Owens Illinois: An Old-School American Manufacturer Adapts to Climate Change

This post explores whether an energy-intensive 20th century glass-bottle manufacturer can be part of the 21st century solution to climate change.

When Americans think about addressing the alarming issue of global warming, they likely conjure images of Google’s driverless cars or General Electric’s wind turbines. In the rare instance that Ohio based glass-container manufacturer Owens Illinois Inc. (“O-I” or “Company”) does enter the conversation, it is in the context of a pejorative label: polluter.

Founded in 1903, O-I is the world’s largest producer of glass containers with $6 billion of annual revenue from 49,000 customers. It employs 27,000 workers in over 80 manufacturing facilities in 23 countries (17 in the US). [1][2] These jobs pay well, typically don’t require a college education and are located in rural parts of the country; they are of the sort that Republican nominee Donald Trump has built a campaign vowing to protect.

Business Risk from Climate-Change Related Regulatory Action

Manufacturing glass is an energy intensive process. Industrial-sized furnaces superheat a mix of sand, limestone, soda ash and recycled glass to 1,565 degrees Celsius. Once the molten glass cools, forming machines mold it into glass containers which are reheated and cooled to strengthen the glass. [3] O-I estimates energy costs constitute between 10% – 25% of total manufacturing process expenses. [4] With 2015 EBITDA margins of 12% and significant financial leverage (4.0x 2015 Adj. EBITDA), increases in the price of energy could materially harm the financial viability of the business. [5]

O-I fuels its operations through a continuous supply of energy in the form of natural gas, fuel oil and electrical power. These energy sources contribute to the creation and release of carbon dioxide (“CO2”), the primary greenhouse associated with global warming. Regulators are increasingly pursuing policies aimed at limiting global CO2 emissions through governmental interventions such as a carbon tax, cap and trade scheme or government-mandated changes to industrial processes. Several regulations already impact O-I: [6]

- European Union Emissions Trading Scheme cap and trade system

- Extension of the Clear Air Act definition of pollutants to include CO2 emissions (EPA now has broad authority to regulate CO2)

- The State of California and Province of Quebec cap and trade system

These measures have not meaningfully increased energy prices; however, the prospect of future, more restrictive regulation seems likely.

Sustainability Efforts at O-I

To its credit, O-I acknowledges climate change as one of the “great challenges of our time” and recognizes the imperative of reducing greenhouse gases. [7] In response, the Company integrated sustainability into its core strategy.

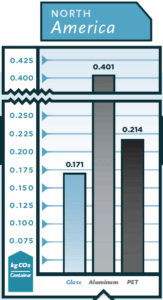

To document the problem, O-I commissioned a 3rd party “cradle to cradle” carbon footprint analysis of the packaging sector (i.e. includes all outputs and inputs for each life cycle stage). While carbon intensive, glass was the most sustainable form of packaging as it (i) has the smallest carbon footprint, (ii) is made of natural, readily available ingredients and (iii) is infinitely recyclable. In North America glass packaging used 0.171 kgCO2 per container—25% and 135% less than similarly-sized PET (plastic) and aluminum packaging, respectively: [7]

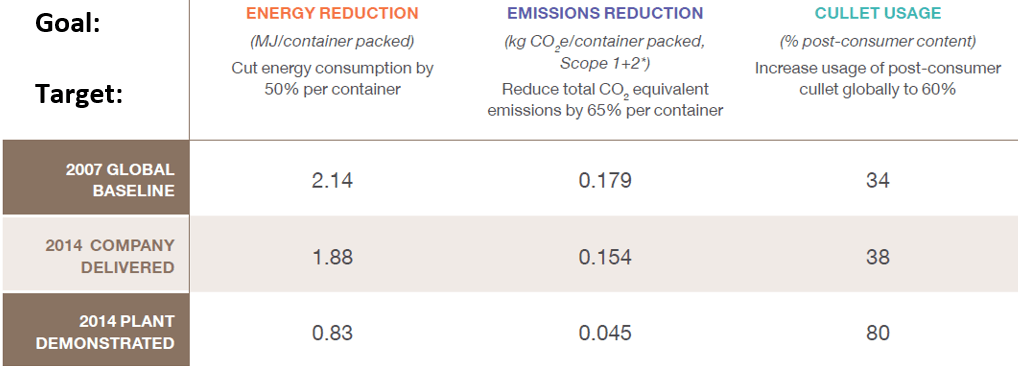

In 2009, O-I set 10-year goals to transition to a more energy efficient and sustainable business model. The goals involved reducing the energy and CO2 emissions per container by 50% and 65%, respectively, and increasing the usage of recycled glass (“cullet”) to 60% globally. Through 2014 the company had improved in all areas though not at a pace sufficient to achieve the aggressive long-term targets; however, several best-in-class plants already demonstrated proof of concept by exceeding the targets. [8]

Ideas for the Future

O-I has demonstrated leadership on sustainability issues and a willingness to invest in long-term solutions to climate change. Despite the risks, it should accelerate this commitment and focus on positioning itself for a future in which government regulations will force companies and consumers to internalize the costs of pollution.

The Company has an opportunity to differentiate its commodity bottle business by being a trusted and innovate provider of best-in-class sustainable products. As customers increasingly demand sustainable products, this positioning could reverse the headwinds the Company faces from consumers substituting glass for cheaper alternatives like aluminum cans and plastics and make glass the container of choice for the 21st century. [9]

Though counterintuitive, O-I should proactively contribute and shape the conversation surrounding the public policy solution to pricing carbon. Given glass is the most sustainable packaging and O-I is the market leader with the resources and scale to develop and deploy new technologies, the Company would likely be competitively advantaged by an across-the-board increase in energy prices that would be in part passed along to consumers. Additionally, if the policy ultimately isn’t thoughtfully constructed and applied globally, glass production which is subject to foreign competition would just shift to lower cost and less sustainable facilities abroad [10]: a terrible outcome for O-I, the US economy and the environment. The risk of not doing anything, as O-I already seems to understand, is just too great.

[Word Count: 800]

References:

- Owens Illinois Inc., “10-K/A Year Ending 12/31/15”, http://investors.oi.com/phoenix.zhtml?c=88324&p=irol-reportsAnnual, accessed November 2016

- Owens Illinois Inc., “Company Facts”, http://www.o-i.com/About-O-I/Company-Facts/, accessed November 2016

- Owens Illinois Inc., “How Glass is Made”, http://www.o-i.com/Why-Glass/How-Glass-Is-Made/, accessed November 2016

- Sustainable Accounting Standards Board, “CONTAINERS & PACKAGING Research Brief”, http://www.sasb.org/wp-content/uploads/sites/4/2015/03/RT0204_CP_Brief1.pdf, accessed November 2016

- Owens Illinois Inc., “O-I Investor Day Presentation”, http://investors.oi.com/phoenix.zhtml?c=88324&p=irol-calendar, accessed November 2016

- IBID

- Owens Illinois Inc., “Life Cycle Assessment Study”, http://www.o-i.com/sustainability/life-cycle-assessment/, accessed November 2016

- Owens Illinois Inc., “2014 Sustainability Report”, http://www.o-i.com/uploadedFiles/Content/Sustainability/O-I-SustainabilityREPORT_FAsingle.pdf, accessed November 2016

- IBID

- Office of Senator Sherrod Brown, “Business Leaders Urge Attention to Sen. Brown’s Clean Energy Manufacturing Competitiveness Provisions”, https://www.brown.senate.gov/newsroom/press/release/business-leaders-urge-attention-to-sen-browns-clean-energy-manufacturing-competitiveness-provisions, accessed November 2016

MicMacMan hit the nail on the head – the cost of inaction for Owens Illinois far outweighs the cost of proactively shifting towards sustainable business practices and contributing to the policy conversation. While the same logic can be applied to many U.S. companies operating in environmentally-consuming industries, few companies are able to take such a long-term perspective on their business.

Let’s take a look at the auto industry, focusing specifically on Volkswagen (“VW”). In 2015, it was discovered that VW was using illegal software to deceive U.S. environmental regulators about how much their diesel engines pollute. As a result, VW, the largest auto manufacturer by revenue in the world, could face fines up to $18BN by the U.S. government, and has likely suffered irreparable reputational damage with consumers [1]. If VW had adopted a mindset similar to Owens Illinois, one focused on innovation around their supply chain to optimize for sustainability at cost parity and / or collaborating with policy makers, VW would be in a very different position today.

[1] Timothy Gartner, “After year of stonewalling, Volkswagen stunned U.S. regulators with confession,” Reuters, September 24, 2015, http://www.reuters.com/article/us-usa-volkswagen-deception-insight-idUSKCN0RO2IP20150924, accessed November 2016.

Thanks for this MicMacMan. I think you’re absolutely right that O-I are relatively well positioned to set a new standard for sustainable glass production.

What I find so compelling is that the use case for glass is so strong and also fairly broad. Wine bottles, perfume bottles, water bottles, drinking glasses: all these could benefit from a new sustainable manufacturing process, and one that could eventually be rolled out globally, if O-I sets a new benchmark and shares its technology. As you say, since glass is the most sustainable packaging, it seems certain that there will be more and more opportunities to use glass as a substitute for a less permanent receptacle, so the opportunities abound. I guess the question is: how insulated are O-I from the competition presented by other glass-making companies? Will they definitely produce the best technology, and do they have the furthest reach? Or may they be wiped out by companies that can produce environmentally-friendly glass much more profitably?

Interesting information and perspective on the production and recyclability of glass and lower lifetime carbon footprint for similarly sized containers. Additional information could shed a light the feasibility of glass packaging as a sustainable solution. What are the recycling rates of glass containers compared to plastic or aluminum containers? And since glass packaging is significantly heavier than the plastic or aluminum alternatives, it would be beneficial to also consider the carbon impact of distribution and transportation of heavier, bulkier items. Trucks would burn more fuel as they bring these heavier, eco-friendly bottles to consumers and melting glass requires significantly more heat input than melting plastic so the recycling process may have inherent emissions as the grid still supplies power from mainly coal fired power plants. Fully understanding the differences glass would make in the entire life cycle of the bottle could help us understand where the trade offs lie as we work towards a greener future.

I had some similar questions to Matt’s thoughts on recycle rates and transportation costs, and I wanted to look into energy required for the recycling process. Although aluminum and plastic require more energy for initial production than glass, aluminum and plastics require significantly less energy to turn into new products during the recycling process. Aluminum can be melted down and used for new products with very little change in quailty and only requires 5% of the energy needed to produce the original can, and plastics use about 10% of the original energy level to produce new recycled products, while glass uses about 80% of the original energy level to produce a recycled bottle.[1] I think glass is a great product and O-I is in a great position to be a global leader to impact the glass industry. I would be interested to see if O-I can use renewable energy sources to heat the furnaces.

[1] SF Gate, “Energy to Recycle”, http://homeguides.sfgate.com/energy-recycle-glass-bottles-vs-aluminum-cans-vs-plastic-79276.html

MicMacMan, you raise some interesting points on the sustainability of glass operations versus the competition (aluminum and plastic). Responding to LG1989’s comments, I am not too worried about the competition creating sustainable glass products more efficiently. It seems from your research OI is the leading manufacturer and likely has established relationships with contractual partners for specific products. I would bet the cost of switching manufacturers is fairly high. However, as more stringent policies are set in motion, I think in addition to increasing the use of recycled glass, OI should invest in sourcing energy from renewable sources. Understanding the company is already highly levered, it is essential that OI plan for a future in which conscious customers want their products produced in the most environmentally friendly way possible. Additionally, glass bottles are likely used for higher-end products, where customers are less price sensitive and can demand more sustainable goods. Since energy constitutes 10-25% of the production cost, it would be smart for OI to invest in clean-energy solutions in anticipation of further government action that incentivizes the reduction of CO2 emissions in processing.