Imagine a World Without Coffee…

How Starbucks is fighting global climate change one coffee cup at a time…

How Climate Change Affects Starbucks

Starbucks is facing a massive issue: global warming is decimating the world’s supply of coffee beans. The farmers who supply Starbucks’ main input cost, the Arabica coffee bean, are facing plummeting crop yields from declining farming opportunities and deteriorating weather conditions. These supply issues stem from a combination of increased hurricanes, mudslides, erosion, pest infestations, and erratic rain patterns…all because of global warming. Not only does this affect the input costs of Starbucks’ coffee beans, but it also will likely lead to further supply constrictions as farmers become less incentivized to cultivate coffee in the future or switch to other crops.[ii]

According to a recent MIT research study, if global warming keeps up at the current pace, 80% of the Arabica coffee bean producing regions located in Central America and Brazil will no longer be fit to produce coffee beans by 2050. Given this effect, the international decline in the coffee supply would fall by a drastic 50%[iii], making Starbucks’ costs rise sharply as production drops. The company is extremely concerned, and their Sustainability Chief Jim Hanna attests: “if we sit by and wait until the impacts of climate change are so severe that is impacting our supply chain then that puts us at a greater risk. From a business perspective we really need to address this now, and to look five, ten, and twenty years down the road.” [iv]

How Starbucks is Fighting Back

Starbucks is seeking to mitigate these threats at the macro level by founding the Sustainable Coffee Challenge to push governments, businesses, and other companies to stimulate growth for sustainable coffee across the value chain. The project has been massively successful, and now includes “a diverse coalition of nearly 50 partners from across the coffee sector from retailers, traders, governments, donor agencies and other NGOs – united by a sense of urgency and shared commitment to ensuring the long-term viability of coffee.”[v]

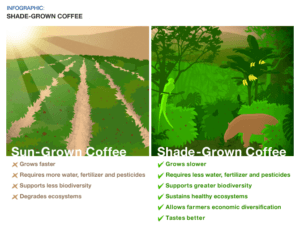

At the micro level, Starbucks has partnered with Earthwatch to bring scientific research and sustainable farming practices to the farmers who supply their coffee beans. These efforts have been at the cutting edge of environmental science, successfully reducing the fertilizer usage levels and reducing acidity levels by increased use of limes (for savings of $243 per hectare equaling over $1,200 per farmer). These methods also increased coffee beans per branch from 25.1 to 33.4, a staggering 25% increase in yields.[vi] Starbucks has even taken their actions one step further, by working with farmers to counterbalance extreme temperature and limited water supply by using an adapted growing technique called “shade grown coffee.” This process utilizes a large canopy of trees which are “not only making their supply chains more resilient, but are curbing global warming by preserving tropical forests, which soak up carbon.”[vii] These actions are cementing Starbucks’ business viability long-term by ensuring that the Arabica coffee bean supply does not diminish rapidly around the globe, while effectively cutting COGs and positively impacting their bottom line.

Recommendations for the Future

Recently, Starbucks has performed admirably in hedging their costs, using one-year commodity hedging derivatives to lock in prices of coffee for next year. By pouring through research reports and looking at the most recent financial statements, one notices that Wall Street analysts have been impressed that management has been able to hedge their increasing commodity costs short term.[ix] However, the company will need to do much more in the future as climate change more drastically impacts the prices of coffee beans. By analyzing the prices of coffee futures longer term, management could actually realize a profit by using more advanced investment instruments. My suggestion is to hire a small team of exotic structured derivatives specialists. Looking at a current chart of the coffee futures market, these experts would identify the coffee market is in contango priced out till August of 2017. This means the index funds in this market have to pay a roll yield as they sell contracts before they expire at a lower price, and then buy a further out contract at a higher price. Devoting more resources and attention toward this will be imperative in the future, as coffee prices become more volatile and the coffee market becomes treacherous for the players trying to hedge out pricing on a yearly basis. A second step that Starbucks could take is commissioning an in-depth independent research study of where coffee prices will trade five years from now. This way instead of hedging out for just one years’ worth of supply, management could hedge out COGs using long term equity anticipation contracts (LEAP options). This would save them from paying higher option premiums for hedges. By doing this, Starbucks could effectively save itself millions of dollars in future costs, and make sure that coffee will still be helping people wake up in the morning for years to come.

Word Count:797

i]Featured Image

[i] Kate Taylor, (2016), Starbucks Across America [ONLINE]. Available at: http://www.businessinsider.com/starbucks-are-running-out-of-coconut-milk-2016-7 [Accessed 2 November 2016].

[ii] Suzanne Goldenberg, “Starbucks Concerned World Coffee Supply Is Threatened by Climate Change,” The Guardian, October 14, 2011, accessed November 2, 2016, https://www.theguardian.com/business/2011/oct/13/starbucks-coffee-climate-change-threat.

[iii] “Coffee Shortage Predicted Due to Climate Change; Starbucks, Agriculture Industry Worried,” Nature World News, May 12, 2016, accessed November 2, 2016, http://www.natureworldnews.com/articles/22059/20160512/coffee-shortage-predicted-due-to-climate-change-worries-starbucks-and-the-agriculture-industry.htm.

[iv] Suzanne Goldenberg, “Starbucks Concerned World Coffee Supply Is Threatened by Climate Change,” The Guardian, October 14, 2011, accessed November 2, 2016, https://www.theguardian.com/business/2011/oct/13/starbucks-coffee-climate-change-threat.

[v] “Follow Starbucks’ 15 Year Journey to 100% Ethically Sourced Coffee,” Conservation International, 2016, accessed November 2, 2016, http://www.conservation.org/partners/Pages/starbucks.aspx.

[vi] “Earthwatch Case Study: Starbucks Helps Grow a Better Cup in Costa Rica,” EarthWatch Institute, 2016, accessed November 2, 2016, http://earthwatch.org/corporate-partnerships/corporate-partnership-case-studies/starbucks.

[vii] Lehner, Peter. “Major Businesses Prepare to Deal with Climate Change.” March 23, 2016. accessed November 2, 2016. https://www.nrdc.org/experts/peter-lehner/major-businesses-prepare-deal-climate-change.

[viii] Conservation International, (2016), Shade Grown Coffee [ONLINE]. Available at: https://coffeeruleseverythingaroundme.wordpress.com/portfolio/coffee-cravings-the-last-link-in-the-commodity-chain/ [Accessed 2 November 2016].

[ix] Bonnie Herzog, “Starbucks Corporation,” Wells Fargo Equity Research. accessed from Capital IQ, Inc., a division of Standard & Poor’s. April 21, 2016. accessed November 2, 2016.

Brad – great post. As I sit here with my cup of coffee reading it, a couple thoughts have occurred: Shade-grown plants grow slower, by how much? Given that Starbucks consumes coffee beans on a MASSIVE scale, how much additional crop land needs to be converted to support the growing consumption of an even faster growing global population? Is it a sustainable solution to move in a direction that actually requires putting more land under active cultivation?

What other options are available for Starbucks – in terms of moving to additional custom beverage and food products?

Also, you need to explain that last paragraph to me…haha

Thanks for the post Brad. It’s interesting to me that there are such accessible short-term options for Starbucks, just through financial engineering.

I wonder – how do you think the capital markets would respond if Starbucks emphasized more diversification as part of its strategy to fight climate change? For example, what if Starbucks accepted that coffee prices are going to rise, and so instead decided to invest more in tea, food, etc.?

Brad, thank you for the thoughtful post. You have highlighted a key issue that Starbucks currently faces. It is great that the Company has taken proactive steps to help counteract some of the effects of climate change. However, I definitely agree with your recommendation that Starbucks should use financial instruments to help hedge against future pricing volatility in the coffee industry. This strategy will clearly help offset some of the inherent risk. What other steps do you think Starbucks can take to mitigate some of the physical devastation we are seeing on a global scale?

Great read – thank you Brad! In addition to the financial measures you suggest, I wonder if there are other strategic and operational levers that Starbucks can pull to assert greater control over its supply chain. For example, as Central America and Brazil become less hospitable to Arabica beans, are there any other regions that may evolve into prime locations for such harvesting (given the changing weather patterns brought about by global warming)? If so, how can Starbucks incent farmers in these regions to start growing Arabica? Alternatively, are there other variations of coffee beans that are less impacted by climate change? If so, could Starbucks begin incorporating these beans into their menu?

Brad- Thank you for the thoughtful post. You certainly fit in a lot into 797 words. Interesting theme emerging across all of our posts on how much of the implication of climate change is impacting the supply chain and prices of many of our favorite goods. While we may be enjoying a warmer winter, you do a good job at showing the hidden costs of climate change and the need for sustainability.

Brad – Your post first caught my eye by your descriptive title. As an avid and perhaps addicted coffee drinker, is it hard for me to fathom a world without Starbucks coffee. While your post focused on gourmet coffee, I think it also raises the interesting question regarding the role of global conglomerates in the climate change discussion. Due to Starbucks large position in the supply chain, it appears that Starbucks has the influence to initiative powerful efforts such as the “Sustainable Coffee Challenge” and the partnership with “Earthwatch.” I think that corporations that occupy a dominant position within the global supply chain will have to play an increasingly active role going forward. While you suggest that Starbucks should invest in a team of structured derivative specialists, I think that the market would also benefit if Starbucks continued to expand its partnerships with local producers. Using its influence, Starbucks could encourage suppliers to adopt more sustainable practices that would benefit its supply chain in the long term.