Is the value proposition of 3-D printing eyewear in inventory management and limited made to order customization, or in fully consumer designed eyewear?

Is the value proposition of 3-D printing eyewear in inventory management and limited made to order customization, or in fully consumer designed eyewear?

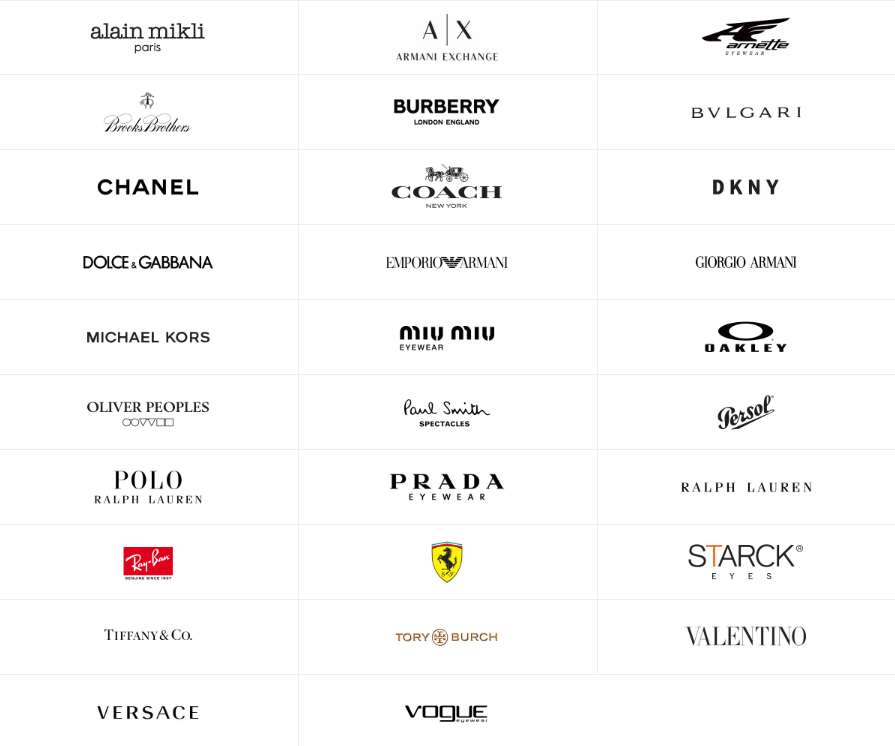

With revenues of over 9bn Euros, 85,000 employees, and 9,000 stores worldwide[1] Italian Luxottica is the global leader in eyewear design, manufacturing and retail. Luxottica today has an unmatched brand portfolio of owned and contracted brands (over which Luxottica holds full design rights) (Fig 1), and is fully vertically integrated from eyewear design to manufacturing, distribution and retail sales.

Plastic frames by Luxottica are manufactured using either a milling or an injection molding process, where up to 75% of every acetate sheet from which most plastic frames are cut is thrown away[2]. As frames are a relatively simple product, there a few efficiencies to be gained in terms of simplifying the process (a benefit more likely to be realized in complex products like engines[3]). However, given the quantity of waste, the materials cost in traditional manufacturing is likely to come under scrutiny as either the price of crude oil and resins increase, or as the throughput time of additive manufacturing technology becomes shorter and it becomes a viable alternative to traditional methods used for high volume SKUs.

Additive manufacturing can transform the process by two major ways, either by limited customization, where the main benefit of the technology is realized by customers from receiving frames that are tailored in size, fit, color, and manufactured to order, and where the benefit to Luxottica is realized through better inventory management and lower net working capital requirements, but where the base design is still done in house.

The other way in which the technology can improve the processes is through fundamentally changing the way in which the company approaches product development. By enabling the consumer to design his or her eyewear from start to finish, there is an opportunity to create a space of creativity through process innovation that will appeal to more individualized consumer preferences, in addition to the operational benefits realized in limited customization. In a seasonal industry with fast turnaround of collections, the supply chain benefit of made to order cannot be overstated.

One of the problems with the current technology is the speed of manufacturing – it is still too slow for a manufacturing giant like Luxottica to shift to fully 3-D printed frames. Even today Luxottica uses additive manufacturing for certain parts of the frame, however the usage is limited to simple parts within the broader supply chain or for prototyping and R&D work. The reality is however that the consumer benefit of additive manufacturing has so far been limited.

Scaling additive manufacturing capabilities is difficult and capital intensive, however, given the number of new entrants into the 3-D printed frames space, building the customer base and brand recognition early on is crucial. Luxottica has both the financial capabilities and experience to invest to own the space, whether it be through in-house R&D and organic growth, or through tuck-in M&A of the number of consumer technology companies in the additive manufacturing space.

There are several innovative start-up exploring both avenues – a route for Luxottica to enter is through an expansion of their M&A strategy from vertical consolidation and brand acquisitions to acquiring pure manufacturing capabilities and knowledge. Materialise and Safilo created a joint capsule collection called OXYDO in 2017 focusing on ‘wearable sculptures’[4] where the focus is on the manufacturing side vs. the design and supply chain side. Chemicals company BASF has also partnered with Safilo on eyewear technology and Danish Monoqool designs collections that are also only manufactured with 3-D printers, but with limited customization. German based DyeMansion 3-D prints a variety of products to order and has experience in the eyewear space with a partnership with ic! berlin[5]. A potential issue is anti-competitive concerns given their foothold on the eyewear market, and given the limited size of the alternative players, the benefit of growing the additive manufacturing capabilities in house could be substantial.

The question then remains on whether in a world shifting toward cheaper contact lenses, is additive manufacturing of custom frames just a temporary solution to a secular decline of framed eyewear, or a way to keep frames relevant?

(763 words)

[1] Luxottixa Group, 2017 Annual Report, p.17, http://www.luxottica.com/sites/luxottica.com/files/luxottica_group_relazione_finanziaria_annuale_2017_eng_20180328.pdf, accessed November 11 2018.

[2] Michaels, Daniel. “Design Your Frames: 3-D Printing Comes to Eyewear.” Wall Street Journal, November 11, 2018.

[3] A. Brown. Chain reaction: Why additive manufacturing is about to transform the supply chain. Mechanical Engineering 140, no. 10 (October 2018): 30–35.

[4] All3DP. (2017). Safilo Group and Materialise Launch Funky 3D Printed Eyewear. [online] Available at: https://all3dp.com/safilo-group-materialise-eyewear/ [Accessed 11 Nov. 2018].

[5] Seeing in Colour: Dyemansion Gives 3d Printed Eyewear a Vibrant Finish. Laura Griffiths – https://www.tctmagazine.com/3d-printing-news/seeing-in-colour-dyemansion/

As someone who owns many pairs of glasses, this article made me really excited. In regards to your question, I am curious if there is a shift worldwide toward contacts over framed glasses, or if this is a more localized trend. I was not able to find any definitive data on the subject, but would love to learn more. In fact, as screens become more and more integrated into everyday objects and behaviors, and AR and VR technologies become increasingly mainstream, I can easily see lots of potential for additive manufacturing in eye-wear. Sure, Google Glass ended up not being the game-changer some predicted, but headsets such as Oculus Rift and Microsoft’s HoloLens are gaining traction in applications for entertainment and numerous other industries. The intersection of fashion and technology is fascinating!

I really enjoyed your article about Luxottica and its current manufacturing process. It sound like it will be very challenging for the company to incorporate 3D printing at scale. I wonder if 3D printing may actually be a huge threat to Luxottica as opposed to a benefit. As 3D printing becomes cheaper and more mainstream, its possible that smaller manufacturers/retailers could begin to offer more customized frames to customers. In fact, it may even be economical for a customer to print their own frames and purchase cheap lenses. Luxottica would be wise to strategically plan for the disruption that 3D printing may bring to their market.

As mentioned in the article, it can be very difficult for a large manufacturer as Luxottica to change its whole production process at once. However, it is paramount that the company start working on the new process as it can really reduce production costs and enable new entrants to the market that, with a better cost structure, can actually end up performing better than Luxottica. I believe one approach that can be taken is to do it incrementally, starting with some brands that can capture more value from the customization process. For RayBan for example, you can already order a custom pair of glasses from their website (choose model, lenses, color, etc.) To include the option to actually customize the frame through 3D printing can bring great value to the customer and help improving brand perception and actually increase sales.

This is a fantastic opportunity for AM. Apparel brands can create a technology-based competitive advantage by offering personally customizable products that are designed for someone’s face shape. One of the most annoying aspects of wearing glasses is the way designs fit differently depending on your face shape. Before, mass manufacturing made it impossible for brands to create multiple SKUs that would work for each person, but now this technology can make that possible. Adding to that the ability to use new materials and scaffolding designs and reduce the weight of glasses opens new and exciting opportunities!

Interesting article! I’m curious to see how this plays out in the next few years. Though I believe there is value in customizing product specifications according to customer’s preferences, I’m skeptical about how scalable it would be to allow them to create their own frames. Also, through contact lenses are indeed cheaper and do not change a user’s appearance, I believe there will always be a market for frames, especially customer made and limited edition frames. Analog watches have not been fully replaced by digital watches or smartphones, but they’ve become a fashion statement. So there might be further opportunity for this to happen in the glasses and frames industry as well.

Really interesting piece, Sara! My perspective on your question is that the most relevant use of Additive Manufacturing in eye wear is not the potential scale production efficiencies, but rather the opportunity for one-of-a-kind designs. As you may know, Nike introduced a product called NikeID several years ago with great success; while this is not an Additive Manufacturing product, it essentially allows individuals to take each component part of some of their favorite shoe models and change the color (and in some case, the material used).

There may be secular decline in functional eye wear, but the relative stability of fashion-based eye wear should provide a strong base of demand for individualized frames. I believe that an eye wear empire like Luxottica would do well to invest in this customization technology through AM which could be applied across all of its brands.

If I am Luxottica leadership I would be very concerned with additive manufacturing. Eyeglasses are one of the highest margin products in existence, as their costs are so low. People can pretty much share their designs and/or Luxottica own designs and create frames at almost no cost at home. In fact, I wonder if 3d printing at home piracy will be perceived as piracy at all among the general population. If you own the equipment, you provide the inputs and you design a product inspired by another one, is that piracy of just DIY?

Great:

-Clearly mentioned the benefits of additive manufacturing from both perspectives; one of consumer and another of Luxottica.

-Clearly addressed the potential of reduction of the waste by additive manufacturing.

Suggestions:

-If this article could provide with specific numbers (e.g. the weight of plastic frames in overall raw material cost, the current price of additive manufacturing machine, estimated operating expense), the reader could understand the potential of economic benefit of additive manufacturing and how far the technology has to be improved from now on in order to make this technology feasible.

-Would be interesting to mention the potential tension that the frame fully designed by consumers could lower the meaning of Brands. Consumers may not find the self-esteem in brand anymore after having their own frame designed themselves, so there is certain risk that Luxottica goes after the strategy of fully customized frame. Given that, what path Luxottica go through considering its competitive advantages are brands it has. This point of view could make the article even richer.

Interesting article! As I read through this, I couldn’t help but wonder if the cost-benefit trade-offs of 3D printing will ever truly make sense for these frames that are essentially made of commodity resins and I would assume result in fairly low inventory holding costs. While I agree the consumer experience could be completely revolutionized by having more custom lenses, I wonder if the Warby approach of selling cheap frames so you can have ~5 pairs at home and mix & match isn’t a more elegant solution to similar consumer issues. Overall, this technology sounds really cool but I am a bit skeptical that it will ever be used at scale in the glasses industry, particularly given Luxottica’s monopoly-like market position.

Great Article. As a daily wearer of glasses (and owner of several pairs), I believe eyewear is also going in the “fast fashion” direction, in that consumers want high quality, affordable eyewear, that they can throw out after a year (e.g. if their prescription changes). Warby Parker and similar brands offer customers the choice to personalize their glasses in many ways ( pick the color, style, type of lens etc) and also offer affordability and a money back guarantee if the customer does not like the frames within the first 30 days.

With 3D printing, I am not sure the increased cost will be something customers are willing to take on. I do think there could be some initial sales with 3D printing given the novelty and personalization, however, I do not know if it is sustainable. I believe those looking for high-end glasses would prefer “hand-crafted” or “hand-curated” over “3D printed.”

Thank you for clearly laying out the benefits of additive manufacturing in the areas of optimized inventory management and custom product development. I think where the opportunity lies will depend on the industry. In the case of Luxottica and sunglasses more broadly, I think a lot of purchasing decisions are reactive to a particular product/style. Though I have a sense of what I might want in a product, oftentimes I find myself buying a product outside of my pre-defined range of conditions because the granular product specifications of sunglasses are not something I generally invest time investigating, and I am thus not as informed in product details. I think for industries where customers are more susceptible to trends (e.g. fashion and adjacent industries), and therefore the product informs the purchasing decision, the value may lie in inventory management. On the contrary, where a customer has a clearly defined set of criteria they’re looking for and where there is a wide range of specs to determine, e.g., functional products such as a laptop, value may lie in the ability to customize. I also wonder whether this will take away any window for upselling, as customers are able to dictate exactly what they want – this may result in higher customer satisfaction in the moment but lower margins and lower customer trial of unplanned features/products.

Thanks for the article Sara! Really enjoyed reading about the intersection of fashion, technology, and additive manufacturing.

I think all the reasons you mentioned for Luxottica to shift towards additive manufacturing are extremely relevant, with customization and creativity being particularly relevant to consumers. To your question on whether it will just be a fad, I think the market for frames may see declines, but will not shrink that rapidly and will never be nonexistent. I do think the high price point continues to be a pain point and an important reason for Warby Parker’s rise. I’m curious if additive manufacturing could help lower costs to combat this price point issue in a way that Luxottica could leverage?

Great article. Your essay clearly presents the benefits that additive printing brings to Luxottixa. While your concern about glass lens losing to contact lens is reasonable, the overall cost of purchase and maintenance still makes contact lens a more expensive investment [*]. If Luxottixa can quickly improve the speed and the scope of 3D printing in their production, Luxotixxa can benefit from a lower cost structure (e.g. either through less material waste or less working capital requirements). This savings would then allow Luottixa to charge their customers a lower price and help sustain the edge of glass lens over contact lens.

*TechNavio Report, ”Global Contact Lens Market 2018-2022,” BusinessWire, May 15, 2018,

https://www.businesswire.com/news/home/20180515006264/en/Global-Contact-Lens-Market-2018-2022—Key, accessed November 18, 2018