Real Estate Development in Post-Sandy Hoboken

Would you invest in Hoboken real estate after Hurricane Sandy? LCOR takes on a mega-project and grapples with climate change.

Introduction

Would you pursue an ambitious real estate project in Hoboken just 4 years after Hurricane Sandy? LCOR, a Pennsylvania-based real estate development and investment firm, is doing just that, moving forward with a massive 65 acre project at Hoboken Terminal and Rail Yard.

Context

LCOR was selected by NJ Transit as the developer for the project in 2005 and has yet to break ground as a result of political pressure, Hurricane Sandy, and subsequent debates regarding appropriate storm-water management systems (5). Following Sandy, Hoboken has taken innovative steps to address climate change challenges, including allocating $230 million from HUD funding to build a flood resistance program (6). However, the flood resistance program only provides protection against a 100-year flood (rather than a 500-year flood as was originally intended) (1). The LCOR NJ Transit project remains in flux.

Hot Real Estate Market or Ticking Climate Time-Bomb?

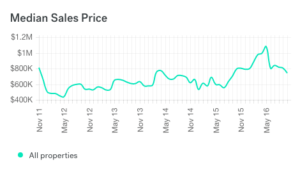

Using Trulia data, we can see that Hoboken real estate prices fell precipitously after Hurricane Sandy but have climbed steadily as Hoboken has become a hot real estate market for commuting families (6). LCOR must determine whether these real estate trends are sustainable in the near term and over the life of the project.

How Will LCOR Be Impacted By Climate Change?

LCOR’s property base includes developments in the DC area and NY/NJ (2). If sea levels rise by six feet then DC would see some significant effects, including the tarmac at the region’s primary airport being underwater. However, NY/NJ is a high-risk area, and LCOR’s properties in Brooklyn and Hoboken have a high risk of being flooded.

LCOR Steps Taken to Mitigate Climate Risk

LCOR has taken steps to address climate risk. First, LCOR has developed the capability of building LEED Gold-certified structures including 1 property in New York and 1 property in Bethesda, MD. These properties prioritize energy efficiency and thus help “do their part” in minimizing greenhouse gas emissions. In some respects if everyone built these type of buildings then it would truly begin to mitigate climate risk by decreasing emissions. Regardless, LCOR has long recognized that climate change is an important aspect of the real estate business and increasingly effects consumer choices in residential selection. We see how branding can affect LCOR’s pivot towards LEED buildings in 2007 when, in describing a LEED-certified project in New York, LCOR Senior Vice President David Sigman said, “Green is never going to replace location, location, location, but it gives you a marketing advantage” (4). In the specific Hoboken Terminal and Rail Yard Project, LCOR adjusted their proposal in 2013 to mitigate the effects of climate change, including a permanent flood barrier (at a cost of $15 million), raising the ground floor by a few feet, and building a drainage system to divert rainwater (1).

Proposed Future Steps to Adapt to Climate Risk

LCOR has important decisions ahead in terms of how it manages existing project risks, how it prioritizes the sustainability of future buildings, and to what extent sea level rise would affect project location selection.

- Diversify urban real estate development practice to service non-coastal American cities or locations less affected by climate change. Doing so might involve hiring staff with additional geographic expertise.

- Increase capabilities in environmental design, water management, and LEED architecture. If we look at the trends in real estate development and climate change projections, it is likely that real estate projects will require increasing sustainability compliance and innovation. If LCOR is able to take a leading position in LEED-certified developments it will be well positioned to capture future opportunities.

- Fund proprietary R&D on resiliency urban architectural structures. In support of this mission of being a cutting edge sustainability innovator, LCOR might need to set up a lab or fund architectural research to ensure that they are identifying best-in-class ideas for their buildings.

- Assess building financial risks. LCOR will need to assess their holdings and exit horizons in relation to their risks as developers. Are they taking on the risk that these buildings will secure tenants? What happens if an area is flooded, whether it is in 5 years or 15 years? Perhaps it would be prudent for LCOR to set aside some funds for flood repairs in their buildings.

Conclusion

Is it too early to short New York / New Jersey real estate holdings? Probably, especially given the timeframe. Additionally, Hoboken’s innovative stormwater management solutions may protect the city and its properties from additional harm. Yet for real estate companies active in this region it is worthwhile to start thinking long-term about their existing holdings. Even if their specific buildings do not get flooded, future projects will need to integrate comprehensive thinking about sustainability and environmental risk management.

773 words

References:

1) Hack, Charles. NJ Transit and developer LCOR says Hoboken Terminal & Rail Yard Redevelopment will include flood wall to protect Hoboken. The Jersey Journal. 2/26/2013. http://www.nj.com/hudson/index.ssf/2013/02/nj_transit_and_developer_lcor.html

2) LCOR homepage. Accessed 11/3/2016. http://www.lcor.com/Pages/default.aspx

3) Shorto, Russell. How to Think Like the Dutch in a Post-Sandy World. The New York Times. 4/9/2014. http://www.nytimes.com/2014/04/13/magazine/how-to-think-like-the-dutch-in-a-post-sandy-world.html?_r=0

4) Traster, Tina. More owners build eco-friendly rehab projects. Crain’s New York Business. 10/14/2007. http://www.crainsnewyork.com/article/20071014/SUB/71013015/more-owners-build-eco-friendly-rehab-projects

5) Trulia. Hoboken, New Jersey Market Trends. Accessed 11/3/2016. https://www.trulia.com/real_estate/Hoboken-New_Jersey/market-trends/

6) U.S. Department of Housing and Urban Development. HUD Announces Winning Proposals From The “Rebuild By Design” Competition. 6/2/2014. https://portal.hud.gov/hudportal/HUD?src=/press/press_releases_media_advisories/2014/HUDNo_14-063

It has been incredible for me to see that real estate development along the coast of Manhattan didn’t skip a beat following hurricane Sandy (especially in the South Street Seaport area). My intuition is that people are discounting the potential that another Hurricane Sandy will strike Manhattan again. It would have been very helpful to see if Hoboken housing prices are increasing at the same rate as other inland properties or if time is allowing homeowners to forget the devastating impact of these natural disasters.

Thanks for the post, agree with Claire that it seems everyone is discounting the impact of a future Hurricane Sandy in making real estate decisions–in fact, I think the relative resilience of the New York / New Jersey area after this 100-year-storm has actually increased the level of discounting everyone is applying to hurricanes.

One question your post brings to mind is how to change demand so that people want to move to areas safe from climate-change-induced sea level changes. Basically, how do you make inland sexy? As your post pointed out real estate remains about location, location, location, and unfortunately demand for coastal buildings seems to be only increasing over time. I’m curious if LCOR or other real estate players have tried marketing inland locations or otherwise introduced water-side properties inland–which is, in my view, unfortunately the only long-term solution to the problem of rising sea levels affecting coastal cities.