Munich RE’s Risks Rise with our Oceans

Munich RE needs to react to climate change's impact on rising ocean levels and the increased damaged caused by flooding.

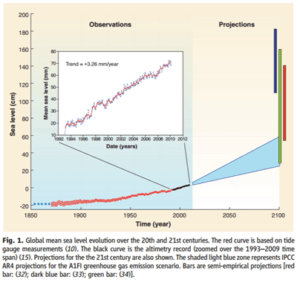

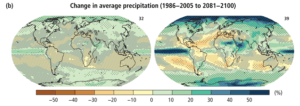

Munich RE, one of the largest re-insurers in the world, is already feeling the pressure of climate change. In fact, over Munich RE’s 136-year history, the global sea level has risen five and a half feet (1.7m)[1] and the five year rainfall average was more than 1.5 inches in 2011-2015 than it was in 1901-1905[2]. This combination of increased water levels and precipitation has and will continue to lead to increased flooding and subsequent property damage that Munich RE needs to appropriately factor into its actuarial tables in order to appropriately price their risk premiums.

This vulnerability does not go unnoticed by the company. In its 2015 Annual Report, Munich RE singles out climate change as “one of the greatest long-term risks of change for the insurance industry. [3]” This worry is not unfounded as average global flood losses are expected to rise from their 2005 levels of roughly $6 billion per year, to $52 billion per year in 2050[4], a nearly nine-fold increase. Accurately pricing this increased damage will be paramount to Munich RE’s continued success. If they understate the risk, they may find themselves struggling for solvency. Over the past five years, Munich RE has a net profit margin of 8%, leaving it a slim buffer for absorbing increased claims expenses[5]. Unfortunately, the cost of our rising oceans is likely to be an ongoing problem. As the sea level continues to rise, the cost of each incremental inch increases[6].

Fortunately, Munich RE is not taking climate change lying down. In 2008, the company founded the Corporate Climate Center (CCC) whose mission is to accurately assess the risk posed by climate change to Munich RE’s business, develop risk transfer solutions for the company’s clients, as well as invest in projects that mitigate or slow the effects of climate change[7]. Through the Corporate Climate Center, Munich RE has taken an area that poses risk to their business and attempted to both mitigate its effects and develop revenue generating products and investments.

While the CCC is an excellent first step in mitigating the risk that climate change poses to its business, Munich RE could consider increasing its on-the-ground presence ahead of extreme weather events. Preparing a home, business, or vehicle for flooding or extreme weather events can severely decrease property damage incurred and government agencies such as FEMA or state officials are unable[8] [9] or unwilling[10] to respond. Providing emergency preparedness for areas in which they have outsized exposure could have a significant impact on the claims filed for the impacted areas.

Munich RE has done an excellent job at recognizing and rising to the challenge of climate change. The challenge will be to continue to evolve its understanding and the impacts the changing climate will have on its business and its customers. It’s inevitable that climate change will cause increased damage as precipitation levels continue to climb, extreme weather events become commonplace, and ocean levels continue to rise. How Munich RE reacts to these new challenges will define how this one century old company weathers its second.

[699 Words]

[1] Pachauri, Rajendra; Meyer, Leo, 2014. Climate Change 2014: Synthesis Report. IPCC, 1, 42.

[2] EPA, 2016. Climate Change Indicators in the United States. EPA, 4, 22.

[3] Munich RE, December 31, 2015 Annual Report via Company Investor Relations, accessed November 2016

[4] Hallegatte, Stephane; Green, Colin; Nicholls, Robert, 2013 Corfee-Morlot, Jan. Future Flood Losses in Major Coastal Cities. Nature, 3, 3.

[5] Munich RE, December 31, 2015 Annual Report via Company Investor Relations, accessed November 2016

[6] Boettle, M, 2016. Quantifying the effect of sea level rise and flood defence – a point process perspective on coastal flood damage. Natural Hazards and Earth System Sciences, 1, 1-3.

[7] Munich RE. 2016. Climate change & climate protection | Munich Re. [ONLINE] Available at: https://www.munichre.com/en/group/focus/climate-change/mission-and-vision/mission/index.html. [Accessed 2 November 2016].

[8] Greg B. Smith. 2011. New Yorkers hit hard by Hurricane Sandy denied aid by FEMA bureaucracy. [ONLINE] Available at: http://www.nydailynews.com/new-york/new-yorkers-denied-aid-fema-bureaucracy-article-1.1211634?print. [Accessed 2 November 2016].

[9] Sandi Doughton and Daniel Gilbert. 2016. Washington state’s plan for megaquake ‘grossly inadequate,’ review finds. [ONLINE] Available at: http://www.nydailynews.com/new-york/new-yorkers-denied-aid-fema-bureaucracy-article-1.1211634?print. [Accessed 3 November 2016].

[10] Perry Chiaramonte. 2012. EXCLUSIVE: FEMA teams told to ‘sightsee’ as Sandy victims suffered. [ONLINE] Available at: http://www.foxnews.com/us/2012/12/07/exclusive-fema-teams-told-to-ightsee-as-sandy-victims-suffered.html. [Accessed 3 November 2016].

It is interesting to learn how Munich RE is contributing to projects that protect against climate change though I’m very curious how their pricing and underwriting models are evolving to accommodate the associated uncertainty. When considering some of the ‘bull whip’ lessons from our supply chain simulation this week, I am thinking how some of those lessons may transfer to and take life in the reinsurance industry… which is admittedly an industry that is unfamiliar to me.

Max—I understand the point that climate change will increase the risk of natural disasters and the total aggregate cost of weather-related damages (to both insured and non-insured). But why is this risk not already factored into the premiums that these insurance companies charge? In other words, if I believe the risk of a hurricane causing damage in a certain book of business, why would I not adjust the premiums upward accordingly to account for this risk such that my overall profitability does not change? Taking it a step further, in theory insurance companies exist to profit off people’s aversion to risk, so could increasing risk from climate change result in more insurance opportunities for these businesses?

Max,

Outstanding read! You mention that “Munich RE could consider increasing its on-the-ground presence ahead of extreme weather events.” This could obviously help reduce the claims they receive, thus increasing return to shareholders. For a business whose profit is almost entirely predicated on minimizing the occurrences of natural events occurring to their customers, do you feel that Munich RE is doing enough to prevent these events from happening in the first place? It seems like it might benefit their bottom line if they took a proactive approach to mitigate the causes of climate change, rather than simply address the effects of said change.

Max,

I can say “I appreciate Munich RE’s efforts to anticipate climate change” in so far as they have to make such efforts in order to keep up with competitors today. However, I believe that their efforts to establish the CCC are entirely absurd. While we have extraordinary computing powers available to businesses today, which might enable a company to run simulations in millions of scenarios, there is no historical basis on which we can compare and predict how climate change will actually impact such a large scale business. I feel that it would be better to pursue a “survival of the fittest” approach by segmenting their businesses geographically and praying that they are spared as the sea rise and the skies darken. It is futile for them to try and predict the future.

It would be interesting to know how the dialogue between insurance companies and reinsurance companies has evolved around climate change.

Who in general should be responsible for taking on this additional risk? Should reinsurance companies like Munich Re increase the premiums they charge insurance companies to take into account this additional risk posed by climate change? and, should insurance companies then in return pass on this surcharge on the premium to the insured?

Interesting post, Max. After reading this, I couldn’t help but wonder about Munich RE’s pricing power – will/can its customers ultimately bear the majority of the costs related to climate change? In other words, insurance companies with high exposure to extreme-weather prone areas are at the mercy of climate change, and as you pointed out above, Munich RE’s slim margins will force the company to raise its premiums, unless it finds a way to minimize weather-related damages. Or will insurance companies need to change their business model to share the costs of climate change and remain solvent?

Natural disasters are becoming increasingly severe due to climate change and will only continue to get worse in the future. As far as the US is concerned, by far the biggest natural disaster risk is that from hurricanes, which historically have accounted for approximately half of total insured losses. Some of that risk can be offloaded to capital markets through catastrophe bonds and related investments (approximately $72 billion, which is about 12% of the $565 billion capital in reinsurance), but overall I think that most insurers will be left with little choice and would need to increase their premiums in anticipation of the greater number of severe hurricanes (and other natural disasters).

http://www.wsj.com/articles/the-insurance-industry-has-been-turned-upside-down-by-catastrophe-bonds-1470598470