Land Ho! Howard Hughes Should Keep Watch for Drier Real Estate

Will waterfront properties continue to trade at a premium given the rising frequency of superstorms? How should real estate developers, such as Howard Hughes Corporation, re-think inventory and portfolio allocation?

Howard Hughes Corporation (HHC) is a developer and operator of Master Planned Communities (MPCs), which are small cities located across the US. HHC meticulously plans each MPC, building residential and commercial properties, attracting tenants, and selling land/condos to third-party developers. Inventory for HHC takes the form of land and buildings which are held for years or decades before being sold. Because HHC holds this inventory for so many years and its value changes based on supply/demand, long-term trends such as climate change will play a crucial role in the monetization of the Company’s assets.

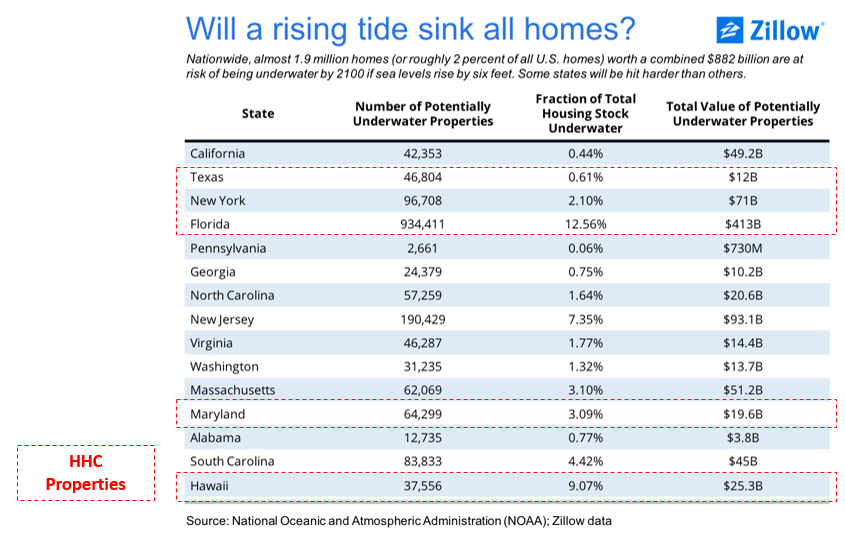

The impact of climate change on real estate inventory is a newly emerging topic. The question remains as to whether people will change their geographic preferences because of climate change. Hugh Gladwin, professor of anthropology at Florida International University, believes that “there’s extra value in [coastal] property, [but] climate change, insofar as it increases risks for those properties from any specific set of hazards — like flooding and storm surge — will decrease value [1].” This sentiment was also addressed by the Scientific American, claiming that “real estate investment may no longer be just about the next hot neighborhood, it may also now be about the next dry neighborhood [1].” Unfortunately for HHC, its portfolio of assets contains properties in Houston, Maryland, Miami, Hawaii, and New York, among other cities. These states have some of the highest predicted property losses in the country, according to data compiled by NOAA and Zillow below [2]:

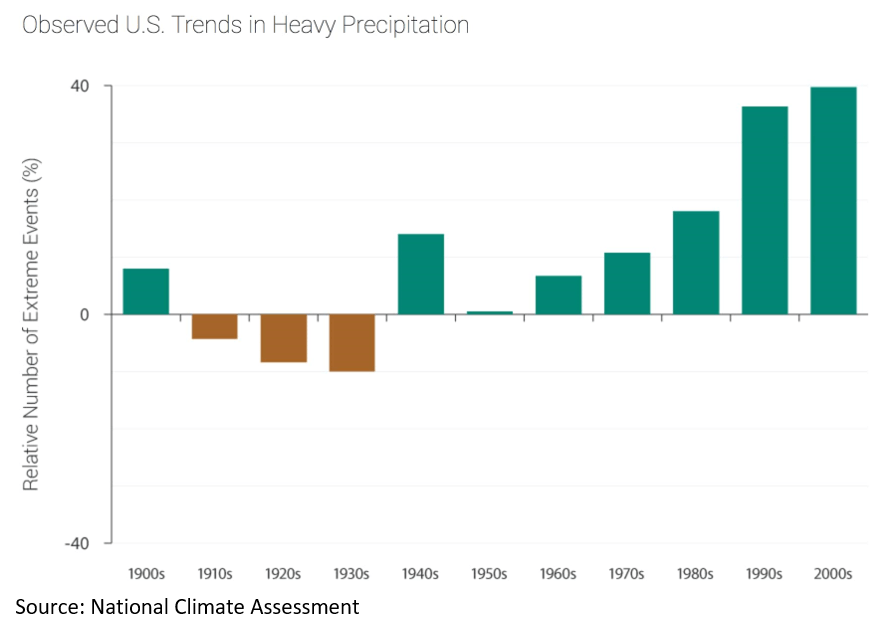

Exacerbating the risk potential for HHC is the rising frequency of heavy precipitation events. According to data compiled by the National Climate Assessment below, the 2000s saw 40% more heavy precipitation events than the average decade from 1900-1960 [3].

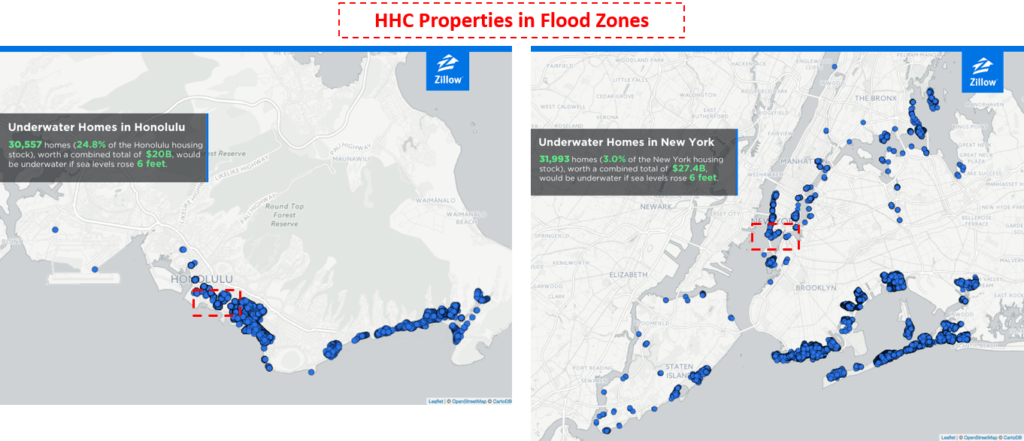

Houston in particular has experienced three 500-year floods (floods that have a 1 in 500 chance of occurring) in the last three years [3]. Currently, HHC’s largest MPC is called the Woodlands, which is located ~30 miles north of Houston. Despite the recent storms, HHC management is committed to environmental sustainability in the Woodlands. The Woodlands vision statement begins with: “The Woodlands, our dynamic hometown within a natural forest, is known for its balance between man and nature.” In bringing this vision to action, HHC invests meaningfully in environmental education programs, recycling programs, and water/forest preservation [4]. In addition to these actions, Management is keenly focused on building LEED certified properties (environmental sustainability certification). The Company’s Ward Village MPC in Hawaii is the largest Platinum Certified LEED Neighborhood Development (LEED-ND) project in the country and the only LEED-ND Platinum Certified project in Hawaii [5]. Broadly speaking, management is very much focused on operating sustainably within its current asset portfolio. Going forward, a key focus will be managing the geographic composition of HHC’s coastal property portfolio in light of climate change.

In Houston and Maryland, HHC’s MPCs are in close proximity, but not directly in harm’s way, of hurricanes and floods. Management has indicated it is confident in the safety of its Houston properties from storms, as all development is done beyond the 100-year flood line. These property values could benefit from Houston citizens moving to the neighboring Woodlands because of the rising frequency of storms in Houston, as noted above. In Hawaii and New York, HHC’s properties are waterfront and very much in hurricane/flood zones (flood zones in each city are indicated by blue dots below) [2]. From a strategic perspective going forward, it could be important for HHC to consider potentially monetizing these assets sooner rather than later.

Rather than investing in waterfront properties in the US, HHC should consider shifting its inventory internationally. According to Michael Bloomberg, “Cities that can harness public and private capital and competency to build out efficient infrastructure will be far more competitive than their less prescient peers in rapidly urbanizing 21st century [6].” One example of such a city is New Songdo City in South Korea. The city is newly constructed and centered around a park, “with 40% of the city being designated as green, all buildings LEED certified, an extensive public-transport network, a fleet of electric water taxis on its Venice-like canals, high-speed rail to Seoul, and minimal accommodation to automobiles [6].” HHC can leverage its experience with developing environmentally friendly cities to shift its supply chain to countries such as China and India, which would benefit massively from a city planned like New Songdo City.

HHC may be uniquely positioned to take advantage of this trend. Key elements of HHC’s success in foreign markets will be: (i) the transferability of HHC management’s know-how from developed markets in the US to emerging markets such as China/India, and (ii) regulatory/legal restrictions on US companies owning/developing large pieces of property in emerging markets. (783 words)

References

[1] Climatecentral.org. (2017). Here’s How Climate Change Could Turn U.S. Real Estate Prices Upside Down. [online] Available at: http://www.climatecentral.org/news/climate-change-us-real-estate-prices-21720 [Accessed 14 Nov. 2017].

[2] Zillow Research. (2017). Climate Change and Housing: Will a Rising Tide Sink All Homes? – Zillow Research. [online] Available at: https://www.zillow.com/research/climate-change-underwater-homes-12890/ [Accessed 14 Nov. 2017].

[3] Washington Post. (2017). Analysis | Houston is experiencing its third ‘500-year’ flood in 3 years. How is that possible?. [online] Available at: https://www.washingtonpost.com/news/wonk/wp/2017/08/29/houston-is-experiencing-its-third-500-year-flood-in-3-years-how-is-that-possible/?utm_term=.5847485323b1 [Accessed 14 Nov. 2017].

[4] Thewoodlandstownship-tx.gov. (2017). Environmental Services | The Woodlands Township, TX. [online] Available at: https://www.thewoodlandstownship-tx.gov/105/Environmental-Services [Accessed 14 Nov. 2017].

[5] Businesswire.com. (2017). Ward Village Becomes the Largest LEED-ND® Platinum Certified Neighborhood in the United States. [online] Available at: http://www.businesswire.com/news/home/20131127005484/en/Ward-Village-Largest-LEED-ND%C2%AE-Platinum-Certified-Neighborhood [Accessed 14 Nov. 2017].

[6] HBS Working Knowledge. (2017). Designing Cities for a Sustainable Future. [online] Available at: https://hbswk.hbs.edu/item/designing-cities-for-a-sustainable-future [Accessed 14 Nov. 2017].

Great piece! I agree with your assertion that heading internationally makes sense, it seems like HHC is in a great position to take advantage of the rapid urbanization occurring overseas.

You mentioned that the business model is based on the ability to sell its properties to third-party developers, and I’m curious what path you’d recommend with their currently owned real estate. Their last 10K had fixed assets pegged at ~$4.7 billion, which is a pretty large amount of real estate holdings compared to its market cap of ~$5.5 billion. If I were a developer and read this article, I would be weary about investing in some of these recently built properties near the water and may look to follow the same strategy you laid out above. In light of that, do you think it’d make sense for HHC to rush and sell its inventory now, even if it means taking a small loss? Or should it continue to go about its usual business and hope the inventory sells similarly to how it has in the past? While I’d be worried about holding onto inventory that may be worthless with rising sea levels, the signal that a below-market sell off would give to both customers and investors doesn’t sound a whole lot better.

Fascinating article! While some aspects of an international growth strategy are certainly compelling, I would be worried about the ability of management to understand local customs and consumer behaviors well enough to win against entrenched competitors, such as Shui On Land in China. Coupled with the regulatory and legal restrictions of foreign owned/operated entities in many emerging markets, I do not think an international focus would be wise to pursue.

Given how little penetration HHC has thus far in the US market, there are plenty of domestic opportunities for the company to diversify their portfolio away from locations of high risk due to rising sea levels. Cities such as Denver, Phoenix, and Nashville are more insulated against adverse effects of climate change than coastal properties in Miami or Hawaii. I do agree with you assertion that HHC should evaluate reducing the holding period for high risk assets. However, as Matt points out above, anything deemed by customers or investors to be a fire sale today could have negative implications for future projects. In addition, with the existing high demand and thus price premium for water-front properties, I think it would be unwise for HHC to entirely abandon developing coastal properties altogether.

Growing up in one of the MPCs and experiencing Houston’s three 500-year floods, I enjoyed reading your piece.

One important note to add would be about the impact of city development on perceived flood severity; many of Houston’s floods have been caused by old drainage systems and outdated flood plain mapping. Two major contributors: home flipping (arguably spurred by the popular HGTV show Fixer Upper) causing homes to not be remodeled to code, and four 3-story town homes taking the place of a small, single family home with yard. Going forward, if I was HHC I would be careful to keep flood plain mapping up to date during development, and in all communities consider designing drainage systems with a larger safety factor so they do not become obsolete.

I think Matt Michel made a good point about the decision-point facing management on what to do with properties increasingly at risk of experience climate-related events. If I were valuing these properties, these concerns would manifest themselves in reduced revenues in the future, but the question that would define the discount at which these properties would need to be sold would be ‘how far into the future?’ If the view is that these storms will continue to worsen in the next ten years, then the NPV of the projects would be greatly less than if the view is that these storms will not worsen significantly for another fifty years. Given the bar chart in the graph, I would be looking to liquidate these assets quickly because bad weather events seem to be accelerating.

On the supply side, HHC should look for properties that will be benefiting from climate change over the next fifty years. I imagine there are some properties in the northern part of the country that might be experiencing more mild winters and more pleasant summers that could be undervalued right now because many investors might not have the same long time horizons that HHC can have.