Maersk Shipping: Melting ice caps to open faster and cheaper arctic shipping routes?

Stormy seas ahead for the world's largest container shipping company?

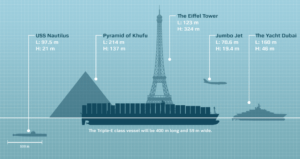

A steady decline in summer arctic sea ice over the past three decades (Figure 1) has opened up a new opportunity for maritime shipping companies to shorten their routes from Asia to Northern Europe. This route, known as the Northeast Passage, reduces the distance travelled by 30%, cutting fuel and other shipping costs for carriers [1]. Seventy-one cargo ships made the trip during the summer of 2013, up from only four in 2010. Despite the recent increase, these figures are still far less than the 17,000 trips made through the Suez Canal annually. Even if this arctic shipping lane remains a minor portion of total trade in the near-term, Maersk Line – the world’s largest container shipping company [2] – has already begun to manage the implications of climate change on their operations.

Figure 1: Arctic Summer Ice Coverage

Industry Background

80 percent of global trade by volume is transported by sea and handled by ports worldwide [3]. Given the close link between trade and macroeconomic growth, maritime shipping volume closely correlates with GDP growth. However, over the past several decades global shipping volumes have increased at a rate roughly twice that of global GDP growth due to the effects of globalization [4]. This staggering growth requires a massive fleet of diesel-fueled cargo ships that contribute to 2-3% of global CO2 emissions, nearly twice as much as the airline industry [5].

Maersk Today

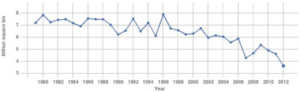

Maersk Line has already begun to grapple with climate change, most notably in their goal to reduce GHG emissions per container in their 611-ship fleet 60% by 2020 relative to 2007 [6]. To this end, Maersk christened a new class of ships in 2013 known as the “Triple E” (Figure 2), which stands for “economy of scale, energy efficient, and environmentally improved” [7]. The design cuts emissions through a combination of size and design advances that reduce the overall per unit environmental impact of cargo transport, winning Maersk “Sustainable Ship Operator of the Year” in 2011 [8]. At the time, these were the largest container ships in the world but have since been surpassed by even bigger variants. However, given the 20-30 year lifespan for a typical vessel, rapidly replacing the entire fleet is not economically feasible. To supplement new builds, Maersk is investing over $1 billion to retrofit their existing fleet with more fuel efficient engines and other technological upgrades, such as enhanced propellers and bulbous bows [9].

Figure 2: Triple E Class Ship

Maersk is also relying on other less investment intensive emissions reduction tactics to meet their aggressive 60% reduction goal. “Slow steaming” is an operational strategy that means running ships at less than their maximum speed, which can reduce emissions and fuel costs [10]. Recent increases in computing horsepower and the widespread adoption of GPS have also spawned route optimization efforts using Big Data. In 2014, these purely digital efforts resulted in an emissions reduction of 125,000 tons of CO2 [9]. Together, these strategies have resulting in a relative emissions reduction of over 40% for Maersk, which is 10% ahead of competitors based on benchmark studies [9].

Impacts in the Future

Despite Maersk’s current efforts to reduce emissions, a realistic assessment of climate change evidence suggests that even with globally coordinated efforts to reduce carbon emissions it is unlikely humanity will be able to prevent a global mean temperature increase of 2-4°C over the course of the 21st century [11]. As a result, Maersk will face new operating challenges from the impacts of climate change. Ports will be impacted by rising sea levels and require significant investment to remain functional [12]. The required upgrade costs will be partially passed on to Maersk in the form of higher berthing and other port-related fees. While no model can accurately predict the impact of climate change on specific weather systems, changes in metocean conditions along major trade routes could add uncertainty and cost in the future. In the most extreme climate change scenarios, trade pattern changes due to human migration and agricultural shifts could add variability to Maersk’s operations.

Rough Seas Ahead?

Even if a global regulatory framework is adopted that applies a cost to carbon sufficiently high to prevent a 2°C impact (e.g. carbon tax, cap and trade), Maersk still faces a challenging future as such a cost would likely put downward pressure on global trade growth. These policies would also increase operating expenditures for Maersk directly through their GHG emissions and indirectly from higher fuel costs due to higher passed through diesel production costs.

However, despite climactic and macroeconomic uncertainty, Maersk’s proactive measures demonstrate both resiliency and adaptability. Even with the headwinds of climate change in the 21st century, Maersk is charting a course for sustainable success.

Word Count: 770

Sources:

[1] Retrieved November 03, 2016, from http://www.cfr.org/arctic/thawing-arctic-risks-opportunities/p32082

[2] Sustainability. Retrieved November 04, 2016, from http://www.maerskline.com/en-us/about/sustainability/low-impact-shipping/low-impact-shipping

[3] Review of Maritime Transport 2015. (2015). United Nations Conference on Trade and Development.

[4] World Ocean Review. Retrieved November 04, 2016, from http://worldoceanreview.com/en/wor-1/transport/global-shipping/

[5] Endresen, Ø, Eide, M. S., Dalsøren, S., Isaksen, I. S., & Sørgård, E. (2007). The environmental impacts of increased international maritime shipping – Past trends and future perspectives. Lecture.

[6] (2016). This is Maersk Line. Retrieved November 04, 2016, from http://www.maerskline.com/

[7] www.maersk.com, Mærsk -. “Follow the Construction of These Giant Vessels.” Triple E. N.p., n.d. Web. 04 Nov. 2016.

[8] “UK: Second Sustainable Shipping Operator of the Year Award for Maersk Line.” World Maritime News. N.p., n.d. Web. 4 Nov. 2016.

[9] Low Carbon Future. (n.d.). Retrieved November 4, 2016, from “Low Carbon Future.” N.p., n.d. Web. 4 Nov. 2016. http://www.maerskline.com/~/media/maersk-line/Countries/int/Images/Sustainability/low-carbon-future.pdf

[10] Liang, L. H. (n.d.). The economics of slow steaming. Retrieved November 04, 2016, from http://www.seatrade-maritime.com/news/americas/the-economics-of-slow-steaming.html

[11] Summary for Policymakers, In: Climate Change 2014, Mitigation of Climate Change,” Intergovernmental Panel on Climate Change, 2014, p. 13, https://www.ipcc.ch/pdf/assessment-report/ar5/wg3/ipcc_wg3_ar5_summary-for-policymakers.pdf, accessed August 2016.

[12] Becker, Austin H., et al. “A note on climate change adaptation for seaports: a challenge for global ports, a challenge for global society.” Climatic Change 120.4 (2013): 683-695.

This article succinctly presents the current challenges faced by one of the industries most reliant on current fossil fuels. While Maersk is showing real leadership in striking a balance between efficiency and environmentalism, and even adopting new routing based on the current realities, I question whether it is too little too late. Given the fact that is is “unlikely” that we will be able to prevent global climate change in the next 20-30 years, I wonder if it would make more sense to invest more in innovative technologies and more sustainable energy solutions rather than focusing on optimizing current processes to reduce overall emissions. Either way, this seems like a pretty daunting challenge for the shipping industry.

I agree that we are generally way too late in addressing climate change, yet it seems inefficient to ask a shipping company to invent new ways of generating energy – that should be left up to others. And in the meantime, we still need shipping!

That said, the Triple E vessels are a significant innovation within sustainable shipping. The ship hauls are shaped very differently from conventional ships, and their engines are engineering marvels in themselves! A huge step forward.

Yay – great article!

An interesting aspect of the slow-steaming strategy is that Maersk has realized that customers – if they must choose – will prefer “timeliness” over “speed” of arrival. (Essentially everyone agrees that variability is the greatest pain of all)

Thus, it has been extremely important for Maersk to couple it’s slow-steaming strategy with a promise to always be on time. Maersk has proven that it can achieve this by demonstrating by far the best “on time” rates in the industry.

Really cool article! Before I started reading it, I assumed that climate change would simply be disastrous to Maersk but it never occurred to me that the ice caps melting could actually create new opportunities for shipping lines and drastically change the way they operate!

This financial times article (https://www.ft.com/content/f44bd53a-2e74-11e3-be22-00144feab7de) talks through some of the difficulties in using the Northeast passage and they seem to be related to having to use ice-breakers or accurately predicting when the route is safe enough to cross. With the slow advent of micro-satellites and underwater autonomous vehicles, I wonder if it would be possible to get higher quality imagery of the route both above and under water to provide the type of data to make such a route more feasible for more ships to pass through.

Micro satellites are a new category of satellites that a few space startups have “launched” (pardon the pun) with the goal of democratizing satellite imagery of the globe. See: http://www.economist.com/blogs/babbage/2014/01/tiny-satellites

Thank you for a very informative article! Regarding the opening of the the Northeast Passage, I wonder how much of the time and money saved can be captured by Maersk? I presume that shipping today is priced based on some combination of weight/volume multiplied by the duration/cost of the journey. If there is a shorter journey through the Arctic Circle, do you think customers would expect Maersk to pass this saving onto them in its entirety? Given the commodity-like nature of shipping, I see this is as a risk. If it is a risk, is there a way to minimize it by establishing some sort of proprietary advantage that locks out competitors (e.g. special ice-breaking super-tankers, or special berthing rights at ports in the Arctic Circle)?