Power of Digital Payments and Mobile Platform

Off Grid Electric is utilizing pay-as-you-go energy model to reshape the economic landscape of one of the most underserved populations in the world.

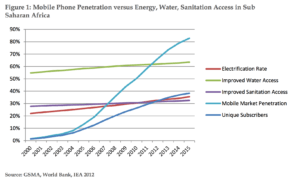

In today’s world, developing countries account for three out of every four new mobile phone connections [1]. In particular, sub-Saharan Africa (SSA) is the fastest-growing mobile market, with an average annual growth rate of 44% since 2000 [2], reaching 64% mobile market penetration in 2012 [3]. Ironically, this monumental shift has created a unique population of millions of people who have mobile phones but don’t have access to basic necessities like energy or water.

Energy poverty is a development challenge that traditional, centralized approaches have often failed to provide fast, reliable solutions [4]. Globally, there are 1.1 billion people without access to electricity, including 589 million in SSA [5]. There is a wide use of dangerous and inefficient alternatives, such as kerosene lamps, diesel generators, and dry-cell batteries, in order to light their homes and operate appliances. Trying to solve this problem by building centralized electric grid system will be prohibitively expensive: up to $2,300 per rural household in SSA [6].

There has been an emergence of companies that are taking advantage of wide mobile adoption to alleviate energy poverty by electrifying the most rural regions of Africa. Off Grid Electric, a micro-solar leasing platform targeted toward residents of Africa, has pioneered a business model that allows consumers with no formal credit to use their existing spending on kerosene to finance solar. Through a mobile-payment platform, they allow customers to purchase energy in small amounts and they choose the service level that best suits their household’s needs. For example, the basic service costs about $6 to set up and about $6 per month, less than what most people pay for kerosene. It comes with solar panel, LED lights, a radio, and a USB charger. Unlike kerosene, which emits harmful particles and offers poor light, the electricity from solar provides better lighting when coupled with LEDs [7]. The company is installing their system in homes of over 50,000 people per month and is on track to light a million homes in Africa over the next few years.

More importantly, this pay-as-you-go (PAYG) energy model provides an opportunity for customers to sign up for their first formal financial service and gives them a tangible reason for regular use. Previously, there was no value or relevance of mobile money to their lives but companies like Off Grid Electric whose business models necessitate digital transactions has completely broken the pattern of this inactivity. As a result, PAYG solar companies are now among the largest bill-pay recipients on mobile money platforms in Kenya, Uganda, and Ghana [8].

Once the firm has established the ongoing financing relationships with its customers, many opportunities lie ahead. There is effectively no limit on the products and services that can be offered through the distribution channel, with existing customers being less costly to serve, and therefore more profitable [9]. Off Grid Electric has already expanded its offerings to provide financing for appliances like radios and TVs. Furthermore, payment history collected through their software can help generate a credit profile for customers, which can help unlock access to other financial services as well. In SSA, only 34% of the population have a financial account.

However, Off Grid Electric faces many obstacles to continue to pursue growth at its current rate. The greatest challenge is raising working capital needed to finance their operation. Despite innovation in business and financial models, investors are not yet comfortable with the inherent risk of this asset class. Outside of Kenya, commercial-grade debt has been reluctant to enter the nascent sector, and the cost of local capital is often prohibitively expensive [10]. To solve this problem, Off Grid Electric must have a systematic methodology to identify viable customers, maintain market share, and to demonstrate its ability to accurately assess the risks.

Off Grid Electric has leveraged multiple innovations to reach their customers. I hope to see continuous innovation to overcome the obstacles and to service the needs of one of the most underserved populations in the world (Word Count: 660).

[1] Wireless Intelligence 2012.

[2] Deloitte/GSMA, Sub-Saharan Africa Mobile Observatory Report, 2012.

[3] Wireless Intelligence 2012.

[4] Daniel Waldron, Xavier Faz, Digitally Financed Energy: How Off-Grid Solar Providers Leverage Digital Payments and Drive Financial Inclusion, March 2016, CGAP.

[5] SE4ALL (Sustainable Energy for All), Progress Toward Sustainable Energy 2015: Global Tracking Framework Report, 2015.

[6] McKinsey, Brighter Africa: The Growth Potential of the Sub-Saharan Electricity Sector, 2015.

[7] Eric Wesoff, Off Grid Electric Raises $45M in Debt for African Micro-Solar Leasing Platform, December 2015, Greentech Media.

[8] Mark Okuttah, Solar Lamp Top-Ups on M-Pesa Pay Bill Jump to 10,000 Per Day, September 2014, Business Daily.

[9] Daniel Waldron, Xavier Faz, Digitally Financed Energy, March 2016, CGAP.

[10] GSMA, State of the Industry Report: Mobile Financial Services for the Unbanked, 2016.

This is a very interesting look at a difficult global problem. Building out a traditional electricity grid at $2,300 per household is a surprisingly high number and even then, I wonder if that figure includes electricity generation or only the distribution network itself. This issue is somewhat of a “check & egg” problem. Communities living in “energy poverty” would likely be able to increase their incomes if they had access to reliable electricity, but instead, they are stuck in a cycle where they cannot earn enough to build out their own electricity network (or have the government help them do it).

Off Grid Electric’s business model here is very impressive. To a degree, the Company knows that these households have been spending some amount of money on kerosene purely to survive. This in a sense acts like a proxy credit profile. By offering the same, if not more benefits to household’s, Off Grid Electric creates a win-win situation for communities by lowering their electricity costs and providing a clean source of energy. By using mobile payments, the company minimizes processing costs, helps to create a credit profile for households, and allows consumers to hopefully have a more reliable source of energy that will allow them to earn more money. With these benefits, hopefully communities that are able to take advantage of this program can begin to raise themselves out of the energy-poverty cycle. One question I have is whether or not the micro-solar unit has storage capacity that would allow households to have lighting after the sun goes down.

When it comes to utilizing technology like solar power in developing countries, maintenance and repair services can become a major challenge which limits perpetual use over time. In the article’s discussion of the business model for off grid energy it would have been helpful to understand how the company is considering this and what steps they are taking to ensure that the business is sustainable. Also, given the equipment necessary for utilizing the solar, how will the company source and supply these parts to such remote villages. If the user stops paying will it deploy agents to collect the equipment that is in the customer’s house? Working at such a micro level could create challenges to achieving the scale of over a million users the blog sites and lead to higher losses than anticipated.