How Vail Resorts Plans to Weather the Storm of Climate Change

How Vail Resorts Plans to Weather the Storm of Climate Change through Diversification and Expansion

Snow is the lifeblood of ski resorts – it’s what draws people to the mountains for skiing, snowboarding, snowmobiling, and other activities. The milder, less predictable winters resulting from climate change pose a long-term existential threat to the $66 billion dollar a year winter sports industry.[1] But for Vail Resorts—which operates 13 ski resorts, predominately in the western United States—these challenges present an opportunity to expand and diversify its offerings.

https://www.instagram.com/p/9ZbtFxq2Cs/

Vail Resorts has long used adaptation strategies to manage variability in snowfall. Like 88% of U.S. ski resorts, Vail ski areas use artificial snowmaking to manufacture snow when Mother Nature does not. Vail Mountain (the company’s first resort) pioneered cloud seeding in 1972, in which it sends silver iodine into clouds, causing them to yield as much as 15% more snow.[2] These adaptation strategies still require minimum temperatures of 32 degrees; otherwise the manmade snow will melt.

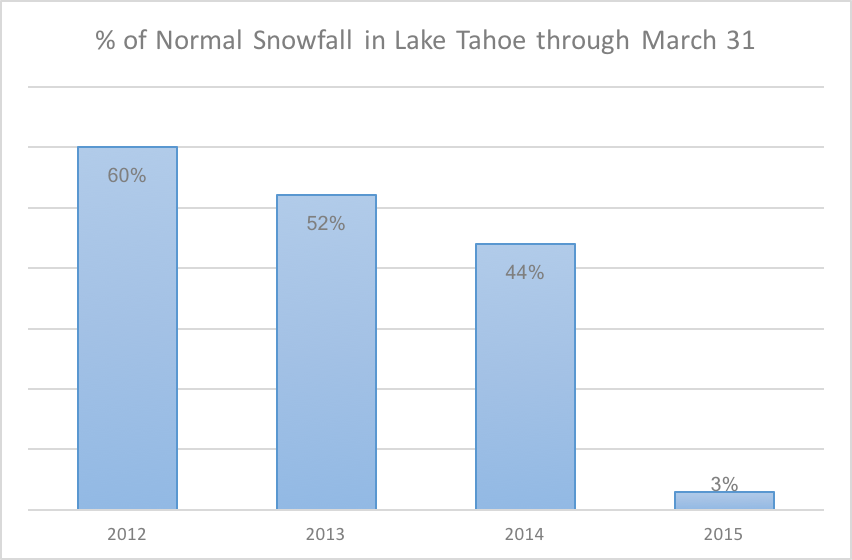

In Lake Tahoe, where Vail operates Heavenly, Northstar and Kirkwood, drought conditions and warm temperatures made the four seasons between 2012-2015 among the worst in a century. [3] Skier visits for the 90 days ending April 30th dropped by 33.1% from 2014 to 2015.[4] However, Vail’s takeover of both The Canyons and Park City Mountain Resort in Utah over the course of 2013 and 2014, which it later combined into a single Park City ski area, helped offset the impact of poor conditions in Lake Tahoe. In fact, due to Vail’s geographic diversification strategy, in 2015—the worst year on record in one of its core regions—revenue actually increased by 11.6%.[5]

Vail continues to pursue this strategy to reduce the impact of climate change. Last month, it completed its acquisition of Whistler Blackcomb in Canada’s British Columbia, the continent’s largest ski resort, to secure additional geographic diversity.[6] Holders of Vail’s popular Epic Pass can ski at any of Vail’s resorts, so avid skiers can purchase the pass over the summer at a discount (it was $809 this year) before the ski season even launches, knowing they’ll likely have several different options for great skiing.[7]

Vail has made other creative acquisitions related to climate change. In 2015, it acquired Perisher, in New South Wales, Australia, the country’s largest ski resort. Conditions at Perisher have become consistently poor due to warmer temperatures and reduced snowfall, but it provided Vail a foothold in the Australian market to develop relationships with local skiers and ultimately entice them to their North American resorts where conditions are better.[8]

Vail is also hedging against variable winters is by bolstering summer offerings. While more tourists come to Colorado, Utah and Lake Tahoe in the summer than in the winter[9], Vail Resorts operates at a loss during summer months because it has not been able to monetize these visitors as they can with skiers and snowboarders who pay for lift tickets, rentals, and lessons (full day private lessons at Vail Mountain cost a whopping $925!).[10] In summer 2016, Vail launched its Epic Discovery summer activities program at Vail Mountain and Heavenly, featuring activities like mountain coasters, tubing, ropes courses, and rock climbing. The company plans to spend up to $100 million rolling out Epic Discovery at other resorts, with Breckenridge preparing to debut its offerings in summer 2017.[11]

https://www.instagram.com/p/BJB4sTngljC/

While Epic Discovery helped decrease Vail’s summer losses from $70.1 million in 2015 to $65.3 million in 2016, it is hard to imagine enough people paying for activity passes in the summer to compensate for shorter ski seasons.[12] After all, some of the most popular summer activities like hiking are free, while winter sports cost money. Vail could raise the price of its Epic Passes and include access to summer activities. That way they could recognize additional revenue during the summer months and also incentivize people to return to Vail Resorts during the summer and spend additional money at their restaurants, hotels, and shops.

Vail should also further diversify its revenue streams. Currently, it has three different segments: mountain activities, lodging, and real estate, which generate 82%, 17%, and 1% of revenues, respectively[13]. Lodging revenues are from hotels serving ski resorts, where business is susceptible to seasonal variability. Leveraging its expertise and scale in hospitality, Vail might consider expanding its RockResorts brand to include beach and golf resorts and leveraging its relationship with the National Park Service to build additional summer lodging at National Parks throughout the country beyond its extant Grand Teton properties.

While many experts are bearish on the future of ski resorts, Vail shows us that these companies need not melt into oblivion.[14] Vail Resorts is future-proofing itself through its expansion and diversification strategy and Wall Street has reacted with an all-time high stock price.

Word count: 780 words

[1] Porter Fox, “The End of Snow,” New York Times, February 7, 2011, http://www.nytimes.com/2014/02/08/opinion/sunday/the-end-of-snow.html?_r=0, accessed November 2016.

Some models suggest over half of the Northeast’s ski resorts will not be economically sustainable by 2039 and that the Rocky Mountains could have no snowpack by 2100.

[2] Shelby Kinney-Lang, “Climate Change Could Decimate the American Ski Industry,” Vice News, February 16, 2015, https://news.vice.com/article/climate-change-could-decimate-the-american-ski-industry, accessed November 2016.

[3] Jeff DeLong, “Sierra Snowpack is ‘worst in a century,’” USA Today, April 1, 2015, http://www.usatoday.com/story/weather/2015/04/01/sierra-snowpack-drought-california-lake-tahoe/70760264/, accessed November 2016. [Chart above also created using data from the article]

[4] Vail Resorts, June 8, 2015, Quarterly Report, p. 6, http://investors.vailresorts.com/secfiling.cfm?filingid=812011-15-31&CIK=812011.

[5] Jason Blevins, “Vail Resorts revenue hits $1.4B, 2015 earnings strong despite bad snow,” The Denver Post, September 28, 2015, http://www.denverpost.com/2015/09/28/vail-resorts-revenue-hits-1-4b-2015-earnings-strong-despite-bad-snow/, accessed November 2016.

[6] Katia Dmitrieva and Prashant Gopal, “Vail to Buy Whistler Blackcomb Ski Resort for $1.05 Billion,” Bloomberg, April 8, 2016, http://www.bloomberg.com/news/articles/2016-08-08/vail-to-buy-whistler-blackcomb-ski-resort-in-1-05-billion-deal, accessed November 2016.

[7] As a ski blogger who goes by Barclay put it, “Vail has created the ultimate game of ski condition musical chairs. When it rains in Whistler, Epic Pass holders can head to Colorado. And when drought strikes California, its pass holders can head north and ski Whistler.”

Barclay (blogger handle), “Vail Resorts Purchased Whistler Partly To Hedge Its Bet Against Climate Change,” Unofficial Networks (part of USA TODAY Lifestyle/Action Sports), August 18, 2016, http://unofficialnetworks.com/2016/08/vail-resorts-purchased-whistler-partly-to-hedge-its-bet-against-climate-change, accessed November 2016.

[8] Swati Pandey, “Australia’s not-so Snowy Mountains: Why Vail bought a ski resort Down Under,” Reuters, April 7, 2015, http://www.reuters.com/article/us-vail-resorts-m-a-australia-idUSKBN0MW0R620150407, accessed November 2016.

[9] Vail Resorts, June 8 2015, Quarterly Report, p. 6, http://files.shareholder.com/downloads/MTN/3117782759x0x913014/68BF4BB5-DB35-4BCD-AAA4-92512CF4D0B4/2016_Proxy_and_Form_10-K.pdf.

[10] “Private lessons,” Vail Mountain, http://www.vail.com/plan-your-trip/book-ski-and-ride-lessons/products/Private-Ski-Lesson?pfm=lrmore.

[11] Jason Blevins, “Vail’s $25 million summer development sparks new era of year-round ski resort playgrounds,” The Denver Post, June 27, 2016, http://www.denverpost.com/2016/06/27/vail-resort-off-season-activities-epic-discovery/, accessed November 2016.

[12] Dow Jones Newswires, “Vail Resorts posts deeper-than-anticipated loss, but revenue grows on season-pass sales,” The Denver Post, September 26, 2016, http://www.denverpost.com/2016/09/26/vail-resorts-posts-loss-revenue-grows-season-pass-sales/, accessed November 2016.

[13] Vail Resorts, June 8, 2015, Annual Report, p. 3, http://files.shareholder.com/downloads/MTN/3118275963x0x913014/68BF4BB5-DB35-4BCD-AAA4-92512CF4D0B4/2016_Proxy_and_Form_10-K.pdf.

[14] Alan Neuhauser, “Snowfall No Longer a Sure Bet, Booming Ski Towns Fight Going Bust,” U.S. News and World Report, February 14, 2014, http://www.usnews.com/news/articles/2014/02/14/snowfall-no-longer-a-sure-bet-booming-ski-towns-fight-going-bust, accessed November 2016.

Terry Root, a Senior Fellow at Stanford’s Wood Institute for the Environment, conveyed the pessimistic outlook many have on the ski industry when she said, “There’s going to be good years and there’s going to be god-awful years. The globe is warming so rapidly, and variability is increasing so much – both of those things together, I’m glad I don’t have stock in ski areas.”

Feature Photo, courtesy of Adam Simmons, used under Creative Commons license, https://flic.kr/p/D4QHWL

Hi Brian – with the HBS ski trip on the horizon, this is quite the timely post! Vail’s diversification strategy does seem really encouraging. However, I wanted to dive a little deeper into your mention of artificial snow generation.

Regardless of how much Vail and other resorts diversify, their core offering is of course still skiing. Unfortunately, artificial snow generation is at once necessary for the business model and extremely damaging to the environment. This is not a new issue – in fact, the NYTimes exposed the risks in the 90s.

For some context, it takes about 150,000 gallons of water to make enough snow to cover an acre of ski trail one foot deep. Depleting rivers and streams is very adverse to local fish and other wildlife. (http://www.nytimes.com/1994/11/14/us/the-battle-over-artificial-snow.html)

This issue has caused both social and legal tensions. In 2012, 13 American Indian tribes took on the Arizona Snowbowl (and subsequently lost). http://www.nytimes.com/2012/09/27/us/arizona-ski-resorts-sewage-plan-creates-uproar.html?adxnnl=1&adxnnlx=1349323660-FIZLcXEoYQeoGygy1vR0TA

Although diversification is a short term “band-aid”, these resorts will need to fundamentally reposting their customer value if they are going to ever become truly sustainable.

Nice post, Brian.

Your suggestion that Vail further diversify its offerings to cover both warm-weather and cold-weather activities is a solid strategy, though I’d like to raise one red flag. In the lead up to the UN Paris Agreement, I spent 2 years consulting with Al Gore to pressure overseas governments to make real commitments to fight climate change. Vice President Gore often repeated that one of the most unappreciated facts about climate change is that, while the planet as a whole will be warming, extreme weather at both ends of the scale—droughts and record highs, as well as tremendous snowfall and record lows—will become much more common. Some years Vail Mountain might be bare…and others its lodges might be literally buried under feet of snow.

Thus, while I agree that diversifying into a diversity of temperature-related recreational areas will be beneficial, Vail will need to become ever more expert in preparing for unpredictable swings, both hot and cold.

Brian, nice post. I hadn’t thought about how Vail is diversifying geographically to hedge against climate change as well as pushing its summer offerings. I think Vail has more opportunity with its summer offerings. As Americans spend more time outdoors, driven by a health & wellness megatrend, Vail Resorts could benefit from the trend. Vail, however, is tasked with changing Americans’ view that ski resorts can be great during the summer!

I agree, I think diversifying is the way for Vail to go in order to secure more predictable revenue streams! I would use Las Vegas as an example of a success story in terms of adding offerings to meet consumer tastes. Back in the day, I think the city was really just a gambling kind of town. Today, many people go to Las Vegas for nothing to do with gambling: nightclubs, theater, shopping, poolside, nature, and so much more. Vail, similarly, can really push well-executed marketing that can communicate, “We’re not a ski resort, we’re an experience for you and your SO or you and your family.” Although space is constrained between the mountains, Vail might consider building more attractions that are not just based on the outdoors so that the complex appeals to a wider variety of guests. It can be a place to get away and relax, rather than just a place to get outside.

I covered Vail Resorts as an equity research analyst and I think you are spot on about Vail recognizing the need to diversify its geographic locations and offerings to consumers in order to reduce the volatility of demand that will come with erratic snowfall patterns. One thing the company has also done extremely effectively is by selling more skiers onto the season pass (prepaid tickets to ski all season). The nice thing about the season pass is that consumers feel like they are getting a deal (pays for itself after 5 visits or so) and also gives them variety. We saw some of this last two seasons when they were able to get some of the customers they lost on the West Coast to ski in Utah and the Rockies more generally.

Going forward though, it will be interesting to see how much they can continue to shift customers around the various locations if overall snowfall is declining across the globe.

Great post, and I’ll admit, I had no idea it was the ski resorts that invented cloud seeding. Very interesting fact. I am concerned however that geographic diversification is only a short term plug on a very real long-term problem for the ski industry. I agree that Vail’s strategy is far ahead of its competitors, but I wonder if they need to be more aggressive with their diversification. One area of interest might include helicopter skiing, which allows resorts to service terrain that cannot be serviced through traditional lifts. As snowfall becomes increasingly erratic, companies like Vail may have to expand the scope of their offerings in such a way.

Having gone to Tahoe several times during all of those draught years you listed, I can attest that it got really bad. There were literally patches of rock and dirt where the snow machines were not doing enough. I will be very curious to see what happens with Vail and other similar companies in the coming decades. I agree that diversification is a good idea, but I wonder whether it will be enough long term. They will need to come up with other ways to get people to drive several hours from the nearest major city when they don’t have snow.

Great post. Like Lane, I have experienced warm winters in the last few years in California, where skiing was only open for 3-4 week-ends out of the whole year. Typically there will be artificial snow on one or two main runs and slush and open rock on most of the higher mountains. It is tragic now only for those who love to ski and snowboard but for all the communities who live in Tahoe and make their living from resorts. Here climate change will have a serious economic effect on these communities, potentially dislocating them. I agree with Matt’s comment, the issue here is a lot more serious and unlikely can be solved just by diversification. It feels like we need to increase our investment the R7D of artificial snow creation and controlling weather to produce snow on demand.