Is the world on the cusp of an electric vehicle revolution? Volvo thinks so.

Volvo has announced a monumental shift in its business towards electric vehicles as governments around the world are banning gasoline and diesel vehicles. Does Volvo have what it takes to compete against electric vehicle leaders Tesla and BYD? How does this change affect the supply chain of a conventional automaker?

Is the world on the cusp of an electric vehicle revolution? Volvo thinks so.

The Swedish automaker has announced that all new Volvo models will sport an electric motor by 2019.

Reacting to Climate Change

Increasing awareness of global climate change caused by human activities has catalyzed the rapid development of electric vehicles. The Netherlands has passed legislation to ban the sale of conventional cars with internal combustion engines (ICEs) by 2025[i] and Germany has followed suit with a ban by 2030[ii]. Even less developed nations India and China are contemplating a similar electric vehicle-only mandates[iii].

Electric Vehicles Are the Future

Electric Vehicles are an important means to reduce the impact of climate change because they contribute no direct carbon emissions and are typically produce fewer life cycle emissions than do conventional vehicles[iv]. This benefit is further amplified if power is generated by renewable sources like solar or wind.

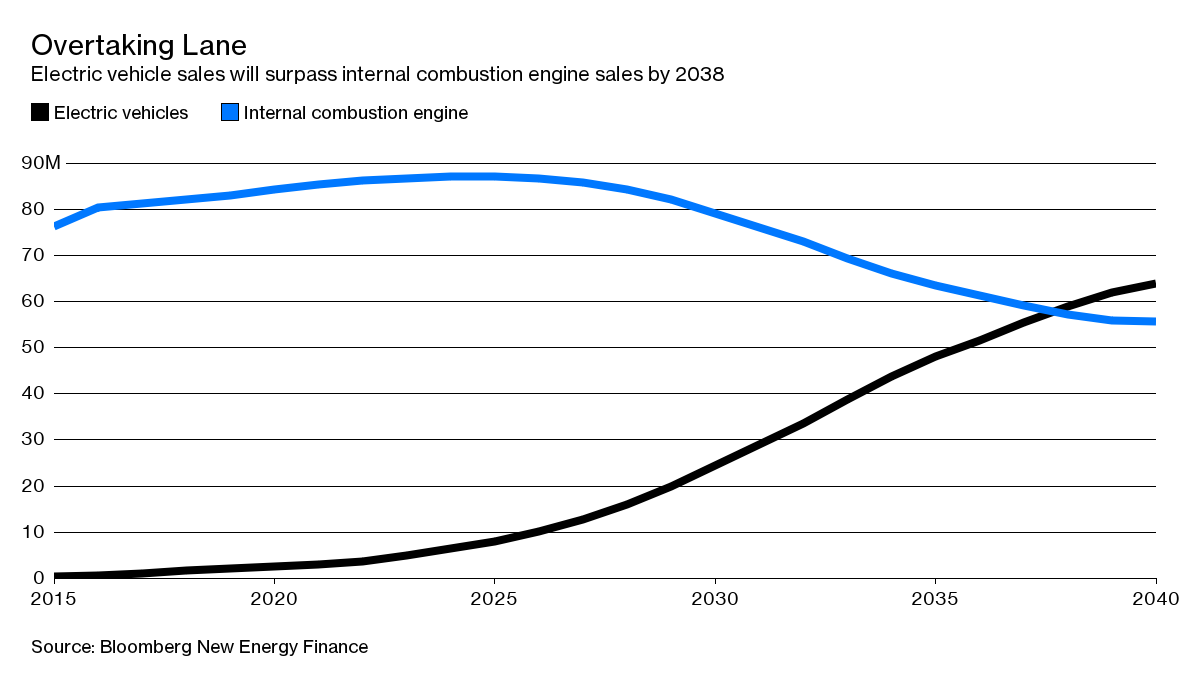

Sales of electric vehicles are expected to grow significantly to over 60 million vehicles by 2040, and overtake those of conventional ICE vehicles by 2038[v], as shown in Figure 1. Additionally, the cost of electric vehicles is expected drop below that of conventional ICE vehicles by 2025[vi].

Figure 1: Sales of Electric and Internal Combustion Engine Vehicles (Bloomberg New Energy Finance)

Volvo’s Ground-breaking Announcement

In July 2017, Volvo announced that “every Volvo it launches from 2019 will have an electric motor”[vii]. Volvo is the first of the conventional automobile manufacturers to electrify their business model, and has garnered the company substantial positive press coverage for doing so. In the short-term, this move has allowed Volvo to focus their limited R&D budget on electric vehicle technology. Over the next decade however, this transition will allow the company to gain market share from the leading electric vehicle manufacturers Tesla and BYD.

Impact on Volvo’s Supply Chain

The disruption caused by electric vehicles will send a ripple through the entire automotive supply chain. The impacts of electrification on the Volvo’s automotive ecosystem are as follows[viii]:

- Automakers: Volvo must quickly produce a competitive electric vehicle, and has recently announced that its first electric offering will be the 2019 release of the XC40 small SUV. The company will have to forge new partnerships to ensure that their products have the latest in battery and user experience technology.

- Suppliers: Current suppliers that focus on the drivetrain (engine, transmission, drive shafts and differentials) will no longer be relevant once Volvo completes the shift to electric vehicles.

- Dealers: Since electric vehicles have fewer moving parts than conventional ICE vehicles, less maintenance is required. Volvo dealers will have to adjust to significantly lower service-related revenues.

- End Customers: As electric vehicles become more common customers will begin to think of their vehicle as a computer on wheels. As such, they will demand the latest innovations in technology such as self-driving autopilot and Volvo will be forced to continually innovate.

How Can Volvo Stay Competitive?

1. Leverage partnerships to advance self-driving technology

The future of automotive transportation may not involve a human driver. Multiple companies from both the automotive and technology sectors are currently pursuing self-driving technology. While Volvo has partnerships with both Uber[ix] and Nvidia[x], additional partnerships will be required to keep up with the pace of self-driving technology.

2. Lock in long-term lithium contracts

Lithium is a necessary component for the lithium-ion battery that powers electric vehicles. Analysts are now concerned about whether the supply of lithium can keep pace with the growing demand. Volvo should enter into agreements to ensure that lithium supply does not limit their growth aspirations.

Food For Thought

As the demand for electric vehicles grows, do conventional automakers like Volvo have any competitive advantages compared to current electric vehicles leaders Tesla and BYD? Do you think that Volvo made the right decision by fully transitioning to electric vehicles before any of their competitors?

(word count: 780)

References

[i] “The Netherlands Will Ban New Gasoline-Powered Vehicles By 2025”, Fast Company (2016) https://www.fastcompany.com/3058649/the-netherlands-will-ban-new-gasoline-powered-vehicles-by-2025

[ii] Schmitt, B. “Germany’s Bundesrat Resolves End Of Internal Combustion Engine”, Forbes (2016) https://www.forbes.com/sites/bertelschmitt/2016/10/08/germanys-bundesrat-resolves-end-of-internal-combustion-engine/#84cdaad60bd8

[iii] Condliffe, J. “China and India Want All New Cars to Be Electric”, MIT Technology Review (2017) https://www.technologyreview.com/the-download/608839/china-and-india-want-all-new-cars-to-be-electric/

[iv] “Reducing Pollution with Electric Vehicles”, US Department of Energy (2017), https://energy.gov/eere/electricvehicles/reducing-pollution-electric-vehicles

[v] Shankleman, J., “The Electric Car Revolution is Accelerating”, Bloomberg (2017) https://www.bloomberg.com/news/articles/2017-07-06/the-electric-car-revolution-is-accelerating

[vi] Shankleman, J., “Pretty Soon Electric Cars Will Cost Less Than Gasoline”, Bloomberg (2017) https://www.bloomberg.com/news/articles/2017-05-26/electric-cars-seen-cheaper-than-gasoline-models-within-a-decade

[vii] “Volvo Cars to go all electric”, Volvo USA (2017) https://www.media.volvocars.com/us/en-us/media/pressreleases/210058/volvo-cars-to-go-all-electric

[viii] “Electric Vehicle – Disruptor of the Automotive Ecosystem”, Infosys (2017) https://www.infosys.com/industries/automotive/white-papers/Documents/disruptor-automotive-ecosystem.pdf

[ix] “Volvo Cars and Uber join forces to develop autonomous driving cars” Volvo Car Group (2016) https://www.media.volvocars.com/global/en-gb/media/pressreleases/194795/volvo-cars-and-uber-join-forces-to-develop-autonomous-driving-cars

[x] Etherington, D. “Volvo and Autoliv aim to sell self-driving cars with Nvidia AI tech by 2021”, TechCrunch (2017) https://techcrunch.com/2017/06/26/volvo-and-autoliv-aim-to-sell-self-driving-cars-with-nvidia-ai-tech-by-2021/

Very interesting piece. Volvo actually just announced it would deliver autonomous SUVs to Uber starting in early 2019 (see article here: https://techcrunch.com/2017/11/20/uber-orders-24000-volvo-xc90s-for-driverless-fleet/). So it seems they are taking heed of your first piece of advice.

I’m intrigued by your second question on whether it made sense for Volvo to race to go electric before its competitors. I don’t think there’s a clear answer to that yet, but I think it depends an incredible amount on one factor alone: government regulation. Many climate-friendly industries like solar, wind, and electric vehicles are only competitive right now due to government subsidies and incentive programs. The big question for Volvo is whether those programs will decline, continue, or increase. Given the current political environments in countries considered eco-friendly (particularly many parts of Europe, and to a less extent, the US) I’m worried about Volvo’s prospects here. With that considered, I think Volvo should be (if it isn’t already) investing a lot of resources into lobbying governments to increase auto regulations to encourage green-friendly technology like Volvo cars. In political environments in which climate change isn’t as high a priority (or is outright scorned like in the US), Volvo should invest in lobbying efforts that change the narrative away from climate change and towards other things that are more politically salient, like energy independence or pollution. But one thing seems clear to me: the success of electric vehicles will, at least in the short term, depend a lot on the extent to which the government regulates them.

Does Volvo have the edge? It’s a great question. I think they do. Their brand heritage and service network in the European market should be considered as a great advantage against US emerging automakers like Tesla and BYD. Knowing Tesla and BYD’s growth has been fairly limited to US market so far, Volvo’s opportunity is in their home court. Volvo, however, may be left behind at home. In November 2016, BMW, Daimler, Ford (Europe), Audi, and a few other companies signed a MOU to deploy a high-powered DC charging network for Electric Vehicles covering long-distance travel routes in Europe. The network is expected to reduce charging time significantly and to build 400 ultra-fast charging sites (https://www.press.bmwgroup.com/global/article/detail/T0266311EN/bmw-group-daimler-ag-ford-motor-company-and-volkswagen-group-with-audi-porsche-plan-a-joint-venture-for-ultra-fast-high-power-charging-along-major-highways-in-europe?language=en). If I were Volvo, I would be worried about being left behind in the alliance. Considering the early stage of the market, it would make sense to start working with the allies to develop infrastructure and to grow EV market in Europe. Hopefully, Volvo shall capture early adopters in the market and build a competitive supply chain.

Thanks for the interesting read. I was intrigued by your closing question: do conventional automakers like Volvo have any competitive advantages compared to current electric vehicles leaders Tesla and BYD?

A few come to mind:

1. Manufacturing capacity and experience – Volvo already has an established production footprint and manufacturing processes (machines, factories, labor, etc.), much of which will be transferable to the electric vehicles business. As a point of comparison, Volvo sold >530,000 vehicles in 2016 vs. Tesla’s ~24,500 [1,2].

2. Distribution network – As S.K. noted in the comment above, Volvo’s existing distribution and service network in the European market gives the company an edge in distributing product internationally vs. current U.S. electric vehicle leaders.

3. Reputation – in business since the 1920s, Volvo has had decades to build its brand and customer base. When given the choice between purchasing a Tesla vs. Volvo electric vehicle, consumers may remain loyal to a brand and product that they know and trust.

[1] Volvo Car USA, “Volvo Cars’ 2016 sales hit new record”, https://www.media.volvocars.com/us/en-us/media/pressreleases/202294/volvo-cars-2016-sales-hit-new-record, accessed November 2017

[2] Jill Disis, “Tesla selling twice as many cars as it was in 2015”, CNN, http://money.cnn.com/2016/10/02/technology/tesla-third-quarter-2016-car-sales/index.html, accessed November 2017

Thank you for the article, BH! Volvo committing to 100% electric cars in 2019 is ground breaking. I’m unsure how the market will react to the adaption at first, but ultimately believe Volvo is at a strong advantage being the market leader in this field. At my prior job, I worked with an automotive interior components supplier to OEM’S (such as Volvo) and am curious about how Volvo’s relationship with its suppliers will change. Given OEM’s often have long-term contracts (5-10 years) with their suppliers to cover the full life of a certain vehicle. Who are the suppliers that are prepared to take on Volvo’s new orders? What will be the terms of those contracts? Volvo could put itself at a clear advantage if it locks in the most attractive new contract terms given its first mover advantage.