Insuring the End of the World: Allstate at the Intersection of the Causes and Effects of Climate Change

Property & Casualty insurers, like The Allstate Corporation, stand at the crossroads of climate change, in both insuring carbon-intensive assets and activities, and paying claims for climate change-related damages.

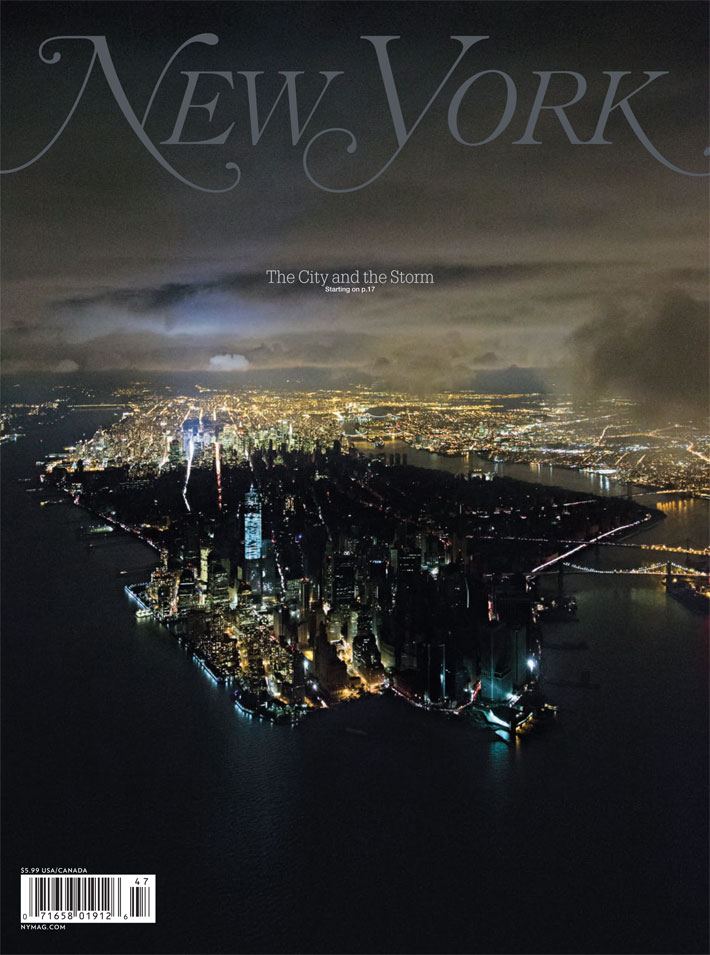

During the darkest days of Hurricane Sandy, when half of Manhattan was literally in darkness, my family watched with horror as homes and businesses were destroyed, lives were ended prematurely, and the city we call home was brought to its knees. But in the aftermath of the storm, few took time to consider who would pay for individual families and business to rebuild. Property and Casualty (P&C) insurers provide familiar services like car and home insurance, as well as other liability insurance, and represent a critical component of the financial landscape. And as extreme weather events, like hurricanes, wildfires, floods and tornadoes increase in frequency as the planet warms, P&C insurers must grapple with how this changes both their operations and their business model. They stand at the crossroads of this global catastrophe, in both insuring carbon-intensive assets and activities, and paying claims for climate change-related damages.[1]

The Allstate Corporation is the largest publicly-held personal lines insurer in the United States, and their P&C segments actively manage the risks related to climate change from a number of angles.[2] In managing their products and services, Allstate views the greatest risks to be related to the “increase in the frequency and severity of auto and property claims when severe weather conditions occur… [particularly] due to hurricanes [in] major metropolitan centers… along the eastern and gulf coasts of the United States.”[3] These losses (for Allstate alone) have historically included $3.6bn in 2005 related to Hurricane Katrina and $2.3bn in 1992 related to Hurricane Andrew.[3] These sorts of catastrophic events are difficult to predict, both in frequency and severity, and a shifting climate makes these estimates even more challenging. Additionally, though Allstate has a lower direct environmental impact than much of the Fortune 100 (as it does not process large volumes of raw materials, operate large factories or maintain large fleets of vehicles), its operations are subject to changes in internal and external demand for sustainable practices.[3]

Allstate has incorporated a number of practices and programs into its operations and business model in order to appropriately react to these changes. In their regular-way business, Allstate purchases reinsurance (i.e. insurance for insurers) to cover significant hurricane- and wind-related losses,[3] limits the writing and renewal of new policies in hurricane-prone coastal areas,[2] implements tropical cyclone deductibles in newly written policies,[2] and participates in state-level insurer facilities, such as the California Earthquake Authority and the Florida Hurricane Catastrophe Fund, which reimburse insurers for losses.[3] The company also actively incorporates the shifting external and internal risk environment into its pricing models.[3] While each of these actions mitigates Allstate’s risk from the effects of climate change, the company also works to mitigate the causes of climate change across the company, its clients and the broader world. In its operations, Allstate has targeted the reduction of 2010 energy use levels by 20% by 2020, driven by the Allstate Sustainability Council, LEED-Certified buildings and consumer programs such as online bill paying.[3] Allstate partners with outside organizations, such the Institute for Business and Home Safety (IBHS) to advocate for stronger and better enforced building codes. Allstate also works to influence the behavior of its customers to greener outcomes, including the Homeowners Policy Green Improvement Reimbursement Endorsement, which pays customers to replace appliances in their home with Energy Star-approved items.[2]

Through these actions and other internal programs, Allstate has worked to manage the risk of the shifting landscape for P&C insurers, however there are additional opportunities to influence the behavior of customers and provide new products and services, to both mitigate and capitalize on the effects of climate change. Though Allstate works with IBHS to advocate for more resilient building codes, it could use its reach and pricing structure to educate homeowners on fortifying their homes and incentivize them relocate to less disaster-prone zones. In addition, Allstate could provide premium discounts for low-emission vehicles and drivers who spend less time on the road, decreasing overall emissions. There are also a number of government or public works programs that would help to manage the effects of climate change and mitigate Allstate’s customers’ risk, including the building of flood defenses for coastal cities and government-subsidized loans to cover the costs of flood and fire-related upgrades in disaster-prone areas.[4] Allstate could also offer a suite of new products to insure against climate change-related damages, including business interruption due to flood-related brown outs, catastrophe-related unemployment, and post-event costs (like the increased costs of construction and cost of living in post-disaster areas).[4]

In this rapidly shifting landscape, it is imperative for P&C insurers like Allstate to continue to adapt, not just to the newly arisen risks from climate change, but also to the opportunities to serve their clients better. And perhaps the next time a superstorm comes to New York City, we’ll be better prepared to handle it.

(800 words)

Sources:

[1] Ross, Christina, Evan Mills and Sean B. Hecht, “Limiting Liability in the Greenhouse: Insurance Risk-Management Strategies in the Context of Global Climate-Change.” Stanford Environmental Law Journal, Vol. 26A, p. 316, 200. Via Social Science Research Network: http://ssrn.com/abstract=987942.

[2] Allstate Corporate Responsibility | Environment. 2016. Allstate Corporate Responsibility | Environment. [ONLINE] Available at: http://corporateresponsibility.allstate.com/environment. [Accessed 03 November 2016].

[3] Allstate Corporate Responsibility | Carbon Disclosure Project. 2015. Climate Change 2015 Information Request Allstate Corporation. [ONLINE] Available at: http://corporateresponsibility.allstate.com/wp-content/uploads/2016/06/ALL_CR14_CDP_2015_Climate_Change_Disclosure.pdf. [Accessed 3 November 2016].

[4] National Association of Insurance Commissioners. 2008. The Potential Impact of Climate Change on Insurance Regulation. [ONLINE] Available at: http://www.naic.org/documents/cipr_potential_impact_climate_change.pdf. [Accessed 3 November 2016].

Great topic and insights into the challenges of P&C insurers as the weather becomes more severe and the risk profile of their contracts changes. An additional issue for insurers like Allstate who have put a huge emphasis on becoming THE company for auto insurance is that ride sharing is disrupting the way people get around. My mother is an Allstate agent, and recent developments with ride sharing and investment in public transit systems has led them to pivot away from emphasizing auto insurance sells and start focusing more on home and life insurance. While I agree with you that an increase in the incidence of severe storms will affect the number of claims each year, I believe if Allstate is aggressive in building their book of business they will still be able to diversify away that risk.

I am also curious about Allstate’s role in investing in sustainability projects. I’m fairly skeptical that any program they pursue would serve any purpose other than goodwill marketing. The return on investment for these program would fairly minimal otherwise as as they can’t expect to make serious changes on the future of climate change.

I also wrote about Allstate so can shed some light on the sustainability projects. This was something I research but ultimately did not include as an area of strength for Allstate as I believe they should be doing more.

Currently, Allstate Investments, LLC manages approximately $72 billion in assets, of which $0.7 billion are (1%) are invested in environmentally-friendly and socially-responsible investment opportunities. In particular for climate change, only .3% in renewable energy. “In 2015, our investments included a low-income-housing tax credit (LIHTC) portfolio of $491 million, a renewable energy portfolio of $230 million, and a socially responsible investment portfolio of $51 million.” (Company Website: http://corporateresponsibility.allstate.com/environment)

Compared to other companies like Metlife, which has invested $4 billion in socially-responsibly investment, $1 billion of those in green bonds; I think Allstate has room to grow.

(https://www.metlife.com/about/corporate-responsibility/our-investments/impact-investents/index.html

SH,

This was a topic I hadn’t thought about before. Insurance is one of those goods that you don’t think about until you need it. One of the ideas that this brought to mind that I’d be interested in seeing is what is the cycle of cash flow? If I buy insurance, I pay Allstate who then pays me if something happens. However, what happens in the scenario of cash flows when Allstate invests in reinsurance or state-driven insurance funds? Where does the money come from? With this, I believe you would be able to see the weakness of these programs: that if climate change continues to intensifies, then Allstate begins to be unable to pay out on claims or that insurance premiums become so high that it is not affordable. Overall, I think it’s an interesting chain of events to look at given the increasing intensity of climate change. If you look at the link provided (http://www.cbc.ca/news/business/insurance-climate-change-adaptability-1.3323132), you can see the impacts of continued extreme weather events – the government begins to play a larger role in securing the insurance.

I agree with you that Allstate needs to adapt to this change. However, I disagree with your suggested methods of offering more insurance products that are based on climate change impacts. If Allstate offers new products to insure against climate change-related damages, including business interruption due to flood-related brown outs (this exists already – loss of revenue), catastrophe-related unemployment, and post-event costs, this continues the negative cycle of Allstate getting premiums from the customer and then paying out large amounts if such an event occurs. This assumes that they will collect more then pay out (or that there will be fewer climate change events causing claims to be paid out). However, your article assumes that climate change events will continue and worsen. Given this, it would be defeatist for Allstate to engage in this.

I think in the short term, Allstate needs to look at premiums and begin to shift the model from probability based (as this is interrupted by low probability, high damage events) model towards insurance for extreme events where they create a cash-reserve and it begins a mandatory products depending on the state one lives in.

SH –

I’m so glad you brought back the image from the New York Magazine cover post-Sandy! What a spectacular series of photographs. I saw a few more of Iwan Baan’s photographs at an exhibition about designing for resiliency at the Annenberg Space for Photography in LA last year (https://www.annenbergphotospace.org/exhibits/sink-or-swim), and was impressed by the ways he highlighted the impacts and response to climate change, particularly in a photograph of a floating school in Lagos (http://iwan.com/projects/makoko-floating-school-lagos-nigeria/).

When New York City set out to create a resiliency plan after Sandy, insurance was one of the main areas of focus. The storm highlighted many vulnerabilities for the city, but what was particularly alarming was that outdated floodmaps meant that more than half of the buildings that flooded during the storm were not within the 100-year floodplain (“PlaNYC: A Stronger, More Resilient New York,” City of New York, 2013, p. 15, [http://s-media.nyc.gov/agencies/sirr/SIRR_singles_Lo_res.pdf], accessed November 2016). I wonder what role a company like Allstate could play in advocating for and supporting work to ensure better mapping of flood risks. FEMA has a set schedule to review and update flood maps, but Sandy demonstrated that more could be done—and that companies like Allstate may have been missing out on potential customers as a result.

Your suggestion of using the rate structure to encourage compliance (or surpassing) updated building code standards sounds like a great role for an insurer. Though it may be difficult for Allstate to incentivize a move (other than no longer offering insurance in that area), I like that line of thinking.

Peter

Great topic – I also wrote about Allstate and it was interesting to hear your perspective. I agree that Allstate as a business first needs to focus on diversifying their own risk (buying re-insurance, cutting exposure in Florida) as short-term perspectives, but also needs to invest in future.

I thought you had great suggestions on creative ways they could help reduce global warming.

You mentioned: “Allstate could provide premium discounts for low-emission vehicles and drivers who spend less time on the road, decreasing overall emissions.” They actually do the second part through a side-program called Drive-wise (https://www.allstate.com/drive-wise.aspx) which incentives people to spend less time on the road! As far as low-emission vehicles, there are other auto insurers, like Farmers*, giving discounts for fuel-efficient cars and this is something I totally agree Allstate should do.

*Farmers: Alternative Fuel – Owners who drive hybrids and other alternative fuel vehicles may save 5% on all major coverages. (https://www.farmers.com/faq/discounts/)

Great topic on the impact of clinate change in a business line that is not commonly related to the topic. Although I like some of the efforts Allston has been taking towards addressing its own impact on clinate, I am worried about the incentives sorrounding the decision making process of the company. Some of the actions the company is taking to influence consumer behaviour have huge positive profit effects far bigger than any climate achievement. Also, there is a clear conflict of interest between Allston and the some of the government related actions and works describe in this post that needs to be address.

Still, I believe there are some valuable lessons that other companies could learn from Allston. One proven way to manage the climate problem in the business and economic context is to allow pricing models to reflect the shifting external and internal environmental risks sorrounding companies. Apparently Allston does a very good job of doing this, something other companies don’t. The entire business community should consider following this effort and government should compliment it with policies that induce such price changes and therefore impact consumer behaviour, such as a carbon tax.