Iliad S.A.: the story behind France’s telecommunications maverick

Iliad enabled the French to slash their internet and phone bills by two after entering both of these markets. Here’s how they did it.

How much would you expect to pay for a cell phone plan, with unlimited talk, SMS , data and no roaming charges when traveling within Canada, the U.S. ,or the European Union? Probably over $100 with a two-year contract. In France, it costs less than $25 per month (€19.99, sales tax included) with no commitment. Free Mobile, a subsidiary of French Telecommunication Group Iliad is responsible for this amazing deal.

Free Mobile entered the market in January 2012. The three existing competitors were offering similar packages for more than twice the price. Less than four years in, it counts over 11 million subscribers (16% market share). The business is profitable and accounts for 40% of revenue.

This was not Iliad’s first attempt at disrupting an established and high margin market. In the early 2000’s it had “broken the cosy status quo of French telecoms and created commercial havoc” with it’s broadband and landline offerings through it’s subsidiary Free. So how did they do it? The answer lies in what I believe are the four pillars that drive Iliad’s commercial and operational strategy: Innovation, Lean Structure, Simplicity, and Attractive Prices.

Innovation

Iliad’s broadband business relies heavily on internal design and R&D of products and seeks technological edge over competition. In 2000, they developed their own end-user home equipment that would deliver internet, phone and TV with only one device. Xavier Neil, Group CEO and founder said in an interview: “We felt sure that it must already exist somewhere in the world, and so we went to the United States and elsewhere, but we didn’t find it anywhere else, and so we decided to make it ourselves. We invented the triple play.” It was rolled out in 2002 and it would take 4 years for the “freebox” to be matched by rivals. The latest version of the box keeps adding additional features at no cost to the customer such as a NAS drive, Android TV or Blue ray player.

Today, Free Mobile is innovative in terms of its commercial offers and distribution channels. It launched 1,600 automatic sim card dispenser machines in the past 18 months available in post offices and newsstands.

Lean structure

In a 2009 interview, Iliad’s CEO and founder Xavier Neil reflecting on his company’s success 10 year into its foray into the broadband market said: Keeping the team small and nimble (“commando spirit”) with no hierarchy and powered by the thrill of being able to give 100%, take initiative and have a real impact […] was key.

Throughout the years, the company has stayed very lean despite its growth. This was a key advantage compared to incumbent competitors. Partially state owned Orange remains bloated following years of monopoly and high margins.

While competitors had to hire many salespersons and spend money on ads, Free “created an offering that you could not ignore”. Costs per customer acquisition remains lower than competition. Free was also first in relocating it’s customer support call center in French speaking Morocco.

In recent years, Free mobile followed the same path. It initially sold its sim cards exclusively online thereby avoiding the costly retail infrastructure or paying commissions to distributors. The introduction of the self-service kiosks mentioned above helped broaden distribution while keeping costs low. Free Mobile leveraged on its sister company Free’s Wi-Fi hotspot network (the world’s largest) as every triple-play modem was a hotpost; thanks to the EAP-SIM protocol, smartphones could connect seamlessly to those hotspots. By running most of its traffic over these, it managed to reduce its cost of delivery and its need for cellular capacity.

Simplicity

Free tries to emulate Apple’s mantra in simplicity of use and limited number of products. It’s Freebox comes in two models. It is plug and play and does not require an installation manual for the setup of TV/Wifi/Phone.

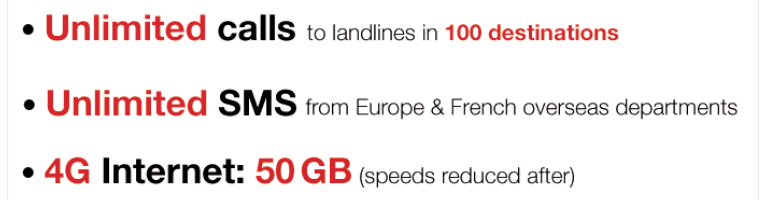

Iliad has very straightforward offers: it has two price points for both its broadband and mobile plans. There are no add-ons: what the competition sells as add-ons is included in Free‘s high priced packages. This simplicity allows for complete price transparency.

Attractive prices

French consumers pay some of the world’s lowest broadband rates (cf OECD data) thanks to Iliad and it’s lean structure. Prior to Iliad’s foray into broadband, France’s telecommunication market was a quasi monopoly with few players and enormous margins. Competitors had no choice but to lower their prices and align with Free, even if it meant lower margins and potentially lower future infrastructure investments.

- OECD Fixed Broadband basket Med 5 : 100 GB / month. 102.400 Mb/s and above, Sept. 2014

When Iliad moved into the cellphone market, it replicated the operational model it had built in broadband and sent prices plunging, forcing the established operators to match its discount prices.

Looking ahead

Free Mobile faces numerous challenges to maintain it’s lean structure. It benefits from a roaming deal with Orange until 2017 but will need to finish creating a nationwide mobile network of its own as French regulation requires universal coverage. Analysts say it will have to invest heavily in spectrum auctions scheduled for 2016 to do so. Does it make sense to fund these massive Capex requirements with it’s mature Broadband business which generates strong positive cashflow? They will need to maintain their innovation edge and lean structure to continue growing market share and reach a size that warrants these investments.

Other sources:

[1] Google could be a great partner for Iliad in its quest for T-Mobile:

[2] L’ARCEP retient la candidature de Free Mobile:

http://www.arcep.fr/index.php?id=8571&tx_gsactualite_pi1%5Buid%5D=1234&cHash=3da45f613f

[3] Wikipedia – Extensible Authentication Protocol (EAP)

https://en.wikipedia.org/wiki/Extensible_Authentication_Protocol

[4] Iliad Financial reports and Management comments:

http://www.iliad.fr/finances/2015/slideshow_2014_120315.pdf

http://www.iliad.fr/finances/2015/Annexes_Consos_2014_120315_Eng.pdf

http://www.iliad.fr/finances/2015/Annexes_Consos_S1_2015_310815_Eng.pdf

http://www.iliad.fr/finances/2015/Rapport_Gestion_2014_120315.pdf

http://www.iliad.fr/finances/2015/Rapport_Gestion_S1_2015_310815_Eng.pdf

http://www.iliad.fr/finances/2015/slideshow_S1_2015_310815.pdf

Laurent, this is a very interesting analysis!

Telecom must be one of the most challenging industries to fight with incumbents due to large capex requirements. It’s amazing to see that Free Mobile is able to compete with large telcos like Orange while using their infrastructure. Being the first mover in introducing bundle packages must have been a great advantage for Iliad’s growth and profitability as it would require analytical infrastructure to build. I wonder if Free Mobile would be able to achieve similar profitability levels if it weren’t Iliad’s subsidiary. The challenges that you mentioned at the end are crucial in sustaining growth and it will be interesting to see how Free will overcome these in the years to come!