How to embrace the shift to a low carbon future when you are an oil company: The Statoil case

How Statoil, the Norwegian oil and gas major, is positioning itself for a low carbon future

As the world acknowledges the scientific consensus on human-induced climate change and the need to reduce carbon emissions in order to limit global average temperature rise to 2°C or lower, oil and gas companies are presented with both opportunities and threats. Understanding that our global energy system is facing a potential transformational shift, Statoil has been able to leverage its Norwegian open-mindset and environmental-focused heritage to be uniquely positioned for this challenge.

Statoil faces 3 main risks related to climate change:

Competitive risk: Oil and Gas companies’ core products (crude oil and natural gas) are mainly used in transportation for cure oil, and power generation for natural gas. Driven by improving economics and climate change related governmental policies, electric vehicles and renewable energy technologies are threatening the dominance of fossil fuels.

Investor risk: The carbon bubble concept [1] states that in order to remain under the IPCC 2°C, up to $20 trillion worth of fossil fuel reserves will need to remain in the ground. Hence, fossil fuel companies’ stock price might be inflated and the broader market could “suddenly” factor this in.

Corporate perception (license to operate) risk: This risk is particularly important to Statoil, as the company is in majority owned by the Norwegian state, which projects itself as being on the leading edge of climate change action.

To address these effects, and create profitable opportunities Statoil has acted on three fronts:

Be vocal for a carbon tax and increase the share of gas production: Compared to subsidies, or cap and trade, a carbon tax would have two main benefits. It would reduce policy uncertainty, enabling long-term investment decisions, which oil and gas companies are used to. It would also push coal out of the energy mix, replacing it by natural gas that generates lower carbon emissions. In addition to that, Statoil has implemented a number of actions to take the lead on reducing its own emissions, in part driven by the €55/ton CO2 carbon tax on oil and gas production activities in Norway.

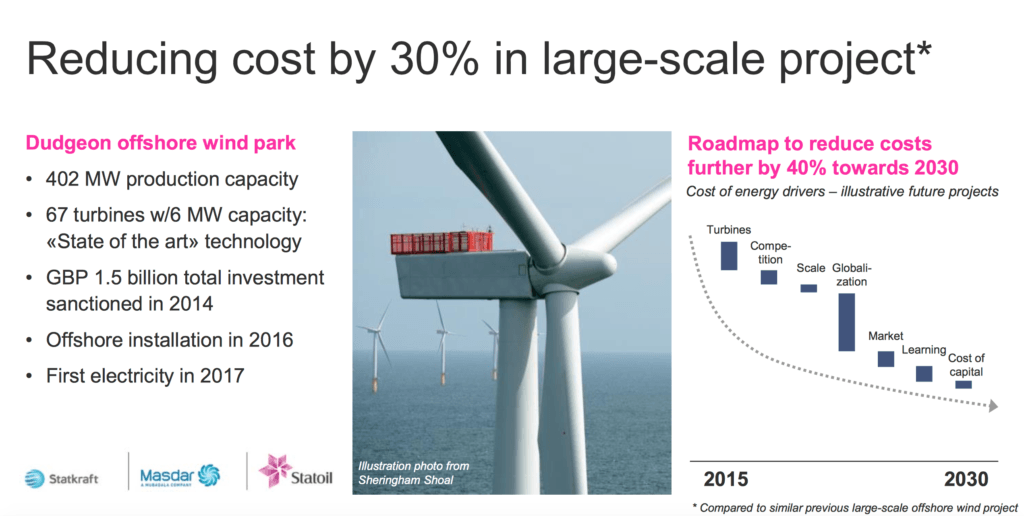

Increase activity in offshore wind: Since 2009 Statoil has built a strong position in offshore wind, both as a developer and operator of offshore wind projects, and as an innovator, though its Hywind floating turbine solution. Statoil’s move into offshore wind projects has been driven by attractive market returns, and by the fact that it plays into the companies’ strengths. One of the main concerns of investors with regards to oil and gas companies expanding into the Renewable Energy space is the mismatch with their core competencies. Leveraging its knowledge in developing complex marine projects, and servicing platforms in rough sea condition, Statoil has been able to enter this space and dramatically drive down cost.

Fig 1. Statoil New Energy EVP presentation, Jan 2016 [2]

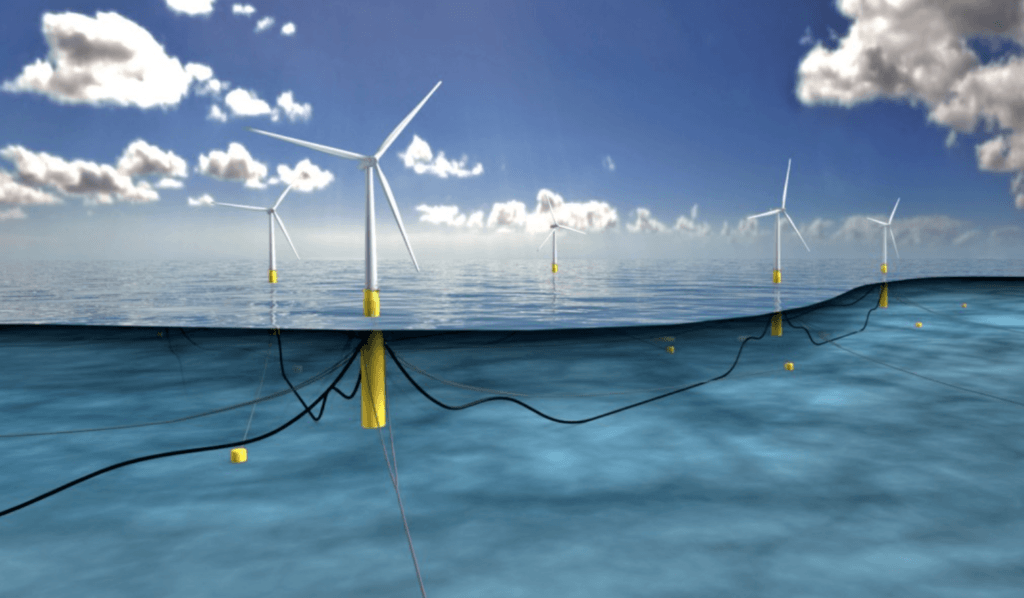

Statoil is also innovating by developing the first offshore floating wind farm (based on a proprietary floating turbine design), to be deployed near Scotland. While currently more expensive than bottom fixed designs, floating turbine designs offer the opportunity to be deployed in many more locations, as well as to be mass manufactured. By being a first mover to offer such a versatile power generation solution, Statoil could potentially reap electricity contracts in future locations.

Fig 2. Hywind Scotland project rendering [3]

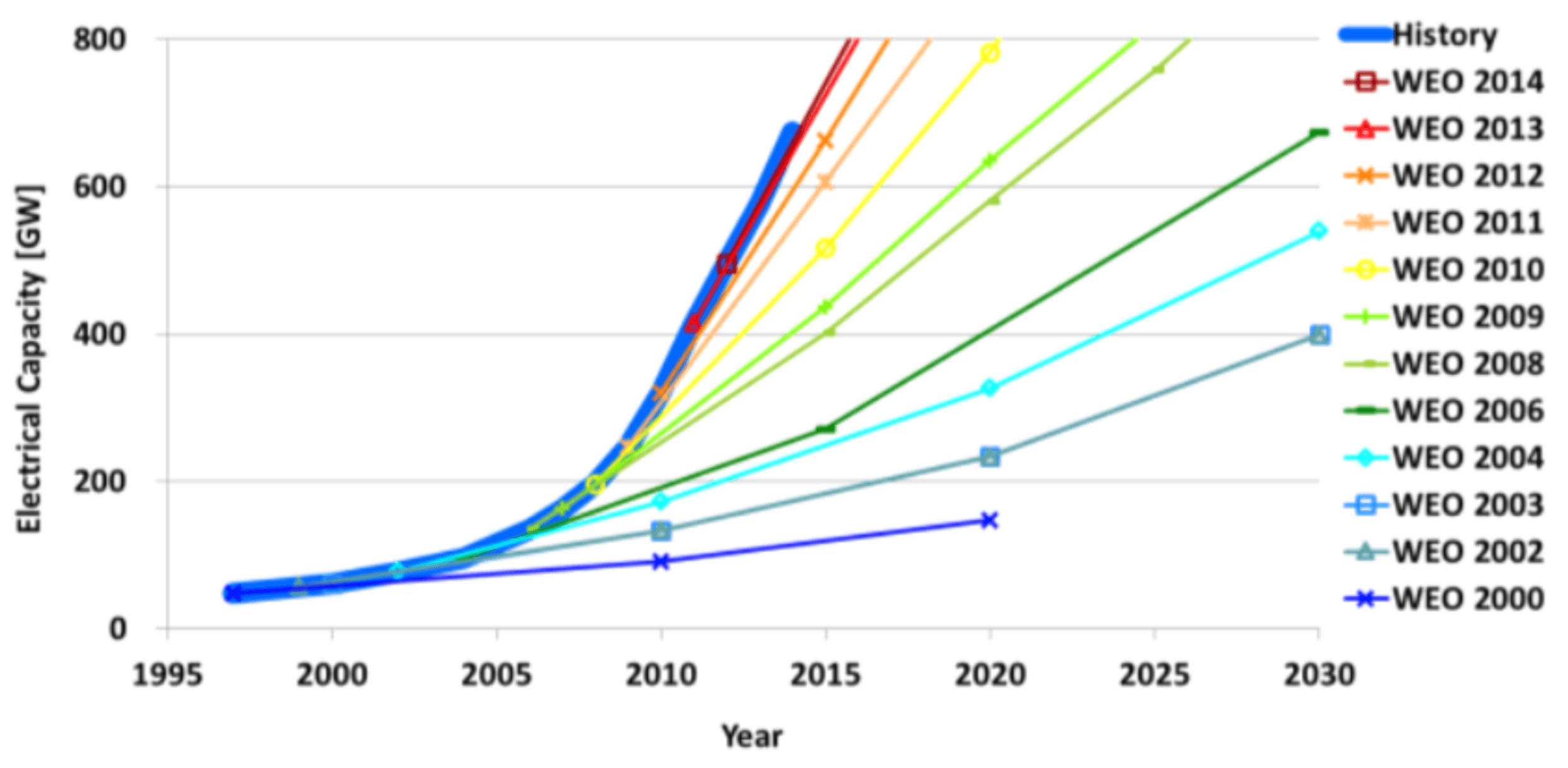

Use Venture Capital as a cost-efficient tool to explore business opportunities in the Renewable Energy space: In early 2016, Statoil established a venture capital unit (Statoil Energy Ventures) entirely focused on investments in clean energy startups [4]. With $200M in funding, Statoil Energy Ventures’ strategic mission is to test and position for future potential growth legs, as well as to explore high impact technologies and business models. The rationale behind this is simple, instead of taking hundred million dollar corporate decisions whether or not to enter a new space in Renewable Energy at scale, why not invest a few millions in a couple of startups to better understand their business model and the potential for profitable growth in their space. Also the future of Energy is hard to predict (Fig. 3), so placing a few bets on potentially high growth opportunities makes sense.

Fig. 3 – Successive projections of Renewable Energy capacity installation from the World Energy Outlook (WEO) published by the International Energy Agency (IEA) [5]

Statoil has been able to navigate the early stages of the transformational shift our global energy system is facing. As the pressure to reduce carbon emissions and production intensifies, Statoil will might need to take more drastic actions. As a relatively high cost producer the company won’t be able to produce oil and gas economically if oil prices are low. Current low oil prices are the result of a structural oversupply, but in the future, low oil prices could be the result of lower demand driven by a carbon tax. In this scenario, Statoil should be ready to close non-profitable fields and progressively shift towards whatever profitable Renewable business it has been able to build (Offshore wind today).

Word count: 782

Sources:

[1] http://www.carbontracker.org

[2]http://www.statoil.com/en/InvestorCentre/Presentations/2016/Downloads/Irene%20Rummellhoff_NES_%20Pareto%20Power%20and%20Renewable%20Energy%20conf_%20Jan%202016.pdf

[3]http://www.statoil.com/en/NewsAndMedia/News/2015/Pages/03Nov_HywindScotland_news_page.aspx

[4] http://www.bloomberg.com/news/articles/2016-02-17/statoil-to-invest-200-million-in-renewable-energy-by-2022

[5] http://www.vox.com/2015/10/12/9510879/iea-underestimate-renewables

Coming from an LNG background, I agree that O&G companies are best poised to adapt to new climate change targets by increasing the mix of gas vs oil. Existing domestic coal power plants in the US produce two and a half times more emissions on a lifecycle basis than that of LNG, so increasing the amount of gas used to generate electricity, the more dirty coal gets displaced – wonderful.

Where I am concerned, however, is what to do with this “bridge fuel”? Yes, natural gas is cleaner than coal and should displace it, but we also know that wind and solar are cleaner than gas. Therefore, while the role of gas will increase over the next decade, its dominance will be short lived as society demands increasingly cleaner sources of energy. Unlike some unproven technologies (like nuclear fusion) that are decades away, wind and solar generation can be deployed today and their economics are continuing to improve. Should O&G companies, and society for that matter, be investing so heavily in this bridge fuel, or should we be focusing on energy technologies of the future?

Great article, Olivier. Thanks. As you point out, most oil and gas companies advocate for an increase share of gas production. The way they present this is that it would yield significant environmental impacts. However, looking at discoveries over the last decade it appears that oil and gas companies are discovering more gas than oil, even though oil discoveries are much more valuable (http://www.wsj.com/articles/oil-companies-shift-exploration-tactics-curb-spending-1477474206). So isn’t this “all for gas” positioning more of a move to turn a negative situation into an opportunity than a true belief in the need to reduce carbon?