Insurance industry vs climate change: early adopters

Curious to see how climate change affects business of insurers and re-insurers? The post discusses what steps have been taken by a company, which began warning the world (as early as 1973) against disastrous effects of human activity on environment.

Word count: 675

Munich Re is one of the world’s largest reinsurers with revenue of EUR 50bn and total assets of EUR 277bn (2015 Annual Report). Reinsurers essentially act as insurers for insurance companies that insure businesses and individuals. If insurance industry sounds boring, then reinsurance is like boring squared, so why even discuss it? Well… what if I told you that Munich re has been one of the earlies believers in anthropogenic climate change and warned the world about its consequences as early as in 1973? Interested? Be my guest.

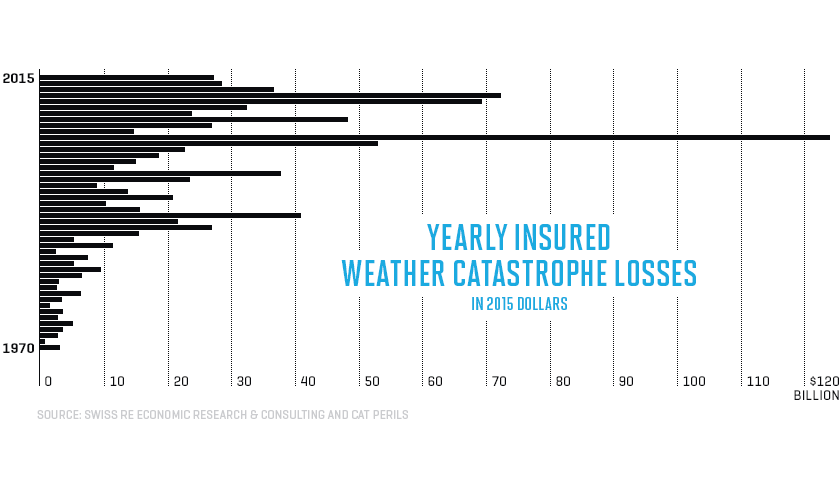

First, why would insurers care at all about climate change? Let’s examine the graph below[1] (Swiss Re research) – seems like recently cost of insured weather catastrophes has been soaring. Just as a reminder, insurance companies make money on not spending their earned premiums on payouts against insured events, which directly hit their pockets.

Really? As Warren Buffet, whose Berkshire Hathaway derives a significant portion of its profits from insurance business, puts it in his letter to shareholders[2], as insurance costs increase, they are matched by rising premiums so “the likely … effect on Berkshire’s insurance business would be to make it larger and more profitable”. However, as more countries acknowledge negative impact of climate change and pledge their support (incl. 154 US corporations at the November 2015 conference in Paris[3]), introduction of new energy and sustainability initiatives could result in decreasing premiums for some companies[4]. Furthermore, changes in climate make it increasingly difficult to measure risk. As Andreas Schraft, managing director for catastrophic perils at Swiss Re (another major reinsurer) puts it, “What we are concerned about is that if risks become too big, they may become unmeasurable”[5]. In addition, in its report “Climate Change-Related Legal and Regulatory Threats Should Spur Financial Service Providers to Action” Standard & Poor’s suggests that the reputational, regulatory, fiscal and legal risks on the short-to-medium term time horizon may be greater threats to insurers than direct costs of covering catastrophes[6].

Alright, since it considers climate change such a threat, let’s see what Munich Re have done to address these fears:

- In 1974 the company launched Geo Risk Research Department to study the topic of climate change. Munich Re created an enormous database of climate data, shared with the public and scientific community.

- Sponsored research initiatives, such as “Evaluating the Economics of Climate Risks and Opportunities in the Insurance Sector”, five-year research project tracking the impact of climate change on the insurance sector, run by London School of Economics (my undergrad university)[7].

- Introduced innovative products, such as micro-insurance for small farmers from developing countries, who would otherwise not be able to afford traditional insurance, and whose lives are adversely affected by climate change of developed countries’ origin[8].

- Has been very active in covering renewable energy businesses through ERGO’s, its primary insurer’s tailored products and HSB subsidiary, leading specialist provider of insurance for renewable technologies[9].

- Launched initiatives, such as Munich Climate Insurance Initiative, aimed at developing new insurance solutions to protect people from emerging countries against growing losses caused by climate change-related events[10].

- Has led “Caribbean Catastrophe Risk Insurance Facility” (CCRIF), set up to offer 16 countries in the Caribbean insurance cover against hurricanes and earthquakes[11].

References:

[1] http://fortune.com/2016/08/23/munich-re-disaster-insurance/

[2] http://www.berkshirehathaway.com/letters/2015ltr.pdf

[3] https://www.whitehouse.gov/the-press-office/2015/11/30/white-house-announces-additional-commitments-american-business-act

[4] http://ww2.cfo.com/risk-management/2016/03/hot-topic-climate-change-insurance/

[5] http://ww2.cfo.com/risk-management/2016/03/hot-topic-climate-change-insurance/

[6] http://www.carriermanagement.com/features/2016/05/10/154213.htm

[7] http://www.lse.ac.uk/newsAndMedia/news/archives/2015/11/ESRCReport.aspx

[8] https://www.munichre.com/en/group/focus/climate-change/strategic-approach/insurance-solutions/microinsurance/index.html

[9] https://www.munichre.com/en/group/focus/climate-change/strategic-approach/insurance-solutions/index.html

[10] https://www.munichre.com/en/group/focus/climate-change/strategic-approach/leading-initiatives/index.html

[11] http://www.ccrif.org/sites/default/files/publications/CCRIF_Strategic_Plan_2015_2018.pdf

Images:

- https://d3.harvard.edu/platform-rctom/wp-content/uploads/sites/4/2016/11/cng-featured-image-insurance-1.png

- https://d3.harvard.edu/platform-rctom/wp-content/uploads/sites/4/2016/11/munich-re-group-climate-change-ice-floe-728×224.jpg

Interesting post, and as I read this, specially given that global warming impact the bottom lines of insurers and re-insrers I wonder whether those players should play a bigger role in fighting climate change: as they are doing with cars insurance – monitoring driving patterns of drivers and increasing premiums for the bad ones – shouldn’t they be doing the same with firms’ and individuals’ practices that impact the environment?

That’s interesting that they were concerned about climate change all the way back in 1973. The quote that says that if the risks of catastrophic perils becomes too great, they become immeasurable, has large implications for the industry of insurers and re-insurers. I’m curious to know whether they are considering changing their investment strategies to actively promote the growth and success of companies who are proponents and implementors of practices that could mitigate climate change. So far, it seems like Munich Re has really just provided funding for research on climate change, but they may reach a point where they need to consider taking on a more active role to reduce contributions to climate change, in order to protect their business (and the planet, obviously…).

I enjoyed reading this post! I admit, I was hesitant at first, but was really glad I read it by the end. Unfortunately, its the poorer countries of the world that suffer the most from climate change. I’m glad to see that Munich Re has taken particular care to help support emerging countries.

Thanks for the post, I’ve always been curious about how insurance companies deal with climate change and had long assumed they were net losers. You bring up a good point that insurance companies can always pass the cost of higher climate change risk to customers via higher premiums, and unlike life insurance the lag time here can be significantly shorter given the increasing frequency of climate change events.

I am curious how you imagine this playing out in the intense competitive field of insurance. I know when I go to buy insurance there are dozens of providers offering me quotes–how do insurers ensure they don’t lose out on business because they “over-passed” the costs to customers relative to their competitors? I could imagine a worst-case scenario where the insurance company that has the worst climate change policy wins the most market share because their premiums are the most mispriced and lowest. I have heard that firms like Berkshire Hathaway can protect against this risk just based on their reputation and resulting ability to be picky about risks they insure, but I’m wondering if there is a race to the bottom and if so, what are your thoughts on how the industry can protect against these effects.