Globalization vs. Isolationism: Finding Nike’s New Competitive Advantage?

How do global brands thrive in an era of isolationism and protectionism? For Nike, the answer is lobbying, automation and reshoring.

Nike is synonymous with globalization. Over the past two decades, Nike has been one of the pioneers in outsourcing production to the developing world. Today, Nike’s contracted factories employ 1.02 million workers in 42 countries to produce all its products, with 29% of product made in China and 44% in Vietnam [1] [2]. While this global supply chain has undoubtedly been a competitive advantage for this international brand, the Trump Administration’s “America First” approach of economic nationalism and the reemergence of protectionist policies globally represent a significant challenge to Nike’s worldwide manufacturing strategy [3].

Today, Nike faces an average 11% tariff on shoes imported into the US, with the looming threat of an increase to 45% for goods coming from China [4] [5]. While such policies are designed to protect domestic industries, they can have perverse outcomes: import costs passed on to the consumer, drive up prices and leadto cost-push inflation. Lower consumption as wage growth trails price increases, would be a huge hit to Nike, where 48% of its revenue generated in 2016 was in North America [6]. As such, how should Nike respond in an era of protectionism and isolationism?

Strategy to Date

Lobbying: In the short term, the company has ramped up lobbying efforts in support of free trade and open boards. As an example, Nike has been a vocal proponent of the Trans Pacific Partnership. The US brand threw its weight behind the program, promising to create 10,000 jobs in advanced manufacturing domestically should TPP become law [7]. For Nike, TPP would have reduced tariffs on trainers made in countries like Vietnam [8]. However, with the US’ withdrawal from the deal, competitors in countries like Australia are reaping the rewards of trade deals negotiated, which the US might otherwise have won via TPP [9].

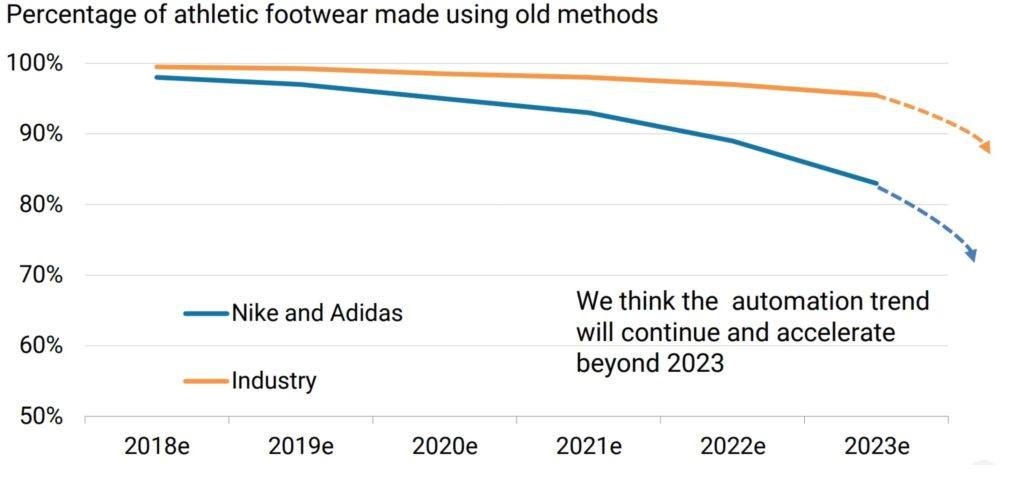

Automation: Nike’s medium-term solution to protectionist pressures is to reduce reliance on cheap foreign labor in its production process through automation. In partnership with Flex, a high-tech manufacturing company, Nike has introduced greater efficiencies into the otherwise labor-intensive process of making shoes, with an estimated 20% of production set to be automated by 2023 [10].

Exhibit A: Nike and Adidas are expected to be industry leaders in manufacturing automation and innovation [10].

Reshoring: Increase in automation have bolstered the case for reshoring the manufacturing process where high domestic labor costs were previously a barrier to reentry. The benefits of addressing the issue of protectionism through this approach is twofold:

- Tariff Reduction: local manufacturing implies zero tariffs. Nike already has a precedence for employing this strategy. Independent factories in Argentina, India, Brazil and Mexico were established in response to high import tariffs in these geographies [11] [12].

- Supply chain reinvention: Historically, it can take up to 18 months to develop a new shoe – a sizable dilemma in the era of “fast fashion”. Footwear companies have had to predict trends ahead of time which often results in a mismatch between on-hand inventory and consumer demand. Faster delivery and shorter production cycles through onshore productions present an opportunity to cut costs and increase sales to meet consumer trends [13].

Is it enough?

Lobbying 2.0: While Trump aims to minimize US involvement in multinational trade agreements, Nike should continue to push for trade agreements even on a bilateral basis, particularly with the Asia Pacific bloc. Although automation allows cost savings and efficiency gains, manufacturing remains largely entrenched in Asia. As Kasper Rorsted, CEO of Adidas notes, complete reshoring is an “illusion” and “[by moving to the US] you are moving into a market where you have no competence…that goes for the entire industry, I’m not speaking just for Adidas.” [14] Moreover, as North America is expected to drive only ~16% of total company growth through to 2022, expanding its global footprint is key to Nike’s growth trajectory [15].

Vertical Supply Chain: For automation and reshoring to succeed, Nike also needs to consider and innovate on other parts of its supply chain. Today, China’s competitive advantage owes in part to its vertical supply chain, and specifically its extensive material base. For Nike’s onshore strategy to be competitive, R&D in materials manufacturing should also be a priority.

High skilled labor: Over the past two decades, the eclipse of domestic manufacturing brought on by offshoring, has starved the economy of high skilled labor in advance manufacturing. As Rose and Reeves write, “the US suffered a net loss of nearly 19,000 manufacturing firms between 2001 and 2015” [16]. To address this gap, Nike should invest in education, training programs and skill development to develop the talent pool needed to support reshoring and automation efforts, necessitated by protectionism.

Looking Ahead

As we look ahead, two key questions emerge:

- Will protectionism achieve its intended outcome and bring back jobs at scale?

- Is reshoring here to stay? Will renewable energies and lower transportation costs coupled with automation and innovation advances in the developing world, reinvigorate the case for offshoring?

(Word count: 798)

References

[1] Bissell-Linsk, J. (2017). Nike’s focus on robotics threatens Asia’s low-cost workforce. Financial Times. [online] Available at: https://www.ft.com/content/585866fc-a841-11e7-ab55-27219df83c97 [Accessed 8 Nov. 2017].

[2] Sole, J., Singlehurst, L., Greenberger, K. and Cheng, T. (2017). The Need for Speed Hits Athletic Wear. Brand Apparel & Footwear. Morgan Stanley, pp.11.

[3] Mann, T., Paletta, D. and Tangel, A. (2017). Donald Trump Warns of Penalties If U.S. Firms Take Jobs Abroad. The Wall Street Journal. [online] Available at: https://www.wsj.com/articles/trump-takes-credit-for-saving-indiana-jobs-1480628609 [Accessed 10 Nov. 2017].

[4] Sole, J., Singlehurst, L., Greenberger, K. and Cheng, T. (2017). The Need for Speed Hits Athletic Wear. Brand Apparel & Footwear. Morgan Stanley, pp.12.

[5] Haberman, M. (2016). Donald Trump Says He Favors Big Tariffs on Chinese Exports. New York Times. [online] Available at: https://www.nytimes.com/politics/first-draft/2016/01/07/donald-trump-says-he-favors-big-tariffs-on-chinese-exports/?_r=0 [Accessed 9 Nov. 2017].

[6] Statista. (2017). Nike’s revenue worldwide from 2009 to 2017, by region (in million U.S. dollars). [online] Available at: https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/241692/nikes-sales-by-region-since-2007/ [Accessed 9 Nov. 2017].

[7] Financial Times (2017). What business thinks of Donald Trump. [online] Available at: https://ig.ft.com/sites/trump-business-reaction/ [Accessed 9 Nov. 2017].

[8] Financial Times (2017). What business thinks of Donald Trump. [online] Available at: https://ig.ft.com/sites/trump-business-reaction/ [Accessed 9 Nov. 2017].

[9] Donnan, S. (2017). Globalisation marches on without Trump. Financial Times. [online] Available at: https://www.ft.com/content/d81ca8cc-bfdd-11e7-b8a3-38a6e068f464 [Accessed 11 Nov. 2017].

[10] Sole, J., Singlehurst, L., Greenberger, K. and Cheng, T. (2017). The Need for Speed Hits Athletic Wear. Brand Apparel & Footwear. Morgan Stanley, pp.7.

[11] Bain, M. (2016). Your sneakers are a case study in why Trump’s America-first trade policy is nonsense. [online] Quartz. Available at: https://qz.com/859628/your-nike-sneakers-are-a-case-study-in-why-trumps-protectionist-america-first-trade-policy-is-nonsense/ [Accessed 13 Nov. 2017].

[12] Sole, J., Singlehurst, L., Greenberger, K. and Cheng, T. (2017). The Need for Speed Hits Athletic Wear. Brand Apparel & Footwear. Morgan Stanley, pp.33.

[13] Sole, J., Singlehurst, L., Greenberger, K. and Cheng, T. (2017). The Need for Speed Hits Athletic Wear. Brand Apparel & Footwear. Morgan Stanley, pp.6.

[14] Hancock, T. (2017). Adidas boss says large-scale reshoring is ‘an illusion’. Financial Times. [online] Available at: https://www.ft.com/content/39b353a6-263c-11e7-8691-d5f7e0cd0a16 [Accessed 12 Nov. 2017].

[15] Sole, J., Ryan, E. and Kessler, M. (2017). Analyst day out in the spotlight, way out of the quagmire. Morgan Stanley, pp.12.

[16] Rose, J. and Reeves, M. (2017). Rethinking Your Supply Chain in an Era of Protectionism. [online] Harvard Business Review. Available at: https://hbr.org/2017/03/rethinking-your-supply-chain-in-an-era-of-protectionism [Accessed 11 Nov. 2017].

In addition to pioneering production outsourcing, Nike has also increasingly become a pioneer in sustainability; I’m wondering if its sustainability efforts may help to support the kind of vertical supply chain described in the article. For example, recent breakthroughs in Nike’s product design have made the company less dependent upon geographically-specific materials (e.g., cotton); it is instead becoming more advanced at using recycled and synthetic materials, which may be produced just as easily/cheaply in the U.S. as in China. Nike’s R&D in sustainability, not just in manufacturing broadly, may help it competitively should the re-shoring trend continue.

I agreed NIKE’s strategy to go lobbying, integrate supply chain vertically, and the effort of hiring more skillful labors. What NIKE can do more is to extent its sustainable practice. Not only focus on product raw materials but also on how to make overall supply chain more efficient and sustainable, which lower the cost at the same time to cover the complexity post by regulations.

This is a very well thought out analysis of how Nike can mitigate the downsides of isolationism.

Before diving into the solutions more, it’s important to set the current climate Nike is facing. According to its earnings report which was released this past October, quarterly sales were flat company-wide when compared to last year, and sales in North America were “particularly weak.” North American revenues declined 3% because of “an unexpected decline in North America wholesale revenue.”

Given this competitive landscape, Nike cannot afford to lose more customers. I support option “Lobbying 2.0,” and it seems as though Nike is already making strides in this area. According to the Washington Post, “Nike is amping up lobbying efforts in Washington, this month hiring Alpine Group to lobby on the Trans-Pacific Partnership, a free trade agreement that could eliminate tariffs on shoes made abroad.”

Source: https://www.washingtonpost.com/business/capitalbusiness/nike-fights-to-lower-duties-on-foreign-made-shoes-freedom-to-marry-lobbies-to-repeal-doma/2013/02/15/d417750a-7496-11e2-95e4-6148e45d7adb_story.html?utm_term=.b62f5f7aa52b

Great questions, and a big dilemma. To answer your question- I think automation and innovation advances in the developing world will certainly reinvigorate the companies in the developing countries and Nike needs to take advantage of that. I think you touched a key point when you said that North America is expected to drive only ~16% of total company growth through to 2022, this has to be in the back of Nike’s mind when they analyze their financials going forward. The US government should also understand that the US market is not necessarily the biggest and most meaningful to all companies, and thus while they want to “bring businesses back home” when they make harsh demands and high tariffs on imported goods, they may be driving companies away from the US and into competing markets.

This is a really interesting piece and I think representative of what a lot of companies are dealing with now. It reminds me a bit of the Fuyao case discussion we had.

I worry about making any serious, capital-intensive decisions in response to Trump’s isolationist posture. There are two reasons for this: (1) it’s unclear how ideologically com mitted Trump truly is to isolationism (versus it being a policy he will support insofar as his base feels like he’s ‘protecting’ them) and therefore how persistent and comprehensive his opposition to free trade policies will be, (2) there is a significant chance that he will lose the 2020 election and be replaced by someone more open to free trade. Therefore, investments in upskilling domestic labor or high-tech machinery for domestic automated production may not be the best way to allocate resources, particularly since the payoffs in those things are not immediate. Perhaps an alternative or additional area to focus on is getting Trump to offer massive tax breaks for some symbolic amount of on-shoring… the tax breaks would offset uncompetitive production costs while the company waits for the next political administration. Trump actually did this early on in his tenure with United Technologies, brokering a deal that had Indiana offer ridiculous tax benefits to keep a modest number of jobs from being sent elsewhere (http://fortune.com/2016/12/02/indiana-carrier-jobs-tax-breaks-mexico/).

All of the above said, I think a lot of the decision comes down to whether you think this isolationist position is going to be pretty sticky in American politics for the medium term. There’s a good argument to be said that it will be given that both the far left and far right wings of the country’s two parties actually agree on having isolationist trade policies, and both heavily influence federal policymaking.

Nike appears to have a well thought strategy against isolationism by automation and reshoring for the short term. If I were in Nike’s shoe, however, I would be cautious of the merit that automation can actually bring. For instance, would the massive capital investment and depreciation costs of automated factory be more economical compared to the cheap factory and labor in low cost countries ? Is there enough skilled labors to operate the machines and what if the automated factory needs maintenance and renovation every few years ? How would such kind of (unpredictable) operation still benefit Nike and other companies of the supply chain inside Nike’s eco-system ? My point of view is, the beautiful strategy may not be as attractive when actually implemented. That said, a deliberate estimation of the total return on investment and total cost of ownership may be worth a review before going forward. I also believe the same can be said whether advances in developing countries would reinvigorate the case for offshoring in the future.

This is a very interesting topic and well-written article. As a cynic, I am not convinced that Nike would like to bring more jobs to the U.S.

Protectionism is currently en vogue among the world’s politicians but many of the jobs that have been lost to technology are not coming back. We should not be afraid of other countries, in the long run, but robots. [1] Even if I am proven wrong and Nike opens up a few factories in the U.S., the efficiencies gained from automation will not go unnoticed. Nike’s supply chain will eventually have limited dependence on factory workers.

[1] http://fortune.com/2017/04/05/jobs-automation-artificial-intelligence-robotics/

Well detailed piece and an exciting dynamic in the apparel industry! The case for onshoring is driven by the “fast fashion” trend you mentioned and the need for firms to respond to customer demands or preferences at an unprecedented speed. When companies like Nike first brought manufacturing and supply operations overseas it was in an effort to lower labor costs to increase margins on final products. In a digital environment where automated robotics can replace many labor costs and customers are looking for new and improved goods at a faster pace the new efficiency company’s can integrate is flow of information and data [1].

These elements of the design and supply process today essentially necessitate onshoring [2]. If the North American Market is Nike’s largest and most strategic being closer to market is advantageous. Coupled with the savings from tariffs (at their current or elevated levels) and the decreased speed to market, onshoring allows Nike to more effectively serve its customers while decreasing the risks associated with global transportation of raw materials, technology, or finished products.

[1] Paul Page, “Today’s Top Supply Chain and Logistics News From WSJ”, Wall Street Journal, October 31, 2017.

[2] Tara Donaldson, “Next Step for Sourcing? Go Where No Supply Chain Has Gone Before”, Sourcing Jounral, October 27, 2017.

I think what makes this issue so interesting, particularly given the company you have chosen to highlight, is the backlash that Nike has faced for decades in light of “sweatshop” allegations. For a company that has such a dubious reputation regarding labor practices to now be pressured to bring these same jobs back to the U.S. via reshoring is truly bewildering. From a lobbying perspective, it will be interesting to see how various political groups shake out in terms of supporting U.S. job creation versus a “not in my backyard” mentality regarding mass apparel manufacturing and the traditional labor conditions associated with the industry. Thanks for such a thoughtful and provocative piece.

Thanks for your engaging post on an important American company during interesting political times. Looking ahead, I think your question of whether or not protectionism will bring jobs back at scale is the right question, and I think that it will only be a sustainable movement if those driving the movement correctly incentivize companies to do so. The potential corporate tax reduction would be a huge step in the direction of protectionist sustainability.

This movement (if it lasts) also seems like an amazing opportunity for a major player like Nike to innovate around its automation and supply chain reinvention. A significant R&D project to reinvent the Nike factory could benefit Nike’s facilities around the world and enable them to decrease costs and decrease lead times for new products. Furthermore, this may also be an opportunity to take advantage of local incentives that may be offered for construction of new facilities (like Tesla was able to capture for building its Gigafactory in NV).

Thanks for sharing this story! I found it striking that only 16% of total company growth through 2022 is expected to come from the U.S. This fact on its own led me to question how significant an issue this actually is for Nike. While much of the strategy, marketing, and finance functions may be housed in the U.S., it seems that Nike could benefit by further diversifying its operations across the globe, not only to avoid the threat of isolationist policies, but also because it may allow the company to more efficiently serve the 84% of total growth coming from outside the U.S. From this perspective, I think Nike should be focused on policies that foster investments in education and support overall business, and it doesn’t seem that there should be as much of a focus on policies that are targeted towards trade and manufacturing in the U.S. I don’t believe reshoring will be entirely necessary, but I do think supporting policies that promote the development of highly skilled labor in the U.S. will ultimately be in Nike’s interest in the long run.

It is so interesting to see that the vicious cycle at work: protectionist trade policy creating import-tariffs, some fraction of which can be passed on to consumers, and then the company must respond in order to minimize the effect of this tariff on their costs (if they need to eat the portion that consumers won’t accept) or on their revenues (if increased costs affect demands). I am fascinated by the idea that companies are responding to isolationist political trends with increased automation, which drives their costs down and makes the tariff more bearable.

I question whether these political trends will stand the test of time, or whether a two-party system (at least in the top office of the US) will always have enough turnover that any forceful isolationist legislation will be overturned within 2-4 years (and vice versa). With this kind of turnover rate, are companies actually incentivized to invest capital in building manufacturing plants, in a geography in which (as you point out) they have no core competencies?

I agree with your proposed next steps for Nike – continue financing lobbyists, driving supply chain efficiencies. If Nike projected more growth from US sales, would they be more willing to consider ‘reshoring’? Would all of the upstream material partners also need to ‘reshore’ (assuming they’re not vertically integrated when they first reshore back to the US) in order to fully benefit from isolationist policies?

American companies outsourced labor work to other countries not only because labor costs are cheaper there but also because many American people do not want to work at a low wage. Protectionism is not a sustainable way to bring jobs back to America.

Forcing Nike to move production to onshore will incur large increase in labor cost and production cost for Nike. There is no guarantee that the output and efficiency level in onshore facility can match that of facilities in other countries.

Nike can increase automation work, which requires some capital investment, so that it will require less labor and thus lower labor costs. However, if automation work goes up and labor work goes down, this defeats the purpose of bringing jobs back to the U.S.

Maybe the facilities in emerging countries and in the U.S. can serve different customers. I think there is no need to shut down the factories overseas as the consumer buying power in emerging markets is increasing.

Great paper, as you discuss and present a very relative and important topic which is broad reaching through the business and political arenas. Nike is one of the most well known global brands that is changing the way it operates due to changing isolationist views by parties both in and outside of the company. It will be interesting to see how global sales and revenues are impacted by the stance Nike is taking, and how it is re-positioning it’s supply chain management and structure as well as general feelings towards free trade. Additionally, I think the automation topic was initially separate and unique from the isolationist stance, but now that companies such as Nike are altering their business model in line with the isolationist view – they are concurrently taking advantage of this opportunity to implement improvements to the production process via automation.

I think this is an interesting subject that many companies are struggling with. I think one of the biggest questions is whether a company is willing to bet that the isolationist trend is a short-term or long-term one. Many of the strategies you’re discussing that Nike is either already doing or will do are based on assumptions that these trends will continue. In my personal opinion, globalization cannot be stopped and in the long-term will overcome isolationist actions we’re seeing now. So should Nike re-shore its production if in the long-term this isn’t the most cost-effective method of competing? I like the fact that they are trying to combat the labor cost issue through automation rather than moving its workforce as this is a strategy that can be successful regardless of regulation or new tariffs. I think Nike has to be careful to implement strategies that can be successful in both a global and isolationist environment since it is something that will constantly be evolving through time and different administrations.

Thank you for the article, Isabel! I’m shocked to learn that Nike may be exposed to a 45% tariff on shoes imported to the US from China. That would be devastating to Nike’s business. As we look ahead, I think Nike needs to prepare for both scenarios you outlined in your questions: (1) train workers in the US and invest R&D in materials manufacturing in the event policy becomes isolationist and (2) identify key countries offshore where it would be advantageous for Nike to have factories. A drastic policy change like increasing tariffs from ~10% to 45% is dichotomist outcome that Nike should be prepared for either way.

This is a very interesting topic and even more interesting as it relates to Nike, the forerunner of footwear importation before it was forced to build its own brand and only outsource production to Japanese manufacturers. I completely agree with the Adidas Chief Executive that it’s illogical and financially nonviable to reshore and I further think that any reshoring that is going to happen will be limited and designed to be just enough to appease the politicians.

More than 90% of Nike’s operations are located outside of the USA. It’s hard to imagine how a significant portion of that could be relocated back to the USA especially as global business serving the global market. It is quite clear that any onshoring that will happen will be due to political pressure and may be nothing more than a symbol. However, it may be enough to create enough jobs to make a difference in the for the few who would benefit, regardless of how low skilled those jobs are.

Really nice and well-supported piece. It is interesting to see how US protectionism does not only impact international companies but also US brands with global exposure. The current protectionism also puts Nike and other US companies in a complicated dilemma: should they define their long term strategy based on the current (and limited to 4-8 years) political environment?

To address your questions, I can see Protectionism as a double edged sword for US jobs. In the short term, it may lead to reshoring and increasing local jobs. However, it will certainly accelerate automation which at some point will offset the previous job creation. That said, I also believe that Nike may have already started investing in automation, which can be supported with the information showed in Exhibit A of your article. Regardless of US protectionism, Nike knows that it will eventually face higher labor costs in the developing world and then automation will also play a key role there.

Nike is an interesting company in the context of isolationism. Nike has never had a factory in the United States and seems to never intend to have one. Often, we have seen Trump take on company’s that are moving factories from the US abroad. Phil Knight’s original strategy in the business was to use the arbitrage of offshore manufacturing in the US shoe market. Given that Nike is a brand that is part of the American way of life, I wonder if that position would insulate it from any large imposed tariffs and the fact that it has never had a US factory.

Protectionist policies are an interesting question with respect to Nike. The company has historically conducted manufacturing offshore due to cost advantages / labor arbitrage, but as we’ve seen vis-a-vis the recent iPhone 10 debacle at Foxconn and other suppliers, labor arbitrage is hardly a sustainable strategy going forward. Further, “speed to market” has been a hugely important area of focus for Nike over the past several years, and irrespective of protectionist trade policies, the company has made a very deliberate shift towards near shore manufacturing in response to consumer demands, not due to the political climate. In addition, as the company’s business shifts increasingly towards emerging markets such as China and Southeast Asia (around 40% of Nike’s business is from North America, and this will decline over time), production will naturally shift towards those high growth markets. Nike’s long term decisions will hardly be governed by a tenuous, ephemeral political administration that has demonstrated little capability to execute on its stated agenda.

Isolationism will clearly be a difficult trend for Nike to combat. It appears that Lobbying in the shorter term is one way the company is fighting back. However, 11% import tariffs in the Trumpian era is going to be a difficult trend to combat.

I highly doubt that this America first rhetoric and policy will result in economic benefits for the United States. What it has done is create incentives for more automation in these industries which will in the long term likely remove more manufacturing jobs here at home.

In response however, Nike’s approach has been robust. Setting up factories in high import countries was a smart immediate step for the company. Additionally, hiring and training high skilled workforces will fall in line with the President’s wishes and will hopefully result in positive outcomes.

I don’t think protectionism will achieve its intended goal. It is not aligned with the fundamental interest of a US-based multi-national corporation. An MNC will seek the global source of labor with the lowest cost to build its competitive edge. Meanwhile, the US consumers also benefit from the low price incurred accordingly. However, what politician thinks is to increase the local jobs. These two motives don’t align well. It is not advisable to force companies to create more jobs at the sacrifice of their economic interest or competitive advantage. This probably will result in the company’s operating inefficiently and cut off jobs in the end.

In this globalized world, what the US should think about is how to better educate its people so that they can assume the jobs with high value in the value chain. Low-end jobs are either face the challenge of being transferred to emerging market or being replaced by automation or artificial intelligence.

Very well written and interesting read Isabel! While I am skeptical of the government being able to impose a 45% tariff due to retaliation from China, I agree that such isolationist policies will hasten adoption of advanced automation and AI-based technologies in factories. I am curious to see if Nike can find ways to source raw materials and move onshore some of the up-stream activities.

It seems that offshore manufacturing is in the DNA of the Nike business model, as the labor costs have been so significantly differently. But what if automation changes that? What if a sneaker built by robots and a few skilled production line managers makes US truly competitive? Nike and primary competitor adidas seem to be investing heavily in developing products and automated manufacturing capacity [1]. In fact, Adidas is building a factory in Atlanta this year [2]. If were sitting in Beaverton watching the increasing trend toward Isolationism around the world I would be exploring blue prints for smaller more automated factories that could bring the production closer to the markets they serve and ofter protection from increasing tariffs. Just don’t tell Trump that it’s robots and not the american electorate that will be working the line.

[1] https://www.recode.net/2016/9/27/13065822/adidas-shoe-robots-manufacturing-factory-jobs

[2] http://www.businessinsider.com/the-future-of-shoe-manufacturing-in-america-2017-3