Is Goodyear’s Supply Chain Designed to have Good Years in the Future?

Goodyear has dealt with US import tariffs on tires from China over the past decade. In 2017, there are additional tensions as the Trump administration may exit existing trade negotiations, affecting the global supply chain of Goodyear. How is Goodyear responding today, and how should they adjust their supply chain in an increasingly protectionistic world?

Over the past decade, US import tariffs on tires have been in flux which can complicate the supply chain of tire manufacturers. Goodyear, the largest multinational tire manufacturer in the United States, operates 48 manufacturing facilities in 21 countries and groups these geographies into 3 segments: Americas, Europe, Middle East, and Africa (EMEA), and Asia Pacific. As each segment exports to the other segments as part of a global supply chain, import tariffs are a risk which Goodyear must watch and plan for strategically [1].

In June 2009, the United States International Trade Commission (USITC) responded to a petition by the United Steelworkers (USW) and decided that the rise in tires imported from China was causing a decline in the volume, market share, and employment of the US tire industry. In response the US implemented temporary anti-dumping (when foreign manufacturers sell goods in the US at less than fair value) and countervailing (when foreign governments provide assistance or subsidies to manufacturers that then export goods to the US) tariff safeguards through 2012 on passenger vehicle and light-truck tire products.

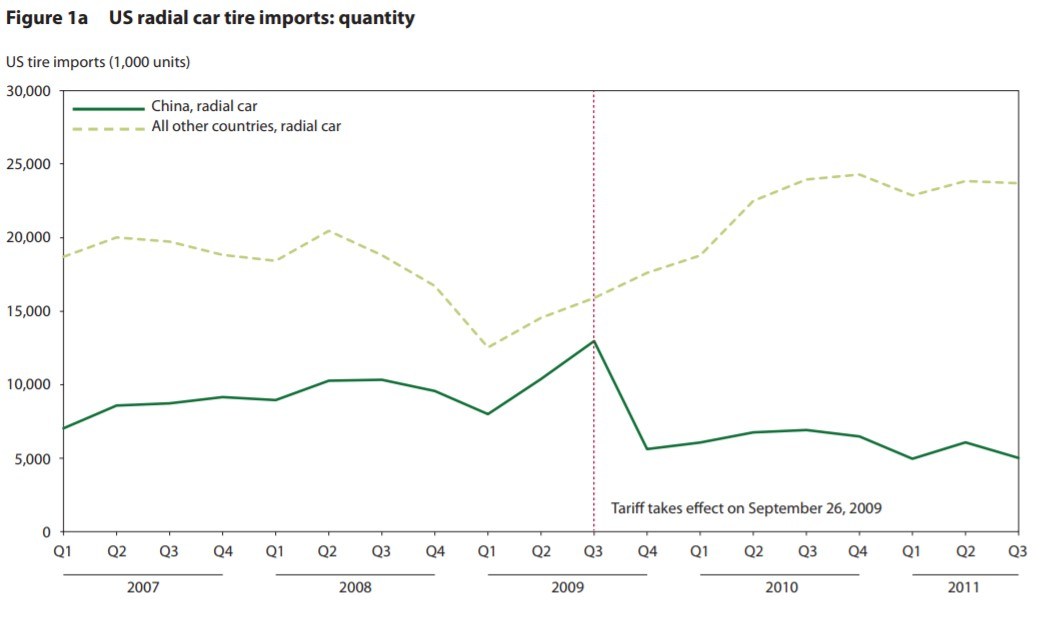

Goodyear, as well as other companies, responded by importing tires from other countries. Imports from China plummeted (see figure below), but imports from South Korea, Thailand, and Indonesia offset the loss. For Goodyear, although they operated a plant in China, they also had plants in India, Indonesia, Japan, Malaysia, and Thailand as well as six plants in the United States. Keith Price, Goodyear’s director of national media, responded saying that the tariffs “had a minimum impact on us” and that Goodyear’s tires are higher quality so they don’t compete with Chinese imports [2]. With the tariffs, however, tire prices went up and economists estimate US consumers spent $1.1B more on tires [3]. After the tariffs expired in 2012, the USW newly petitioned the USITC in 2014 to impose tariffs on Chinese tires. US officials gave a “preliminary” decision to again impose tariffs and tire prices quickly rose up to 15% [4].

[5] (Hufbauer and Lowery 2012)

The year 2017 continues to bring complexity for Goodyear’s supply chain. In March 2017, the USITC admitted they had erred in their calculations of countervailing duties and would no longer assess tariffs on bus and truck tires from China [6]. Also, the Trump administration has made several statements declaring intentions of renegotiating the North American Free Trade Agreement (NAFTA) and exiting the Trans-Pacific Partnership (TPP).

In the short term, Goodyear is still investing in its global footprint. In the beginning of November 2017, the first Goodyear plant built in the Americas in 25 years was officially operational as the $550M tire plant in San Luis Potosi started producing [7]. Goodyear doesn’t appear to be worried about changes to NAFTA. Keith Price says, “We continually look at our manufacturing footprint, and our strategy is to produce tires as close as possible to where we sell them. The vast majority of tires we sell in the U.S are made in the U.S. We’re not anticipating making any near-term changes to our current manufacturing footprint.” [8] Goodyear is also in the process of closing plants in Philippsburg, Germany and Wolverhampton, U.K as part of its EMEA restructuring as well as expanding its manufacturing facility in China [9].

For the next decade, Goodyear appears to be planning for business as usual. “If you’re monitoring the news, it changes daily. It’s probably best not to speculate but to wait and see what they (the Trump administration and the new Congress) want to do” says Price [7]. Executive Vice President Laura Thompson says of the trade situation, “We take no position at Goodyear. We are a global tire company. We play globally” [4].

In the short term, I recommend that Goodyear stay politically neutral. Although a mock poll conducted by the Tire Industry Association showed that 56.8% of the Global Tire Expo attendees support Trump, Goodyear needs to take the middle ground as they are an American company with a large, global footprint [7]. Over the next decade, I recommend that Goodyear reopen its plant at Wolverhampton or open a new plant in the U.K. as Goodyear no longer manufactures tires in the UK and the looming Brexit could make importing tires more difficult. I also recommend that Goodyear engage in more hedging of raw material costs as rubber went up 75% in cost since August 2016 due to commodity speculators in China, and Goodyear has already had to raise prices and pass these costs onto consumers [10].

A couple unanswered questions remain:

- How should the board communicate its global strategy to its unionized manufacturing workers in the US?

- Considering Goodyear also exports tires from the US to other parts of the world, how will other countries react to the protectionist policies on tires enacted by the US?

(799 words)

[1] Goodyear Tire & Rubber Company. 2017. “Form 10-K”. https://corporate.goodyear.com/en-US/investors/financial-reports.html#recentModal4

[2] LA Times. 2017. “Limited Success Of Chinese Tire Tariffs Shows Why Donald Trump’s Trade Prescription May Not Work”, 2017. http://beta.latimes.com/business/la-fi-tariffs-trade-analysis-20160724-snap-story.html/

[3] Veeman, Michele. 2017. “North American Trade Policy For Agriculture And Forestry: Can Economics Trump Politics?”. Canadian Journal Of Agricultural Economics/Revue Canadienne D’agroeconomie 65 (1): 43-68. http://onlinelibrary.wiley.com/doi/10.1111/cjag.12135/full/

[4] Davis, Bob. 2015. “As The China-U.S. Tire Battle Rolls On, American Consumers Pay More”. The Wall Street Journal, 2015. https://blogs.wsj.com/economics/2015/06/02/as-the-china-u-s-tire-battle-rolls-on-american-consumers-pay-more/

[5] Hufbauer, Gary, and Sean Lowery. 2012. “US Tire Tariffs: Saving Few Jobs At High Cost”. Peterson Institute For International Economics 12 (9): 4. https://piie.com/publications/pb/pb12-9.pdf/

[6] Hatch, Daniel. 2017. “The USITC And Tire Tariffs: What On Earth Happened?”. Traction News. http://www.tractionnews.com/usitc-chinese-truck-and-bus-tire-tariffs-decision-reversal/

[7] Mexico Now. 2017. “Goodyear Tire Plant In San Luis Potosi Is Officially Operational”, 2017. http://www.mexico-now.com/index.php/article/3224-goodyear-tire-plant-in-san-luis-potosi-is-officially-operational/

[8] Aguilar, Mike. 2017. “Tires And Trump: What The New President Means For Us”. Traction News, 2017. http://www.tractionnews.com/united-states-tire-industry-reacts-to-president-trump/

[9] Goodyear Tire & Rubber Company. 3Q 2017. “Form 10-Q”. https://corporate.goodyear.com/en-US/investors/financial-reports.html#recentModal4

[10] Craymer, Lucy. 2017. “China Speculation Molds Rubber Market”. The Wall Street Journal, 2017. https://www.wsj.com/articles/china-speculation-molds-rubber-market-1486526404/

First, I would like to respond to the recommendation to reopen the plant in Wolverhampton, UK based on the Brexit vote. More than likely, the UK will attempt to create additional trading opportunities outside of the Eurozone market. This would lead me to believe that importing tires into the UK market should get easier as they progress through their Brexit talks.

I agree that increasing protectionist policies by the US will strain Goodyear’s ability to meet global demand. If the Trump administration does push America into a trade war with other members of the OECD, Goodyear’s most successful strategy would be to diversify production across international borders. Considering Goodyear already has “48 manufacturing facilities in 21 countries” they seem to be in position to maintain profitability in an economy marked by increased protectionist policies. Rather than make dramatic changes to their operations, they should take a regional approach to production and attempt to produce their tires as close to their end consumers as possible.

Thanks for the interest article. Goodyear’s strategy of producing tires in the regions where it sells them is beneficial from two perspectives. First, it makes them closer to their customers, thus reducing freight costs significantly and increasing customer touch points. This allows Goodyear to more effectively compete in these tire markets where products have low value density. Secondly, the strategy functions as a hedge against isolationist movements globally. By locating production with different countries, Goodyear is able to avoid tariff complications.

Goodyear’s management should lean into this global strategy and communicate the following to its U.S. unionized workforce:

1. Goodyear is committed to continuing to produce tires for the U.S. market in the U.S., thus protecting its factories located here and the jobs of its unionized workers

2. Goodyear’s practice of locating factories abroad helps it reach global markets in a low-cost, sustainable manner, benefitting profitability and growth for the overall company in the long-run

Goodyear’s U.S. workforce should be receptive to this strategy provided that the company continues to produce domestically.

This post is especially interesting as supply chain decisions are not just based on changes driven by consumers and suppliers. In this case, the driving force is well beyond the control of individual companies – regulations and government policies. As the policy changes are still under development, it’s important for large companies like Goodyear to plan ahead to gain competitive advantage. For instance, if Goodyear is slower at entering a new market, costs at some of these smaller overseas markets may be higher. Given this industry is facing increasing isolationism, Goodyear should leverage their global presence in different regions and continue to meet their regional demand with the most cost-effective production plants.

Interesting read! I would think that Goodyear should look at countries 1) for which the US government is looking to apply protectionist policies and 2) that are currently supplied by Goodyear’s US plants. If it makes sense for Goodyear to open new plants in these countries, now might be a good time, in order to hedge against the risk of these countries imposing tarifs in response to US’s protectionist strategy.

Additionally, Goodyear should reassure its unionized workforce by communicating their strategy of producing tires locally. They should also makes sure that global isolationist movements won’t cause their US plants to produce overcapacity. Goodyear’s workers should be clearly informed on that topic.

I found this article interesting from a macroeconomic policy perspective. While the intent of the tire tariff was to increase “the volume, market share, and employment of the US tire industry,” I don’t see how it has been effective in its goals in any way, shape, or form. US employment has not been affected, given that manufacturers simply shifted to other Asian countries (not the US); the volume and demand levels in the US likely went down given higher prices; and the additional cost was passed through to the American consumer, who paid $1.1 billion more for tires.

While I certainly wouldn’t sit on my heels given the changing nature of the cost of doing business in various countries such as the US or the UK, if I were Goodyear I would continue to take a nimble approach to manufacturing with a localized approach where necessary. That being said, I may also be laughing my way to the bank, as higher tariffs in isolationist countries only stand to benefit the largest manufacturers that have the ability to shift their production to other facilities around the world (as Goodyear did in this case).

Great piece! While these tariffs are designed to help local tire suppliers, it is interesting to see that they can sometimes lead to counterproductive results. In both 2009 and 2017, expectations of a future tariff led US tire distributors to build-up excess inventory of Chinese tires, leading to a short-term exacerbation of the problem that tariffs were attempting to solve [1].

I also wonder what the impact of the shift to natural gas will have the US tire industry. A common rubber used in tires is SBR, which is made using butadiene, which itself is a byproduct of ethylene production when heavier feeds such as naphtha are used [2] [3]. As the natural gas boom continues in the US and ethylene crackers shift away from naphtha and towards ethane, the supply of butadiene might decline [4] [5]. This large macro-level shift might hurt US producers against their Asian counterparts long term.

[1] Kopcha, Joy, Trucking Info, “No Tariffs, No Certainty for Truck Tires”, http://www.truckinginfo.com/channel/equipment/article/story/2017/06/no-tariffs-no-certainty-for-truck-tires.aspx

[2] https://www.britannica.com/science/styrene-butadiene-rubber

[3] https://www.ncbi.nlm.nih.gov/pubmed/17324391

[4] Petrochemical Update, “Insights from first wave of US ethylene projects drive second wave decisions” http://analysis.petchem-update.com/engineering-and-construction/insights-first-wave-us-ethylene-projects-drive-second-wave-decisions

[5] Frank Caprio, Hose Master, Understanding Naphtha and Ethane Cracking Process “http://www.hosemaster.com/understanding-naphtha-ethane-cracking-processes/”