Navigating the Storm: SEACOR and the Jones Act

A regulation that has long protected the U.S. maritime industry faces scrutiny in the aftermath of the catastrophic Hurricane Maria in Puerto Rico. Can U.S. shippers win the debate in Congress and withstand the fallout?

While rising isolationism around the world poses threats to many companies engaged in trade, one niche industry in the United States stands to benefit: the domestic shipping industry. The Merchant Marine Act of 1920, commonly referred to as the Jones Act, protects the U.S. maritime industry by requiring that any shipments between U.S. ports be made using American-built, American-owned, and American-crewed (“U.S. flagged”) vessels [1]. This arcane regulation recently entered the spotlight in the wake of Hurricane Maria which devastated Puerto Rico in September 2017. Many politicians, economists, and pundits blame the Jones Act for limiting the flow of relief goods to Puerto Rico (subject to the regulation as a U.S. territory) and are using this crisis to highlight broader concerns about the inefficiencies caused by the protectionist policy [2, 3, 4].

The conflict of the recent swell of anti-Jones Act sentiment with the broader rise of isolationism creates uncertainty for U.S. shipping companies such as SEACOR Holdings Inc. How can SEACOR, which has relied on the relative obscurity of the Jones Act, navigate the heightened level of public scrutiny and legislative uncertainty?

SEACOR’s Protected Business

SEACOR is a diversified holding company primarily in the shipping and logistics businesses [5]. SEACOR owns and operates 1,472 barges and 22 towboats for U.S. inland river shipping as well as 10 petroleum-carrying tankers and dozens of harbor and offshore tugs and barges [6]. In SEACOR ’s core businesses of inland and general shipping services, 87% of 2016 revenue came from coastwise trade within the United States protected by the Jones Act [7].

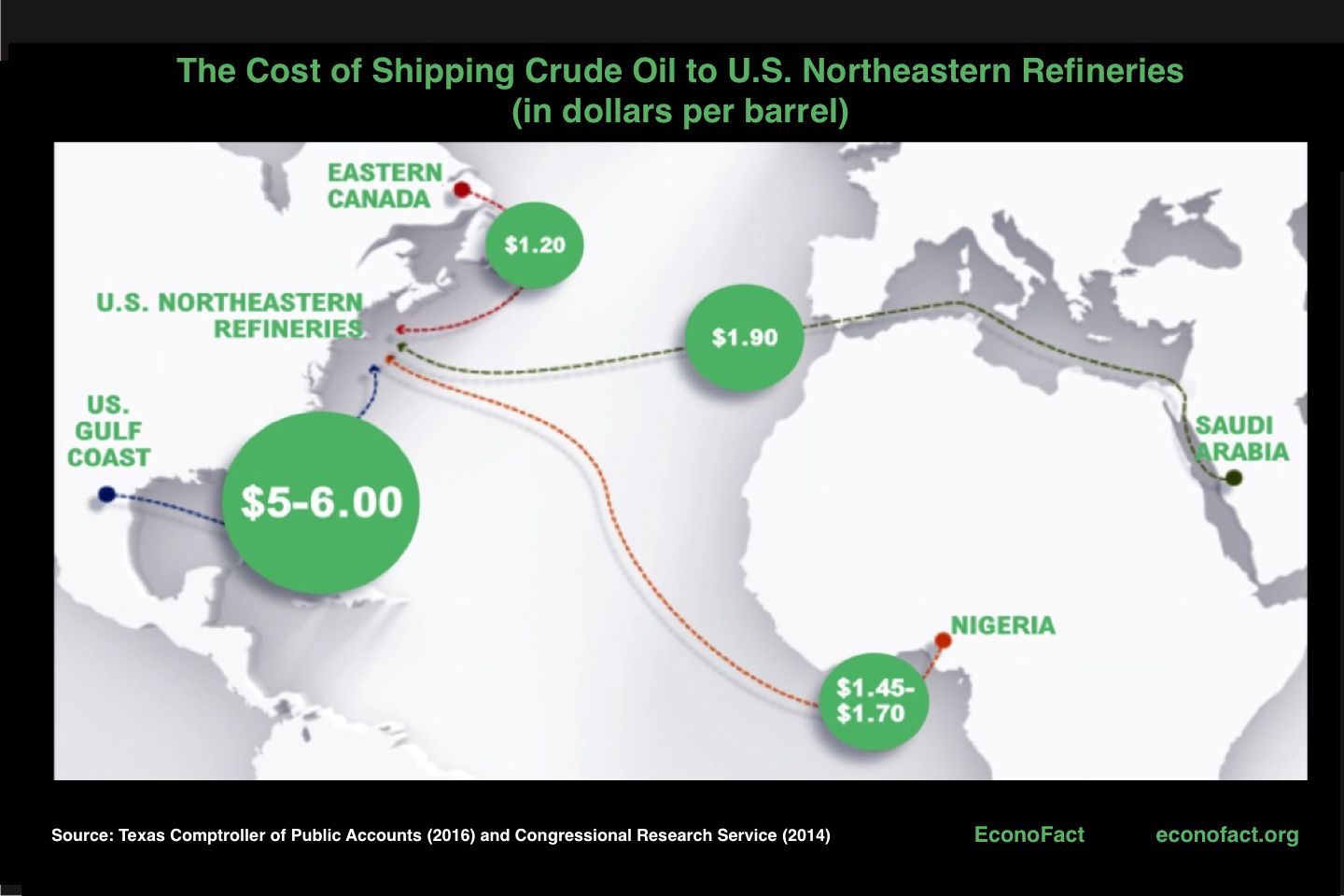

Since vessels engaged in this trade must be “U.S. flagged,” there is a limited supply of qualifying ships and no competition from lower cost international operators. SEACOR’s revenues are boosted and costs are covered by the higher price tag for transporting goods between American ports; in a 2012 report, the Federal Reserve Bank of New York estimated that shipping a twenty-foot container from the East Coast to Puerto Rico cost $3,063 compared to only $1,504 to the nearby Dominican Republic [8]. Higher prices are driven in large part by ship construction, which can cost four times as much in the U.S. as in foreign shipyards, as well as higher wages and benefits to U.S. crews [9]. Critics of the Jones Act claim that while a small constituency of companies such as SEACOR benefits from these dynamics, a vast group of consumers is harmed by higher costs (see figure above) and limited choice [10].

Defending the Industry

SEACOR acknowledges the possibility of a repeal of the Jones Act, listing it as a material risk factor in its annual 10-K reports [11]. To date, the company has focused its efforts on lobbying to defend protections for the domestic maritime industry. One of the company’s senior leaders sits on the Board of Directors of the American Maritime Partnership, a coalition of businesses in the U.S. shipping industry and leading advocate for its constituents’ shareholders and employees. The industry coalition has successfully combated previous attempts to repeal the Jones Act, such as one push by Senator John McCain in January 2015 [12].

SEACOR is also battling negative press from the crisis in Puerto Rico by making a concerted effort to publicly highlight its engagement in the hurricane response through press releases [13]. Likewise, the American Maritime Partnership has dedicated a section of its website to demonstrating the U.S. shipping industry’s service to Puerto Rico (see video from its webpage below) [14].

https://www.youtube.com/watch?v=t4-BdPYXKuY

Defending the Company

SEACOR, bolstered by a strong industry coalition and growing isolationist sentiment, may be able to weather the recent outburst against the Jones Act and survive without changing in the medium to long term. However, the company’s management should not rely on lobbying and public relations to ensure its ongoing competitiveness. Instead, SEACOR should focus on finding ways to either secure its revenue streams over longer-term contracts or improve its cost effectiveness in anticipation of a potential increase in competition.

SEACOR may need to team up with shipbuilders to invest in research and development for technologies that offer lower cost solutions and seek new ways to gain operating efficiencies. It may also benefit from launching or acquiring new lines of business that are not reliant on the Jones Act, perhaps international shipping operations or other equipment services that are demanded globally such as maintenance and repair. With a renewed focus on its business’ fundamentals, SEACOR may be able to cushion the potential blow of a repeal of the Jones Act and meanwhile improve its profitability.

Several important open questions remain. Can SEACOR management plan for the possibility of a Jones Act repeal without signaling a concession? Should SEACOR and its sister shipping companies elevate their appeals beyond Congress to the American public to gain ground support for this historic domestic industry?

(791 words)

Footnotes:

[1] Thomas Grennes, “An Economic Analysis of the Jones Act,” Mercatus Research, Mercatus Center at George Mason University (2017), http://mercatus.org, accessed November 2017.

[2] Niraj Chokshi, “Would Repealing the Jones Act Help Puerto Rico,” New York Times, October 24, 2017, https://www.nytimes.com/2017/10/24/us/jones-act-puerto-rico.html?_r=1, accessed November 2017.

[3] Sam Ori, “Puerto Rico’s Challenges After Hurricane Strengthen Case Against The Jones Act,” Forbes, November 7, 2017, https://www.forbes.com/sites/ucenergy/2017/11/07/puerto-rico-has-had-a-hard-time-getting-fuel-for-our-next-disaster-lets-fix-the-problem/#6f0770356646, accessed November 2017.

[4] Daniel Flatley, “Puerto Rico Oversight Official Backs Jones Act Exemptions to Boost Economy,” Bloomberg, November 7, 2017, https://www.bloomberg.com/news/articles/2017-11-07/puerto-rico-overseer-backs-jones-act-exemptions-to-boost-economy, accessed November 2017.

[5] SEACOR Holdings Inc., March 30, 2017 From 10-K, https://www.sec.gov/Archives/edgar/data/859598/000085959817000047/ckh-12312016x10k.htm, accessed November 2017.

[6] SEACOR Holdings Inc., “Investor Fact Sheet,” https://d1io3yog0oux5.cloudfront.net/seacorholdings/media/e517aaa3cee3aed6f8c1039f62172fda.pdf#zoom=100, accessed November 2017.

[7] SEACOR Holdings Inc., March 30, 2017 From 10-K, https://www.sec.gov/Archives/edgar/data/859598/000085959817000047/ckh-12312016x10k.htm, accessed November 2017.

[8] Jaison Abel et al., “Report on the Competitiveness of Puerto Rico’s Economy,” Federal Reserve Bank of New York (June 2012), https://www.newyorkfed.org/, accessed November 2017.

[9] John Frittelli, “Shipping U.S. Crude Oil by Water: Vessel Flag Requirements and Safety Issues,” Congressional Research Service (July 2014), https://fas.org/sgp/crs/misc/R43653.pdf, accessed November 2017

[10] Dan Bergstresser (Brandeis University) and Mark Melitz (Harvard University), “The Jones Act and the Cost of Shipping Between U.S. Ports,” Econofact.org (October 2017), http://econofact.org/, accessed November 2017.

[11] SEACOR Holdings Inc., March 30, 2017 From 10-K, https://www.sec.gov/Archives/edgar/data/859598/000085959817000047/ckh-12312016x10k.htm, accessed November 2017

[12] Dan Bergstresser (Brandeis University) and Mark Melitz (Harvard University), “The Jones Act and the Cost of Shipping Between U.S. Ports,” Econofact.org (October 2017), http://econofact.org/, accessed November 2017.

[13] “SEACOR Holdings Businesses Engage in Hurricane Response and Relief Efforts,” SEACOR press release (Fort Lauderdale, FL, October 17, 2017).

[14] American Maritime Partnership, “Puerto Rico Service,” https://www.americanmaritimepartnership.com/puerto-rico-service/, accessed November 2017.

A fascinating read on a company that appears to only make financial sense because of a single piece of protectionist legislation. In the event of a Jones Act repeal, is it even possible for SEACOR to survive? Your recommendation for SEACOR to expand into lines of business not dependent on the Jones Act is a good one; it does make me wonder, though, whether they are remotely cost competitive in a global market. You ask whether the company should pursue a public campaign to defend their position and create a coalition of supportive voters. My instinct, despite the American Maritime Partnership’s skillful propaganda video, is that the Jones Act is most likely to survive if it disappears from the public eye. A public campaign would be countered by opponents pointing out the consumer impact of the cost differential between American and international shipping rates. Given stagnation in Congress, the Jones Act — like gun legislation — is likely to remain unaffected as the publicity storm passes.

A very insightful analysis on this fascinating topic. Jones Act was one of the strangest regulations I have encountered in international trade, and as you rightly highlighted, it creates significant distortion in charter market, ultimately pushing the burden of higher costs to the US companies. One bizarre case I have encountered was shipping of US raw materials from US mainland to Hawaii, where US suppliers are restricted to use US flag vessels which were (i) highly limited in availability, and (ii) priced exponentially higher than the international rate. The distortion was so significant that the supplier was simply unable to ship their product to Hawaii most of the time, while the supplier’s product and price would otherwise be most competitive in the international market (the buyer often ended up buying Indonesian material). I would like to highlight that while I am not familiar with SEACOR’s exact portfolio of vessels, freight market in general is under significant cost pressure, and the international freight giants have been operating at loss for significant period of time (bankruptcy of Hanjin was a particularly dramatic event). In the last decade, shipping companies have gone through restructuring, consolidation and many other forms of cost cutting, therefore I imagine that it would be extremely difficult for SEACOR to be competitive overnight in spite of various measures of innovation. On the other hand, shipping market is cyclical, and recent downturn has drastically reduced the number of vessels under construction, therefore it may be possible for US regulators to time easing of regulations so the domestic carriers will be exposed to less competitive landscape (for dry bulk vessels, 2019 – 20 is generally thought to be a good turning point).

Very interesting read, as I was unaware of the the Jones Act. The intent of this policy is clearly in line with the current isolationist movement led by the Trump administration, so SEACOR should feel safe in the short-term. However, I would leverage this current tailwind of support to further solidify its position and mitigate the material risk an appeal presents. SEACOR and its sister companies should ramp up spend to bolster lobbying support to try and create any additional security around the Act that they can obtain. The administration and its platform will be supportive and success is likely.

Interesting, well researched piece. ‘Stroke of the pen’ risk can be difficult to manage as an operator and even harder to value as an investor. Rather than being comfortable with the current regulatory environment, I agree with the author that SEACOR should position itself with longer term investments that would enable the company to continue thriving in an environment without the protections afforded by the Jones Act. One way to achieve this industry positioning is to purposefully lower margins in the near/medium term to fund the R&D spend that would enable the development of more cost effective assets. In addition to remaining competitive inside of the US, the resulting cost effectiveness would also increase SEACOR’s long term competitiveness in international trade.

SEACOR’s economic gains from the Jones Act provide yet another example of the market distortions created by isolationist policies. Your recommendations to SEACOR are strong – specifically your proposal to engage in more long-term contracts and invest in research and development to achieve operating efficiencies. However, I’m skeptical that SEACOR would proactively work toward them in the short or long term. The experience of the Export-Import Bank (which provides cheaper financing to large American manufacturers, such that they can be competitive globally) is relevant here. While pressure exists to close the Bank, it has remained active because of effective lobbying by large manufacturers. With that as a comparison point, I wonder if SEACOR would actually overcome inertia and improve its operations at a fundamental level, versus spending cash on a solution (lobbying) that seems to be effective.

https://www.forbes.com/sites/dougbandow/2014/05/05/close-the-export-import-bank-cut-federal-liabilities-kill-corporate-welfare-promote-free-trade/#5c42ffbb3166

Extremely interesting commentary on an under reported regulation that causes distortions in US trade. The Jones Act, from my vantage point, does seem to be a strategically important piece of legislation from a national security perspective. A healthy and vibrant shipbuilding community in the US would appear to me to be strategically important in times of war or distress. But, it strikes me that there appears to be less supply of domestic ships and crews than necessary. I understand that shipbuilding costs are higher in the States than elsewhere, but it appears that constraints on supply are more a function of less ships than necessary for the level of trade. If I were SEACOR I would aggressively target the under-served domestic market, rather than trying to diversify internationally. I would focus on streamlining operations to push costs down, but attempt to position your fleet within ports and markets that have high charter prices. Rather than viewing this legislative framework as a risk, I’d exploit the opportunity while it exists. What do you think about increasing supply domestically? Do you think that there is a market opportunity to exploit opportunities like the one mentioned in Motoaki’s comment?

Great read! In an environment of increasingly protectionist trade rhetoric (notably in the UK and US), it’s interesting to ponder the repeal of an archaic, protectionist policy in the US. It seems likely that SEACOR can play on both fronts – increasing it’s competitiveness in the US market while continuing to lobby behind the scenes for a protectionist policy it clearly benefits from. For example, working to cut costs would benefit the company regardless of its competitive environment. Given gridlock in Congress and the tilt in political winds toward increasing rather than decreasing barriers to trade, it seems unlikely that the Jones Act will be going away anytime soon. Interesting to note, there are fewer than 100 ships that make up the fleet covered by the Jones Act![1] While protecting this industry raises costs for American consumers, given it’s small size it’s unlikely to attract much attention from a distracted American government anytime soon.

[1] “Puerto Rico’s Challenges After Hurricane Strengthen Case Against The Jones Act,” Forbes, Nov 2017 (https://www.forbes.com/sites/ucenergy/2017/11/07/puerto-rico-has-had-a-hard-time-getting-fuel-for-our-next-disaster-lets-fix-the-problem/#3f4585b36646)

Very interesting read. The current situation, although very protective of the company, could literally change the company’s fate in an instant. That said, it is still unclear why such legislation would change in the near future. The company is unlikely to survive in the situation where the regulation changes, however, there does not seem a sign for it. Such change will create a ripple effect that is probably deemed too risky by any political party, and opposition with the public opinion in topics about employment, and international competition have not been very popular. In other words, this does not seem like a fight that anyone might be willing to jump into at the current period of time.

To me, this is an example of the disparity in enforcing free trade. A country like the US can impose penalties on countries that, in the opinion of the US, are engaging in dumping. However, the US exhibits some highly protectionist regulations such as the Jones Act. The Puerto Rico example highlights the inefficiencies – sometimes severe and lethal – that isolationism produces, inefficiencies that are sometimes hard to assess in the abstract.