Nordstrom: How to Leverage the Deluge of Data as a Competitive Advantage

Retailers are facing intensifying challenges including stagnation in brick-and-mortar sales, increase in e-Commerce offerings and sales, and changes in consumer browsing and purchasing behaviors. Realizing that data is one of its most valuable assets, Nordstrom is leveraging machine learning to secure a competitive advantage, remain afloat and survive the Amazon Era. Is it maximizing the value it can generate from ML?

Key Trends Reshaping the Retail Industry

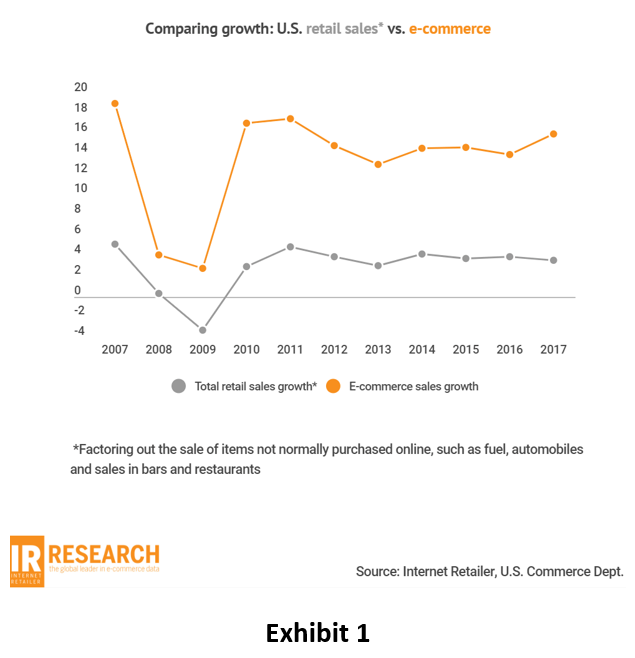

With almost 50% of the population online[1], the world is witnessing a deluge of data like never seen before. In this wake, retailers are facing intensifying challenges. Among these challenges is the stagnation in retail brick-and-mortar sales. In fact, while overall retail sales have been growing slowly over the past couple of years, e-Commerce sales have been witnessing double digit growth (Exhibit 1).[2]

In addition, customer behavior has shifted drastically over the past few years. First, consumers are making increasingly informed purchasing decisions, leveraging digital channels such as social media and search engines – a phenomenon labeled by Google as the “Zero Moment of Truth”.[3] Second, millennials are becoming less focused on buying “stuff” and more interested in experiences. [4]

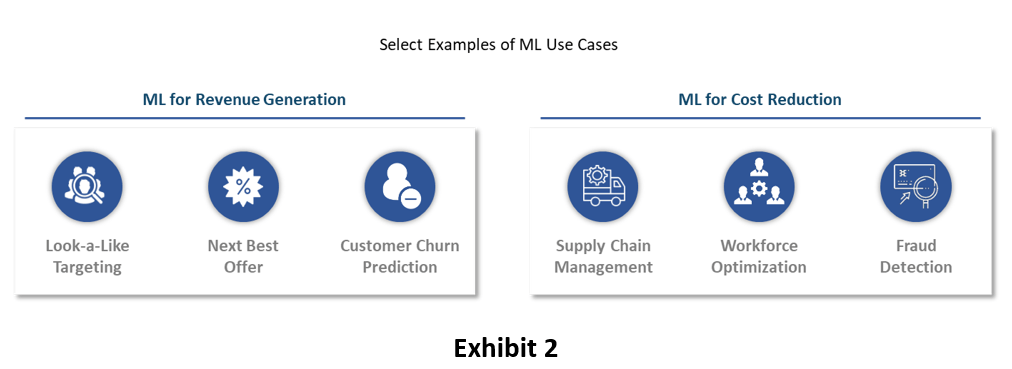

These trends, among others, are forcing retailers to find new ways to innovate in order to capitalize on the online boom and enhance the customer experience across all channels. Retailers are quickly realizing that data is one of their most valuable assets and are turning to machine learning (ML) to increase revenues and reduce costs (Exhibit 2).

Nordstrom Focusing on ML to Reap Maximum Value from Data

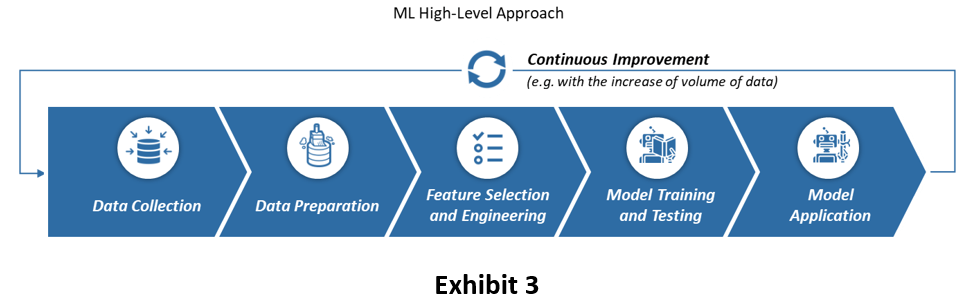

Nordstrom has been heavily investing in building its analytics capabilities to stay abreast of these trends. The retailer has been using ML for multiple use cases including in-store assortment optimization. Particularly, with exceptional customer service as its core value proposition, Nordstrom is leveraging ML to target its customers with customized and personalized marketing messages. In order to do so, the company relies on ML techniques that learn from historical data points (e.g. transactions, footfall, demographics) to predict future outcomes (Exhibit 3).

Nordstrom focused on leveraging data collected from its customers across multiple touch-points throughout their journey, including email campaigns, click streams and purchase data. After integrating data collected across various channels, Nordstrom leveraged ML to develop an “inferred scoring” system that allowed it to improve its marketing campaign efficiency and increase its email-to-dollar conversion by around 25%.[5] In other terms, leveraging ML, the company was able to improve its predictions and offer customers more accurate suggestions of they want and/or need.

The company is also leveraging ML, particularly deep neural networks, to power its visual search engine. The visual search engine is focused on improving customer experience and boosting sales by allowing customers to upload an image of their product of interest to the search engine, which in turn offers to the customer direct or similar products. In order to deliver this functionality, Nordstrom partnered with visual search company Slyce.[6]

Nordstrom is continuing to expand on its ML efforts through multiple initiatives such as the acquisition of two retail tech startups in 2018: BevyUp, a tool to empower salespeople to develop relationship with customers beyond the brick-and-mortar store, and MessageYes, a platform to enable Nordstrom to push personalized notifications to customers, requiring only a “Yes” response from customers to proceed with purchase.[7]

Looking ahead, the company also established the Chief Innovation Officer role to focus on designing the“stores of the future” to allow Nordstrom to “better serve customers through further integration of digital and mobile”.[8] In addition, the company is continuing to identify new ways to digitize multiple touch-points across the customer journey. A clear example is Nordstrom’s new location on West 57th Street in Manhattan deemed as a “sophisticated shopping-tech laboratory”.[9] Digitizing touch-points will not only improve the customer experience but also allow Nordstrom to collect more data, especially in the brick-and-mortar environment.

Considerations for the Future

Nordstrom should continue exploring new ways to reap the full potential of ML and the digitization wave, not only to secure a competitive advantage but also to help address some of its key challenges. For example, one key challenge the company has been facing is a decrease in profits over the past years, some of which is attributed to its growing investment in its online platforms as well as the costs associated with managing increasing online sales (e.g. fulfillment).[10]

Some initiatives that Nordstrom could explore include:

- Driving in-store purchases through its loyalty program: For example, similar to Macy’s, incentivize customers browsing online to complete the transaction in-store by providing additional loyalty points for in-store purchases.

- Leveraging ML to reduce in-store costs: For example, leverage ML for workforce management, including predicting store footfall data and scheduling employee shifts accordingly.

- Deploying artificial intelligence to continue providing exceptional customer service: For example, similar to North Face, deploy a virtual assistant to provide a personalized shopping experience for Nordstrom customers even when shopping online.[11]

- Outsourcing some of its digital efforts to third-party providers, while keeping in mind privacy concerns.

Open Question: How to Survive the Amazon Era?

With around 60% of Nordstrom regulars having Amazon prime membership[10], how can the company find more ways to innovate to survive the Amazon era while remaining profitable?

(799 words)

Sources:

[1] Alex Hern, “Almost 50% of the world is online. What about the other 50%?,” The Guardian, October 18, 2018, http://www.theguardian.com/technology/2018/oct/18/almost-50-of-the-world-is-online-what-about-the-other-50, accessed November 2018.

[2] Fareeha Ali, “A decade in review: E‑commerce sales vs. retail sales for 2007-2017,” Digital Commerce 360 | Internet Retailer, July 24, 2018, http://www.digitalcommerce360.com/article/e-commerce-sales-retail-sales-ten-year-review/, accessed November 2018.

[3] Jim Lecinski, Winning The Zero Moment Of Truth, PDF e-book, https://www.thinkwithgoogle.com/_qs/documents/673/2011-winning-zmot-ebook_research-studies.pdf, accessed November 2018.

[4] Uptin Saiidi, “Millennials are prioritizing ‘experiences’ over stuff,” CNBC, May 5, 2016, https://www.cnbc.com/2016/05/05/millennials-are-prioritizing-experiences-over-stuff.html, accessed November 2018.

[5] Chris Raphael, “How E-Commerce Can Use Predictive Marketing to Lift Sales,” RT Insights, September 4, 2015, https://www.rtinsights.com/predictive_marketing_tibco_19029/, accessed November 2018.

[6] Debbie Hauss, “Nordstrom Focuses On Mobile App, New Leadership Team To Engage Shoppers,” Retail Touchpoints, October 18, 2016, https://www.retailtouchpoints.com/features/retail-success-stories/nordstrom-focuses-on-mobile-app-new-leadership-team-to-engage-shoppers, accessed November 2018.

[7] Karin Muskopf, “Nordstrom Announces Investments In Digital Technology,” Nordstrom, Inc., March 8, 2018, http://press.nordstrom.com/phoenix.zhtml?c=211996&p=irol-newsarticle&ID=2337118, accessed November 2018.

[8] Tara Darrow, “Nordstrom Names Chief Innovation Officer to Focus on Stores of the Future; Names New President, Nordstrom Rack,” Nordstrom, Inc., January 9, 2017, http://press.nordstrom.com/phoenix.zhtml?c=211996&p=irol-newsarticle&ID=2236381, accessed November 2018.

[9] Phil Wahba, “Why Nordstrom Is Betting on High-Touch Tech,” Fortune, May 25, 2018, http://fortune.com/longform/nordstrom-high-touch-tech-fortune-500/, accessed November 2018.

[10] Janet Tu, “Nordstrom’s big, beautiful stores are losing ground,” The Seattle Times, February 19, 2017, https://www.seattletimes.com/business/retail/nordstroms-big-beautiful-stores-are-losing-ground/, accessed November 2018.

[11] The North Face, “Find the Perfect Jacket Using Watson Personal Shopper | The North Face,” https://www.thenorthface.com/xps, accessed November 2018.

[Cover Picture] Kurt Schlosser, “In shifting retail battle, Nordstrom acquires two tech startups to further boost its digital credibility,” GeekWire, March 8, 2018, https://www.geekwire.com/2018/shifting-retail-battle-nordstrom-acquires-two-tech-startups-boost-digital-credibility/, accessed November 2018.

In the short-term, Nordstrom can continue to optimize their online experience while promoting brands that are not available on Amazon. Big traditional retailers like Nordstrom are lagging behind pure e-commerce players in regards to user experience and ease of online shopping. An optimized futuristic storefront that seamlessly integrates with their online platform (similar to Bonobos) could give Nordstrom plenty more runway and competitive advantage in the coming years.

This was a very informative and great article! One competitive advantage I see that Nordstrom has over online retailers such as Amazon is the ability to provide a personal customer experience and direct relationship with customers – an advantage that can potentially be diluted as they shift towards more online sales. On this note, it is relevant to consider how sales employees can touch base with their key customers intimately through various point of sales (online, within the store) and offer specialised products that don’t necessarily cater to a segment of similar customers but individualised to one customer. How can customers trust that their key points of contact at a Nordstrom store to know exactly what they want and that there is still a personalised / authentic touch?

Thanks for this well-researched read! While I think Nordstrom has stayed ahead of the curve in terms of the customer experience (omni-channel integration and personalized service / recommendations as you described), I struggle to see how other retailers (like Amazon) and brands themselves can’t replicate this with enough capital and data. I would suggest that Nordstrom use machine learning to drive more private-label brands which are not only significantly higher margin but also defensible against Amazon if you can create enough brand equity around individual brands. While they already have a number of successes in this department (incl. Zella, their activewear brand, and more recent influencer-collaboration brands like Something Navy), I think they have room to further penetrate vs. third-party brands.

On other initiatives, I like your idea on leveraging machine learning to reduce in-store costs. I wonder if in addition to predicting store traffic and employee scheduling they’re also using ML to better predict what type of inventory to carry at which stores. I imagine that stores already merchandise to specific locations (i.e., carry more down outerwear in Maine vs. Florida), but it seems like they have the opportunity to be more precise with carrying exactly what they know consumers are looking for and when.

Such an interesting article. One competitive advantage could be diversifying their products on their website and optimizing their algorithms to suggest not only relevant clothing items, but also entire outfits that would match their personal style. That would be a major differentiating factor between Nordstrom and companies that are taking the Amazon approach.