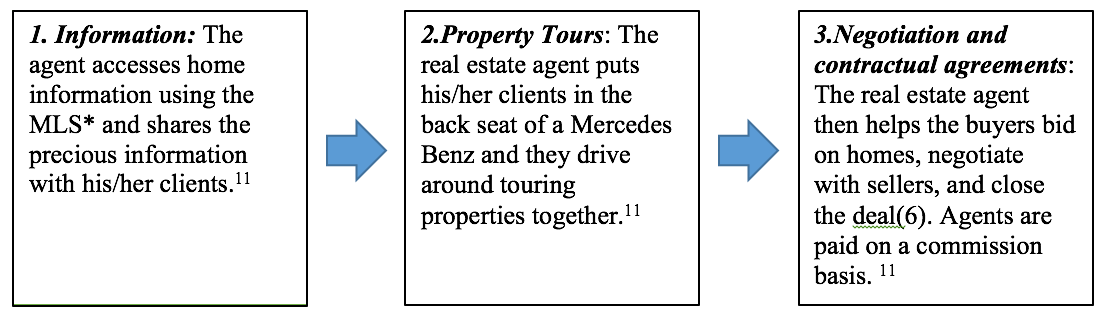

Traditional real estate brokerage operational approach:

*The MLS (Multiple Listing Service) is an online a tool to help listing agents find cooperative agents working with buyers to help sell their clients’ homes(10)

*The MLS (Multiple Listing Service) is an online a tool to help listing agents find cooperative agents working with buyers to help sell their clients’ homes(10)

REDFIN: FLIPPING THE OPERATION MODEL

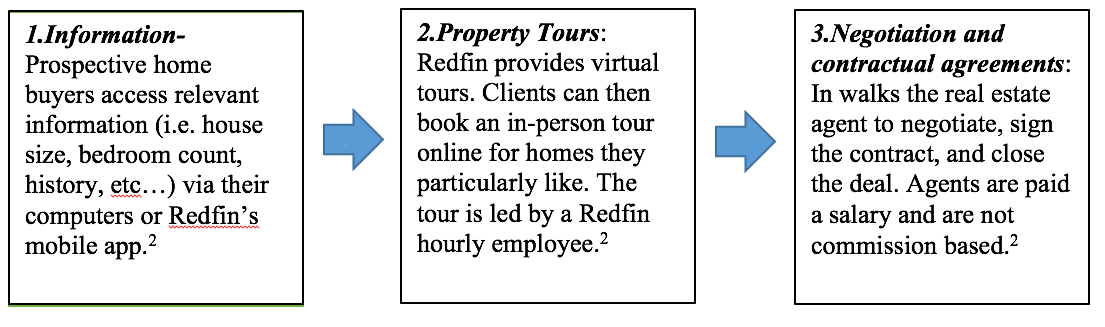

The Redfin digitization approach to operations:

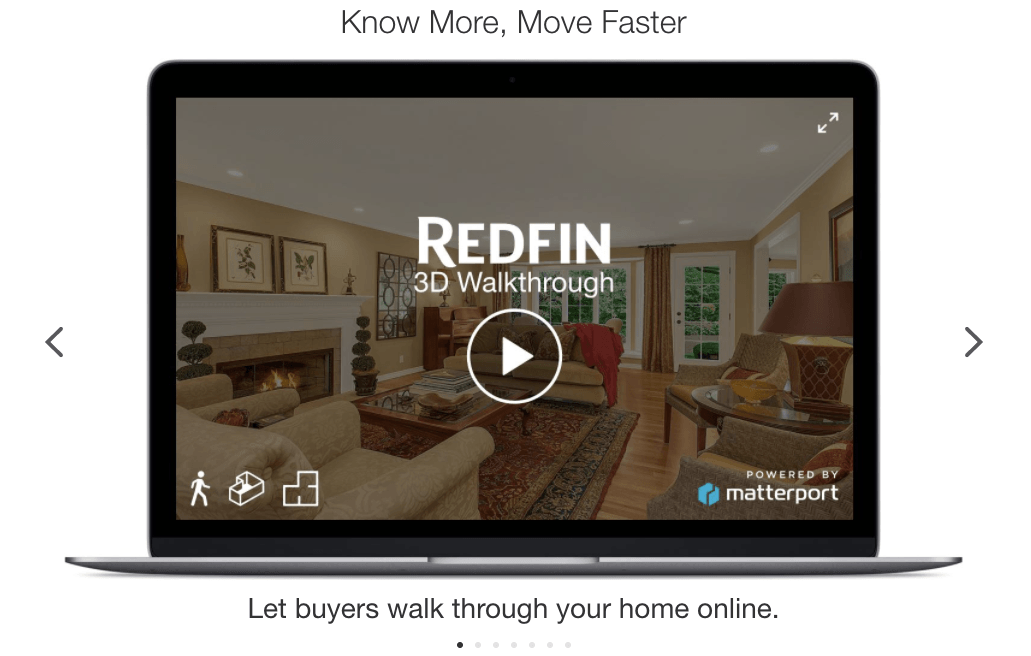

Redfin’s “3d Walkthrough” feature allows home buyers to get full virtual tours online3

Redfin’s “3d Walkthrough” feature allows home buyers to get full virtual tours online3

Redfin’s operational model requires less human capital, allowing it’s real estate agents to do a high volume of deals. Additionally, Redfin agents are on salary while traditional agents are paid on commission. The average Redfin agent closes eight deals a week while the average traditional agent takes a year to close the same amount4. The end result is a new distribution of value between the real estate brokerage and the client.

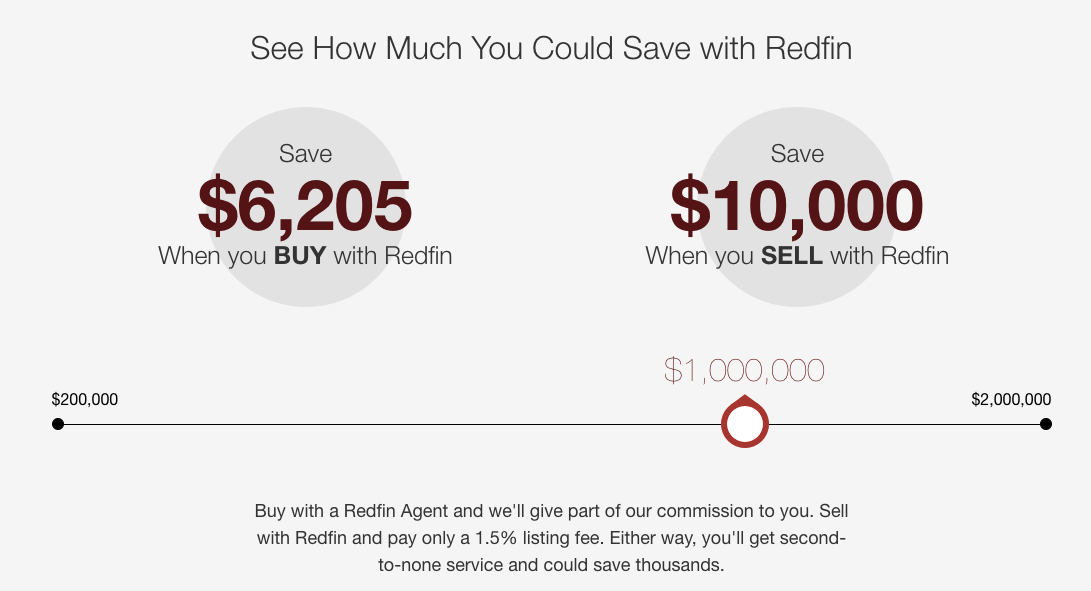

By taking advantage of digitization, Redfin has been able to capture traditional real estate agents’ sacrosanct commissions and put more money back in the pockets of its clients.2 For example, on a $1 million home purchase, the average Redfin client gets a kick-back of $10,000 when they sell with Redfin and $6,250 when they buy with the company- a savings of $16,250 if you are selling your existing home and buying a new one!3

BLUEPRINT FOR REMODELING THE HOUSE THAT REDFIN BUILT

With competitors looming, Redfin must take an aggressive approach and be the first real estate company to fully disintermediate traditional real estate agents. They can achieve this by:

Sourcing User Contributed Information: Redfin should consider incentivizing home owners to provide additional information regarding their homes that cannot be inferred by an algorithm (i.e. repairs or remodels, maintenance costs, neighbors).

Fully Digitalized Contracts: Reading through a contract for the purchase of a home can be an arduous process. Digitalizing and making the process simple for clients to read and understand will be essential for the Redfin model to continue to real estate agents.

Automated Auctions: Bidding on homes should be handled by an online digitized automated system that includes legally-binding documents that would be instantly accessible to clients’ attorneys for review.

As the world changes, and digitization further pushes the real estate industry past the status quo, Redfin is in a strategic position to continue to change the way people purchase homes.

(768)

Notes

1 Geekwire. What keeps Redfin CEO Glenn Kelman Up at Night. http://www.geekwire.com/2015/what-keeps-redfin-ceo-glenn-kelman-up-at-night/. Accessed 16 Nov. 2016.

2 CBS News. Chipping away at the Six Percent. http://www.cbsnews.com/news/chipping-away-at-realtors-six-percent-11-05-2007/. Accessed 16 Nov. 2016.

3 Redfin. https://www.redfin.com/. Accessed 16 Nov 2016.

4 CBS News. Hi-Tech Real Estate Moves In. http://www.cbsnews.com/videos/hi-tech-real-estate-moves-in/.Accessed 16 Nov 2016.

5Wall Street Journal. http://blogs.wsj.com/cio/2014/11/12/what-the-heck-is-digitization-anyway/P;. Accessed 17 Nov 2016.

6Suzuki, Takeshi, and Yu Meng. “System and method for evaluating real estate and the surrounding environment and visualizing the evaluation results.” U.S. Patent Application No. 10/304,510.

7Gelman, Irit Askira, and Ningning Wu. “Combining structured and unstructured information sources for a study of data quality: a case study of Zillow. com.” System Sciences (HICSS), 2011 44th Hawaii International Conference on. IEEE, 2011.

8The Economist. http://www.economist.com/news/technology-quarterly/21615067-more-and-more-devices-are-becoming-connected-will-they-speak-same. Accessed 16 Nov. 2016.

9Realtor.http://www.realtor.org/topics/nar-doj-settlement/multiple-listing-service-mls-what-is-it. Accessed 16 Nov 2016.

10 Dginger, David. Personal Interview. 15 Nov 2016.

11 Anderson, Craig. Personal interview.16 Nov 2016.

Good read, Craig! I also wrote on the real estate industry (Zillow) and was impressed by Redfin’s model. I think that real estate such an interesting space, since it’s one of the last traditional industries that hasn’t been dis-intermediated.

From my research, I understood Redfin to be one of the only companies that tried to disrupt the stubborn real estate industry, but that it has reverted back to the traditional model in some ways. Redfin has re-structured bonuses such that 75% is based on home price and 25% on customer satisfaction. Otherwise, the company was losing top-performing employees who weren’t compensated high enough for selling the multi million-dollar homes. Since this structure increased overall compensation, Redfin also had to decrease the average rebate to buyers from 2/3 to 1/3, thought it gave bigger discounts to sellers. To me, this shows how engrained the model is due to customer preferences of wanting an intermediary in this transaction, as well as the legal and financial complexity of the purchase/sale.

http://www.inman.com/2014/11/15/redfin-has-risen-still-an-industry-disrupter/

I agree with your suggestions and recommended that Zillow do the same – it would be very valuable if back-end functions like digital contracts and automated auctions were added to make home buying easier.

Very interesting and thought provoking post, Craig! I agree with “SB” and you in saying that the real estate space is incredibly interesting because it is such an old school model. I understand what RedFin is attempting to do but I think it is fighting an uphill battle. Technology will definitely have a role in the future but I don’t think its role will be to disintermediate the broker. To me, the very nature of residential real-estate purchases are highly personal. They are huge life investments for people and I can’t imagine anybody making a significant purchase without seeing a location in person. In my opinion, people still want that high-touch, face-to-face service that brokerage delivers.

Because I think brokers are the past, present, and future, I think what Compass is doing is incredibly interesting (I’d be curious to get your thoughts). Basically, Compass is treating the agents as a stakeholder just as important as the buyers and sellers of the actual homes. As such, Compass operates a centralized model, investing in technology, culture, support, design, and marketing with the goal of providing the absolute best resources to agents which in turn will deliver better customer service to buyers and sellers. Compass’ strategy is to differentiate itself to brokers and incentivize them to come on board. Do you think this is the right strategy to target brokers to grow or do you think the future of real estate is disintermediating brokers and going directly to consumers?

Super interesting model! I think the trend of digitization into real estate is an inevitable one, but will have more focus on certain types of real estate. To my limited knowledge of the industry, certain types of homes are more likely to be sold using its model, where face-to-face interactions are not essential to the value of the home. Price is one factor to differentiate the many models, as SB mentioned, but so is location (suburban vs urban housing) and type of buyer (homes for corporate professionals?), among many others. I wonder where Redfin is focusing its efforts, and where it plans to expand in the future.

Moreover, I wonder if all parts of the process will be digitized- your suggestion on bidding is interesting, but at what cost? There may be benefit in having brokers/intermediaries who help potential buyers how much to bid, and how to prioritize when deciding to buy a house, or ever to suggest similar homes when the ones they initially aimed for wasn’t available.

Great post and I agree that it’s a very interesting and disruptive business model. The focus on making the home buying process easier and easier by digitizing aspects of the process and minimizing the pain of having to visit home after home is very useful. I’m curious if they have been looking at integrating other statistics and analyses into the process either on the buyer side or seller side. For buyers have the considered gathering more data about the buyer in terms of their preferences, backgrounds, or tolerances related to schools in the area, crime, or other publicly available information. From sellers have they also considered gathering information on the owners history and experience with the home? As you note, it seems like there are a lot of opportunities to continue exploring the digitization of the home buying process so I’m interested to see how Redfin will continue to grow.