Holy Guacamole! Your Super-Bowl snack is about to get pricey.

The U.S. demand for avocado cannot be met by domestically-grown product. With an extremely high dependance of imports from Mexico, who would be mostly affected by Trump walking away from NAFTA, Mexican producers and exporters or U.S. consumers?

More than 85% of the avocados consumed in the US today come from other countries, especially Mexico, the world’s largest producer and exporter of this fruit. [1] With NAFTA in place since 1994, avocado’s price fluctuations were mainly dependent of demand, weather and labor. Today, with Trump’s isolationism measures and initiative to re-negotiate NAFTA, a new threat arises that can really affect avocado’s prices: import tariffs.

Aware of these threats is the APEAM, the Avocado Producers and Exporting Packers Association of Mexico. Founded in 1997, APEAM is a private non-profit association, consisting of more than 20,000 producers and 49 packers, mainly from the state of Michoacán, Mexico. It is a cooperating partner recognized by the USDA and oversees promoting and fostering exports of Mexican avocado in the U.S. and other foreign markets. The APEAM implements quality measures to its members to ensure product quality. They also work bilaterally with the USDA and its Mexican counterpart SAGARPA, to ensure fulfillment of safety and certification measures required in the supply chain. Recently, APEAM decided to engage in a marketing campaign that would focus on communicating the superior quality, characteristics and benefits of the Mexican avocado under a brand called “Avocados from Mexico”. [2] (https://www.youtube.com/watch?v=Aa78KOPz-fA)

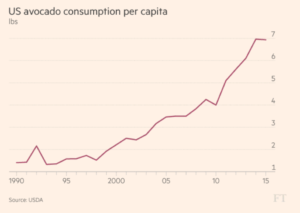

Although its campaign has paid-off in the short-term, the threat of tariffs being imposed in the border concerns producers and exporters alike in the long-term. Currently, fluctuations in price have been mainly absorbed by the end consumer, and apparently it has not affected the upward trend in demand. Consumption of avocado in the US has soared since the trade deal was signed. In 1990, the average person consumed 1.4lbs, jumping to almost 7lbs in 2015. [3] Apart from increasing availability, healthier lifestyle trends in the U.S. and consumption of avocado in big chain restaurants such as Chipotle, have also increased demand. [4]. In addition, reduced availability of land due to climate change, seasonal restrictions and temperature requirements, have also played an important role in the shortage of supply and therefore, increasing prices. At the beginning of 2017, an avocado was 89 cents, rising to $1.56 in October 2017, according to the Haas Avocado Board, an agriculture promotion group based in the United States. [5].

Recommendations

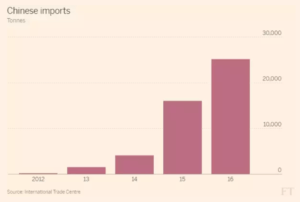

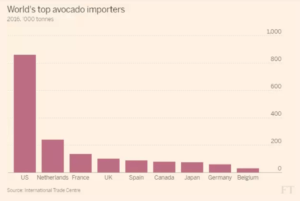

Find new markets – “If Michoacán decided to stop exporting, there is nowhere else in the world that could provide the quantity of avocados that U.S. markets are consuming,” said Adrián Iturbide, a Mexican avocado grower. [6] Even though some producers might feel sheltered, the combining threat of all the aforementioned factors should be taken into serious consideration. That is why, producers are also looking into new markets, such as China. According to the Financial Times, exports from Mexico and Chile to China have been growing at a rate of 250% from 154 tons in 2012 to 25,000 tons in 2016. [7] Other top avocado importers such as the Netherlands, France and the UK might also benefit from more and better supply from countries such as Mexico. [8] In response to the tariff threat, APEAM should continue developing its relationships with such countries in order to decrease dependence from the US.

Build Alliances – Currently, the only region of Mexico that can export to the United States is Michoacán. Regions like Jalisco, for example, are restricted – due supposedly to sanitary reasons. Over the last years, several attempts have been made to release this ban. In January 2017, after what seemed like a successful negotiation, Jalisco’s avocados where lifted from the ban, just to be halted at the border a few hours later. [9] Especially now, APEAM should begin working with the government and its counterpart in Jalisco (APEAJAL) to increase its negotiating power with the US. Rather than fighting for an uncertain US market, as suggested above, Mexican producers could join strengths and start looking at new interesting markets in Europe and Asia. Moreover, by increasing supply these alliances could help maintain price at reasonable levels and prevent a future decrease in demand.

The question facing APEAM now is, at which price point could consumers stop consuming avocado and/or trade it to a substitute, more accessible fruit? Is this positive trend going to continue, or is a potential 20% tariff imposed by the US government really threatening the future demand of avocado? Should APEAM remain focused on the US, or shift their focus towards China? Going forward, these answers will define the future of thousands of Mexicans involved in the avocado supply chain as well as availability of one of the most demanded fruits in US actuality.

(Word Count 791)

References

[1] Ferdman, R. A. (2015, January 22). The rise of the avocado, America’s new favorite fruit. Retrieved from The Washington Post: https://www.washingtonpost.com/news/wonk/wp/2015/01/22/the-sudden-rise-of-the-avocado-americas-new-favorite-fruit/?tid=a_inl&utm_term=.78ac158cad4d

[2] APEAM. (2017, November 12). What is APEAM? Retrieved from APEAM: http://www.apeamac.com/que-es-apeam/#1498534220395-e488fa21-b865

[3] Webber, J., & Terazono, E. (2017, January 19). Super Bowl weekend: The Trump effect and the guacamole dip. Retrieved from Financial Times: https://www.ft.com/content/fb1caaf8-dd92-11e6-9d7c-be108f1c1dce

[4] Gillespie, P. (2017, September 11). Avocado prices have soared 125% this year. Retrieved from CNN Money: http://money.cnn.com/2017/09/09/news/economy/avocado-prices-soar/index.html

[5] HAAS Avocado Board. (2017, November 12). Retail Volume & Avocado Price for 2017. Retrieved from HAAS Avocado Board: http://www.hassavocadoboard.com/retail/volume-and-price-data

[6] Barrera, A. (2017, February 2). In avocado country, Mexicans not afraid of Trump tariff threats. Retrieved from Reuters: https://www.reuters.com/article/us-usa-trade-nafta-avocados/in-avocado-country-mexicans-not-afraid-of-trump-tariff-threats-idUSKBN15H2KC

[7] Hancock, T. (2017, April 2017). haasAvocado imports soar as China develops taste for ‘butter fruit’. Retrieved from Financial Times: https://www.ft.com/content/97340c8a-2652-11e7-8691-d5f7e0cd0a16

[8] Terazono, E. (2017, May 3). Avocado prices hit record after bad weather dents supply. Retrieved from Financial Times: https://www.ft.com/content/d99e786c-3011-11e7-9555-23ef563ecf9a

[9] Mortimer, C. (2017, January 27). The US is turning away Mexican avocados at the border. Retrieved from Independent: http://www.independent.co.uk/news/world/americas/mexico-trade-avocado-us-border-wall-donald-trump-imports-exports-a7550131.html

Shanker, D. (2017, September 8). Avocados Could Get a Lot More Expensive Under a New NAFTA. Retrieved from Bloomberg: https://www.bloomberg.com/news/articles/2017-09-08/avocados-could-get-a-lot-more-expensive-under-a-new-nafta

The New York Times. (2017, April 27). Revisiting Nafta: The Stakes for Key Industries. Retrieved November 12, 2017, from https://www.nytimes.com/2017/04/27/business/economy/nafta-impact-industries-cars-agriculture-apparel-pharmaceuticals.html

Wattles, J. (2017, January 27). Guess where all those avocados come from. Retrieved November 12, 2017, from CNN Money: http://money.cnn.com/2017/01/27/news/economy/avocados-trump-mexico/index.html

While I agree that it seems that the US may need to find new markets for avocados, I was surprised that China was a possible alternative. According to the US government, the shelf life of an avocado is 7-28 days (see link below). Asian suppliers of avocados would need to find a very efficient means of transporting the avocados in order for them to have the same life when they reach grocery stores as avocados from our neighbor Mexico.

As I was reading your post I was interested in the question that you raised of price sensitivity. Will US consumers be willing to bear the burden of higher tariffs? You mentioned that avocado prices have fluctuated due to changes in demand. I wonder if we could get a sense of price sensitivity by looking to this past data and measuring consumer responses.

Finally, are there any synthetic / greenhouse alternative options to avocado production that we could create here in the US? While this may be possible, my guess is that the higher production cost would be comparable, if not more, to that caused by the tariffs.

http://www.tis-gdv.de/tis_e/ware/obst/avocado/avocado.htm

Since it seems very hard to shift the current supply to other countries such as China or Europe, the APEAM should focus in generating cost efficiencies in the avocado production process. Consumer price elasticity has a limit; therefore it is critical that producers are able to absorb a part of the tariff into their production cost. I see three levers for increased cost efficiency:

Automation: Avocado production in Mexico still relies in manual procedures and labor is the major production cost. A key lever for cost efficiency could be automation both in the irrigation process and in the recollection process.

Scale: the APEAM should do a greater effort to unify independent avocado producers to share best practices and generate economies of scale in critical cost items such as Transportation or recollection.

Long term contracts: By leveraging scale in the same way that for transportation costs, the APEAM should look for potential long-term contracts with wholesalers that could mitigate part of the increase tariff. For instance, now when the amount of the tariff is still unknown the APEAM could lock mid/long term contracts for a specified price hedging partially the effect of a new tariff.

This article highlights the potential dangers of political ineptitude on people’s everyday lives. Certainly there are more substantive issues around NAFTA that get the lion’s share of attention, but who benefits if avocado imports are shut off? Who benefits if there is an additional tariff to ship avocados to the US? Surely nobody went to the polls on this issue, and yet many would notice if the price of avocados increased.

This discussion also highlights that there are often issues outside of the control of a company that can significantly impact operations. Managers can plan for all sorts of scenarios, but sometimes your business gets caught up in political fights.

First off, I can’t believe that the average person consumed 7 lbs of avocados in 2015, that’s incredible! To your question, I don’t think that there is a substitute for avocado. The statistics you cited as well as the trend of increasing health consciousness has led to the avocado being such a highly sought after fruit. What I envision changing however, are three changes: 1) restaurants passing on price increases to the consumers, 2) restaurants substituting real avocados with avocado pulp/powder and 3) consumer changing consumption habits.

If the cost of raw ingredients increases, restaurants like Chipotle will simply pass on the higher cost to customers, for example by implementing higher prices for guacamole. To your point, I do think that there is a certain ceiling to price sensitivity and increases in the cost to the consumer. Thus, when consumers start to balk at the high prices of guacamole at restaurants, these businesses could accommodate by using avocado mix rather than fresh avocados in their dishes, or even downsizing the amount of guacamole available in each order. Last, it seems as if our spring and summer stock of avocado comes primarily from California, which produces avocados from March/April until labor day [1] while the supply in the rest year comes from Mexico. I think this means that if exorbitant tariffs were to be imposed on avocados coming from Mexico, consumers may not see avocados in grocery stores all-year around – they may only be available as a seasonal produce in a few months of the year and thus consumers would have to adjust their purchases accordingly.

[1] http://www.latimes.com/business/la-fi-avocado-prices-20170815-story.html

Wow, that is a lot of consumption of avocado in a year by an average person in the US! Great article!

To your question, I think there is merit in starting to think about China to hedge your bets. There will come a time when the demand for avocado will start to go down as price increases. If and when that happens, I am quite sure, that the US will find methods to artificially create conditions to produce avocado in a price efficient manner if that is possible.

Supplying to countries like China can be hard though. The supply chain issues that come with the distance and market dynamics can be challenging. How would Europe be for a market to target as those developed economies also turn to healthier foods? Would be easier to supply to them as well.

I do not really agree with the recommendation you made about looking for customers in other countries. Firstly, there will be an increased transportation cost (probably even higher than for other goods due to what Shalei mentioned about shelf life), which will either be passed on to the consumer (possibly ending in a similar situation like the +20% due to NAFTA) or be absorbed by the company (and if that is the case, why can the producer not absorb the +20% NAFTA premimum?). Secondly, other countries, notably the EU have strict import regulations and it may therefore take some effort to get access to that market. Finally, going away from an existing market with loyal customers to a market that may be notably different (e.g. China) with completely new customers and competitors poses a big risk and may require a completely new approach, e.g. to marketing.

AF, this was a very insightful post! Thank you for sharing!

I agree with your assessment that tariffs in the US will lead Mexico to do business with new partners. Although they were expensive, avocados from Mexico were available at many supermarkets in Japan, and to agree with Iturbide, they were of better quality and taste than those imported from the Philippines, even though the transportation involved was much longer. I am not sure if the avocados were from Michoacan, but I can tell you that they were popular.

I am extremely curious to see not only the effects on American purchases of Mexican agricultural goods, but also to see whether Mexico could retaliate to the tariffs by placing similar restrictions on American agricultural goods. Mexico is one of the biggest purchasers of American corn [1]. Cooling relations with the neighbor to the North will increase the possibility of trade agreements with China as well – an undesirable outcome for the American economy.

[1] http://www.businessinsider.com/mexico-corn-buying-response-retaliation-trump-immigration-border-wall-2017-3

[2] http://money.cnn.com/2017/07/05/news/economy/mexico-china-trade-deal/index.html

I agree that the potential threat of import tariffs being imposed by the U.S. to avocado coming from Mexico is a serious challenge to APEAM. This market is the biggest for Mexican avocado producers and any change in the demand side will hit them directly. Every company that has a concentration of demand needs to develop contingency plans to diminishes its dependency.

I believe that finding new markets is not enough. You don’t want to have many countries consuming a little portion of your product. In order to really make a difference, APEAM has to focus on a market with huge potential for increase avocado consumption and invest heavily to develop this habit in its population. This is a very big challenge because food consumption is so much linked to culture. The Chinese market is huge and has shown a good response to avocado consumption but it is still irrelevant in terms of imports compared to other countries. If they want to take the Chinese market to the next level, they need to develop the supply chain to deliver avocado in the right location and invest in marketing efforts to change customer habits.

Very interesting article!

The idea of finding alternative markets especially in countries such as China does not seem like the right strategy to me. Even though these countries might be a large demand driver, given their geographical distance from Mexico, I would be concerned about the risk of spoilage during transit periods. In my opinion, Mexican producers should try to build long-term contracts with major American retailers and consumers of avocados to safeguard the demand of their avocados. They could also look at countries closer to them, such as Canada, if they want to diversify their consumption market. Lastly, as mentioned by Cesario, marketing can be a critical tool in the USA to increase consumption of avocados and build customer habits toward avocados, which will help increase the price inelasticity of the product.

Great article!

Exploring new markets such as Europe and Asia is certainly an appropriate solution to the challenge that Mexico is about to face.

There is, of course, much more complexity in transporting avocados to Asia than to the United States. Exporters will have to follow best practices in keeping avocados fresh whilst transporting them across the globe, an operation that will no doubt incur additional expenses.

I guess the question to the exporters is whether this additional cost (combined with the markets’ willingness to pay) will be less than the extra 20% that US importers will have to pay. And if the US relies heavily on Mexico for the import of its avocados, it may ultimately be willing to pay a higher price for them, so it may be worth Mexico’s while holding tight to see if they can ride this wave!