Industry Luminary

The bright future of the lightbulb business…

Lighting the Way

Acuity Brands, Inc. (“Acuity”) provides a variety of indoor and outdoor lighting solutions for commercial, institutional, industrial, infrastructure and residential applications. The company’s primary product segments include: fluorescent and LED bulbs/sockets, fixtures, lighting controls, power supplies and prismatic skylights. Acuity (NYSE: AYI) serves the new construction, renovation, and maintenance and repair end-markets in North America and several international markets. Customers include electrical distributors, system integrators, retail home improvement centers, electric utilities, lighting showrooms, national accounts and energy service companies.[i] The business currently generates $3.3 billion of revenue and trades at an equity market capitalization of $11.2 billion (as of 11/14/16).[ii]

Electrifying the Business & Operating Models

While the company has historically manufactured discrete standalone products, the Acuity management team is now addressing the mounting market need for energy efficient solutions. To do so, the company has proactively transitioned from selling lighting fixtures to selling “smart” networked lighting solutions. This next generation of products relies on motion sensors and occupancy sensors that can immediately respond to the demand for lighting, or lack thereof. Said differently, the products automatically provide artificial light when and where required, thereby saving energy. Perhaps most importantly, these systems of devices can be actively monitored and controlled remotely.

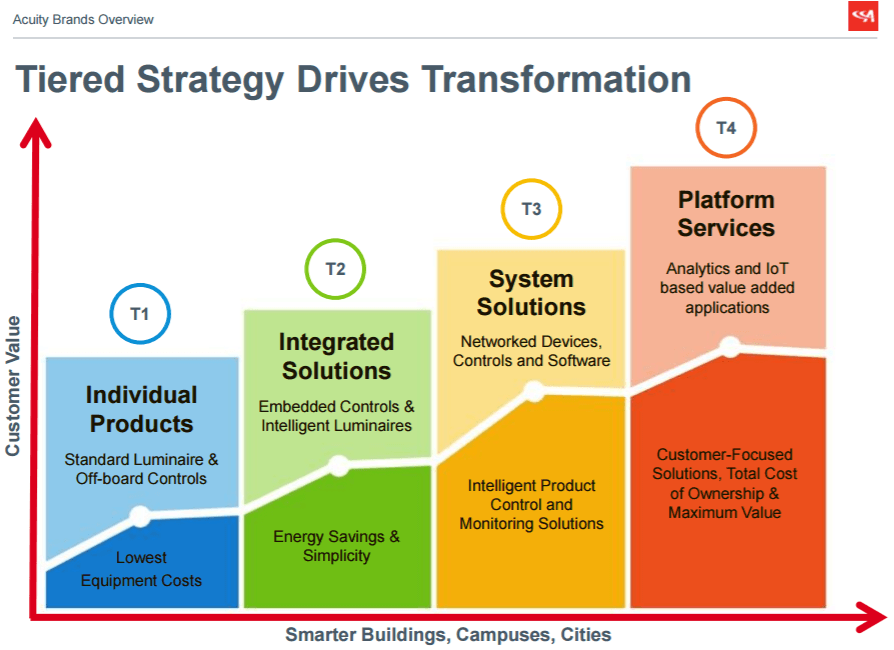

To execute on this plan to move down the value chain, the company has rolled out the following tiered product strategy[iii]:

Tier 1 and Tier 2 represent the company’s core lighting fixtures (or luminaires), including those with embedded controls. Tier 3 represents the new system-based solutions. These networked devices are a mixture of hardware, software and connectivity that can collect and transmit data, thereby enabling ongoing monitoring. Tier 3 only makes up ~10% of the company’s sales today, but management and research analysts agree that these new offerings have the potential to bolster future profitable growth.[iv] In fact, the Department of Energy (DOE) recently published a report stating that networked lighting solutions are expected to grow from 1% of total market share in 2015 to 15% in 2020.[v] In addition to consumer sentiment and cost savings, updated building codes in the U.S. will drive demand for these types of solutions in new construction, renovation and retrofitting.[vi]

Going one-step further, Acuity has further extended its product roadmap to Tier 4, or platform services. These services will essentially run analytics on the mountains of data being pulled off the Tier 3 products. To jump-start the aggressive strategy, this former lighting fixture manufacturer has recently acquired a handful of pioneering software companies[vii]:

- DGLogik (June 2016): Provides visualization tools to manage energy usage in a facility setting.

- Geometri (December 2015): Provides software to map, navigate and analyze physical spaces.

- Distech Controls (September 2015): Provides building automation solutions that allow for the integration of lighting, HVAC, access control, closed circuit television, and related systems.

Acuity has also subtly tweaked its operating model in order to better support the delivery of more software-related integrated offerings. As an example, management disclosed that they are currently consolidating production activities across their 20 manufacturing facilities, seven distribution facilities and two warehouses. Management also disclosed that they are realigning various selling, distribution and administrative departments. In fact, the latest 10-K sheds light on the recent uptick in operating expenses: “The increase in employee costs reflects the Company’s investments in capabilities related to areas of future growth as well as enhanced customer service.”[viii] These fundamental adjustments to the business and operating models have materially improved how public markets value the company’s future growth, margins and cash flows:

Further Enlightenment

Acuity has historically sold its products to electrical distributors, retail home improvement centers and lighting showrooms, among others. As management transitions to “smart” networked solutions, it is imperative to allocate resources to educate and train all stakeholders in the distribution chain and channel. This is particularly true for electricians, who likely play a vital role in the recommendation and purchase of the lighting systems. One idea to address this gap is to setup working demonstrations in trade shops and lighting showrooms.

It is also worth considering where in the technology stack Acuity can defensibly maintain the most margin long-term. Some industry analysts argue that the collection and transmission of data, such as from a light fixture, will ultimately be commoditized over time. With that in mind, Acuity might explore how they can best capitalize on their ability to ingest, aggregate and analyze data streaming off systems of similar devices. One idea is to build out a device-agnostic platform that can crunch data from a broad range of energy-related devices, not just those manufactured by Acuity. It may also be worth advocating for partnerships and consortia to approve open standards and maximize system interoperability.[ix] [793 words]

Endnotes:

[i] Acuity Brands, Inc. (2016). Form 10-K 2016. Retrieved from S&P CapitalIQ.

[ii] “Acuity Brands, Inc.,” S&P CapitalIQ, November 2016.

[iii] “AYI Company Profile,” Acuity Brands, Inc., November 2016. Retrieved from company website.

[iv] “Acuity Brands,” Cowen & Company, Equity Research, October 5, 2016.

[v] “Acuity Brands, Inc.,” Wells Fargo, LLC, Equity Research Department, October 30, 2016.

[vi] “Acuity Brands,” Cowen & Company, Equity Research, October 5, 2016.

[vii] Acuity Brands, Inc. (2016). Form 10-K 2016. Retrieved from S&P CapitalIQ.

[viii] Acuity Brands, Inc. (2016). Form 10-K 2016. Retrieved from S&P CapitalIQ.

[ix] “Industrial Internet of Things,” World Economic Forum in Collaboration with Accenture, 2015, http://www3.weforum.org/docs/WEFUSA_IndustrialInternet_Report2015.pdf, accessed November 2016.

Wow – this is a great example of a company embracing the digital era and diving headfirst into change. This does seem like a significant & quick transformation for Acuity, moving from manufacturing to energy management software to, as you suggest, more complex analysis. With three new acquisitions to integrate, a restructuring of production and the workforce, and a sales force to train, I wonder if Acuity has taken on too much at once. I’ll be curious to see how quickly they can move on this total transformation.

Interesting post, Matt! I really like the dual benefits of Acuity’s system – integration of sensory data into lighting fixtures as well as increased energy efficiency. I also think your point at the end about the commoditization of data is interesting, and I wonder how public utility companies (and ultimately, the government) will use this kind of data. I think there could be all sorts of interesting incentive programs that are tied to installing an Acuity system or other types of energy efficiency measures for real estate owners, but I do worry that the there is a strong enough aversion to data privacy that these kinds of incentives may take a long time to get implemented. Perhaps these are some of the advocacy efforts that Acuity is working on!