Optimizing the Health Care Supply Chain

The healthcare supply chain needs to be optimized. How can companies utilize big data to reduce costs for those involved?

The high cost of healthcare

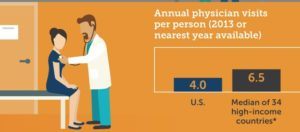

It’s no secret that the United States spends an inordinate amount of money on healthcare. In 2016, per person healthcare costs surpassed $10,000 for the first time, representing a national spend of ~$3.3 trillion, a figure that is projected to grow at approximately 5% over the next decade.1 This spend, however, is not attributable to a higher number of doctor visits or patients who are “more sick;” rather, it is due to a greater use of expensive medical technology and reliance on high-cost prescription drugs that disproportionately drive up costs (see figure 1).2 The system continues to struggle to recognize the best methods to deliver care to patients in a cost-effective manner. I initially found this to be puzzling. Given the rise of big data and the plethora of information and resources, why aren’t stakeholders doing a better job of converting knowledge into solutions?

Figure 1: High US Health Care Spending is Largely Driven by Technology Use, Prices

What isn’t working?

In practice, it is much easier to collect data than to use it, especially in healthcare. The healthcare supply chain is incredibly disconnected, inflexible and opaque, and many of the stakeholders closest to it have neither the capacity nor the resources to manage the chain. In a recent survey, frontline clinicians stated that they spend ~17% of their week managing inventory issues, yet ~65% wish that they could trade this time for more patient care. Furthermore, approximately 1/3 of hospitals have not implemented a new inventory management system in over 6 years, and another 1/3 don’t even know what RFID (tracking technology) is.3 Even in its barest form, supply chains detract doctors from doing what they are good at and enjoy most, and throwing a bunch of data at them without the right implementation tools exacerbates revenue cycle issues and contributes to the inefficiency of healthcare spend.

This inefficiency, however, presents much opportunity for optimization. By learning from industries like fast-moving consumer goods which have used digitalization to integrate the supply chain, the healthcare sector can better use data to significantly cut lead times and obsolescence while also reducing inventories (see figure 2).4 Ultimately, the efficiency creates a better patient experience, boosts profitability for stakeholders and optimizes healthcare spend.

Figure 2: Operational Metrics Suggest Huge Opportunities

Cardinal Health

Cardinal Health, a major distributor and manufacturer of pharmaceutical and medical products, has taken advantage of several of the aforementioned opportunities to create value for its customers and shareholders. Broadly, Cardinal’s strategy has been two-pronged: R&D and M&A.

In 2015, Cardinal opened a Healthcare Supply Chain Innovation Lab aimed to strengthen organizational connectivity and monitoring across the supply chain.5 One of the overarching goals of the Lab is to increase transparency in the supply chain.6 Just as the retail industry streamlined product development by facilitating cross-functional collaboration among stakeholders to ensure that end consumers got their product when they wanted it, Cardinal is pushing for a consumer-driven network where all stakeholders are aligned. Changes in reimbursement dynamics continue to spark incentives for such alignment. In fee-for-service, the supply chain existed to ensure product availability. Now, as consumers become more knowledgeable and involved in healthcare, they require more than the service – they are only willing to pay for value. In order to provide that value, the supply chain needs to reduce costs for everyone. By dedicating a facility that exists solely to explore better ways to automate inefficient processes like device replenishment or machine standardization,7 Cardinal removes the administrative burden from providers while optimizing the tools they use to treat patients and manage their supply chain.

Another strategy of focus for Cardinal has been M&A. Since 2013, Cardinal has been actively growing its Medical Devices business and diversifying its portfolio in response to growing concerns regarding the company’s drug distribution unit.8 Though the M&A strategy doesn’t necessarily stem from digitalization, a consolidated network provides Cardinal with increased control over manufacturing and distribution and ultimately creates a more continuous flow and use of data. With a more robust portfolio of devices and supplies, Cardinal has much better visibility into what providers need and an increased ability to make real-time decisions.

Looking ahead

Though Cardinal has recently been dealing with some pricing (and naturally, investor) pressures, I am encouraged by the company’s direction in applying digitalization and consolidation towards a more optimized supply chain. To truly create a cross-functional supply chain, it will be important for Cardinal to collaborate with other stakeholders in the ecosystem that collect data to integrate, observe and extract insights that ultimately help patients better manage their health. It is one thing to innovate and consolidate – it is another to partner with others and diversifying the problems to solve, not the portfolio.

Inevitably with healthcare, questions remain, especially considering the current regulatory environment. How will companies like Cardinal Health continue to innovate and collaborate while managing the ever-changing regulatory requirements of healthcare and data?

Word Count: 799 words

Sources

[1] Ricardo Alonso-Zaldivar, “$10,345 per person: U.S. health care spending reaches new peak,” PBS News Hour, July 2016, www.pbs.org/newshour/health/new-peak-us-health-care-spending-10345-per-person, accessed November 2017.

[2] Mary Mahon, “U.S. Spends More on Health Care Than Other High-Income Nations But Has Lower Life Expectancy, Worse Health,” Commonwealth Fund, October 2015, www.commonwealthfund.org/publications/press-releases/2015/oct/us-spends-more-on-health-care-than-other-nations, accessed November 2017.

[3] Jacqueline Belliveau, “78% of Hospital Staff Still Face Manual Supply Chain Management,” RevCycle Intelligence, February 2017, https://revcycleintelligence.com/news/78-of-hospital-staff-still-face-manual-supply-chain-management, accessed November 2017.

[4] Thomas Ebel, Erik Larsen and Ketan Shah, “Strengthening Healthcare’s Supply Chain: A Five-Step Plan,” McKinsey & Company, September 2013, https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/strengthening-health-cares-supply-chain-a-five-step-plan, accessed November 2017.

[5] “Cardinal Health Unveils IoT Supply Chain Innovation Lab,” Technologies Group, 2013, http://www.t-sgrp.com/cardinal-health-unveils-iot-supply-chain-innovation-lab/, accessed November 2017.

[6] Mike Duffy, “Making the Healthcare Supply Chain Patient-Centered – A Necessary Transformation,” Cardinal Health, May 2016, http://www.cardinalhealth.com/en/essential-insights/a-patient-centered-healthcare-supply-chain.html, accessed November 2017.

[7] Cardinal Health, http://www.cardinalhealth.com/en/services/acute/business-solutions/cardinal-health-inventory-management-solutions.html, accessed November 2017.

[7] RBC Capital Markets, Initiation Report, September 2017, via CapitalIQ, accessed November 2017.

As HJ writes, there certainly appears to be significant room to improve the supply chains of health care providers. I wonder, however, what the root cause of this inefficiency is, and whether digitization will be able to address it. I continue to be struck by our conversation with Jim Koch, particularly when he mentioned that technological innovations have not been the core driver of increased efficiency in his supply chain – rather, it has been a shift in forecasting and delivery tactics, a decidedly low tech solution. Would increasing technological firepower at hospitals and healthcare providers really solve their problems, or do their issues require a fundamental shift in basic supply chain management?

Great article HJ. I agree that Cardinal seems to be innovating in the right direction, asking the tough questions and dedicating the time and resources toward solutions. I wonder though, how possible it is to fully streamline supply chain purchasing practices across such an incredibly fragmented industry? In the US, the 3 largest hospital chains still make up less than 5% of the total industry. The industry is trending toward consolidation, specifically to leverage the negotation power that comes from consolidating purchasing and reimbursement, but there is still has a long way to go. Cardinal’s approach to smoothing the supply chain is a necessary next step, but how do we also begin to solve for the complexity of so many fragmented delivery points and needs among the end users, the hospitals? Also, as hospitals budgets continue to get squeezed by rising costs and falling governmental reimbursement, how can we incentivize adoption of Cardinal’s supply chain innovation?

HJ, thanks for the interesting article, I’m ready to buy some Cardinal stock 😉

While I agree with you that digitization could improve the supply chains for hospitals, I think you’re looking for solutions in the wrong places. I don’t understand why Cardinal Health would want more efficient supply chains for hospitals. The current mess that is hospital purchasing benefits pharma and device manufacturers at the expense of us the taxpayers. Perhaps this is a little cynical of me to suggest but, based on my experience in the medical device world, I would not be surprised if Cardinal Health and other medical manufacturing companies are researching digital solutions to hospital supply chains in order to acquire and shut them down before they gain traction.