Put Your Money Where Your Mouth Is. Align’s Approach to Additive Manufacturing

Align Technology, the makers of Invisalign, boasts the largest customized 3D printing operation in the world. But the revolution in additive manufacturing is nothing for them to smile about.

Align Technology was born from a desire to improve the painful, uncomfortable and seemingly endless symbol of adolescent orthodontia- braces. From a consumer perspective, the advantages of Invisalign, Align Technology’s hallmark product, over traditional braces are manifold; they are removable, virtually invisible, easy-to-clean, residue free, lead to shorter treament times [1], and are remarkably pain-free! However, since its inception in 1997, the technological underpinnings of Align Technology have been its innovative use of digital scanning and stereolithography, a form of 3D printing using light-activated chemical reactions [2].

Orthodontia Revolution

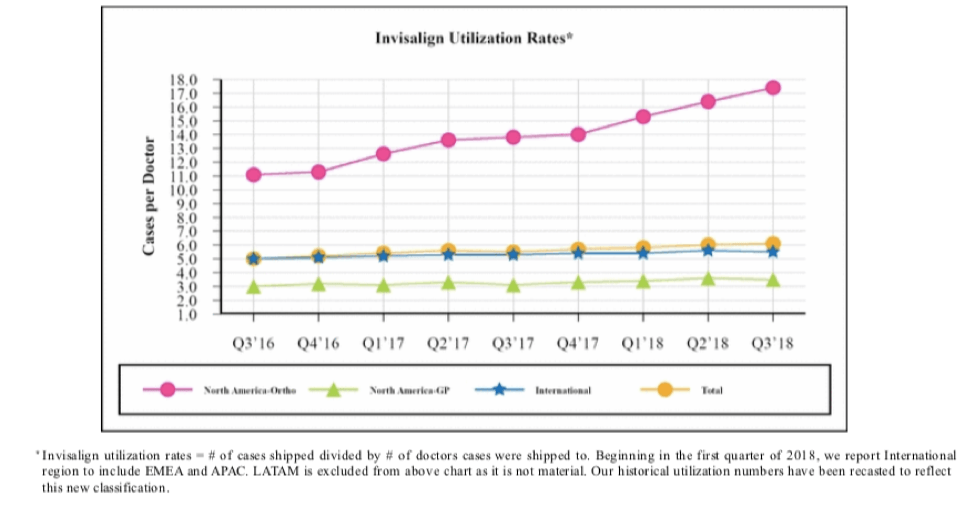

To grasp the essential role of additive manufacturing in Align’s business model, it is instructive to review the Invisalign process. First, a patient requiring orthodontic treatment has their teeth digitally scanned. The dentist uses specialized software to plot intermediate stages in teeth movement, sending the finalized images to Invisalign for processing. Sets of “aligners” are then fabricated, shipped to the dentist and administered at regular appointments (Ex.1).

Exhibit 1: Process Flow Diagram

Source: Align Technology 2018. Investor Day – 2018 Operational Prowess. http://investor.aligntech.com/investor-relations

It is crucial to understand that Align doesn’t simply benefit from additive manufacturing, its premier product, Invisalign, would not be possible without it. This is because in traditional orthodontia, the dental equipment is identical for each patient (brackets, bands, wires and ligatures), while the dental labor is customized. Thus, it would be impossible to create removable braces, as the hardware doesn’t “contain” the treatment specifications of the patient, and the patient lacks the expertise to reapply them. Furthermore, it would be prohibitively costly to produce customized aligners via conventional manufacturing as teeth size and positioning are unique; machines would require complete retooling for each patient [4][5].

As highlighted above, by customizing the equipment for each patient, labor time and complexity are drastically reduced. In fact, whereas braces were predominantly the province of orthodontists, the relative simplicity of Invisalign allows general dentists to offer the service as well [6]. These benefits make Align uniquely suited to additive manufacturing. However, it is worth enumerating the more generalized advantages Align receives from its use of 3D printing.

Additive manufacturing grants Align complete flexibility in geometrical design [7], allows them to maintain lean inventories [8] and grants the freedom to create new products without the need for scale [9]. The photopolymerization process involves zero waste. Rent, floor space and labor is reduced as many disparate parts have been consolidated into a single piece of equipment manufactured by a single machine [10] Finally, shipping costs and lead times are reduced as 3D printing equipment can be located in facilities close to the end consumer without loss of efficiency or scale [11].

3D Becomes Mainstream

In order to keep its technological edge, Align Technology continues to invest heavily in R&D [12], fiercely protects its 420 patents, and partners with 3D systems, the “inventors” of modern 3D printing, to operate its 3 state-of-the-art facilities that produce 320,000 aligners daily [13]. While Align relies on its expertise in additive manufacturing as a competitive advantage, the proliferation of cheap, precise and accessible 3D printing technology actually poses a significant threat. Larger competitors, such as Danaher Corporation and 3M, are devising similar offerings and leveraging their existing relationships and financial capabilities to challenge Align’s dominance in the clear aligner market [14]. The barriers to entry are, in fact, so low that Align views competition from startups offering clear aligners direct-to-consumer as equally threatening [15]. There are a number of services offering DIY aligners for a few hundred dollars and, in some instances, individuals who print their own [16]. Align has taken a number of measures to combat these risks. In 2011, Align purchased Cadent [17], the leading 3D dental scanner used for aligners as well as a number of unrelated procedures. This diversifies their revenues, creates synergies between their scanning and Invisalign services and, potentially, allows them to offer dentists bundled packages. Invisalign has also been actively engaged in a number of clinical trials meant to bolster their status as the incumbent medical technology in the aligner space- the safest, most effective and most familiar option [18]. Lastly, Align is expanding its number of manufacturing facilities, bringing production closer to consumers and further reducing lead times [19].

Beating Out the Competition

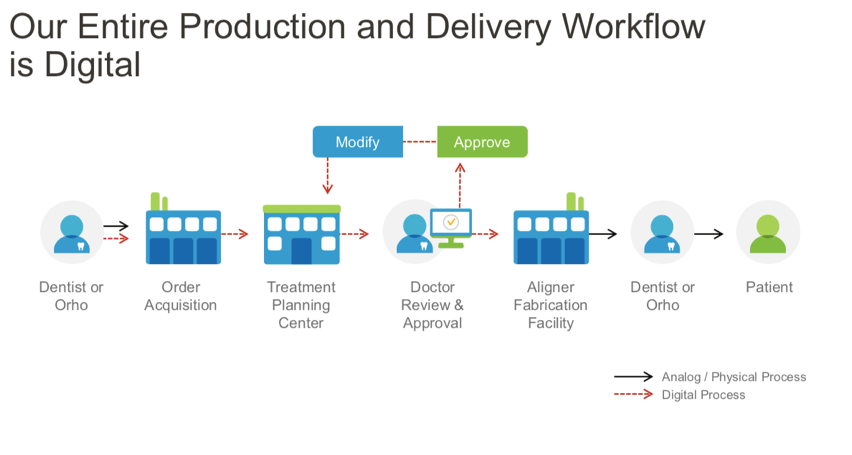

With a gross profit margin of 76% [20], I believe that Align should consider lowering its prices to compete with new entrants in the aligner market. Align can afford this measure by reducing its extremely high spending on sales and advertising [21], measures that are no longer necessary as Invisalign has achieved a critical mass of users and penetrated mainstream awareness [Ex.2]. Align should leverage its history to emphasize its track record in safety, efficacy and its status as the only aligner brand to receive FDA approval.

Looking Ahead

No longer untouchable, Align must find its place in a world where 3D printing is cheap and widely available. Moving forward, which is Align’s greatest competition- traditional braces, large medical device companies or start-ups selling direct-to-consumer? Should Align consider changing its business model in response?

(800 Words)

Exhibit 2: Invisalign Utilization Rates

Source: Align Technology. Form 10-Q 2018. (3Q2018): 30.

Source: Align Technology. Form 10-Q 2018. (3Q2018): 30.

(800 Words)

Sources:

[1] Garret Djeu, Clarence Shelton, Anthony Maganzini. Outcome assessment of Invisalign and traditional orthodontic treatment compared with the American Board of Orthodontics objective grading system. American Journal of Orthodontics and Dentofacial Orthopedics, Volume 128, Issue 3, (2005): 295.

[2] Benson H. Wong. Invisalign A to Z. American Journal of Orthodontics and Dentofacial Orthopedics, Volume 121, Issue 5, (2002) 540.

[3] Press release: 3D systems’ SLA 3D printers enable align technology’s unprecedented use of 3D printing in manufacturing. (2018, Sep 11). Dow Jones Institutional News.

[4] Campbell, Williams, Ivanova. Could 3D Printing Change the World? Atlantic Council, Policy File. (2011).

[5] Invisalign often requires 10-12 sets of aligners for each patient. Wong. “Invisalign A to Z”. 540.

[6] Align Technology, Inc. at Credit Suisse Healthcare Conference – Preliminary. (2013). Fair Disclosure Wire, Fair Disclosure Wire, Nov 12, 2013.

[7] Campbell, Williams, Ivanova. Could 3D Printing Change the World? Atlantic Council, Policy File. (2011).

[8] 10% of their 2017 gross sales. Align Technology. Form 10K 2017. Consolidated Financials and Supplementary Data. Retrieved from http://investor.aligntech.com/financial-information/sec-filings

[9] A. Brown. Chain reaction: Why additive manufacturing is about to transform the supply chain. Mechanical Engineering 140, no. 10 (October 2018): 33.

[10] Ibid.

[11] Campbell, Williams, Ivanova. Could 3D Printing Change the World? Atlantic Council, Policy File. (2011).

[12] 7% of gross sales. Align Technology. Form 10K 2017.

[13] Press release: 3D systems.

[14] Align Technology at Robert W Baird.

[15] Align Technology. Form 10K 2017. Risk Factors.

[16] https://money.cnn.com/2016/03/16/technology/homemade-invisalign/index.html

[17] Deals roundup: Align to ‘streamline’ procedure with $190M Cadent purchase. (2011). Medical Device Daily, p. Medical Device Daily, March 31, 2011.

[18] Align Technology Inc Corporate Analyst Meeting – Final. (2016). Fair Disclosure Wire, Fair Disclosure Wire, Jun 2, 2016.

[19] Align Technology at Robert W Baird.

[20] Align Technology. Form 10K 2017. Consolidated Financials and Supplementary Data.

[21] Align Technology spends ~$244M on advertising and selling based on Align Technology. Form 10K 2017. Consolidated Financials and Supplementary Data.

Gabe-cool topic! As someone who had to deal with traditional braces, I’m only jealous these didn’t come along sooner. Were these retainers always 3D printed, or was that a more recent innovation? It’s crazy to me that Align can hold 420 patents and still face such extreme cannibalization. This company is going to need to think about the role of the orthodontist/dentist very carefully as an essential ingredient in their value proposition. I know I wouldn’t trust myself to go through a teeth-straightening routine without supervision. I think you’re right that they have a lot of wiggle room on price, so they should get less greedy in order not to be left behind.

Wow, I can’t believe this has been used since 1997! This is an application where 3D printing makes perfect sense (or, as you say, is the only way it’s even feasible). The ability to heavily customize is really crucial here. I’m surprised about how low the barriers to entry are now; basically then Invisalign only became famous and successful because they were able to take advantage of a still-unknown technology? And essentially their relative competitive advantage can easily be eroded? Yikes…

I definitely agree then that lowering prices could be crucial. If anyone comes in and undercuts them, this seems very high risk. I would disagree though that they should reduce reliance on advertising (think about Casper which took a not-the-most innovative product but made it seem hip and changed delivery/channels alongside cheap prices). Especially if they move into a D2C model, refreshing the advertising to consumers might actually be crucial. I would think though that having strong relationships with orthodontists would be most effective to potentially keep out other competitors. I can’t imagine not going to one at some point to get these made… Does Invisalign employ any of their own? Wonder if they have considered a telemedicine model where you can connect over the internet and somehow get everything made. Really interesting!

Gabe, thanks for your work putting this together. Super interesting!

I agree that Align technologies is facing some significant challenges going forward. As you pointed out, the extremely low barriers to entry in this market spell trouble for a company that has existed as the only major player in the market thus far. To your question, I see aligns main competition as the major manufactures, as they will be able to produce at the lowest cost at the end of the day due to their scale.

I don’t think the start-ups will be a major competitor because while they can initially compete on price, the competition will respond and eventually price will be driven down to marginal cost. In my view, the best way to combat this is marketing and relying on the history of the brand. Viagra, for example, was able to hold on to their market share after their patent expired due to marketing. Align would need to do something similar to survive.

Thanks, again, for sharing!

This is interesting. What are the patents for if not to protect Align’s rights to the technology? 3D printing technology may be more and more ubiquitous, but I would’ve assumed that the true value of the technology is (1) the dental scanning technology and (2) the technology that shapes the teeth into the desired outcome one brace at a time. This is less to do with its hardware but its software. Nevertheless, it’s interesting to see what Align is doing to maintain its competitive edge. The fact that startups and even adventurous individuals are considered viable competition makes me wonder if this space is adequately regulated. After all, inappropriate dentures are a surefire way to cause lasting damage to one’s teeth.

This is a fascinating use of additive manufacturing! I would be interested to know more about what is covered in Align’s 420 patents and what Align will be losing in terms of competitive advantage when they expire. What sort of things are they doing to iterate on their current product (and patent those iterations) so that competitors can’t directly copy them?

I would be wary of getting into a price war. As you mentioned, some people are already 3D printing their own aligners, so it stands to reason that a price war could go all the way to $0 (e.g. open source software that allows users to upload a photo of their teeth and outputs a file that can be 3D printed using any 3D printing service). I would suggest leaning into Align’s partnership with the dental community and focus promotion on the “officialness” of this product over competitors’ products. I would intuitively guess that dentists’ approval of the product would represent value in a consumer’s mind.