How digital technology is breathing new life into Manulife

Digital technologies are creating unprecedented opportunities and challenges in the life insurance industry. As a result, Manulife is transforming its business model to better navigate and compete in the rapidly changing landscape.

In 2014, Americans purchased $2.8 trillion in new life insurance and life insurers held more than $6 trillion in assets under management. [1] As immense as these numbers are, life insurers are facing an uncertain future. For the last half century, customer adoption has steadily fallen – in 2014, only 44% of consumers owned life insurance policies compared to 72% in 1960. [2] At the same time, customer expectations are rapidly transforming. Conditioned by experiences in industries like retail (e.g., Amazon) and entertainment (e.g., Netflix), life insurance customers now expect to be serviced where, when, and how they want. Technology companies – established and emerging – have recognized this growing customer dissatisfaction and are rapidly entering the space, eager to use their data and digital prowess to disrupt the industry.

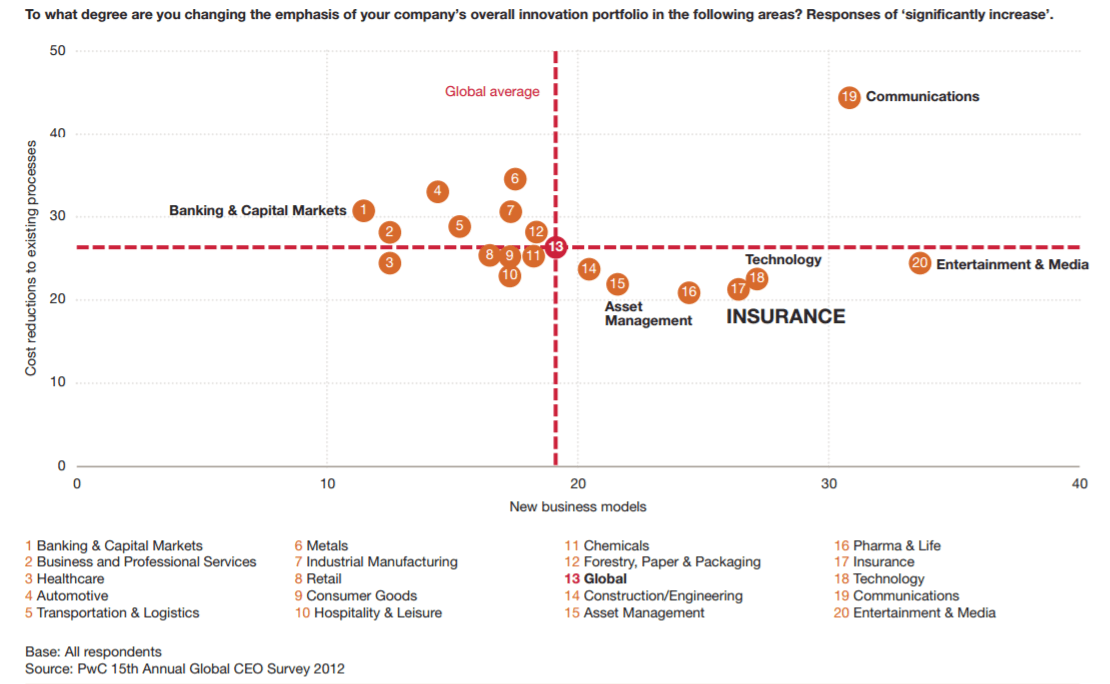

The traditional business model of life insurers is changing. No longer are customers willing to be hard-sold into confusing policies, requiring invasive medical tests and lengthy application times. No longer can insurers afford distant, low-touch relationships with their clients. Life insurers are ready to embrace new business models (Figure 1) and digital transformation – from mobile apps to wearable devices – has ushered in new opportunities to deliver unprecedented value to customers anytime, anywhere.

Figure 1. Readiness to innovate and adopt new business models. [3]

Manulife is one of the largest life insurers in the world, with operations in Canada, the U.S. (under the John Hancock brand), and Asia. It is at the heart of the industry’s digital evolution and is transforming its operating model in response. The firm has taken a top-down approach to becoming more digital-centric. It recently hired a Chief Innovation Officer, reporting directly to the CEO, to ensure that technology and innovation are key components of its business strategy. To fully embed digital into its operations, Manulife is engaging both employees and the broader technology community. For example, the company recently launched innovation labs in all major markets, tasked with finding creative ways of using digital technology to create value for customers and for the company.

Figure 2. Manulife’s Innovation Lab in Singapore [4]

Figure 3. Employees in Manulife’s Innovation Lab participating in a hackathon [5]

To achieve its strategy “to develop more holistic and long-lasting customer relationships,” Manulife is focusing its digitalization on three areas. [6]

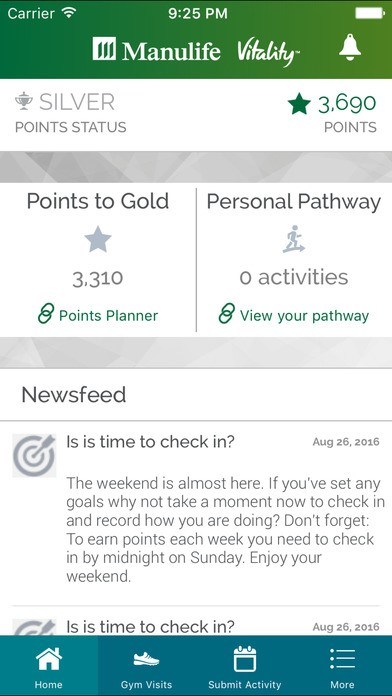

- Innovative products that better engage next generation customers. Manulife recently launched Vitality throughout North America, and Move in Asia. These first-of-their-kind products enable customers to track their healthy living and rewards them with reduced premiums and other benefits for achieving goals. Customers track their progress using a free FitBit and a mobile application (Figure 4) that is integrated in real-time with Manulife’s systems. These products engage customers on their terms with solutions that matter to them (i.e., improving their health), while enabling Manulife to connect with younger clients and gain access to large amounts of valuable data. [7]

- Leading customer service facilitated by 360-degree view of the customer. Manulife has implemented digital systems that display the entire customer relationship across all channels in real-time, enabling the firm to give highly targeted service and advice.

- Targeted and efficient underwriting. Manulife has made significant investments into its analytics capabilities enabling it to underwrite clients more efficiently and effectively. It recently launched its Quick Issue Term product, which underwrites customers in less than a day without the need for invasive medical exams. [8]

Click here to learn more about how John Hancock Vitality works.

Figure 4. Manulife Vitality mobile application [9]

As Manulife continues to address shifting customer expectations and emerging competitive threats, there are additional steps the firm should take to embed digital technology into its operations.

- Fostering a global culture that is deeply committed to technology and innovation. Manulife has access to over 30,000 employees and 60,000 agents around the world. [10] Both groups represent a wealth of untapped ideas and insights. Establishing a culture that encourages (and rewards) insight-sharing and experimentation will accelerate digital transformation across the organization. A culture that embraces technology will also be key to attracting and retaining top tier talent.

- Seeking creative partnerships with large technology firms. Manulife should explore opportunities to partner with big technology companies (e.g., Apple, Google). For example, Manulife could partner with Apple and leverage data collected through the iPhone/iWatch (e.g., activity, sleep habits, interests) to better understand a customer’s needs and risks. Examples of non-traditional partnerships like this are already emerging, especially in the health insurance industry. [11]

- Acquiring smaller technology firms with specific capabilities. Strategic acquisition will enable Manulife to evolve quicker. Launching an internal venture capital group, like those at Northwestern Mutual and AXA, would improve the firm’s ability to identify acquisition candidates. [12]

The implications are serious – life insurers like Manulife run the very real risk of becoming irrelevant if they don’t evolve. Embracing digitalization is key for insurers to capitalize on the opportunities and mitigate the threats associated with the industry’s rapid transformation. Only time will tell if they’re successful.

(770 words)

Sources

[1] American Council of Life Insurers, “2015 Life Insurers Fact Book,” p. 7, https://www.acli.com/Tools/Industry%20Facts/Life%20Insurers%20Fact%20Book/Documents/FB15_All.pdf, accessed November 2016.

[2] Ernst & Young, “Life Insurance Distribution at a Crossroads”, p. 1, http://www.ey.com/Publication/vwLUAssets/ey-life-insurance-distribution-at-a-crossroads/$FILE/ey-life-insurance-distribution-at-a-crossroads.pdf, accessed November 2016.

[3] PWC, “Life Insurance 2020: Competing for a future,” p.3, http://www.pwc.com/gx/en/insurance/pdf/pwc-life-insurance-2020-competing-for-a-future.pdf, accessed November 2016.

[4] LOFT Twitter, https://twitter.com/innovateforward, accessed November 2016.

[5] LOFT Twitter, https://twitter.com/innovateforward, accessed November 2016.

[6] Manulife, 2015 Annual Report, p. 10, http://www.manulife.com/servlet/servlet.FileDownload?file=00P5000000dfLKVEA2, accessed November 2016.

[7] “John Hancock becomes the First U.S. Life Insurer to Reward Consumers for Health Eating,” PRNewswire, April 6, 2016, http://www.prnewswire.com/news-releases/john-hancock-becomes-the-first-us-life-insurer-to-reward-consumers-for-healthy-eating-300245945.html, accessed November 2016.

[8] Manulife, “Life insurance designed for people on the go – Manulife Quick Issue TermTM,” YouTube, published June 7, 2015, https://www.youtube.com/watch?v=PdNGkVudsvg, accessed November 2016.

[9] App Store and Google Play Store.

[10] Manulife, Global Company Fact Sheet, http://www.manulife.com/servlet/servlet.FileDownload?file=00P5000000hybmfEAA, accessed November 2016.

[11] Parmy Olson, “Apple’s iPhone Just Stepped Closer to Shaping Your Health Costs,” Forbes, October 1, 2014, http://www.forbes.com/sites/parmyolson/2014/10/01/apple-iphone-healthkit-humana-insurance-partnership/#552f26f472c2, accessed November 2016.

[12] “Insurance Industry Ramps Up Startup Investing – Jumps 5X in 2014,” CBInsights, June 2, 2015, https://www.cbinsights.com/blog/insurance-startup-investing/, accessed November 2016.

Great post Hugh! Life insurance is an extremely interesting example of how digitization is changing how an industry works. Reading your post reminded me of our class discussion on the ethics of car insurance and its ability to alter the behavior of its clients through statistical modeling, which can be dangerous from a customer privacy and “over-generalization” angle. While I understand that life insurance is inherently different than car insurance because it is not compulsory, do you think the broader use of big data analytics in life insurance policies could lead to a world where individuals feel less free to engage in activities that they may want to do, but could be viewed as risky (ex: travelling to foreign countries)? Moreover, with models that quantify the risk of these such activities, is there potential for these models to spill over to other services like health insurance (ex: https://www.statnews.com/2015/12/15/insurance-big-data/)?

Hugh- this is great post, thank you for sharing! I particularly loved hearing about the Vitality and Move applications. The screenshots were quite helpful, the UI looks great!

As Manulife thinks about continuing to build out these apps, I wonder if there’s an opportunity to update premiums in real-time and create a social component to them. “Gamifying” the act of improving your lifestyle may incent more consumers to participate. For instance, with every prolonged period of physical activity logged into the app, a consumer’s premium could drop slightly, showing their progress. If days go by without a consumer getting to the gym or if weeks go by without a consumer getting a physical exam, premiums may go up. Similarly, if others are able to see healthy actions that their friends and family are taken through some kind of social network, they may be more motivated to actually lead a healthier lifestyle.

I loved what you said about integrating technology and innovation into the culture. I wonder if one way to do this is by having employees participate in some kind of contest where they come up with new ideas for using digital technology to improve the customer experience and present them to the company’s leadership. This is a great way of empowering employees while also mining their individual perspectives for new ideas.

Thanks again Hugh- really enjoyed reading this post!

As much as I love it, Insurance is a tragically outdated industry that is scrambling to catch up to modern technology and trends. Manulife is not alone in integrating high tech underwriting models and hip new marketing schemes to attract younger generations. With the insurance market as soft as it is, insurers are doing everything they can to innovate and stay relevant – but I think they are throwing money at a symptom of the problem instead of the root. Insurers are desperate for young, technologically savvy talent. They are in need of the technologies and software development that is saturating silicon valley, but let’s face it, insurance isn’t sexy. There are no ping pong tables, no kegs, and these institutions are gigantic and OLD and have correspondingly clunky bureaucracies and regulatory committees. Manulife has built some fun looking office spaces and introduced a hackathon, but the future of insurance is going to hinge on attracting the right talent. Or perhaps they’ll give up on building out the technologies in house and we’ll see a surge of insurance software startups?