GM strikes back

In a battle of giants, GM has joined forces with other automakers and players in the auto sector to stop President Donald Trump and avoid the collapse of NAFTA. Can GM handle the consequences If the initiative fails?

Extreme conditions require extreme measures. That was probably General Motors’ (GM) rational when it joined Driving American Jobs, a coalition between auto industry groups to urge Donald Trump not to withdraw from the North American Free Trade Agreement (NAFTA). Besides GM, the coalition unites players in every part of the supply chain: dealers, suppliers and the biggest automakers such as Toyota, Volkswagen, Hyundai and Ford. It is a combined effort to avoid big losses for the industry and it is the first time that these groups have all joined together to advocate on a single issue [1].

Trump against NAFTA

NAFTA allows for free trade on a number of goods between United States, Mexico and Canada [2]. On cars and trucks, duty-free imports and exports among the three nations are allowed as long as 62.5% of the cars can be traced to one of the three [3]. According to Driving American Jobs, it allowed US car industry to remain globally competitive.

President Donald Trump made it clear his intentions of either withdraw from NAFTA or to renegotiate major rules: he aims to increase the percentage produced in one of the three countries to 85% and to impose a threshold of 50% for how much is produced in US, in an attempt to create more jobs in the country [4].

However, nowadays vehicles are built on global platforms. They use global supply chains, and are sold in markets all over the world [5]. Global supply chain has become so diverse and complex that assigning country-of-origin status to every component has become difficult or impossible [6]. Auto parts come from every place in the world, and if players are no longer able to use a global supply chain to find the best value, they will no longer be able to compete against a vehicle that is made in Europe or Asia [7]. Off-shoring to “best cost” countries is an integral aspect of the global supply network, and contributes to higher productivity levels in the overall industry. This results in lower prices for consumers and return on capital for investors [8].

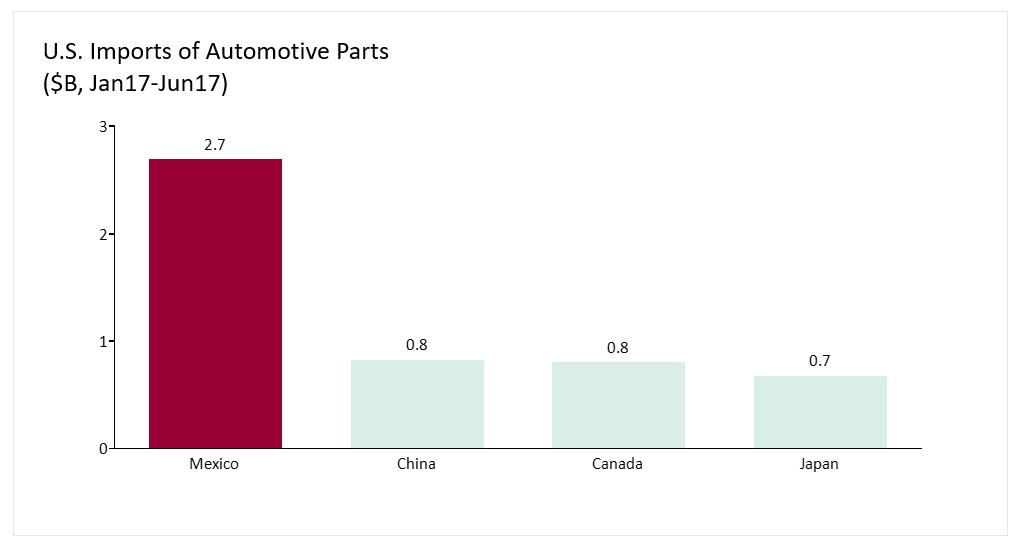

For example, for US automakers, Mexico plays an important role in the supply of cheaper auto parts. It represented approximately 40% of the top 35 imports in auto parts in 2017 [9]

Figure 1 – U.S Imports of Automotive Parts Source: Data excerpted from International Trade Administration

Source: Data excerpted from International Trade Administration

GM reactions

With that context in mind, it seems clear why GM has taken part in a movement to prevent harmful changes in NAFTA agreements. Joining Drive American Jobs was an important step in a battle that has been going for some time. The company has been resisting some attacks from the president.

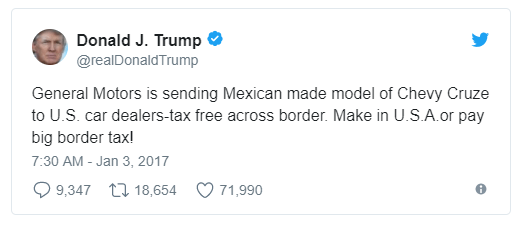

In the beginning of this year, Trump publicly criticized GM in his twitter account for manufacturing its Chevy Cruze in Mexico and then sending it tax free to USA. GM responded to Trump’s tweet, saying it makes most of its Chevy Cruze models in the United States and sells only a “small number” of one model made in Mexico in the U.S. [10]

Source: CNBC

Even after the criticism, GM stated publicly that it would not change its plans. Its small-car production would stay in Mexico, since manufacturing and plant investments are not easily changed [11]. GM’s CEO, Marry Barra, made it clear that GM would not alter its global manufacturing strategy to comply with political pressure [12]. The strategy remained the same some months later, when GM also stated that it would continue with its plans to shift production of GMC Terrain vehicles to its Mexican plants [13].

It appears that the company’s short and long term strategy has been standing against Trump’s protectionism movement and trying to avoid it at any costs. Since the stakes are so high, the company is putting its efforts to partner with others in the sector to get it voice heard.

What is next?

The future is unclear. Should GM still hope and bet that NAFTA will continue going on? Or should it take other measures to absorb the impact of the possible end of NAFTA?

The company has been doing a great job in being true to its values and resisting the new era. However, given the uncertain scenario, GM should analyze its supply chain, think about the possible scenarios and what it would do in each one of them. It should be prepared for the worst case scenario.

If US really withdraws from NAFTA, GM’s costs in its American operations will probably increase due to higher import charges. It might be a cost that the company can’t afford and it will be tempted to move production to lower cost countries. Will that be possible? In order to address these questions and other concerns, the company should conduct studies to understand impact in its supply chain, risks involved and possible solutions.

(790, without Figures legend and sources)

References

[1] Ryan Beene, “Auto Industry Campaign Aims to Steer Trump Away From Quitting Nafta”, Bloomberg Politics, October 24, 2017, https://www.bloomberg.com/news/articles/2017-10-24/auto-industry-campaign-aims-to-steer-trump-away-from-nafta-exit, accessed November 2017

[2] “How the US automotive industry may be impacted by the new administration”, PWC Automotive Series, April 2017, https://www.pwc.com/us/en/industrial-products/publications/assets/pwc-new-administration-impacts-auto-industry.pdf, accessed November 2017

[3] David Kiley, “Trump’s NAFTA Threats Put Auto Industry On Offense”, Forbes, October 25, 2017, https://www.forbes.com/sites/davidkiley5/2017/10/25/trumps-nafta-threats-put-auto-industry-on-offense/#1c9061f644bc, accessed November 2017

[4] “NAFTA Negotiation Update: Auto & Parts Sector Implications”, CAR, October 13, 2017, http://www.cargroup.org/nafta-negotiation-update-auto-parts-sector-implications/, accessed November 2017

[5] Dziczek, Kristin, Bernard Swiecki, Yen Chen, Valerie Brugeman, Michael Schultz and David Andrea. (2016). “NAFTA Briefing: Trade benefits to the automotive industry and potential consequences of withdrawal from the agreement.” Center for Automotive Research, Ann Arbor, MI.

[6] David Kiley, “Trump’s NAFTA Threats Put Auto Industry On Offense”, Forbes, October 25, 2017, https://www.forbes.com/sites/davidkiley5/2017/10/25/trumps-nafta-threats-put-auto-industry-on-offense/#1c9061f644bc, accessed November 2017

[7] Danielle Paquette, “Push for all-American cars will kill American jobs, auto suppliers say”, Chicago Tribune, September 25, 2017, http://www.chicagotribune.com/business/ct-nafta-american-cars-20170925-story.html, accessed November 2017

[8] Dziczek, Kristin, Bernard Swiecki, Yen Chen, Valerie Brugeman, Michael Schultz and David Andrea. (2016). “NAFTA Briefing: Trade benefits to the automotive industry and potential consequences of withdrawal from the agreement.” Center for Automotive Research, Ann Arbor, MI.

[9] International Trade Administration, “Automotive Parts Exports and Imports (PDF file), downloaded from International Trade Administration website, https://www.trade.gov/td/otm/autostats.asp, accessed November 2017

[10] Jacob Pramuk, “Trump blasts General Motors: Make Chevy Cruze model in US or ‘pay big border tax’”, CNBC, January 3 2017, https://www.cnbc.com/2017/01/03/trump-blasts-general-motors-make-chevy-cruze-model-in-us-or-pay-big-border-tax.html, accessed November 2017

[11] Madeline Farber, “General Motors CEO Mary Barra Says Donald Trump’s Threats Won’t Change the Company’s Plans”, Fortune, January 9 2017, http://fortune.com/2017/01/09/donald-trump-general-motors-mary-barra/, accessed November 2017

[12] Paul A. Eisenstein, “GM’s $1B Investment Is Not Driven by Trump and Likely Dates Back to 2014”, NBC News, January 17 2017, https://www.nbcnews.com/business/autos/gm-s-1b-investment-not-driven-trump-likely-dates-back-n707661, accessed November 2017.

[13] Narayan Ammachchi, “General Motors Bulks up in Mexico as Cloud Hangs over NAFTA”, Nearshore Americas, October 24 2017, http://www.nearshoreamericas.com/general-motors-mexico-nafta/, accessed November 2017

This is really interesting – well written! I wonder whether Trump’s action spur isolationist reactions from countries that would be impacted by a potential American repeal form NAFTA? For example, while Canada’s Trudeau is quite the opposite of Trump in that he champions trade and Trump campaigned on protectionism, I think he might have to express some isolationist threats to increase his chances of renegotiating a good (new) NAFTA agreement on behalf of Canada, should it ever come that far. As an outside observer from Europe, I find it hard to understand whether Trump actually believes that the people who voted for him would be better off without NAFTA. While an American NAFTA repeal would potentially drive jobs to the US, it will inevitably also drive up the prices on the cars.

As you pointed out, General Motors is doing a great job staving off potential charges to date. However, is it worth making a long-term (10-15 year plus) investment in a domestic factory to crank out low-cost Chevy Cruzes based on the uncertainty of our current Commander and Chief? Other responses to the TOM challenge have referenced longer-term plays that GM has made, which align with the future of the automobile industry, along the lines of renewable/electric vehicles, combined with autonomous driving capability. I think in this case, GM can use potential isolationist policies as a means to justify longer-term domestic investments in the US (where the technology to develop environmental/autonomous vehicles exists) to its shareholders, who should also understand that the capex needed to relocate/re-establish a low-cost factory in the US simply to avoid potential trade tariffs down the line is not a feasible solution.

I’m having a hard time understanding the President’s arguments. I wish the Trump camp would provide more substantial evidence for their claims of job growth. Their move seems short sighted at best.

I took an economics course through the Teaching Company a couple years ago. The course surveyed dozens of issues we face in our economy today. The professor would inject in each discussion data on how many economists agree or disagree about enacting the economic policy under discussion. I have never forgotten that 95% of economists agree with the principles of free trade. For the dismal science this was quite the sticking point.

What GM should do? I agree with Jason that substantial CapEx investments seems shortsighted on GM’s front. They need to wait to see if the political winds change in the next election. If I were CEO I wouldn’t budge until NAFTA is actually renegotiated.

Great topic! Challenges posed by the increasing winds of isolation do not bode well for North American industry. I agree with Jason as well that CapEx investments at this point do not make much sense. Undoing NAFTA will not happen overnight and GM should buy as much time as possible before taking significant action to change the supply chain.

That being said, planning to do nothing is not ideal either. GM should fully understand the cost, schedule, and quality implications of having to in-source sub-components or whole vehicle manufacturing. Much like Jide’s article about Toyota in the UK with Brexit, I find it hard to see a situation where the North American consumer benefits from this scenario.

I agree with you that scenario planning and preparing for the worst in this case should not even be a question for an organization like GM. Banks have faced a similar conundrum with Brexit and moving their HQs to other European financial hubs despite knowing what the transition period will look like. I think though even beyond scenario planning, it may be prudent to start testing suppliers and alternatives may be on a smaller scale.

Most thoughts seem to be debating the long-term capital outlook and the capital investment required and opposing the government vehemently. My thought on this was that when government bodies seem to be irrational with some decisions, is it better to figure out certain loopholes or compromises given that the government will not want to look on the logical arguments?

From my basic reading about NAFTA, it claims that at least 62.5 percent of a passenger car or light truck’s net cost must originate in North America. Would it be possible to do some compromises to win government support just like Ford which decided to cancel future plans to build factories in Mexico, which did win praise from the President and in the meanwhile continued to produce its highest selling cars in Mexico – essentially sacrificing the pawn to save the Queen.

In the meanwhile, the companies should also push the government to come up with a plan where the government demonstrates its intentions to help these firms reduce costs in areas where they will be impacted most. All this could just be a method to stall this argument for a few years before one fully finds out the stability of this political setup.

Great write up and very thought-provoking. It led me to think what would happen in the worst-case scenario.

If the US withdraws from NAFTA, and the US can no longer import cars from Mexico tariff free, in order for GM to stay competitive, it may decide to do the following:

– Only keep enough manufacturing capacity in the US to serve the domestic market

– Move all other manufacturing outside of the US

This will have the following consequences:

– Production of the high-value, technically sophisticated export-oriented models such as certain Cadillacs will need to be moved outside of the US.

– Cars sold in the US market will be more expensive because of higher costs of production.

– Many low-volume cars will no longer be available to US consumers because of high-unit cost to manufacturer in the US and high tariff to import into the US. For example, economy cars such as the Chevy Spark which GM has been trying to popularize in the US can no longer be offered at a reasonable price.