Open Innovation in the Investment Management Industry: Is This The New Frontier?

Can the benefits of open innovation in investment management outweigh the costs? In this piece, we quickly examine the benefits of such an approach agains the backdrop of a traditional asset manager and one of the biggest struggles Quantopian, a firm pioneering in the space, faces.

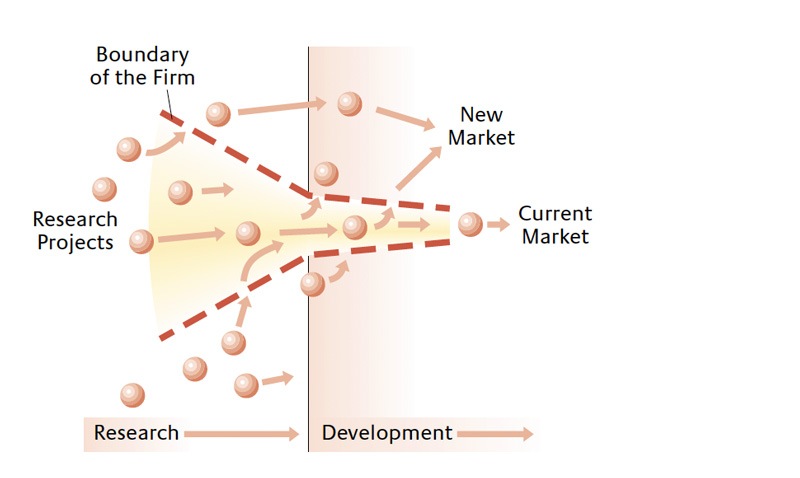

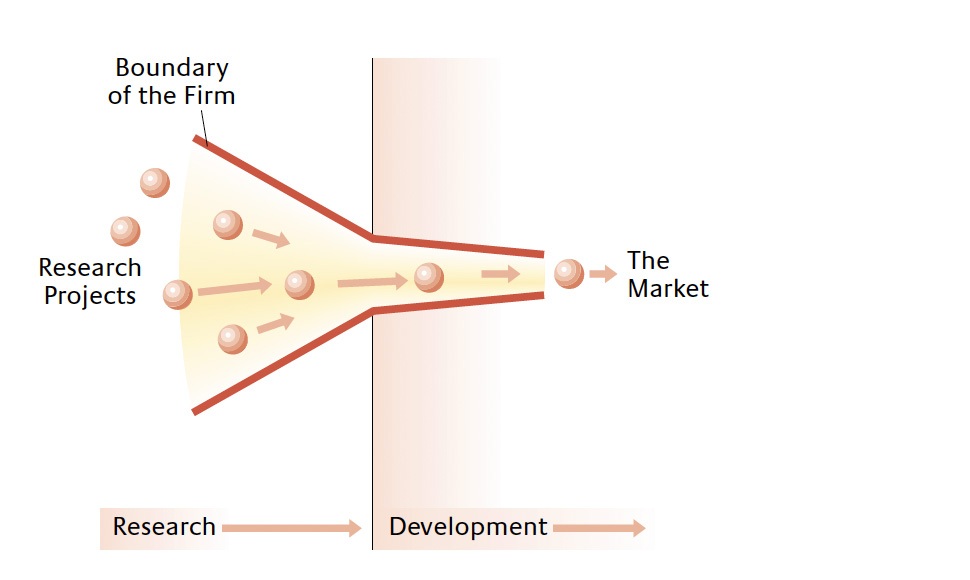

Open innovation, more generally known as crowd sourcing, is a phenomenon which has only really been able to come to scale in recent years through the advancement of technology. This is not to say that in the past it has not been possible, but the logistical and technological barriers to achieve sufficient scale to drive material innovation on a sustained bases have not been overcome until recently. Quantopian is one such company which has capitalized, quite literally, on this new form of innovative sourcing, allowing it to achieve unprecedented growth and success in an industry predominantly dominated by the minds of a few. Quantopian is a platform which enables education of, and experimentation with, quantitative finance algorithms and allows “Select members [to] license their algorithms and share in the profits”[1]. As of October 2017, Quantopian had “crowdsourced over 500,000 unique algorithms from a community of 100,000 users – ‘authors’ – around the world”[1]. The importance of this scale boils down to the diversity of ideas which would previously be unachievable; however, with this breadth of new ideas comes the problem of selection and validity. As Quantopian continues to grow, the question becomes can they filter and select the algorithms for their portfolio on a scale and speed equivalent to their ability to globally source.

“Enterprise adoption of crowdsourcing can allow specialized skills to be dynamically sourced—from anyone, anywhere, as needed”[2]. Quantopian was one of the first companies to realize this can be applicable to the investment management industry and now, by providing the right tools, has an ability to source and implement ideas on a scale which was previously unachievable. This is important for two reasons, first, coming up with new ideas in the industry is difficult as the majority, if not all, of the low hanging fruit has been exhausted and second, with Quantopian’s current sourcing model, there is no large costs as they only need to “pay authors a share of the performance fee [they] charge.”[3]. To put the above differently, as Quantopian continues to scale their rate of idea generation will far outpace the rate of their cost growth, antiquating the models of many traditional investment managers.

With this sourcing model however, there are many challenges which must be overcome and as highlighted above the biggest may be selection. “Open innovation engagements tend to generate idea corpuses that are large, highly redundant, and of highly variable quality”[4] which is especially true with Quantopian’s low barrier sourcing. To address this filtering issue, Quantopian has taken several important measures. In the short term Quantopian uses standardized testing techniques to filter out easily detectable poor or fraudulent ideas (i.e. algorithms overfit to historical data)[1]. In the longer term, Quantopian is making sure to operate in a way in which new ideas which may not have fit the previous mold are capitalized on rather than discarded. As Thomas Wiecki, Director of Data Science at Quantopian, puts it “markets are changing constantly”[5] but “as new users from all over the world join the platform every day we have an inexhaustible source of fresh ideas that keep us one step ahead”[5]. With an eye on continued market innovation and a rigorous filtering system, Quantopian should be well suited to outlast many of it’s industry rivals if they hold steadfast to their traditional ways.

With everything that Quantopian is doing, it seems that they are well positioned to be around for the long term; however, at this juncture the biggest misstep that Quantopian, as an investment manager, can take is to find itself with negative returns in the first few years of it’s founding and soliciting the doubtfulness of its investors. The biggest potential to this happening is implicit to open innovation, and is due to the incentives of its authors. None of the authors are worried about the risk their algorithm poses in the context of all other submissions and are instead myopic to the potential returns of their own algorithm. Because of this blind spot that all authors possess, Quantopian must be careful to construct its portfolio in ways which mitigate this risk and allow it to optimize for long terms gains as well as reduced draw downs.

As Quantopian continues to push the frontier of investment management, several big questions abound. Can they continue to incentivize their authors to contribute their best ideas as the barriers to Do-It-Yourself trading continue to drop? If they can continue to incentivize their authors, what is preventing a competitor from doing the same thing? Said other words, where is the competitive advantage for open innovation in this industry? (764)

[1] Sara Fleiss, Adi Sunderam, Luis Viceira and Caitlin Carmichael, “Quantopian: A New Model for Active Management” HBS No. N1-218-046 (Boston: Harvard Business School Publishing, 2017), http://hbsp.harvard.edu, accessed November 2018.

[2] Jonathan Trichel and Marcus Shingles “Industrialized Crowdsourcing” ,Tech Trends 2014, Deloitte Insights, February 21, 2014, https://www2.deloitte.com/insights/us/en/focus/tech-trends/2014/2014-tech-trends-crowdsourcing.html, accessed November 2018.

[3] Quantopian, “Get-Funded; Your Compensation” https://www.quantopian.com/get-funded, accessed November 2018.

[4] Ana Cristina Bicharra Garcia and Mark Klein, “An Idea Filtering Method for Open Innovations,” http://catalyst-fp7.eu/wp-content/uploads/2014/09/ci2014-KleinGarcia.pdf accessed May 2001.

[5] Joahua New, “5 Q’s for Thomas Wiecki, Director of Data Science at Quantopian,”Center For Data Innovation, September 15, 2017, https://www.datainnovation.org/2017/09/5-qs-for-thomas-wiecki-director-of-data-science-at-quantopian/, accessed November 2018.

[6]Henry W. Chesbrough, “The Era of Open Innovation,” MIT Sloan Management Review (Spring 2003):

The nature of investment management is such that it is unlikely that any algorithmic approach to the field is unlikely to outperform the market in the long term. That said, negative returns in the first few years should not, to the truly rational investor, ring the death knell for the project as long as the market has a whole has comparable returns. If the project still outperforms the market, even with the negative returns, it could still be viewed favorably.

I think it would be difficult for Quantopian to keep incentivizing the authors, because authors need to keep outperforming the market (with justifiable amount of risk) to keep attracting more institutional investors, thereby giving a reason for Quantopian to keep incentivizing the authors. In other words, if the authors cannot keep performing well over the long run, this platform cannot sustainably keep supporting the authors. History dictates that it is extremely challenging to keep outperforming the market over the long term. Thus, I am basically skeptical about the sustainability of the company’s incentive system.

As long as some portion of the fees charged by the fund are allocated to the developer of the algorithm in which capital is placed and investors are flocking to the platform, there will be an incentive to develop algorithms for the platform. However, after reading this article, I considered the perspective of the investor and I was left wondering – what is the advantage to parking capital with Quantopian compared to a broad index fund or another investment vehicle? I couldn’t come up with a viable reason to invest in Quantopian, unless the investor fundamentally believes that one or some combination of algorithms at Quantopian will yield higher returns than the market.

In this case, I don’t think there is a reason to believe that Quantopian will yield higher than average returns. As DIY trading platforms become commonplace, there is less incentive for investors to use the platform and consequently less incentive for developers to produce content for the platform.

This article is super interesting and brings to light a use case of open innovation that I had not considered before. I agree with the previous comments about the limited long-term viability of any one algorithm to provide consistently outperform the market. I wonder what processes Quantopian has in place to refresh ideas to take advantage of short-term market inefficiencies? How often do they reevaluate their portfolio? Is there a time constraint on holding algorithms? I am also not clear on the reason an author would use Quantopian rather than employing the algorithm themselves, given the low barrier to market entry. Maybe they provide computing power or other benefits from their platform. Fascinating topic, thanks again for sharing!

What an interesting company! I think they have a great product since it is actually really easy to test the algorithms given the wide availability of historical data on investment yields. I wonder why quantopian does not also “crowd-sell” the product, selling its products to the wider public and increasing the potential revenue pools.

In general, I think that all those new start-ups could do a greater job working with more traditional institutions such as universities. It seems that many educational institutions, specially in the developing world, lag ~5 years in what they teach and could greatly benefit from interacting with companies such as Quantopian.

This is a very interesting topic Hypatia! I see few major concerns related to your questions and the way Quantopian currently operates:

(1) The way the authors of the algorithms are incentivized might create perverse incentives in the short-term as these authors are getting a fee without risking their capital. This could be perhaps mitigated by requiring the authors to investing their own capital in the strategies they propose.

(2) I am very skeptical about authors sharing winning investment strategies openly, especially when the barriers to invest are becoming so low. If such as thing as a strategy that beats the market exists, why would an author not keep it for herself / himself?

(3) How fast do these strategies become obsolete?

(4) Is it really possible to properly evaluate the quality of an investment algorithm? Even using backtesting as a technique does not mitigate the fact that history does not repeat itself.

Overall, I am very intrigued by what Quantopian does but also not very optimistic on the sustainability of the company in the longer term.

Excerpt from the New York TOMs review:

Can breadth of investigation and the wisdom of the crowd overcome depth of research in long-term algorithmic investment performance? Ms. Hypatia’s “Open Innovation in the Investment Management Industry” offers a stimulating discussion of this question through Quantopian, which relies on crowdsourced investing ideas submitted to a free online platform. […]

The article highlights the company’s philosophy of automatically filtering low-quality ideas through statistical testing, but would have greatly benefitted from a discussion of how the algorithms that pass the filter are integrated into a broader portfolio strategy. At top-level quantitative hedge funds such as Two Sigma and D.E. Shaw, the investment model and resulting algorithms form only the first component of a three-tiered approach, with integration, or balancing between different strategies, and execution, conducting trades as quickly and unobtrusively as possible to avoid front-running and adverse market movements, forming the latter two stages.

Furthermore, quantitative hedge funds generally rely on either better infrastructure or more comprehensive information, collected through a combination of data mining and research, to provide them with the edge they require. Can the diversity of crowdsourced ideas outweigh the lack of particular advantages in these two areas, especially since it may be difficult to redesign user-submitted algorithms to make use of extra information? A discussion of the relative importance of these factors would have been much appreciated. […]

The central dilemma in applying open innovation to investment management is that large sets of investment ideas will almost inevitably produce market-level return. We discussed the law of large numbers in finance — when an investor diversifies his/her holdings by investing in a large number of assets, the resulting returns will be close to market (SP500) index performance. The merit of open innovation is that it allows a large set of fresh ideas to emerge and a few great ideas to blossom through a peer review/selection process. In the case of investment management, it is doubtful whether more ideas = better performance. Re: the question you posed on incentives, I think Quantopian could do something SeekingAlpha had some success with — SeekingAlpha systematically backtested the recommendations put forth by its members online and certified a small group of idea contributors as “power investors”. And the platform charges a fee for accessing power investors’ ideas. I think Quantopian could tap into a similar approach of idea certification and tiered-pricing in order to provide sufficient incentives for people to contribute quality ideas

Really interesting article on this space and a very thought provoking view into what should be an interesting future for the investment management world. Reading through the analysis, I was also left with the question of whether a future exists in which these crowd-sourced algorithms could be matched with crowd-sourced funds and the investment firm could be cut out altogether? The function of filtering the algorithms for selection, I would assume, is already a highly programmatic activity that could be embedded in one of either the algorithm or funding platform.

Open innovation is truly interesting. I think it is a interesting way to decentralize decision making. What do you think will be the largest headwinds outside of investor sentiment. I can see how there still could be other factors that could hinder process.