L.L.BEAN: DIGITALIZING AND THRIVING

The impact of supply chain digitalization on L.L.Bean’s apparel business.

The New Normal

The old paradigm of apparel sourcing focused on obtaining cheap labor from less-developed countries. Having nearly exhausted the profitable opportunities from these supplier markets, retailers have shifted focus to supply chain digitalization in order to “lower costs, shorten lead times and increase transparency.”[1] In an information-rich, technology-driven world, the power has shifted to the customer. To remain competitive and relevant, apparel retailers must cater to a more demanding customer base. According to a McKinsey study, “greater agility and flexibility are critical if companies are to offer savvy customers what they want, when they want it, where they want it, and at the right quality.”[2] L.L.Bean is an outdoor apparel retailer that has fully embraced the shift to digitalization in order to reach this goal. It is servicing its customers by identifying slow-moving items, evaluating seasonal demand, spotting market trends, and offering products with short lifecycles.

L.L.Bean’s Response

Historically, catalog retailers have had control over which products were available and when they were available with considerable predictability. With the presence of digital channels, customers are now calling the shots and deciding what they want. L.L.Bean is evolving in order to thrive in this new customer-driven environment. According to Kirsten Piacentini, VP of Inventory Management, “it’s a lot harder to predict to what and when [customers] are going to react, and in what quantities.”[3] When the number of channels grew to include catalog, phone, in-store, and e-commerce, L.L.Bean developed multiple independent forecast systems, which hindered its ability to share information across the organization. This resulted in conflicting forecast information. By integrating company departments, and connecting with vendors and suppliers via a digital supply chain, L.L.Bean is positioning itself to quickly react to changing trends, resulting in optimal lead times, reduced expenses, improved quality, and maximized profits.

Stepping Ahead

The full digital transformation at L.L.Bean will involve a multi-year process. The forecasting and inventory purchasing elements are in various stages of piloting and implementation. Historically, only chain-level inventory data was available for product ordering. With the inclusion of store-level data, Piacentini says that L.L.Bean has observed improvements in customer service levels of “10 percentage points” as well as “cut lead times.”[4][5] Data is now downloaded nightly for every product across every channel, fostering increased transparency and improved decision-making. L.L.Bean is positioned to forecast over an 18-month period and to share data with vendors. With data in hand, vendors will be able to do more advanced planning, including booking capacity in factories, committing to fabric or raw materials with vendors, responding to information about out-of-stocks and backorders, and re-prioritizing productions. Next, L.L.Bean will shift its focus to enterprise planning.[6] By connecting enterprise planning to forecasting and buying tools, it can better leverage real-time demand signals and market forecasts to create a time-phased inventory plan. Longer term, L.L.Bean will commence work on the assortment planning phase, which will serve to align products with demonstrated customer needs.[7] This phase will remove guesswork by linking buying decisions to actual customer profiles.

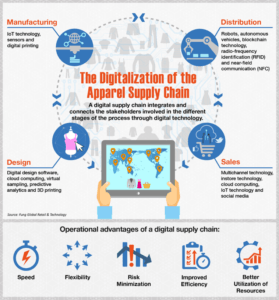

Digitalization of the Apparel Supply Chain (Fung Global Retail & Technology)

Further Considerations

L.L.Bean should incorporate additional planning tools to address inventory optimization as well as promotions and markdowns. Digitalization of inventory will accommodate customer demands for speed and service. However, over-investing in product inventory is an expensive proposition. Digitalization will balance speed and responsiveness with inventory costs to ensure that the right products are in the right place at the right time, seamlessly matching orders to available inventory. This initiative will directly decrease costs associated with excess inventory and improve customer satisfaction and loyalty. Digitalization of promotions and markdowns will permit the retailer to evaluate promotional and markdown opportunities for slow-moving items. The digital supply chain can exploit the data to determine the optimal pricing and promotional strategies for every product at every point along its lifecycle, from launch to promotion to markdown to phase-out. The retailer will be well-positioned to provide differentiated and competitive offers to its customers.

L.L.Bean has embraced the digital supply chain to satisfy the modern customer whose shopping style does not tolerate long lead times and renders big-batch production infeasible. In so doing, it has started the journey to improve returns, efficiently allocate production capacity, and spot bottlenecks earlier.

Open Questions

- What new and creative actions can L.L.Bean take to leverage its platforms to gain a competitive advantage?

- What role can L.L.Bean play to ensure a mindset change amongst suppliers and to create true strategic partnerships? Specifically, how can L.L.Bean establish an effective interface management process from manufacturing through delivery?

(763 Words)

Sources

[1] Barrie, Leonie. “Digitisation – The next apparel sourcing hotspot?” Accessed November 11, 2017. https://www.just-style.com/analysis/digitisation-the-next-apparel-sourcing-hotspot_id131665.aspx September 14, 2017, parg. 1.

[2] Achim Berg et al., “The Apparel Sourcing Caravan’s next stop: Digitization. McKinsey Apparel CPO Survey.” Sept. 2017. file:///C:/Users/Owner/Downloads/The-next-stop-for-the-apparel-sourcing-caravan-Digitization.pdf, p. 16

[3] qtd. in Julie Knudson, “More accurate data and streamlined systems give L. L. Bean an omnichannel edge”. Stores. Accessed November 11, 2017. https://stores.org/2017/10/31/dominating-demand-forecasting/ October 31, 2017, parg. 5.

[4] Ibid., parg 17

[5] Ibid.,, parg 27

[6] [JDA Software]. (2017, Nov 8). L.L.Bean – JDA Real Results [Video File]. Accessed November 11, 2017. Retrieved from https://www.youtube.com/watch?v=FY6Ex0y0MdU.

[7] Ibid.

L.L. Bean’s approach to digitalizing its supply chain reminds me of the Barilla case in many aspects. Both emphasize the importance of information sharing throughout the supply chain. With collaborative parties prioritizing collective cost, the natural solution would be to share, plan, and optimize together to become agile and lean at every step of the chain.

I think L.L.Bean has their work cut out for them. The challenge of embedding other functions such as finance, procurement, and marketing into the digitalized supply chain can’t be understated. Information needs to flow cleanly within the company, and not cause miscommunication or redundant efforts such as multiple forecasts. This will be especially important as the company plans on integrating its enterprise resource planning infrastructure with supply chain decisions.

Furthermore, L.L.Bean is tasked with making sure suppliers embrace, rather than resist, the disruption of the supply chain digitalization. L.L.Bean must clearly convey the benefits to its suppliers. For instance, suppliers can benefit from being able to use the data to inform fabric requirements and reduce lead time of purchase orders. They can then get an early read on market trends before committing to styles and sizes.

As L.L.Bean grows its e-commerce channel, evolving from being primarily a catalog retailer, it can borrow many lessons from other retails chains that have had to tackle supply chain digitalization before them. A few years ago, The GAP made a push to use big data to streamline their inventory management and offer increased personalization to the shopping experience. Zara has long been known as supply chain experts in the retail space, and they embraced supply chain digitalization by using social media feeds and website click data to inform demand, and IOT and GPS data to inform supply.

Gap: https://risnews.com/gap-gets-personal-big-data

Zara: https://www.forbes.com/sites/kevinomarah/2016/03/09/zara-uses-supply-chain-to-win-again/

Great post, Alesso! I was surprised to learn that such an old company like L.L. Bean was investing in digitalizing their supply chain. I would have guessed that their demand, inventory, and overall supply chain was so stable and so entrenched that they would almost not even have a need for the digitalization of their supply chain.

I would think for this to truly be a value add for L.L. Bean, they need to go further than simply digitalizing their supply chain to save on costs and improve their operations. I think they need to use the digitalization of their supply chain to capture more demand upstream. If they can make better use of their company data and more quickly respond to trends, this could become a real competitive advantage for a brand that hasn’t changed much in many years! I’ll be interested to see where they go with this!

I am quite impressed with how aggressive L.L. Bean has been in digitizing their business model! I do wonder, however, what the incremental benefit of this strategic initiative is. This clearly is a costly initiative. It requires massive investments in technology and human capital. However, L.L. Bean is a private company. It does not face the same pressures of a publicly traded firm. To this end, I wonder what the true benefit of hyper-optimization is?

For large firms like Gap, I completely understand why this makes sense. For fast-fashion firms like H&M or Zara, I also understand why this makes sense. For a privately owned firm that could probably get by with just producing inventory for 80% of expected demand, and just running out of stock, I do wonder if this investment makes the most sense.

Based on my experience in data analytics at a retailer, I would be wary to put data on a pedestal like we often do in class. While I agree that better information across supply chain stakeholders has the potential to drive costs down, data itself is not the process, but rather it is an output and input of the medium. In my previous team, we were able to monitor the specific product health metrics for specific merchandise types, but our decision making ended up being the true bottleneck in our operational model. The main reason for this impact is that, frankly, most data is useless due to “noise” inputs that may occur while your record it. Most data analysts estimate that the amount of useful data in the world ranges in around 3-4%, with the majority of it being filler data. Noise can be anything from measuring the wrong “behavioral cues”, to outright recording unrelated environmental factors (speed vs acceleration analog).

As it often is with “older” firms, transition to using data effectively is not easy but L.L. Bean seems to be on a good track. However, L.L. Bean’s next steps should definitely be operational improvements enabled by this digitization rather than moving further along with the digitization itself. Especially when trying to create value for its supply chain. Combining this with another megatrend, digitization can be used to support sustainability improvements along the entire supply chain, while increasing profitability. A proposition hard to refuse.

Totally agree that the shift from a supply driven retail landscape to a demand driven one puts a lot of “old paradigm” retailers at risk. The channel count increase means that a 360 view of the customer base is harder to achieve but also more valuable, as different channels are frequented by different customer profiles. However, I’m not sure LL Bean’s success so far has been due to its effective use of digital channels so much as its strong brand loyalty. Due to globalization (cheap goods, sourcing + transportation) and the internet (limitless information in the hands of the customer), the apparel market saw a swift movement of power to the hands of the consumer. Ubiquity in the apparel market is still eating into the once superior margins of J Crew, Gap, etc. Some companies survived, and it’ll be interesting to see what characteristics the winners have (sustainable sourcing? superior customer service? distinct design?), and whether LL Bean possesses enough of those characteristics.