Reaching the Digital Generation: Disney’s Acquisition of YouTube MCN Maker Studios

“Short-form online video is growing at an astonishing pace and with Maker Studios, Disney will now be at the center of this dynamic industry” – Disney CEO Bob Iger

In March 2014, The Walt Disney Company purchased leading YouTube multi-channel network Maker Studios for $500M, with an additional $450M in bonuses if Maker were able to meet certain growth goals. Disney’s primary goal in acquiring Maker Studios was to reach the younger, digital audiences that Disney was struggling to engage. The acquisition sent a clear message to major media players: online video is the future.

In March 2014, The Walt Disney Company purchased leading YouTube multi-channel network Maker Studios for $500M, with an additional $450M in bonuses if Maker were able to meet certain growth goals. Disney’s primary goal in acquiring Maker Studios was to reach the younger, digital audiences that Disney was struggling to engage. The acquisition sent a clear message to major media players: online video is the future.

Today’s consumers expect video viewing anytime, anywhere, and on any device. Traditional industry players are clambering to create content targeted at the younger digital generation on new, emerging platforms. With the rise of affordable production technology and accessible distribution platforms like YouTube, digital content creators and aggregators are challenging the notion that production and distribution of content is an expensive business controlled by the networks and studios. A network television program can cost upwards of $5M per episode and generate millions of views, while a short-form video posted on YouTube by a top-tier creator can be produced and marketed for $10,000 – $50,0000, attracting the same number of views. As a result, traditional media companies have been forced to re-think how they develop, distribute, and monetize content to compete against these new content creators and digital studios. In the case of Disney and Maker Studios, Disney opted to acquire Maker and its network of 55,000 content creators instead of attempting to build their own online audience and content library.

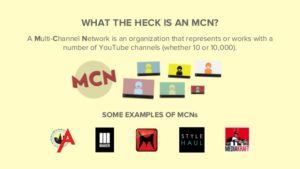

YouTube is a big business. The top 100 YouTube channels receive over ten billion views per month, and YouTube stars are more popular among American teens than mainstream celebrities. Multi-channel networks (MCNs) like Maker Studios aggregate thousands of YouTube channels to syndicate and monetize their content. At the time of the acquisition, Maker Studios was one of the largest MCNs with 5.5 billion video views per month. Maker was home to many well-known YouTube creators including PewDiePie – the most subscribed channel on YouTube. Individual YouTube creators like PewDiePie build up their subscriber base by regularly posting compelling content to their YouTube channels and interacting with their fans to create a more personal and authentic experience for viewers. Many YouTube personalities choose to sign with an MCN to scale their brands, receiving production support, funding, cross-promotion, digital rights management, increased advertising revenues, brand sponsorships, and cross-platform audience development, in exchange for a percentage of advertising and sponsorship revenue from the creator’s channel. Advertisers that work with MCNs pay for traditional video overlay ads as well as in-show brand sponsorships and product endorsements. For advertisers, working with MCNs means that they can reach a large volume of young, “engaged eyeballs” and benefit from the association with these popular online celebrities.

YouTube is a big business. The top 100 YouTube channels receive over ten billion views per month, and YouTube stars are more popular among American teens than mainstream celebrities. Multi-channel networks (MCNs) like Maker Studios aggregate thousands of YouTube channels to syndicate and monetize their content. At the time of the acquisition, Maker Studios was one of the largest MCNs with 5.5 billion video views per month. Maker was home to many well-known YouTube creators including PewDiePie – the most subscribed channel on YouTube. Individual YouTube creators like PewDiePie build up their subscriber base by regularly posting compelling content to their YouTube channels and interacting with their fans to create a more personal and authentic experience for viewers. Many YouTube personalities choose to sign with an MCN to scale their brands, receiving production support, funding, cross-promotion, digital rights management, increased advertising revenues, brand sponsorships, and cross-platform audience development, in exchange for a percentage of advertising and sponsorship revenue from the creator’s channel. Advertisers that work with MCNs pay for traditional video overlay ads as well as in-show brand sponsorships and product endorsements. For advertisers, working with MCNs means that they can reach a large volume of young, “engaged eyeballs” and benefit from the association with these popular online celebrities.

One of Disney’s main goals in acquiring Maker Studios was to use YouTube stars in the Maker network to promote its films, TV shows, and theme parks. In particular, Disney hoped to push properties like Marvel, Pixar and Lucasfilm that appealed to Maker’s younger audience. Furthermore, Disney aimed to distribute its own content through Maker’s platform. However, the integration of Maker and Disney did not go exactly as planned, with constant conflict between the executives of the new and old media players. Maker executives complained of the slow integration process and that they didn’t receive access to Disney’s brand and intellectual property. A year after the acquisition, Maker was rumored to have received less than half of the potential $450M bonus, and Maker CEO Ynon Kreiz left the company.

Disney has taken a giant step towards securing a digital future through the acquisition of Maker Studios. However, MCNs are still by and large unprofitable. About 45% of MCN revenues come from YouTube, and an additional 35-40% of revenues are paid out to the content creators. As such, Maker’s number one goal should be to diversify distribution off of YouTube to new distribution platforms like Netflix, Sling TV, Xbox, and Verizon’s Go90, since many of these platforms are willing to pay licensing fees for quality content and/or offer better advertising splits than YouTube. One approach to migrate YouTube subscribers to these new platforms would be to release new content on these platforms first before releasing it on YouTube. Maker has both the production expertise and enormous amounts of data about the content preferences of its audience, so Maker should leverage Disney’s resources to create new cost-effective original programming that stays true to Maker’s roots, like the original comedy sketches and gaming entertainment shows that made Maker popular. Since Maker’s creator network is its greatest asset, Maker should try to engage these creators in coming up with new series ideas that leverage Disney’s assets. Another approach is for Maker to expand to emerging markets, and they can do this by signing local content creators to the network and expanding content offerings to suit these target markets.

Word Count: 797

Sources

Weiss, Geoff. “Why Disney’s $500M Acquisition of Maker Studios is Proving Less Than Picture Perfect.” Entrepreneur. August 17, 2015. https://www.entrepreneur.com/article/249659

Grover, Ronald. “Disney to Buy Network Maker Studios for $500 million.” Reuters. March 24, 2014. http://www.reuters.com/article/us-disney-maker-idUSBREA2N1PV20140324

Kafka, Peter. “Disney and Maker Studios’ Big Deal May Be Smaller Than They Thought.” Recode. August 14, 2015. http://www.recode.net/2015/8/14/11615570/disney-and-maker-studios-big-deal-may-be-smaller-than-they-thought

Hamedy, Saba. “Maker Studios president: Disney ‘has really embraced Maker.’” Los Angeles Times. February 11, 2015. http://www.latimes.com/entertainment/envelope/cotown/la-et-ct-maker-president-digital-entertainment-world-expo-20150210-story.html

Bennin, Kristina, Blum, Sebastian, and Vollmer, Christopher A.H. “How Media Companies Can Make Multichannel Networks Profitable.” Forbes. December 19, 2014. http://www.forbes.com/sites/strategyand/2014/12/19/how-media-companies-can-make-multichannel-networks-profitable/#26d5876e6876

Jarvey, Natalie. “Deal of the Year: $1B Acquisition of Maker Studios.” The Hollywood Reporter. December 17, 2014. http://www.hollywoodreporter.com/news/deal-year-disneys-1b-acquisition-758424

BCG Perspectives. March 21, 2016. https://www.bcgperspectives.com/content/articles/media-entertainment-digital-revolution-disrupting-tv-industry/#chapter1

Ault, Suzanne. “YouTube Stars More Popular Than Mainstream Celebs Among U.S. Teens.” Variety. August 5, 2014. http://variety.com/2014/digital/news/survey-youtube-stars-more-popular-than-mainstream-celebs-among-u-s-teens-1201275245/

Jodie this was a fascinating post. I have to admit, I felt really outdated because I didn’t even know who PewDiePie was. I had to look him up and went down the rabbit hole of YouTube videos…

I find it fascinating that the Maker and Disney merger did not go as well as they intended. Especially after seeing Disney and Pixar’s merger and successful integration, I had thought maybe Disney would be able to integrate with a company whose culture and process are so different theirs. I wonder if it has something to do with MCNs not having found a way to be profitable yet. I think MCN is a tough position to be in because they don’t develop their original content, and since I feel like the YouTube celebrities can leave them anytime. It’d be very interesting to see if they can enter newer distribution channel like Netflix or Xbox.

Great article, Jodie! It seems to me that one of the challenges MCNs in general may be facing is the difficulty of migrating users from free to paid. Up to this point, users have been able to watch all their favorite content creators on YouTube for free. However, as you pointed out, YouTube is not a very lucrative channel for the MCNs, as YouTube only pays out only 55% of the advertising revenues to the MCN, and most of that value gets passed on to the content creators. Migrating users to other platforms that pay more is a great idea; however these platforms are able to pay more because users are in turn paying more for the service. Until users’ willingness to pay increases, it might be hard for MCNs to make more money than they do now.

One service that tried to get users to pay for YouTube-style short-form content was Vessel, which got acquired by Verizon in October after 18 months of operation (per TechCrunch: https://techcrunch.com/2016/10/26/verizon-acquires-vessel/). Vessel experimented with “windowing” – i.e., allowing users to watch content before it was available elsewhere, for a fee of $2.99 per month. Verizon acquired the company for the technology and product, but unfortunately, since they shut the service down we don’t know whether they would have been successful at getting users to pay more for short-form content in the long-run. However, my read of the situation is that given Vessel was sold after only 18 months, either Verizon made them an offer they couldn’t refuse, or the company was struggling to find product-market fit.

Awesome post Jodie. You nailed it right on the head – new platforms for distribution have not found a meaningful way to capture revenue from their subscribers and web traffic. Even snapchat, vine…these are distribution networks with their top most active users attracting hundreds of millions of views and not enough dollar bills. Advertising space can’t eventually be the only way these companies make money. They are out-competing other platforms by remaining largely free – but I think the idea you mentioned of licensing fees and royalties from other distributors is phenomenal. Treat youtube MCN’s more like an agent or talent management team – and broker deals to studios. The problem is the studios are then incentivized to find their own talented youtube web-stars (of which there are many including of course PewDiePie but my favorite is an animator named Zach King). I think the next few years will be a really interesting time for content makers.

Jodie, great post. Interesting view on how an industry mainstay has used acquisition to respond to digital pressures and perceived opportunities.

I thought there was an interesting connection between two statements you made: “One of Disney’s main goals in acquiring Maker Studios was to use YouTube stars in the Maker network to promote its films, TV shows, and theme parks.” and “However, MCNs are still by and large unprofitable.” To me, it feels like a Disney acquisition makes sense here, as the MCN doesn’t have to be independently profitable (although that would certainly be a plus and an admirable goal), but that it can boost the profitability of the rest of the business and thereby justify ongoing losses. The challenge here would be how to attribute uplift in performance back to Maker Studios. I wonder if this is something Disney is working through now, as they consider the value of Maker Studios going forward.

Jodie, this was a fascinating read. As someone who is blissfully unaware of the current media landscape, I learned a ton through your post.

I agree that Maker’s top priority is shifting its consumer base off of YouTube and onto other media, like Netflix. As you mentioned, this is not for the faint of heart, and it seems consumers have not paid up for early access to media, as AG pointed out in the Verizon-Vessel example. An alternative approach would be for Maker to sign on a budding content creator or release the first few episodes of a particular series or saga, and then move the content creator/series off of YouTube and on to the Netflix/Sling TV/Xbox etc. I believe HBO took a similar approach with Game of Thrones & HBO Go. (http://www.slate.com/articles/arts/culturebox/2012/03/game_of_thrones_how_hbo_and_showtime_make_money_despite_low_ratings_.html)

I want to echo NT’s idea of treating MCN’s as agents – I think a hub-and-spoke model may work here. At the very least, it’s worth a shot!

Hi Jodie — Thanks for sharing! I think Disney along with the rest of “traditional media” are in a for a rough ride as they try to figure out how to build a sustainable model in the new direct-to-consumer world of online media. Disney is clearly trying to embrace this new world – however changing an organizational culture, particularly a creative one to dive head first into an undefined future is really difficult. As you pointed out the Maker deal is turning out to be a disaster – MCNs are turning out not to be the new beacon we all thought. That said, I applaud Disney for continuing to take big bets. The latest is a $400M investment in Vice Media and launch of the Viceland cable channel in lieu of History Channel 2. Candidly, I am not sure the Vice deal will pan out either, but one thing is for sure: the only thing we know will fail is if they do nothing!

Thanks for your post Jodie, it was really interesting! One additional concern that I had regarding Disney’s purchase of Maker Studios is also the move into a space where they are not owning creating of content – they are managing a platform that relies on content created by other Youtube celebrities with large followings. While this could be a good thing from a cost perspective, as they do not have to pay for the expensive creation process of new content, it also means that they give up a certain level of control over that content. I would think that lack of control of content could be an issue for a company such as Disney, which bills itself as primarily for kids and families and as a wholesome business. What would happen if one of the Youtube videos posted on this channel was offensive or controversial? How much blowback would there be onto Disney in the case this happens and does Disney have controls in place to try to protect against this possibility?

Hi Jodie – thanks for the great post! I too have been following the MCN space for a while, and though fascinating there is one looming problem for all of them: it isn’t profitable. Not even close. YouTube is by far and wide the biggest distribution platform, and the numbers just don’t work out.

If you’re bored, here’s how the dismal math works for YouTube:

– Revenue split: YT takes a 45% cut of the revenues. Of the remaining 55%, the split is 70% to the talent, and 30% to the MCN, which leaves the MCN with 16.5% of the overall revenues.

– CPMs: For professional TV content, advertisers are willing to pay $20-30 per thousand views (CPM) of a 30-second video ad. For the majority of MCN content that CPM is much lower – in the $10 range or less since the content is viewed as subpar quality (which it is).

– Ad impressions: Further, not every viewer is served an ad on YouTube. The rough guess is about 1 in 3 views are served an ad, and of those, if given the choice to skip, less than half watch the ad. Also, a lot of millennials use ad blockers – about half is the industry estimate. So really only 1 in every ~12 views are actually served an ad. These are the views you can charge for.

Putting all this together, let’s say a video gets a million views. Of the million views for the video, only 83.3k result in “ad impressions”, which converted at $10 CPM gives $833. MCN’s cut is 16.5%, which is $137. That’s a measly 1.37 cents per view, all-in, after everybody is paid. Only the very very top performers like PewDiePie, or viral videos like Gangnam Style are able to make a decent profit.

The 45% cut, and the low quantity of ads served makes it virtually impossible for MCNs to stay alive, so really the only way for MCNs to make money is to find a different distribution platform other than YouTube. You might notice this is now basically the same business model as a talent agency: find talent, find a distribution platform, take a small cut of their revenues.

Once everybody understands that MCNs are basically talent agencies for 14 year old kids who desperately yell anything into a camera for attention, I wonder if the hype will live on.

Bad Hombre really went in on the math for cents per view — very impressive. My overarching concern for this acquisition is that the strategy seems to hinge on the hope that these YouTube power producers (like PewDiePie) will be able to continue their current level of engagement with their dedicated fans while also promoting Disney products.

As an avid YouTube viewer, I’ve seen the quick decline that YouTube stars go on once they start to monetize their efforts. I don’t know why fans are so sensitive to the issue of “selling out,” but I think it’s very real.

I’d be curious to see how subscriber count declines once the promoted materials come out. It would make sense that Disney tested the fan sensitivity to “promotion” videos, but I would be surprised if that decline in subscribers wasn’t a large one.

Very interesting Jodie!! I am a huge huge fan of Disney -not just because of my son- and I think that it is great that they are trying to find new ways to engage younger audiences. I was not very familiar with MNC so it was been very interesting and helpful and also after reading some of the comments and Bad Hombre sharing the figures of the business, I am really concerned if Disney went on the right direction with this acquisition, setting aside the fact that the merger did not go as planned. My real concern here is, given the business model that disney has and their creative development thus far, how exactly is this going to translate and they move into these new platform and will this really be a sustainable bet for the future if they want to preserve the Disney magic?