Our Problem Isn’t My Problem: Pushing the Costs of Carbon Mitigation onto Supply Chain Partners

As the world marches towards a low-carbon future, costs will inevitably be incurred throughout the supply chain. Companies who are prepared to leverage size and tough tactics can extract value by inequitably dispersing costs through their supply chain partners, even in ‘collaborative’ relationships. Take a look at how this was done in the Australian grocery industry during the short-lived Carbon Tax in 2012.

In business, there is often little place for concepts of “fairness” or “equity” when seeking shareholder value. As carbon abatement policies emerge, firms face little incentive to bear costs that they could otherwise pass on to other firms within their value chain. This is a blog post about an Australian firm – Coles Supermarkets – which successfully passed on the costs of the ill-fated “Carbon Tax” to its supply chain partners.

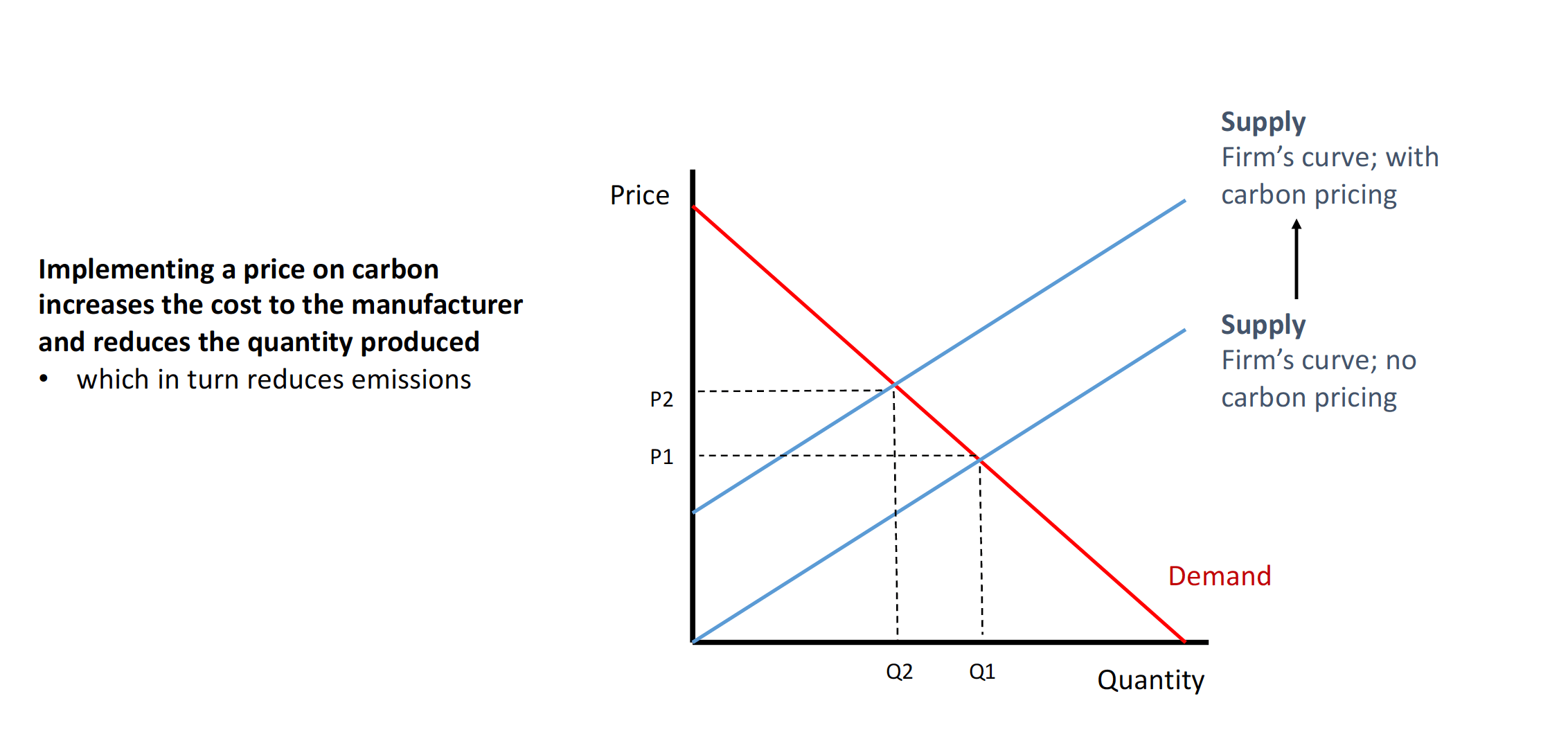

The principle behind a carbon tax is to accurately price an externality within a production system. Imagine a biscuit manufacturer who generates carbon pollution while she manufactures your favourite treat. Carbon pollution is a “cost of production” similar to the cost of cocoa beans. However, “the costs of pollution [are] externalised wherever possible and and thus borne by members of the wider community” [1]. This results in more biscuit production than is socially optimal, and shifts the burden of carbon pollution on the wider population.

Put a price on carbon, however, and suddenly the manufacturer has to incorporate these costs into her operations. In response to the higher price, she can either reduce the amount of biscuits she makes, or invest in technology to reduce her emissions. Either way, the result is a reduction in emissions and benefit for society as a whole:

This was the theory behind the Australian Labor government’s “Carbon Tax” in July 2012. Suppliers suddenly found an input cost on the horizon, yet on the other end of the value chain the two largest supermarket chains refused to pass on any price increase to the end consumer [2].

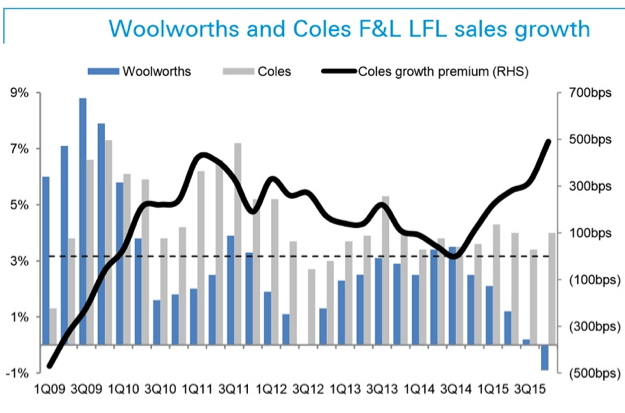

To understand why, consider the state of the grocery industry at the time. Coles had implemented an aggressive discounting strategy, which they funded by using their market power to extract rebates from suppliers [3]. The strategy was extremely effective. Grocery price deflation ran at 2% per annum in Coles [4] and drove significant like-for-like store sales growth versus their major competitor [5]:

As suppliers sought to pass on the cost of the tax in the form of higher product prices, Coles suddenly faced legislation that was diametrically opposed to their successful strategy. The main issue for Coles was the erosion of competitive advantage. Suppliers might successfully negotiate a price increase with Coles, yet fail to secure the same price increase in other retailers. That would cause Coles to either be price-uncompetitive in market, or face squeezed margins if they did not reflect the new price on shelf.

To counter that, Coles relied on their “price justification process”, a negotiating tool that forced suppliers to justify a price increase by listing their input costs. Coles would then go through line-by-line and refute increases that it felt were unjustified – one of which was the carbon tax.

Furthermore, the credibility of the carbon tax was in question from the day it was introduced:

- An election was due within 14 months and the government was floundering in the polls

- The Liberal opposition had promised to “axe the tax” upon reaching government

It was not unreasonable for Coles to assume that, if they could push back on cost increases in the short term, the tax would be revoked in the near future. This is what ultimately happened [6].

It is not equitable, but the lesson is clear. Whilst climate change policy can affect an entire industry, there is scope for firms to shift the burden of the policy onto other entities in their supply chain by leveraging their relative size and by utilising effective negotiating tactics. Furthermore, climate change policy is often controversial. Therefore, before making substantial changes to a firm’s operating model, it is wise for firms to assess whether the policy is likely to exist in its current form within the firm’s investment horizon.

Whilst a price on carbon is unlikely to re-emerge in the near future, Coles will still need to consider how to amend their operating model in a low-carbon future. If suppliers invest in reducing emissions, costs will come down the value chain:

The Stick – whilst Coles enjoys significant market power, so do many of its suppliers. Browbeating tactics would be responded in kind, which results in disengagement and lost sales. Coles should consider planning a thorough negotiation strategy for these discussions and judiciously decide which suppliers can have their cost increases consistently refused.

The Carrot – Coles can also work with suppliers to seek areas of efficiency within their supply chains by reducing logistics costs. It is not uncommon for suppliers to rent space on a retailer’s freight system, for example. There is certainly a more collaborative approach using vendor management inventory that can reduce carbon emissions and maximise profit throughout the supply chain – indicating that there is yet opportunity for retailers and suppliers to walk hand-in-hand towards a more environmentally conscious future.

(798 Words)

[1] Brian Andrew, “Market Failure, Government Failure and Externalities in Climate Change Mitigation: The Case for a Carbon Tax”. Public Administration and Development, 2008, p. 396.

[2] Blair Speedy, “Coles under fire over carbon tax”. The Australian, June 12, 2012, http://www.theaustralian.com.au/business/economics/coles-under-fire-over-carbon-tax/story-e6frg926-1226391647182, accessed November 2016.

[3] Malcolm Knox, “Supermarket Monsters”. The Monthly, August 2014, https://www.themonthly.com.au/issue/2014/august/1406815200/malcolm-knox/supermarket-monsters, accessed November 2016

[4] Colin Kruger and Eli Greenblat, “Suppliers count the cost as Woolworths and Coles shoot it out over prices”. The Sydney Morning Herald, April 21, 2012, http://www.smh.com.au/business/suppliers-count-the-cost-as-woolies-and-coles-shoot-it-out-over-prices-20120420-1xcfl.html, accessed November 2016.

[5] Chris Pash, “Woolworths can reverse its fortunes – because Coles is killing it”. Business Insider, August 31, 2015, http://www.businessinsider.com.au/woolworths-can-reverse-its-fortunes-because-coles-is-killing-it-2015-8, accessed November 2016.

[6] Rob Taylor and Rhiannon Hoyle, “Australia Becomes First Developed Nation to Repeal Carbon Tax”, The Wall Street Journal, July 17, 2914, http://www.wsj.com/articles/australia-repeals-carbon-tax-1405560964, accessed November 2016

Very interesting sir. I had not thought through the implications that a carbon tax gas through supply chains in any depth before and this is certainly an interesting example. Just such a shame that there wasn’t enough time here for competitive dynamics to play out properly and to see whether the carrot or stick approach would come to the fore. From first principles I like the idea of carbon taxes however if (or hopefully when!) they are introduced there are sure to be many casualties who aren’t able to alter their inputs fast enough and so take a hammering. It will also create a huge reliance upon reporting standards and I wonder if, in the almost entirely voluntary system we currently have, there is enough robustness in such monitoring that we can actual rely on companies to report accurately… Cheers!

A novel take on how carbon taxes and their associated costs ripple through a supply chain. When dealing with powerful partners in the value chain, it’s critical to think about how the Goliaths may lord their authority over smaller suppliers. As much as I think Coles has an obligation to pay carbon taxes (as the actual producers of the biscuits), it seems to me that their suppliers were also at fault for being unable to put together their own cohesive negotiation strategy. I would expect that the term “justifiable cost” would be a major sticking point in any contract discussion, and there should be some shared responsibility between the two parties for any increase in costs due to external factors (in this case, legislation uncontrolled by either party).

Great example of climate change regulation affecting operating models, Graham! This post has really struck a chord with me, as it doesn’t seem to make sense that the retailer, Coles, had all the power in this specific case. Wouldn’t all of the other suppliers of the grocer inevitably also be facing the same increased costs? Shouldn’t they have the collective bargaining power to simply pass the costs down to retail (or at the very least, share them?)

Perhaps it was only due to the temporal nature of the regulations, and there would have been a more civil result given more time (as Archer pointed out). However, it is only a matter of time before more regulation appears in markets around the world, and I think this case really shines a line on how important it is to understand how the impact of policy will reverberate through the market. Ideally, the regulation should increase investment in sustainable business operations, but sometimes it just makes more sense for businesses to eat the costs. Design and implementation of these types of policies will be hyper-critical moving forward.

I find it strange how these large supermarkets can force away the tax – especially after it was passed. I presume that if the government did not do away with the carbon tax, then many small suppliers would have gone belly-up and the government would have found itself with an unemployment issue and reduces overall taxes. In such a world, these supermarkets would have also then suffered as supply chains collapse and consumption declines. Hence it was a bold move by the supermarkets to stand their ground to see who blinks first.

Also, since implementing a carbon tax and letting it pass though the system is ineffective for structural reasons, perhaps the government could impose taxes directly onto corporations at every level though Renewable Energy Credits (“RECs”)? RECs ensure companies do not produce too much carbon, and forces them to bear the cost of excess consumption.

A wonderful economics lesson, Graham! Since you covered quite well how the firm can handle the effects of the carbon tax on its business, I’m left wondering what that ability to push the cost down the supply chain means for the effectiveness of the tax as public policy. The intention of a carbon tax, as you describe, is to raise prices on carbon usage such that a new equilibrium between supply and demand is reached, at a point that requires less carbon input. If Coles is working to ensure that the consumer (and the grocer itself) do not see the increase in prices that result from the tax, would the tax still have its intended effect of lowering carbon usage? Coles’ plan to shield customers from the supply costs would mean that demand would remain unchanged, but the cost has to be borne somewhere in the chain. The suppliers could theoretically take a lower margin and continue to consume carbon at the same level, which means that the cost of the externality is brought into the system, but it doesn’t directly result in lowering emissions. The question is whether on a macroeconomic scale it would be felt in terms of emissions. I’d argue that it would—ultimately, the lower profit the supplier would make would result in them consuming less elsewhere, which can be assumed to mean lower emissions based on underproduction elsewhere. Do you know if anyone looked into that in the case of Coles, the Australian law, or carbon taxes more broadly?

Hey team! Wanted to reply to your thoughtful comments, thanks for discussing my blog post:

– Regarding supplier negotiation strategy, the trouble with “collective action” is that it’s collusion/cartel behaviour! The overarching perspective is that the consumer benefits from low prices so suppliers have to be really careful about how they behave when taking cost increases. That gives the retailers a lot of power.

– Completely agree with the difficulties of measuring one’s carbon emissions in a voluntary system. But the majority of the cost would have been incurred at the electricity & utilities end, much easier to measure there.

– Interesting point about the RECs, I’m not sure how that would play out in the industry. The sad legacy of the carbon tax is that it’s left a bad taste in everyone’s mouth about market solutions to pollution. Any kind of new initiative would just trigger an allergic reaction from corporations – and make it too easy for the Opposition to level accusations of the government “killing Australian jobs” etc etc.

– Some of you raised some other great points about whether the tax is more effective in reducing emissions if it’s felt at one end of the supply chain vs the other. I suppose if it hits the consumer, it reduces demand & therefore output/emissions go down. If suppliers end up eating it, then it’s in their best interests to invest in low-carbon technology and efficiencies in their plants or end up taking a margin hit (to Peter’s point). There are also government assistance packages to invest in cleaner technology which ultimately end up being funded by the taxpayer. So I guess the consumer ends up paying for it one way or another.

There were other areas where the execution of the carbon tax really fell down. There were hugely generous industry assistance packages which – ironically – shielded some of the worst polluters from the impact of the tax. Of course, the whole point of the tax was to provide a pecuniary incentive to change polluting behaviour!

To that end, if you can’t get enough of that carbon tax goodness, here’s more light reading: “Perry, N. ‘A Post Keynesian Perspective on Industry Assistance and the Effectiveness of Australia’s Carbon Pricing Scheme’. The Economic and Labour Relations Review, Vol 23. No 1. pp 47-66”