How ExxonMobil can become carbon neutral in 20 years, and make money doing it

With oil prices dropping and cost of carbon emission on the rise, the future of ExxonMobil looks bleaker than ever.1

While current day cost of emitting carbon are hovering around $10 per ton CO2, most forecasts are estimating that cost to double by 2030.2 In addition to government taxation, the future social cost of current CO2 emissions is estimated at a whopping $220 per ton.3 ExxonMobil is responsible for emitting roughly 900M tons of CO2 per year. By that measure, their emissions place a social burden equivalent to $200B per year.

Something must change. ExxonMobil says it has a strategy. But, is it enough?

Current strategy

The company states on their website that “ExxonMobil is taking action by reducing greenhouse gas emissions in its operations, helping consumers reduce their emissions, supporting research that leads to technology breakthroughs and participating in constructive dialogue on policy options”.4 However, operations do not compensate for downstream oil consumption, and supporting consumers is not the same as implementing change. The core problem lies in the dependency on oil, and humanity cannot afford to gamble on the hope that a technology breakthrough will allow us to burn fuel without consequences.

Looking behind the scenes, ExxonMobil’s big bet is that governments are not going to impose the actual cost of emission, because that would be too great a burden on the economy. Their internal report on managing the risk of relying on carbon produced energy states that “it is difficult to envision governments choosing this path in light of the negative implications for economic growth and prosperity that such a course poses”.5 Should they be wrong, and the carbon emission tax credits rise to a projected $30 per ton CO2 in 2030, then all of ExxonMobil’s profit margins will vanish.

Alternative strategy: Invest 1/3 of earnings in wind power to become oil independent in 20 years.

By relying on oil, ExxonMobil has cornered itself in a battle against future governments. But fortunately, there is a way out. In the next 20 years, the company can build 228,000 wind turbines and generate alternative energy output equivalent to that of their oil production. By doing so, they would not only set themselves up for a carbonless future, but also generate $45B in yearly revenue from electricity sales.

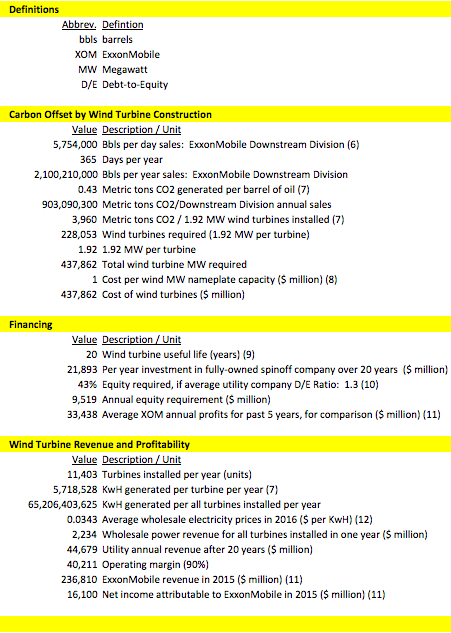

How does it work? ExxonMobil creates a fully-owned spinoff responsible for mass production and setup up of 1.92 MW wind turbines. Every year, the company sets aside $9,519M or 28% of earnings to finance the investment. With a typical debt to equity ratio of 1.3, the spinoff can then install $21,893M worth of turbines, or 11,403 units, per year. Each turbine produces energy equivalent to removing 3,960 tons of CO2, so after 20 years they have wind power replacing the 900M tons of yearly CO2 emissions. See Exhibit for details.

Assuming a 90% operating margin and current day wholesale electricity prices, ExxonMobil can in 20 years become the largest alternative energy provider, with a $40B yearly operating profit. By reducing the carbon risk through diversification, the company sets itself up for survival in the future and creates a competitive advantage as the carbon crisis rallies on. With wind turbines in place, the company can then alter their current lobbying efforts and instead go for the opposite message: Implement higher carbon taxes to save the earth, while making the transition tougher for ex-competitors.

Exhibit Financial analysis of proposed wind turbine investment

769 words

Endnotes

1 Lauren Gensler, “The World’s Largest Oil And Gas Companies 2016: Exxon Is Still King” http://www.forbes.com/sites/laurengensler/2016/05/26/global-2000-worlds-largest-oil-and-gas-companies/#77156c3e18d9, accessed November 1, 2016

2 Patrick Luckow, “2015 Carbon Dioxide Price Forecast” http://www.synapse-energy.com/sites/default/files/2015%20Carbon%20Dioxide%20Price%20Report.pdf, accessed November 1, 2016.

3 Frances C. Moore “Temperature impacts on economic growth warrant stringent mitigation policy,” Nature Climate Change, http://www.nature.com/nclimate/journal/v5/n2/full/nclimate2481.html, November 25, 2014, accessed online November 4, 2016

4 ExxonMobil, “Our position on climate change”, http://corporate.exxonmobil.com/en/current-issues/climate-policy/climate-perspectives/our-position, accessed November 4, 2016

5 ExxonMobil, “Energy and Carbon – Managing the Risks,” http://cdn.exxonmobil.com/~/media/global/files/energy-and-environment/report—energy-and-carbon—managing-the-risks.pdf, accessed November 1, 2016

6 Statista, “Petroleum product sales of ExxonMobil’s Downstream division 2001-2015”, https://www.statista.com/statistics/264126/petroleum-product-sales-of-exxon-mobils-downstream-division/, accessed November 4, 2016

7 US Environmental Protection Agency, “GHG Equivalencies Calculator,” https://www.epa.gov/energy/ghg-equivalencies-calculator-calculations-and-references, accessed November 4, 2016

8 Windustry, “How much do wind turbines cost?” http://www.windustry.org/how_much_do_wind_turbines_cost, accessed November 4, 2016

9 WindMeasurementInternational, “Operational and Maintenance Costs for Wind Turbines,” http://www.windmeasurementinternational.com/wind-turbines/om-turbines.php, accessed November 4, 2016

10 J.B. Maverick, “What debt/equity ratio is typical for companies in the utilities sector?” http://www.investopedia.com/ask/answers/070715/what-debtequity-ratio-typical-companies-utilities-sector.asp, accessed November 4, 2016

11 XOM 10-K 2011-2016, http://ir.exxonmobil.com/phoenix.zhtml?c=115024&p=irol-SEC, accessed November 4, 2016

12 U.S. Energy Information Administration, “Wholesale Electricity and Natural Gas Market Data,” https://www.eia.gov/electricity/wholesale/, accessed November 4, 2016

I like the idea! Just wonder how feasible it is..

While you have calculated a rough operating margin for the wind turbine projects, I wonder how profitable it will be when we consider the ongoing operating costs of maintaining almost half a million wind turbines. What about project NPVs? Wind projects require considerable civil works (infrastructure), not to mention the significant cost associated with transporting the numerous large pieces of equipment across the world.

I have serious doubts about the reaction of the board and shareholders to such a proposal. Becoming a utility, in essence, will reduce the company’s margins. Also, these wind projects will take away from the amount of available CAPEX for other traditional O&G projects. An important KPI for O&G companies is the reserve replacement ratio:

The reserve-replacement ratio measures the amount of proved reserves added to a company’s reserve base during the year relative to the amount of oil and gas produced. A company’s reserve-replacement ratio should be at least 100% for the company to stay in business long-term; otherwise, it will eventually run out of oil. The reserve-replacement ratio is just one method investors should use to get an accurate picture of how well an oil company is performing.

It is also worth considering what is the maximum feasible scale for wind. Firstly, wind turbines cannot be installed simply anywhere and must take into account wind patterns, land use, and local regulations. Secondly, due to the variability of energy generated by wind turbines, there is an upper limit that the local grid will allow although improvements in battery technology and other forms of energy storage may resolve this issue. Finally, can manufacturers produce the amount of windmills demanded by such a buildup? Is current capacity constrained, and will the sudden surge in demand end up increasing the price of raw materials and parts?

I find it interesting that you are criticizing Exxon for not factoring a potential change in carbon price in their long term strategy, but then you are using a “current day wholesale electricity prices” to build your case on why they should invest in wind power. Adding more Renewable based power generation onto the grid tends to lower the wholesale price (UK power prices go negative as renewables boom distorts market – https://www.ft.com/content/5164675e-1e7e-11e6-b286-cddde55ca122). The Renewable energy boom over the last decade has benefited from certainty in prices (through Feed-in-Tariff for example), but these initial incentives won’t last, and Renewable projects will at some point face the risk of fluctuating wholesale prices. So betting on Renewable energy as a certain money-maker over the long term might not be an obvious assumption.

Thank you for the interesting article! I have never thought about the idea that major oil companies like Exxon may start looking into renewables. I agree that there is skepticism about the reality of such shift in business model but I agree that even for a company like Exxon should be preparing for a new era. I personally think that the renewable energy market corrected itself during the collapse in early 2010 and is now growing at a healthy rate. I find your idea very interesting and feasible in the long-term.

While I am not sure about the feasibility of this project, I really like the thinking. I believe that the current practices are not working and people need to start looking outside the box for real solutions.

At this point in time, I don’t think it makes sense for Exxon to go down this path. I’m not sure wind turbines strategically makes sense for Exxon when they could just buy carbon credits from wind turbine operators without adding an unrelated business to their portfolio. In addition, it’s not clear that it’s economically responsible to build that many wind turbines (otherwise other companies would already be building them). Without a change in government regulations (increase carbon taxes or reduce reliance on carbon based energy sources), it might not make sense anytime soon.

That being said, Exxon should definitely be ready in case government regulations do change, otherwise they could get left behind.