Go Home Handelsbanken, You’re Obsolete

Gertrude Stein famously said that ‘rose is a rose is a rose’, but when it comes to FICO, is it true that a 720 is a 720 is a 720? A new crop of alternative lenders is saying ‘no’.

During an economic recession, consumer lending typically undergoes a market correction wherein volumes of loan originations will slow. This slowdown can originate from lagging consumer demand, tightening credit standards reducing supply, or both. In the most recent recession of 2007 – 2009, growth in commercial lending fell significantly and remained negative for close to four years following the recession[1]. This was significant not just for the protracted length of negative growth but also for the degree to which this growth stemmed from tightening credit standards, i.e., supply side constraints. However, where traditional lenders have sought to limit exposure to consumer credit, a new set of firms in the fintech space have stepped in to disintermediate banks and offer consumers new lending options. The largest and perhaps most notorious of these new entrants is Lending Club (“LC”).

Founded in 2006 as a peer-to-peer lending platform, LC established a platform whereby consumers could obtain unsecured personal loans through funding provided by investors who purchase notes entitling them to cash flows linked to repayments by borrowers. LC’s operating model took a novel approach to the traditional lending model in several aspects:

- Algorithm-based credit scoring: While traditional lenders rely principally on FICO scores for borrowing decisions, LC harnessed technology to create proprietary algorithms that ‘leverage behavioral data, transactional data and employment information’[2]. These algorithms form the base of LC’s credit models, which are continually retooled based on loan performance; LC adjusts weightings of certain metrics and adds or drops attributes with aims of improving default rates.

- Automatic decisioning. LC leverages online data and technology to scrape data and streamline the borrower application process. Rather than rely on review by loan officers, LC uses an automatic credit decisioning process based on the proprietary algorithms to deliver borrowers an offer in a matter of minutes[3].

- Internet-only presence: LC operates entirely online with no physical branch locations, thereby reducing costs. Cost savings can then be passed on to borrowers in the form of lower interest rates and on to investors in the form of enhanced returns.

- Zero credit exposure. Unlike local banks which typically retain consumer loans on their balance sheets, and thus retain the credit risk, LC acts solely as a platform, selling off loans to investors and making money through an origination fee on the loans plus a servicing fee.

- Social networking aspect. When LC first started operating, it posited that borrowers would be more likely to repay investors with whom they shared elements in common, e.g., profession, geographical location. LC uses an algorithm called ‘LendingMatch’ to allow investors to find borrowers with common relationships[4],[5].

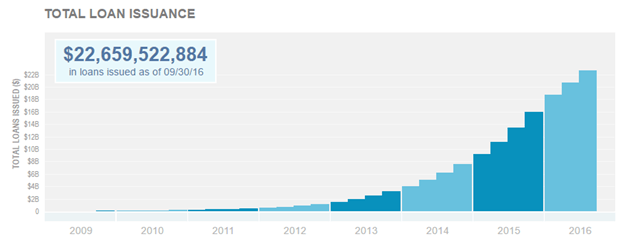

This new lending model has gained enormous traction with borrowers and investors. Lending Club has originated a total of $22.7 billion from inception through 3Q 2016[6]. Additionally, a host of competitors such as Prosper and SoFi have entered the market as LC has demonstrated that the traditional lending market is rife for disruption. Institutional investors have also flocked to the sector. Banks themselves have increasingly become investors in these loans, seeking yield in today’s low interest rate environment.

As commercial banks have constrained their consumer lending, LC and others have stepped in to fill the void. Yet the question has now become whether the market has overcorrected and credit become too loose. As LC’s revenues are based on origination fees, it is incentivized to grow loan originations, which has been evidenced by aggressive marketing campaigns and repeated decreases in interest rates offered to entice borrowers. Some analysts view this with caution as ‘While new data-driven credit models have been set up, they’ve only been tested in the current easy-money environment, and haven’t faced an economic downturn or credit crunch’[7]. It is easy to imagine that in a less benign credit environment, there may be significant losses on these loans. But even though it’s no longer banks making the loans, they may still be the ones bearing the brunt of these losses due to their role as investors in these loans. Suddenly that credit crisis begins to look a lot more like 2007, just with a tech twist.

Word Count: 792

[1] Dvorkin, Maximilliano, “Bank Lending During Recessions,” Economic Synopses, 2016. St. Louis Federal Reserve.

[2] LendingClub Corporation. Form 10-K 2015. Retrieved from SEC Edgar database.

[3] Ibid. Form 10-K

[4] Although LendingMatch still exists, after registering with the SEC in 2008, Lending Club no longer maintains that such shared commonalities will reduce defaults.

[5] LendingClub Corporation. Form S-1 as filed with the SEC on June 20, 2008. Retrieved from SEC Edgar database.

[6] “Lending Club Statistics.” Lending Club Statistics | Lending Club. LendingClub, 30 Sept. 2016. Web. 18 Nov. 2016.

[7] Hutchinson, Martin. “Lending Club Troubles Show Why P2P Doesn’t Work.” Wall Street Daily. 16 May 2016. Web. 18 Nov. 2016.

Thanks for the post, Emma! Very compelling business model but I think you touch on the key elements that will determine if this is just a bull-market product or if this is the new normal. I think there is a great potential for misalignment given the brokers are compensated by origination fees but the lenders are compensated by the interest rates on the loans. We’ve already seen in the news recently one significant example of inappropriate lending practices at Lending Club in which the company knowingly sold a loan to an investor that did not meet the investor’s “express instructions.” I guess the natural counter to that would be that folks like Lending Club are incentivized by good loan performance because they want investors to keep coming back to purchase more loans. Lending Club was in fact held accountable given its stock dropped over 35% and is CEO was pushed out. But, the question remains as to what happens when there is an economic downturn and widespread loan defaults vs idiosyncratic events such as the one mentioned above.

Very interesting Emma! One thought regarding the “automatic decisioning”. Since lending criteria are different than those of traditional banks (and could possibly be abused because it’s online-based), do you think there’s a risk that such lending platforms will be used by over-leveraged people as a last recourse to get additional debt? It seems that a lot of people are already using these platforms to pay down their credit card debt, which doesn’t seem very healthy. Could these websites contribute to the creation of a debt bubble (at the individuals level)?

Great post and peer-to-peer lending is a fascinating innovation in the somewhat stale banking system. My fear is that because of the high levels of government debt in the US, the federal government has been very constrained in applying fiscal policy, leaving monetary policy as its primary means of stimulating the economy, which is why we continue to live in a zero-real-interest-rate environment. This environment, combined with onerous regulations on banks’ required capital ratios, left a fat open space for non-bank lenders like Lending Club to pile into the space. Because they do not take on deposits, they are not limited to the same regulations and can be riskier in their practices. Do you think Lending Club would survive at a higher interest rate environment if a possible bubble bursts?

Thanks for the post, Emma! I think you touched on a really interesting point about LC being incentivized to increase loan origination since its revenues are based on origination fees and like you hinted, that story begins to sound a lot like the incentives for mortgage origination that set up the mortgage crisis. As Ilan mentions, LC is not limited to the same extensive regulations that banks are subject to. But I wonder as LC begins to get more successful and increase its $22.7 billion in loans issued and new fintech firms continue to grow in success, whether it is only a matter of time for regulation to catch up to the business model and write new standards. With the added administrative costs and restrictive nature of potential future regulation, the sustainability of LC’s business model looks a little shakier.

I found the LendingMatch social networking aspect of LC to be very interesting, and I would be interested to see the psychology behind how customers’ willingness to lend is impacted by that feature. It also brings a very antithetical flavor to traditional bank lending compared to the perceived impersonal, transactional nature of borrowing from banks.