Nordstrom’s Attempt to Survive in the New Amazon Era

“We knew it was going to happen, it’s just happened faster than we thought.” – Peter Nordstrom[1]

The crushing emergence of the “800-pound gorilla”, Amazon, has forced the US retail landscape to fundamentally shift and to do so swiftly. As Macy’s and J.C. Penny shut down 15% and 14% of their store bases, respectively, traditional retailers have struggled to balance their e-commerce obligations with their physical infrastructure in the new omnichannel era. However, to remain profitable and relevant, adapting the supply chain is critical.

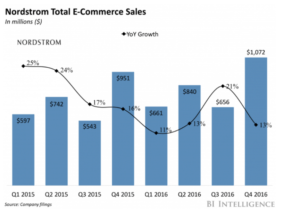

Nordstrom’s online business has reached over $3 billion, growing 30% on an annualized basis since 2010 and representing ~25% of the company’s revenues. [2] Peter Nordstrom believes it could be 50% of their business in the next five years or so.[3] However, the rapid rise of e-commerce and “omnichannel” retailing demands far more complex and interconnected supply chains and today’s retail supply chains are not set up for it. The accelerated shift to e-commerce has negatively impacted Nordstrom’s overall profitability as CFO Michael Koppel notes:

However, the rapid rise of e-commerce and “omnichannel” retailing demands far more complex and interconnected supply chains and today’s retail supply chains are not set up for it. The accelerated shift to e-commerce has negatively impacted Nordstrom’s overall profitability as CFO Michael Koppel notes:

“This business model has a high variable cost structure driven by fulfillment and marketing costs in addition to ongoing technology investments. With our increased investments to gain market share along with the changing business model, expenses in recent years have grown faster than sales.”[4]

Rising demand for online retail has created a bottleneck at the fulfillment stage, whereby carriers and retailers are struggling to manage fulfillment and their inventory with the increasing volume of online orders.[5] Furthermore, SKU proliferation through e-commerce has created new capacity and cost challenges including expenses for picking up additional online orders, acquiring additional DC space and processing peak-season demand.[6] As such, even with distribution centers across the country, digitalizing the supply is critical since supply can still be restricted because of the costs associated buying and holding inventory, as well as building and maintaining facilities.[7] Moreover, by not adjusting the supply chain to better manage inventory, retailers like Nordstrom risk either overbuying and leading to discounting and margin deterioration, or underbuying and missing sales opportunities.

So how has Nordstom adapted?

An investment in DS Co., a supply software firm, is Nordstrom’s first step to combatting this problem. The software acts as a middleman such that retailers and their suppliers can seamlessly communicate information about inventory levels and other data to each other.[8] In traditional supply chains, retailers and suppliers use different methods to track inventory data, making it difficult to share the data and ensure that products are in stock and can be shipped out in time.[9] As such, the customer is led to believe that a product is available when in fact it is not.

DS Co. automatically reduces inventory quantities using advanced logic – meaning that when a supplier hasn’t updated their supply since recent orders came in, DS Co. logic will inform the retailer of the most likely true inventory, resulting in lower cancellation rates.[10] Furthermore, the investment in inventory control enables Nordstrom to further to expand its “drop shipping,” a delivery method in which the product is shipped to the consumer directly from the manufacturer, as opposed to the traditional method of shipping from the retailer’s distribution center.[11]

Rather than guessing months in advance as to what consumers will want to purchase and then holding the inventory, by utilizing drop shipping and DS Co. software, Nordstrom will let consumers dictate what they want and adjust accordingly. In doing so, Nordstrom will be able to reduce the cost and the risk of holding inventory. Additionally, Nordstrom may stock only popular colors of a certain item, but make a broader array of colors available to customers via drop shipping.

Next steps for Nordstrom?

While it remains to be seen who will win and who will lose in the new retailing era, retailers will either build a transformative set of supply chain capabilities in the new world order or struggle to survive. These changes will require both meaningful investment and time. Nordstrom is ready to adapt as CFO Koppel notes, “with technology and supply chain as a key enabler of delivering customer experiences, roughly 40% of our plan is allocated towards modernizing our tech platform, delivering digital and mobile enhancements, and expanding our fulfillment network.”[12] As Nordstrom looks ahead, they should focus on implementing advanced analytics to better understand consumer preferences and finding ways to make shopping in a brick and mortar store more experiential and personalized for customers.

Final thoughts / questions

Beginning to digitalize the supply chain is a good start, but will it be enough to help combat current retail trends or is it too late? Will the new concept stores even bring customers back? Ultimately, time will tell whether Nordstrom will be able to move fast enough and if their changes will make enough of a difference to survive.

Word Count: [780]

[1] Phil Wahba, “Nordstrom Thinks Half Its Business Could Be Online Within 5 Years”. Fortune. 10 October 2017. Accessed 14 November 2017. http://fortune.com/2017/10/24/nordstrom-online/

[2] Stuart Lauchlan, “Nordstrom’s e-commerce boom is both an asset and an issue”. Diginomia. 16 May 2017. Accessed 13 November 2017. https://diginomica.com/2017/05/16/nordstroms-e-commerce-boom-asset-issue/

[3] Phil Wahba, “Nordstrom Thinks Half Its Business Could Be Online Within 5 Years”. Fortune. 10 October 2017. Accessed 14 November 2017. http://fortune.com/2017/10/24/nordstrom-online/

[4] BI Intelligence. “Nordstrom’s CFO makes crystal clear why online shopping is killing traditional retailers”. Business Insider. 19 Feb 2016. Accessed 13 Nov 17. http://www.businessinsider.com/nordstrom-president-on-ecommerce-issues-2016-2

[5] BI Intelligence. “Nordstom’s impressive online sales”. Business Insider. 27 Feb 2017. Accessed 14 Nov 17. http://www.businessinsider.com/nordstroms-impressive-online-sales-2017-2

[6] Chaturvedi, N., M. Martich, B. Ruwadi, and N. Ulker, “The Future of Retail Supply Chains,” McKinsey & Company.

[7] Jeremy Hanks, “Evolving the Supply Chain in the Ecommerce Age”. Multichannelmerchant. 12 Aug 2013. Accessed 14 November 17. http://multichannelmerchant.com/must-reads/evolving-the-supply-chain-in-the-ecommerce-age/

[8] Allison Zisko, “Nordstrom Enhances Drop-Ship Program with Dsco Investment”. HFN. 12 Jul 2016. Accessed 13 November 2017. http://www.hfndigital.com/news/nordstrom-enhances-drop-ship-program-dsco-investment/

[9] Loretta Chao, “Nordstrom Buys Stake in Software Firm”. Wall Street Journal. 8 July 2016. Accessed 12 November 2017. https://www.wsj.com/articles/nordstrom-buys-stake-in-software-firm-1467970381?mod=yahoo_hs

[10] DSCO. “Nordstrom Uses the Dsco Platform to Improve Drop Shipping Partner Operations”. DSCO. Accesed 14 Nov 2017. https://www.dsco.io/case-studies/

[11] BI Intelligence. “Nordstom invests in supply chain software firm”. Business Insider. 11 Jul 2016. Accessed 14 Nov 2017. http://www.businessinsider.com/nordstrom-invests-in-supply-chain-software-firm-2016-7

[12] Jamie Grill-Goodman, “Nordstrom’s Tech Investment Plans for 2017”. RIS. 4 April 2017. Accessed 13 November 2017. https://risnews.com/nordstroms-tech-investment-plans-2017

I certainly agree that the inventory challenge within these large footprint, large format department stores needs to be addressed in an efficient manner before they lose out to more nimble companies (like Zara). Nordstrom is far from alone in the omnichannel debacle: I worked at Macy’s right as they moved to “Single-View-Inventory,” which essentially addressed the issue that the consumer should be able to purchase what he/she wants despite the origin of the purchase. For example, if a customer is shopping in her local store, she should be able to purchase a size “X” jeans if they have the inventory through e-commerce (even if it isnt on-site). In size-intensive businesses like footwear or denim, an omnichannel approach is necessary for companies to be able to deliver the product offering without having to carry the burden +100s of SKUs!

That being said, is a streamlined inventory approach enough to address the slow decline of the department store model? I think more needs to be tested before we can write off brick-and-mortar: having touch-points with consumers across all channels increases their average spend. While product-less concept stores are new to the market, “Buy Online, Pick Up in Store (BOPS),” loyalty programs, in-store events, exclusive designer partnerships and a shift to experiential shopping (digital fitting rooms, mobile point-of-sale) are all initiatives being tested to enhance the customer experience and drive omnichannel strategies. At the end of the day, there is a bit of storytelling and merchandising that department stores are responsible for, and focusing on fulfillment is only going to fix part of the problem.

I agree with you that supply chain management methods such as predictive analytics and drop shipping help Nordstrom avoid bearing the risk of holding excessive amount of inventory. I think you’re also completely on point to highlight that the complexity of supply chain management that is introduced with the e-commerce model isn’t going to be solved through just these measures since I think the changes are pushing the burden on to the manufacturer as opposed to eliminating them. In other words, Nordstrom is actually going to have to be good at guessing what customers will want to purchase even if where the product is shipped from is now different. And to that point, leveraging e-commerce for better data analytics will be key.

Thank you for your article, Kat K! The concept of drop shipping is new and fascinating to me. We talked about cutting out the middle man in the case of Aqualisa Quartz whereby the producer cut out the plumber and instead marketed directly to customers through trade shows. Your article highlights an interesting online application of making a supply chain more efficient. Another component of the logistics system that I’m curious how well Nordstrom is equipped to manage is the volume of returns. I also wonder how the in-store shopping experience will change as the company shifts more towards an online model.