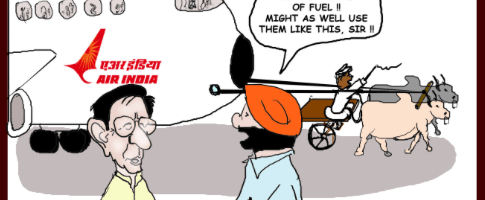

How NOT to run an airline : AirIndia

A handy checklist of what not to do when you are in the airline business.

“We regret to inform that the flight has been delayed. Our airhostess is stuck in traffic and she will get here in fifteen minutes”. This is not a joke from the internet, this was the exact announcement I heard in the Air India flight in 2011, when it had an outstanding debt of 6 billion and loss of 3 billion!

Business Model:

Air India is the government owned and operated airline of India. It is a full service airline that operates domestic and international flights. Being a government owned airline, it is mandated to serve even less profitable routes in the interest of connecting the country and it cannot fire people to boost profitability. Given the slumping airline industry and rising fuel costs, managing revenue and costs are very important, but let’s see how the air India did everything that was wrong!

Operating Model:

Inconsistent Pricing: The pricing strategy was not in line with “Full service carrier” positioning. They competed with low cost carriers at times and would shift towards higher prices at other times. While they rolled out updated lounges and cabin interiors to improve the company’s image among customers, they also cut fares drastically and provided two-for-one discounts.

Improper Fleet Management: Half of its debt was due to purchase of 110 large planes, and this purchase happened while most of its planes were too large to be profitable on their particular routes. In 2006 Air India dry-leased four Boeing 777s for a period of five years, only to get delivery of its own aircraft from July 2007 onwards. For two years it kept five Boeing 777s and five Boeing 737s on ground at a loss of $125 Million. Luckily for Air India, Boeing could not meet the delivery schedules for its new B 787 Dreamliners!

Failed Merger:Air India (Government owned International Airline) was merged with Indian Airlines (Government owned Domestic Airline) in 2007. Their combined loss was $100 Mn at that time, and in two years it escalated to $1.1 Bn. The two merged entities were competing with each other for routes and they largely operated as two separate airlines without leveraging any synergies. They did not share airline codes and operated with two reservation systems.

Improper Route Management: Frankfurt was made a hub in 2009, but it was shut down a year later due to high operating costs. They were running 3 leased Boeing 747s to Los Angeles and one leased Boeing 767 to Bangkok which were running at less than 40% load, but just as these routes were gaining popularity,, it was shut down because the aircraft lease had ended! The merged entities were competing internally for domestic routes .

High Agent Commission: Sales Agents were given 3% share on revenue and an additional 9% share on ticket sales. Additional bonuses were given to specific agents in London, which resulted in commissions of $8.5 Million in 1997.

Poor People Management: Air India had a bloated head count of 214 employees per plane while Singapore airlines has 160 and British Airways has 178. Also, inadequate training of existing pilots resulted in hiring expatriate pilots who were paid more than double the salary.Without proper leadership and motivation, Air India suffered poor service and poor on-time performance. The merger didn’t integrate human resources efficiently, and the pilots compared each other’s salary structures and went on a prolonged strike demanding perks. The domestic pilots were asking for equal compensation as international pilots and the international pilots did not want the domestic pilots to be trained on the new Boeing 787 Dreamliner fleet. The pilot strike resulted in a lot of last minute flight cancellations, disillusioned customers and bad press. There was this particular case where the pilot got off the flight in a transit destination and went on strike, leaving the passengers in a state of flux.

Excessive Freebies: It offered up to 24 free tickets each year to each of their 24000+ employees and even their extended families could use it. An employee whistle-blew one such scam, where employees would often buy tickets from external agents at inflated prices and claim reimbursement while the agents would provide employees with perks like travel packages in exchange and earn commission from the sales. Ministers could fly domestic routes for free, and their “Mumbai-Delhi” domestic route was actually found to be “Mumbai-Singapore-Johanessberg-London-Delhi”!

Conclusion:

In 2012, the government pumped in $480 Mn to rescue it from spiralling debt. With a leadership change, some measures like better merger integration, control of prices and optimization of route is taking place. In 2013, Air India posted its first positive EBITDA in years.It was dropped from the Star Alliance in 2007, but has been reinstated recently.

In the 1960s, Air India was doing so well that a fledgling carrier from Singapore came and studied it and is today the famed Singapore Airlines. One can only hope that the Maharajah will be restored to the glory of his yesteryears.

References:

I am curious to what degree Air India’s future success depends on Prime Minister Modi’s ability to deliver on his promises of economic reform. I recently read an article by Shikhia Almia on Time.com (“5 promises Narendra Modi Must Break” http://time.com/105151/narendra-modi-india-economy/) which claims that “more than 20% of India’s economy consists of poorly run, federally owned companies. About one-third of them operate on a loss, and the rest return profits of less than 1% annually.” It certainly seems as if Air India is more representative of the economy than it is an exception. I suspect that Air India may be subject to future calls to privatize, if it hasn’t been already. If this proves to be the case in order for Modi to deliver on his promise, I wonder if this will be a boon or a burden to Air India’s operating model. I imagine that it will have difficulty adapting, as the company does not appear to have a great deal of flexibility built into its operating model, as loosely defined as it currently seems to be. However, with capable leadership, this company seems ripe for improvement. New leadership would need to first define what it’s customer promise will be, as it can’t try to be everything to everybody as its recent history suggests it has tried to be.

Thank you for writing this – it presents a very interesting problem and business situation!

Thanks for the excellent viewpoint Charlie. Interestingly, the privatization of the airline has been a hotly debated topic since 2008. The privatization view point holds that the government should not be in such an industry which has fierce competition and thin margins as it requires tough and quick decisions that often is not possible by the state machinery. Also, the government ended up making conflicting decisions as it did not impose regulations on the entry of foreign players and has created competition for itself,which is a feature absent generally in public industries like the Indian Railways. However the roots of the country lies in socialism, we were ardent socialists until the decline of the Soviet Union, and while private capital is largely taking off in the country, it is still viewed with a lot of suspicion and is subject to several bureaucratic check points. The biggest argument for non privatization is connection of non-profitable routes and social obligations during the time of crisis or war. Given these and the recent improvement in financials from Air India,the government has currently ruled out any discussion on this front.

Interestingly, Air India was started privately by the Tata group and was forcibly and unfairly acquired by the Government post Independence, Mr.Tata himself learnt it from the news. The Tata group is keen to buy it back and so are several other players. However, a private industry expert heading the airlines (as opposed to someone from the bureaucracy) is the only thing that the government is looking into.

Great blog. I have taken Air India myself and I have to say I totally concur with the assessment!!! It’s kind of amazing … Airlines in general are a challenging industry, and turning something like this around seems almost impossible. It might make more sense to shut this down and start from scratch? If Tata really wants it back I would totally sell this… wouldn’t you?

Thanks Professor! I would say privatization is the easiest way to turn it around. If only they’d sell it to Tatas! The second best way is to have good leadership at the helm who can boldly take decisions with minimal interference from the government. The rest of the stuff like route optimization,demand planning, marketing it well and restoring the brand image should be fairly standard!

Excellent assessment Charanya! Sounds very similar to what has been happening to PIA (Pakistan International Airlines) as well. I agree with Charlie that privatization should be the key focus. It is surprising how many buyers in and outside India would be interested in acquiring this. With increased travel traffic, airline industry has become a much more interesting space. What is more important (and what we agree for PIA as well) is to bring the airline to a certain operationally efficient state and then resell at a high value vs. selling it for peanuts in the current state. Hope the government, at some point, agrees to sell it to Tata.

Thanks for the comment Ona! Interesting to know that PIA is also in a similar state.

Very interesting post, Charanya. You honed in on many detailed operating model failures, which are a shame given the lofty goal of maintaining domestic and international connectivity. I would be curious to see how Singapore Airlines is operating differently to maintain profits and will certainly think twice before booking with Air India when I am there in January.

Thanks Brendan! I think it will be easier for Singapore airlines because it is a smaller country without obligations for “loss routes” connecting corners of the country. Also they have managed to convert Singapore airport into a prime transit zone in SE asia, which I think is a main reason for their success giving more route options and code sharing options for the airlines.