PetroChina: Can Deep Pockets Reach Deep Shale?

China is restructuring its energy mix due to increasingly bad air quality. Will PetroChina be able to deliver?

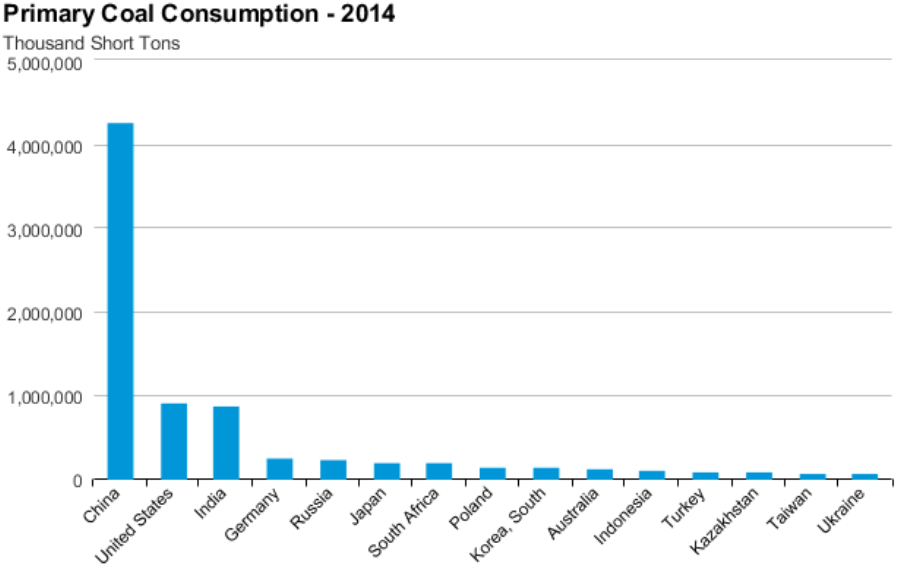

China has fueled its country’s growth with coal to become the world’s second-largest economy and largest energy consumer1. While coal has improved living standards for China’s citizens, declining air quality has resulted in significant health and environmental concerns. The 2010 Global Burden of Disease study estimated that poor air quality led to 1.2MM premature deaths and $230B (3.5% of GDP) of environmental degradation in China2. In 2015, 63% of all days were classified as unhealthy or worse levels for particulate pollutants3. Due to increasing pressures from its citizens and world agencies, China has vowed to improve its air quality and signed the Paris Agreement.

The Agreement, negotiated by 195 countries in 2015, is an action plan to keep global warming below 2°C above pre-industrial levels4. In its 13th Five-Year Plan, China stated it will begin to replace coal in non-power sectors with natural gas and electricity. The plan calls for natural gas to make up 10% of total energy use by 2020, up from 6% today (and hopes to reduce coal from 62% to 50% by 2030)5. The rationale for the switch is that natural gas produces approximately half as much carbon dioxide per unit of energy as does coal6. This plan requires massive changes to China’s domestic energy infrastructure. However, China has shown over the past few years that it has an inability to meet its domestic natural gas demand.

Who will provide this natural gas? PetroChina (NYS: PTR) is the likely candidate, despite its current lack of expertise in shale gas drilling. The company’s reserves have historically been heavily weighted to giant, mature, conventional oil reserves in domestic and international locations. Despite the obvious opportunity before PetroChina, whose parent is national oil company CNPC, the company must make significant organizational and structural changes to adapt to drilling unconventional shale gas.

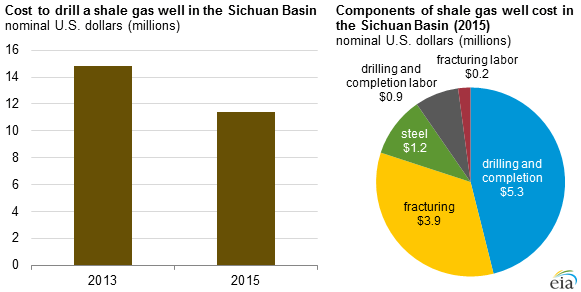

China has the largest shale gas potential in the world (1,115 Tcf), or 1.7x larger than United States’, but has only developed a fraction of the reserves7. PetroChina has taken steps to position itself as the premier domestic producer by investing in joint ventures in the United States to learn drilling technology applications from American companies. In 2011 it partnered with Shell, who promised to invest $1B in China’s shale plays annually8. The primary shale basin in Sichuan is remote, densely populated with tightly packed farms, and has poor infrastructure. The gas is trapped in deep, complex geographical formations and is difficult to extract. Additionally, bureaucratic delays resulted in a one year delay in contract approval. These factors resulted in elevated costs of ~$14.5MM per well in 2013 and $10.5MM per well in 20159. While costs declined over that time frame, they were still substantially higher than the ~$4MM per well cost of drilling in the United States. Accordingly, Shell rescinded its investment and left China due to the myriad of political and logistical problems outlined above.

Beyond the costs, China’s workers are generally inexperienced in shale drilling and contractors have not been trained in modern safety standards. The drilling process is water intensive, requiring rig sites to share water sources with local farmers. Temporary PVC pipes transporting fresh and chemical-filled waste water have ruptured causing spills that have leaked into farmland and local rivers10. With the shale gas located in China’s breadbasket, spills could endanger the country’s food source.

An additional future threat is global warming itself. The region’s droughts and storms will likely become much more severe due to climate change. PetroChina’s history is checkered with spills and environmental standard violations11. It is imperative that the company address these concerns to be a part of China’s climate solution, rather than exacerbating the problem.

Steps for the Future

In order to reduce costs and limit future environmental problems, PetroChina should execute the following initiatives:

- Establish permanent infrastructure, including roads, power sources, and pipelines to carry hydrocarbons to market.

- Develop fully enclosed containment systems for wastewater and hydrocarbons that can withstand earthquakes, utility outages, and untreated flood runoff.

- Train workers in modern environmental and safety standards for emergency situations.

- Redefine floodplains to account for sediment erosion and storms.

- Secure deep table water sources away from farmland and implement waste water disposal and recycling best practices.

- Explore shale plays outside of China’s breadbasket. With climate change negatively impacting farmland and food supplies, PetroChina must preemptively minimize the possibility of an environmental disaster impacting food distribution channels.

It is imperative that China uses its shale gas as a bridge fuel to reduce carbon emissions until renewable resources are readily available. PetroChina is best positioned to supply the country with natural gas, but must improve its processes to reduce costs and mitigate potential environmental disasters.

(774 words.)

Sources:

- Hirst, T. (2015, July 30). A brief history of China’s economic growth. Retrieved November 3, 2016, from World Economic Forum, http://1.https://www.weforum.org/agenda/2015/07/brief-history-of-china-economic-growth/

- Wong, E. (2013, April 01). Air Pollution Linked to 1.2 Million Deaths in China.New York Times. Retrieved November 1, 2016, http://www.nytimes.com/2013/04/02/world/asia/air-pollution-linked-to-1-2-million-deaths-in-china.html

- (2015, December 8). China Pollution: First Ever Red Alert in Effect in Beijing.BBC. Retrieved November 1, 2016, http://www.bbc.com/news/world-asia-china-35026363

- European Commission. (2011, March 16). Paris Agreement. Retrieved November 3, 2016, https://ec.europa.eu/clima/policies/international/negotiations/paris/index_en.htm

- Clemente, J. (2016, April 24). China’s Rising Natural Gas Demand, Pipelines, and LNG.Forbes. Retrieved on October 30, 2016, http://www.forbes.com/sites/judeclemente/2016/04/24/chinas-rising-natural-gas-demand-pipelines-and-lng/#1d685ad96a38

- S. Energy Information Administration. (2016, February 29). How Much Carbon Dioxide is Produced per Kilowatthour When Generating Electricity with fossil fuels? EIA. Retrieved November 3, 2016, http://www.eia.gov/tools/faqs/faq.cfm?id=74&t=11

- Bailey, T. (2016, July 19). China Attempts to Shake its Dependence on Coal by Turning to Shale Gas. World Finance. Retrieved November 2, 2016, http://www.worldfinance.com/markets/china-attempts-to-shake-its-dependence-on-coal-by-turning-to-shale-gas

- Spegele, B., & Scheck, J. (2013, September 5). Energy-hungry China Struggles to Join Shale-Gas Revolution.Wall Street Journal. Retrieved November 1, 2016, http://www.wsj.com/articles/SB10001424127887323980604579030883246871124

- Aloulou, F. (2015, September 30). Shale Gas Development in China Aided by Government Investment and Decreasing Well Cost. Retrieved November 1, 2016, https://www.eia.gov/todayinenergy/detail.php?id=23152

- Lee, J. (2014, September 01). The Great Frack Forward: A Journey to the Heart of China’s Gas Boom. Mother Jones. Retrieved November 4, 2016, http://www.motherjones.com/environment/2014/09/china-us-fracking-shale-gas

- Bloomberg News (2013, August 29). CNPC, Sinopec Refining Projects Suspended on Emissions Tests. Bloomberg News. Retrieved October, 30, 2016, http://www.bloomberg.com/news/articles/2013-08-29/cnpc-sinopec-refining-projects-suspended-after-emissions-tests

Hunter, thanks very much for this informative post. Whether China can meet its own climate targets will go a long way towards determining whether the world can meet the overall goals of the Paris Agreement, so I really appreciated the chance to learn more about one aspect of China’s efforts. It seems to me that the action plan you outline – while sensible – would require substantial upfront investment from the company. Is the company in a position to make this investment, especially when its ability to effectively extract gas is in question? If not, is there a role for the Chinese government to play, especially in training workers, upholding safety standards, and developing environmentally friendly infrastructure? As you may know, the Chinese government is preparing to implement a national cap and trade program in the coming years. Let’s hope some of the revenue generated from that program will help support the environmentally friendly development of natural gas resources as a bridge fuel in China.

Hunter, do you think the Party is committed to these efforts while attempting to maintain the growth of its economy? As growth slows and energy demands increase, I wonder whether natural gas can replace, rather than complement, coal production. I also wonder whether geopolitical issues encourage the Party to invest in natural gas domestically when there are political and economic objectives that can be accomplished by focusing available resources on drilling in disputed waters. China has been plagued with environmental problems for years, and despite the talk, it does not seem like there has been much actual commitment to change. I hope so though! Thanks for your post.

Hunter, many thanks for bringing visibility of the issue. Despite coming from China and Sichuan, I was not aware of the role my hometown would be going to play to supply for the country’s energy in the next couple of years. (shame on me…). But after doing some initial search, here come some of my thoughts. I totally agree with you that Chinese government and state-owned-enterprise are highly motivated to combat environmental issues. Social pressure for not addressing environmental issues have mounted so high that it runs the risk of distablizing the rule of the government. Never before has environmental pollution hit headline so often in China. Considering tight media control in the country, the issue must be also the priority of the government to be allowed discussion. Besides, with Paris agreement in place, the alignment of China’s own agenda to push for environmental improvement and the expectation from international community on it to do so will provide good opportunities and support for China to achieve its targets.

While government’s commitment gives me biggest confidence that the issues will be addressed, I think you bring up good points in PetroChina’s problems in the implementation. As far as I know, the government and the company have run several rounds of auctions to lease lands and find partners to execute the plan, from whom both PetroChina and local governments can learn a lot in terms of technology, safety standard, and acquire skilled labors.

Great post Hunter. Thank you. Indeed, China’s plan is for natural gas to represent 10% of the country’s energy mix by 2020. I think that although shale gas will play a major role in reaching this target, I view LNG imports as the second major source of natural gas. That said, an additional Step for the Future could be for the country to ensure that it has the LNG regasification capacity, either through regasification plants or FSRUs (Floating Storage and Regasification Units), in place. Regasification capacity has been considered by many the bottleneck in China when it comes to LNG. Please see below an article that I think you will find interesting.

http://www.reuters.com/article/us-column-russell-lng-asia-idUSKCN0Q415P20150730

I am very happy to see more major players entering the crude oil markets, especially one that would absolutely not be intimidated by the existent cartels and pseudo-cartels. The events of the past 3 weeks are a case in point that commodities markets are much more volatile than necessary as a result of geopolitical jockeying by players with differing motives. In the past 2 years, we have seen front-month crude oil prices collapse from over $100/barrel down to a low of mid $20s earlier this year. When OPEC announced an agreement to cut production three weeks ago, we finally seemed to break past the resistance point of $51, only to have Russia quash the rally by saying they would not play along (down 20% as of last Friday).

Markets should on net ideally reduce the volatility, and instead the government policies and movements seem designed to manipulate markets instead. I would say the more players the better: more liquidity, more volume, and hopefully more transparency.